Discover the ABCD Strategy: A Simple yet Effective Approach

What is the ABCD strategy? When it comes to tackling complex problems, having a clear and structured approach can make all the difference. That’s …

Read Article

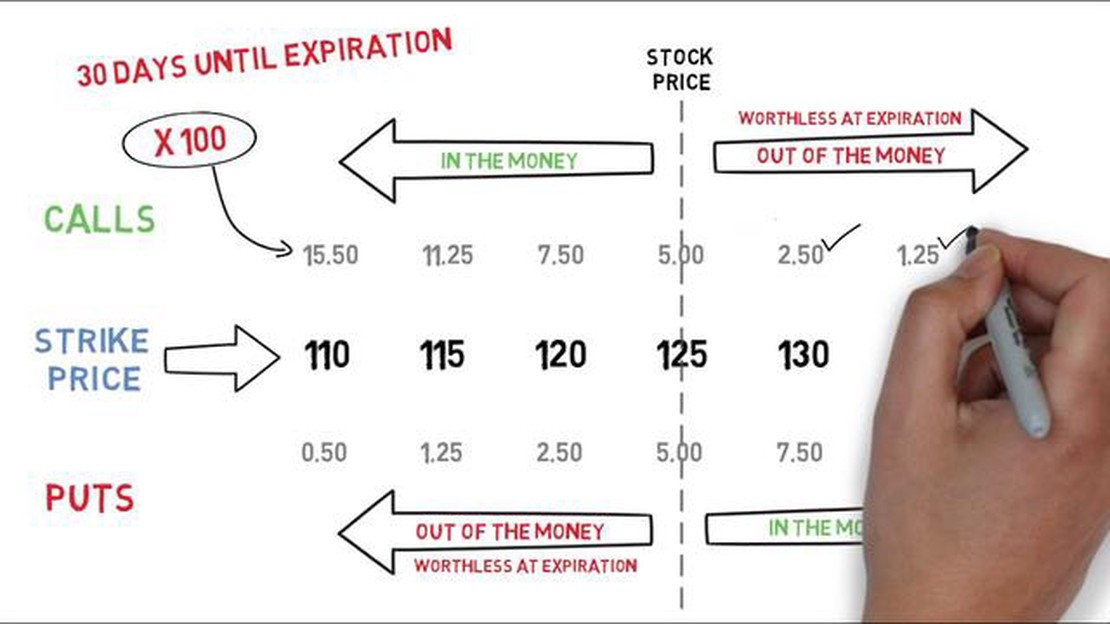

Out of the Money Call Options are a type of financial instrument that allows investors to buy the right to purchase a specific asset at a predetermined price within a set time frame. These options are said to be “out of the money” when the current price of the underlying asset is below the strike price of the option. While this may seem like a disadvantage, there are actually several benefits to buying out of the money call options.

One of the main benefits of buying out of the money call options is the potential for significant returns. Since these options are cheaper to purchase compared to in the money or at the money call options, investors can leverage their capital and potentially earn a higher percentage return if the price of the underlying asset rises above the strike price. This allows investors to participate in the upside potential of the asset without needing to invest a large amount of capital upfront.

Furthermore, buying out of the money call options can provide investors with a limited downside risk. The maximum potential loss when buying call options is limited to the premium paid for the option. This means that even if the price of the underlying asset does not rise above the strike price, the investor’s loss is limited to the initial investment. This limited risk can be appealing to investors who want to participate in the potential upside of an asset while managing their overall risk exposure.

Additionally, out of the money call options can act as a form of insurance for investors who already hold the underlying asset. By purchasing out of the money call options, investors can protect themselves against a potential decline in the asset’s value. If the price of the asset does drop, the investor can exercise the call option and sell the asset at the higher strike price, effectively limiting their losses.

In conclusion, buying out of the money call options can offer investors the potential for significant returns, limited downside risk, and a way to protect existing assets. However, it’s important for investors to carefully consider their investment strategy and risk tolerance before engaging in options trading.

Buying out of the money call options can provide several advantages for investors and traders. Here are some of the benefits:

1. Lower cost: Out of the money call options tend to have lower premium prices compared to in the money or at the money options. This lower cost allows investors to control a larger amount of underlying assets for a lower upfront investment.

2. Potential for higher returns: While the probability of out of the money call options expiring in the money is relatively low, their potential for higher returns is significantly greater. If the price of the underlying asset increases substantially, the value of the out of the money call option may increase exponentially.

3. Limited risk: The maximum loss for purchasing out of the money call options is limited to the premium paid. This means that investors have a known, limited risk when buying these options, making them a suitable choice for those looking to manage risk.

4. Leverage: Out of the money call options offer investors leveraged exposure to the underlying asset. This means that a small percentage move in the price of the underlying asset can result in a much larger percentage gain in the value of the options. This leverage amplifies potential profits.

5. Flexibility: Out of the money call options provide investors with the flexibility to execute various strategies. They can be used to speculate on the price of an asset or as a hedging instrument to protect against unfavorable price movements. This versatility makes out of the money call options a valuable tool in a trader’s arsenal.

It is important to note that buying out of the money call options also carries certain risks, including the potential for the options to expire worthless and the loss of the premium paid. Investors should carefully consider their risk tolerance and investment goals before incorporating these options into their portfolio.

Read Also: Learn how to add a simple moving average in MT4 with this step-by-step guide

Buying out of the money call options can provide the potential for lower cost compared to buying in the money or at the money options. Out of the money call options have strike prices that are higher than the current price of the underlying asset.

When you buy out of the money call options, you’re paying a lower premium because there is a lower probability of the option expiring in the money. This lower cost can make out of the money call options an attractive choice for traders who have a limited budget or want to limit their risk exposure.

Additionally, the lower cost of out of the money call options allows traders to potentially increase their leverage and potential returns. With a smaller investment, traders can control a larger number of shares of the underlying asset if the price moves in their favor.

However, it’s important to note that buying out of the money call options also comes with higher risk. If the price of the underlying asset doesn’t increase above the strike price before the option expires, the option will expire worthless and the trader will lose the premium paid.

Overall, the potential for lower cost is a significant benefit of buying out of the money call options. This lower cost allows traders to potentially maximize their leverage and potential returns while limiting their initial investment.

Buying out of the money call options can offer an opportunity for higher gains compared to other options trading strategies.

Read Also: Does a higher Delta mean better options?

When you buy out of the money call options, you are essentially betting on the price of the underlying asset to rise significantly within a specific time frame. If your prediction turns out to be correct and the price of the asset exceeds the strike price of the option by expiration, you can potentially make substantial profits.

Because out of the money call options have a lower upfront cost compared to in the money or at the money options, your potential return on investment (ROI) can be much higher. This is because the lower cost allows you to control a larger number of options contracts, which in turn can result in higher profits if the underlying asset experiences a significant price increase.

However, it’s important to note that buying out of the money call options also carries a higher risk compared to other options strategies. If the price of the underlying asset doesn’t rise as expected or doesn’t reach the strike price by expiration, the options may expire without any value, resulting in a loss of the premium paid for the options.

Therefore, it’s crucial to carefully analyze the market conditions, the potential for upward price movement, and the time frame before deciding to purchase out of the money call options. Additionally, it’s essential to diversify your options trading portfolio and not allocate all your capital to a single options strategy to mitigate risk.

In summary, buying out of the money call options provides an opportunity for higher gains due to the potential for greater ROI compared to other options strategies. However, it’s important to consider the higher risk involved and to conduct thorough analysis and risk management before entering such positions.

Out of the money call options are call options where the strike price is higher than the current market price of the underlying asset. These options have no intrinsic value and are considered “out of the money” because it would not be profitable to exercise the option at the current market price.

One benefit of buying out of the money call options is that they can offer a lower upfront cost compared to in the money or at the money options. This means that investors can potentially control a larger amount of the underlying asset for a smaller initial investment. Additionally, out of the money call options can provide an opportunity for substantial profits if the underlying asset’s price rises significantly before the option expires.

The main risk associated with buying out of the money call options is that if the price of the underlying asset does not rise above the strike price before the option expires, the option will expire worthless and the investor will lose the entire premium paid for the option. This means that there is a possibility of losing the entire investment if the market does not move in the desired direction.

Out of the money call options can be used as a hedging strategy to some extent. By buying out of the money call options, investors can protect themselves against a potential price increase of the underlying asset. However, it is important to note that this strategy is not foolproof and does not guarantee protection against losses. Hedging with options involves various risks and complexities that should be carefully considered.

The tax implications of buying out of the money call options can vary depending on individual circumstances and the specific tax laws of the country or jurisdiction. In general, any profits from options trading, including out of the money call options, may be subject to capital gains tax. It is advisable to consult with a tax professional or financial advisor to understand the specific tax implications in your situation.

Out of the money call options are call options where the strike price is higher than the current market price of the underlying security. This means that if you were to exercise the option and purchase the underlying asset, you would be buying it at a premium compared to its current market value.

What is the ABCD strategy? When it comes to tackling complex problems, having a clear and structured approach can make all the difference. That’s …

Read ArticleWhere to find the best Euro exchange rate in Canada? Are you planning a trip to Europe from Canada? One of the most important things you need to …

Read ArticleRegulator of the National Australia Bank Limited When it comes to overseeing the financial industry in Australia, there are a number of regulatory …

Read ArticleIs there a fee for options trading on thinkorswim? Options trading can be a lucrative investment strategy, but it’s important to understand the costs …

Read ArticleUnderstanding TCA Trade Cost: A Comprehensive Guide Trade Cost Analysis (TCA) is a crucial tool for investors and traders to evaluate the cost of …

Read ArticleWhat happens to options at the money? At-the-money options are a key concept in the world of options trading. In simple terms, an at-the-money option …

Read Article