Are There Overnight Fees for Options Trading?

Are there overnight fees for options trading? Options trading is a popular and lucrative activity for many investors. The ability to leverage your …

Read Article

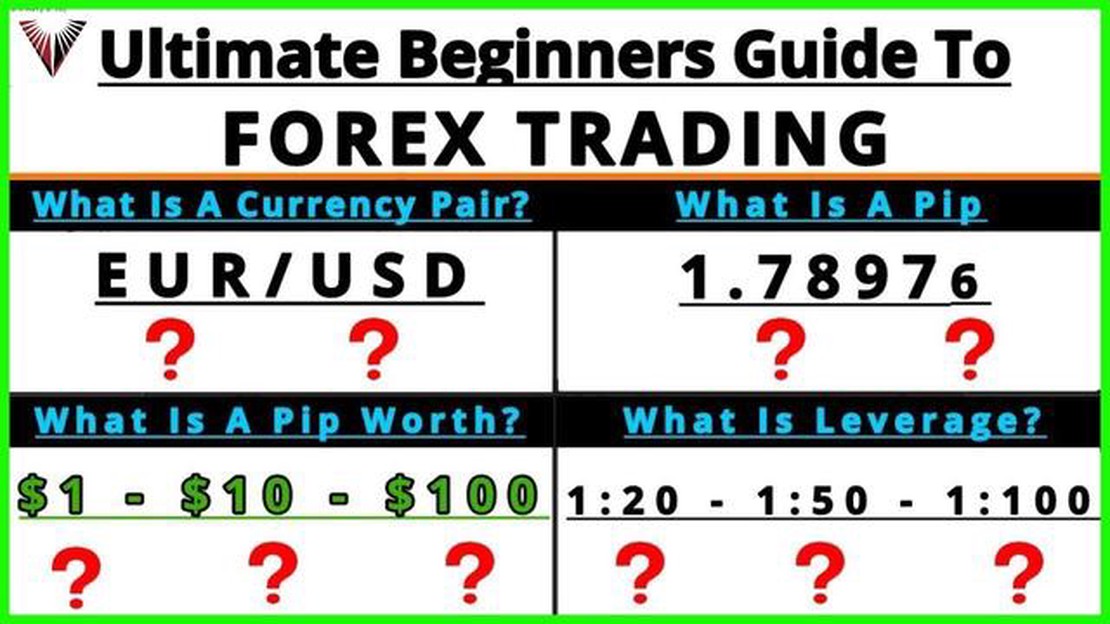

Forex trading, also known as foreign exchange trading, is the buying and selling of currency pairs on the global foreign exchange market. With a daily trading volume of over $6 trillion, it is the largest and most liquid financial market in the world. Whether you are interested in generating additional income or exploring new investment opportunities, learning forex trading can be a rewarding endeavor.

However, getting started in forex trading can be overwhelming, especially for beginners. This beginner’s guide aims to provide you with the necessary information and steps to start learning forex trading. From understanding the basic concepts to developing a trading strategy, this guide will help you navigate the world of forex trading.

To begin your forex trading journey, it is essential to have a solid understanding of the fundamental concepts. This includes learning about currency pairs, exchange rates, and how to read and interpret forex charts. Familiarizing yourself with these concepts will provide you with a strong foundation and enable you to make informed trading decisions.

Once you have grasped the basics, it is crucial to select a reliable forex broker. A forex broker acts as an intermediary between you and the forex market, providing you with access to trading platforms and tools. Take the time to research and compare different brokers, considering factors such as regulations, fees, customer service, and available trading platforms. By choosing a reputable broker, you can ensure a safe and seamless trading experience.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the global market. It is one of the largest and most liquid financial markets in the world, making it a popular choice for traders looking to profit from currency fluctuations.

Before you dive into forex trading, it’s important to understand the basics. Here are a few steps to help you get started:

1. Educate Yourself:

Begin by learning the fundamentals of forex trading. Understand how currency pairs work, the factors that influence exchange rates, and the various trading strategies you can employ. There are plenty of online resources, books, and courses available to help you build a solid foundation of knowledge.

2. Open a Trading Account:

Next, you’ll need to choose a reputable forex broker and open a trading account. Look for a broker that offers competitive spreads, low fees, and a user-friendly trading platform. It’s also important to consider factors such as regulation, customer support, and the security of your funds.

3. Practice with a Demo Account:

Most brokers offer demo accounts that allow you to practice trading without risking real money. Take advantage of this feature to familiarize yourself with the trading platform and test out your strategies. Use the demo account to gain experience and refine your skills before trading with real money.

4. Develop a Trading Plan:

Before you start trading with real money, it’s crucial to develop a trading plan. This plan should outline your goals, risk tolerance, and the strategies you will use. Having a plan in place will help you stay disciplined and make informed trading decisions.

5. Start with Small Investments:

When you’re ready to start trading with real money, it’s recommended to begin with small investments. This will allow you to mitigate risk while you gain experience and confidence. As you become more comfortable and profitable, you can gradually increase your investment amount.

6. Monitor the Markets:

Forex trading requires constant monitoring of the markets. Stay up to date with economic news, geopolitical events, and other factors that can impact currency prices. Use technical analysis tools and indicators to identify potential trading opportunities and make informed decisions.

7. Manage Your Risks:

Risk management is a crucial aspect of forex trading. Set stop-loss orders to limit your potential losses and use proper position sizing to ensure you don’t risk too much on a single trade. It’s also important to regularly review and adjust your risk management strategy as needed.

Read Also: How Much is $1 USD in CZK? | Currency Conversion

Remember, forex trading is a skill that takes time and practice to master. Stay patient, continue learning, and don’t let emotions guide your trading decisions. With dedication and the right approach, you can become a successful forex trader.

When it comes to forex trading, selecting a reliable broker is crucial for your success. A forex broker acts as an intermediary between you and the forex market, providing you with access to currency pairs and executing your trades.

Here are some important factors to consider when selecting a forex broker:

Regulation:

Make sure the broker you choose is regulated by a reputable financial authority. This ensures that the broker operates within strict guidelines and follows ethical practices.

Trading Platform:

Read Also: How to Calculate Weighted Average: Simple Example and Step-by-Step Guide

Check if the broker offers a user-friendly and reliable trading platform. The platform should have advanced charting tools, real-time quotes, and a variety of order types to suit your trading style.

Transaction Costs:

Consider the transaction costs involved, such as spreads, commissions, and overnight swap rates. Lower transaction costs can make a significant difference in your overall trading profitability.

Customer Support:

Look for a broker that provides excellent customer support. They should offer multiple channels of communication, such as phone, email, and live chat, and be responsive to your queries and concerns.

Deposit and Withdrawal Options:

Check the deposit and withdrawal options offered by the broker. It should support convenient and secure payment methods that suit your preferences.

Trading Instruments:

Ensure that the broker offers a wide range of trading instruments, including major and minor currency pairs, as well as other assets like commodities, indices, and cryptocurrencies.

Education and Research:

Consider the educational resources and research materials provided by the broker. A reliable broker should offer educational articles, videos, webinars, and market analysis to help you improve your trading skills.

By carefully evaluating these factors and doing thorough research, you can select a reliable forex broker that aligns with your trading goals and preferences.

Forex trading refers to the buying and selling of different currencies in the foreign exchange market. It involves trading one currency for another in the hopes of making a profit from the exchange rate fluctuations.

Forex trading can be suitable for beginners, but it is important to have a good understanding of the market and the necessary skills before starting. It is recommended to learn about forex trading through educational resources and practice on demo accounts before investing real money.

To start learning forex trading, you can begin by reading educational articles and books on the subject. It is also recommended to take online courses or attend seminars to gain a deeper understanding of the market. Opening a demo account with a forex broker is a great way to practice trading without risking any real money.

Forex trading involves certain risks, including the possibility of losing money. Fluctuations in exchange rates can result in financial losses, especially if a trader does not have a proper risk management strategy in place. It is important to be aware of the risks and only invest what you can afford to lose.

Becoming a successful forex trader takes time and practice. It varies from person to person, but generally, it takes several months to years of consistent learning and trading experience to become consistently profitable. It is important to have realistic expectations and be willing to put in the effort to learn and improve your trading skills.

Forex trading is the buying and selling of currencies on the foreign exchange market in order to make a profit. Traders speculate on the value of different currencies, taking advantage of fluctuations in exchange rates.

There are several steps you can take to start learning forex trading. First, educate yourself about the basics of forex trading, including how the market works and the different trading strategies. Then, open a demo trading account with a reputable forex broker to practice trading using virtual money. Additionally, you can read books, watch tutorials, and join online communities to gain more knowledge and insight into forex trading.

Are there overnight fees for options trading? Options trading is a popular and lucrative activity for many investors. The ability to leverage your …

Read ArticleUnderstanding the Anatomy and Function of a Kangaroo Tail Kangaroos are fascinating creatures known for their unique physical features, and one such …

Read ArticleMethods to Discover a WordPress Theme that Resembles a Website Choosing the perfect WordPress theme for your website is crucial for creating a …

Read ArticleRuger Mini 14 Magazine Capacity: How Many Rounds Can It Hold? The Ruger Mini 14 is a popular choice among firearm enthusiasts due to its reliability …

Read ArticleBeginner’s Guide to Aggressive Investing Strategies Investing aggressively is a strategy that can potentially yield high returns and help you grow …

Read ArticleUnderstanding Equity in Options Trading Equity options are a popular investment tool that allow traders to profit from changes in a company’s stock …

Read Article