Understanding the Role of Exchange Participants in HKEX

What is an exchange participant in HKEX? Hong Kong Exchanges and Clearing Limited (HKEX) is one of the world’s leading exchange operators. It plays a …

Read Article

Forex trading, also known as foreign exchange trading, is a global decentralized market where currencies are traded. Unlike other financial markets, such as stock exchanges, there is no centralized exchange or clearinghouse in the forex market. Instead, transactions are conducted electronically over-the-counter (OTC) through a network of banks, financial institutions, and individual traders.

One of the main advantages of forex trading is that it offers traders the opportunity to profit from fluctuations in currency exchange rates. However, like any other financial market, forex trading involves costs and fees. These costs can vary depending on the broker or platform you use, as well as the trading strategy you employ.

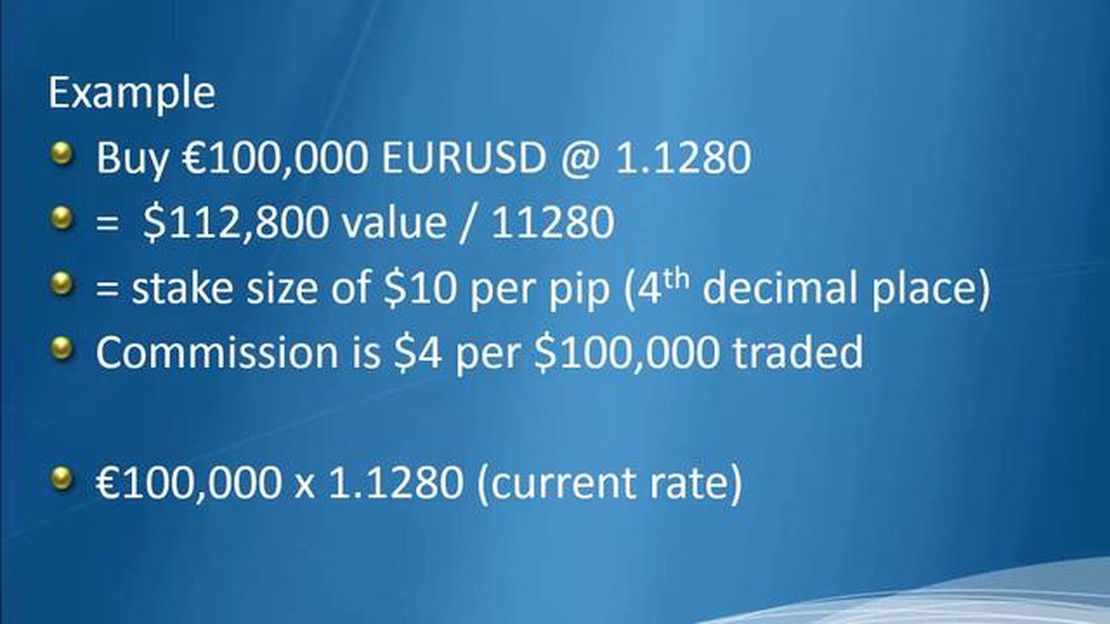

Commission fees are one type of fee that traders may encounter in forex trading. Typically, brokers make money by charging traders a spread, which is the difference between the bid and ask price of a currency pair. However, some brokers also charge a commission fee on each trade. This fee is usually a fixed amount per lot traded or a percentage of the total trade value.

It’s important for traders to consider the impact of commission fees when choosing a forex broker. While some brokers may offer lower spreads, they may charge higher commission fees, and vice versa. Traders should also take into account other factors such as trading platform, customer support, and regulatory compliance when selecting a broker.

Forex trading is a popular investment option for individuals looking to buy, sell, and speculate on foreign currencies. While it offers potential for profit, traders should also be aware of the commission fees associated with Forex trading.

In Forex trading, commission fees are the charges or costs that brokers impose for executing trades on behalf of their clients. These fees may vary depending on the broker and the specific trading platform used.

There are two main types of commission fees in Forex trading:

When considering Forex trading commission fees, it is essential to weigh these costs against the potential benefits and profitability of the trades. Traders should also take into account other factors such as the broker’s reputation, customer support, trading tools, and overall trading conditions.

It is important to note that not all Forex brokers charge commission fees. Some brokers offer commission-free trading, but these brokers may compensate for the lack of commission by widening the spread or charging additional fees in other areas.

Read Also: Is TCS Stock a Good Long-Term Investment Option?

To choose the most suitable broker for Forex trading, traders should carefully compare the commission fees, spreads, and other relevant charges. They should also consider their trading style, risk tolerance, and long-term investment goals.

Overall, understanding and being aware of commission fees in Forex trading is crucial for traders. By factoring in these fees when calculating potential profits or losses, traders can make informed decisions and manage their trading portfolios effectively.

When it comes to forex trading, one important aspect to consider is the presence of commission fees. Unlike other financial markets, such as the stock market, forex trading does not typically involve paying traditional commission fees.

Instead, most forex brokers make money through the spread, which is the difference between the bid and ask prices of a currency pair. This means that when you enter a trade, you will pay a slightly higher price than the current market price, and when you exit a trade, you will receive a slightly lower price than the current market price.

While there are no commission fees in forex trading, it is important to understand that brokers may charge additional fees in other ways. For example, some brokers may charge an account maintenance fee or an inactivity fee if you do not place any trades for a certain period of time. Additionally, there may be fees for depositing or withdrawing funds from your trading account.

It is crucial to carefully review the fee structure of any broker you choose to ensure you are aware of any potential costs beyond the spread. This will help you make informed decisions and manage your trading expenses effectively.

Key Points:

Remember, understanding the fee structure of forex trading is essential for managing your trading costs and making informed decisions.

Read Also: Is MT5 a Trustworthy Platform? Find Out Here!

Commission fees in Forex trading refer to the charges imposed by a broker for executing trades on behalf of the traders. These fees are usually a percentage of the total trade volume or a fixed rate per trade.

No, not all Forex brokers charge commission fees. Some brokers make their profits through spreads, which is the difference between the buying and selling price of currency pairs. These brokers are called “no commission” or “commission-free” brokers.

The amount of commission fees in Forex trading varies depending on the broker and the type of trading account. It could be a fixed rate per trade, such as $10 per trade, or a percentage of the trade volume, such as 0.1% of the total trade volume.

Generally, yes. Most brokers have a tiered commission structure, where the commission fees increase as the trade volume increases. This means that larger trade volumes will attract higher commission fees compared to smaller trade volumes.

No, commission fees are not the only cost in Forex trading. Traders also need to consider other costs such as spreads, overnight financing charges (swap fees), and any additional fees charged by the broker for specific services or features.

Commission fees in Forex trading are charges that brokers impose on traders for executing their trades. These fees are separate from the spread, which is the difference between the buying and selling price. Commission fees can be a fixed amount per trade or a percentage of the trade volume.

No, not all brokers charge commission fees in Forex trading. Some brokers offer commission-free trading, where they make their profits solely from the spread. However, there are also brokers that charge commission fees in addition to the spread. Traders should carefully consider the fee structure when choosing a broker.

What is an exchange participant in HKEX? Hong Kong Exchanges and Clearing Limited (HKEX) is one of the world’s leading exchange operators. It plays a …

Read ArticleWhen does the London Session start in Germany? Trading in the London session can be incredibly lucrative, but for traders in Germany, it can also be a …

Read ArticleTrading Options with Penny Stocks: What You Need to Know If you’re a trader or investor looking to capitalize on the volatility of penny stocks, you …

Read ArticleHow much can I earn per day in forex trading? Forex, also known as foreign exchange trading, is a popular market for individuals seeking to make money …

Read ArticleUnderstanding the 50 and 200 Day Moving Averages (DMAs) The 50-day and 200-day moving averages (DMA) are important technical indicators used in …

Read ArticleIs VW a good stock to buy? In the world of investing, choosing the right stocks can be a daunting task. With so many options available, it can be …

Read Article