Foreign Currency Options: Where to Trade and How to Get Started

Foreign Currency Options Trading Locations Foreign currency options have become an increasingly popular investment tool for traders looking to …

Read Article

Option trading can be a lucrative way to make money in the financial markets. However, many traders find themselves losing money instead of making profits. Understanding the reasons behind these losses is crucial to turning things around and becoming a successful option trader. In this article, we will discuss the top five reasons why you might be losing money in option trading and provide strategies to help you overcome these challenges.

1. Lack of knowledge and experience: One of the biggest reasons why traders lose money in option trading is due to their lack of knowledge and experience. Trading options requires a deep understanding of market trends, risk management, and trading strategies. Without this knowledge, it is easy to make mistakes and incur losses. To overcome this, traders should invest time in learning about options and gaining practical experience through paper trading or by participating in trading courses and seminars.

2. Failure to analyze and research: Another common mistake that leads to losses in option trading is the failure to thoroughly analyze and research the underlying asset. Before entering a trade, it is essential to evaluate the market conditions, study the company’s financials, and analyze any relevant news or events. By conducting proper research, traders can make informed decisions and minimize the risk of losses.

3. Emotional trading: Emotional trading is a significant hurdle that often leads to losses in option trading. Greed, fear, and impatience can cloud a trader’s judgment and result in poor decision-making. To overcome emotional trading, traders should create a well-defined trading plan, stick to predetermined entry and exit points, and avoid making impulsive trades based on emotions.

4. Overtrading and lack of discipline: Overtrading, or trading too frequently, is a common mistake made by novice traders. This can lead to increased transaction costs and a higher chance of making mistakes. Moreover, lack of discipline in sticking to your trading strategy can also contribute to losses. To overcome these challenges, traders should be patient, focus on quality over quantity, and follow a disciplined approach to their trades.

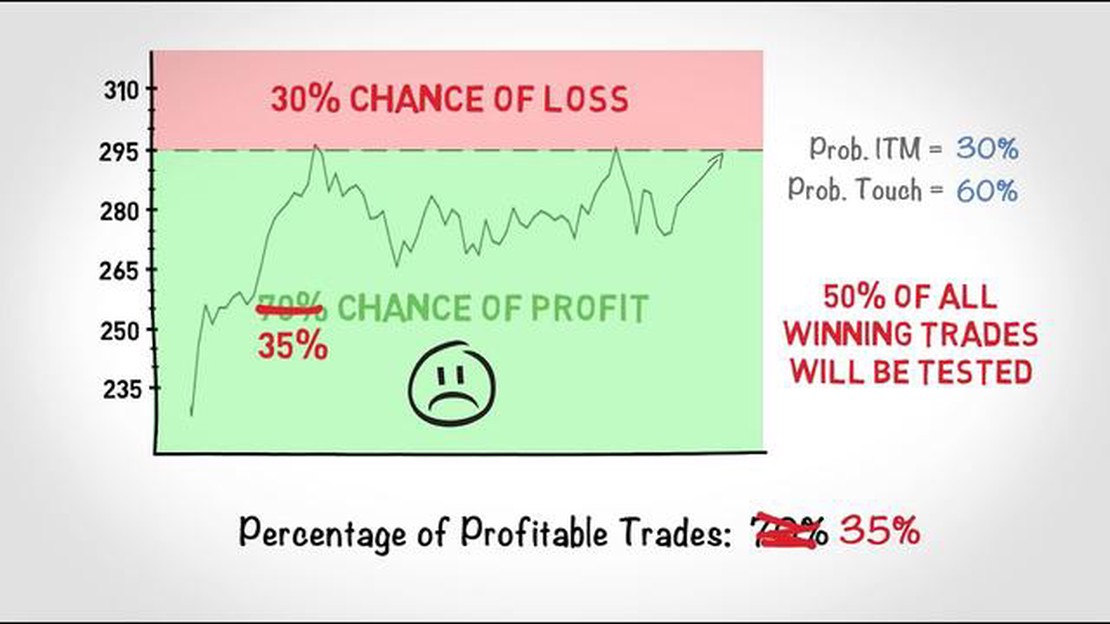

5. Poor risk management: Effective risk management is essential in option trading to protect against potential losses. Traders who fail to implement proper risk management strategies often find themselves facing significant losses. It is crucial to set stop-loss orders, diversify your portfolio, and avoid risking too much capital on a single trade. By managing risk effectively, traders can minimize losses and increase their chances of success in option trading.

In conclusion, losing money in option trading can be frustrating, but understanding the reasons behind these losses is the first step towards turning things around. By acquiring knowledge, conducting thorough research, controlling emotions, practicing discipline, and implementing proper risk management, traders can increase their chances of success and become profitable option traders.

One of the major reasons why traders lose money in option trading is due to inadequate knowledge and understanding of the options market. It is essential to have a strong foundation in the concepts and strategies involved in options trading before entering the market.

Many traders fail to spend enough time learning about the options market and the various factors that can affect their trades. They may not fully understand how options contracts work, the different types of options available, or the risks associated with trading options.

Without adequate knowledge and understanding, traders are more likely to make poor trading decisions and take unnecessary risks. This can result in significant losses and a negative overall trading experience.

Read Also: Understanding the Importance of Tracking Signals for Efficient Monitoring

It is important for traders to invest time in educating themselves about options trading before risking their hard-earned money. There are numerous resources available, including books, online courses, and seminars, that can help traders improve their knowledge and understanding of the options market.

By acquiring a solid understanding of options trading, traders will be better equipped to make informed decisions, implement effective strategies, and manage risk more effectively. This will increase their chances of success and help them turn their losses into profits.

One of the main reasons why traders lose money in option trading is because they make emotional decisions. Emotional trading decisions are often impulsive and not based on logical analysis or a well-thought-out strategy. These decisions are driven by fear, greed, and other emotions that can cloud a trader’s judgment and lead to poor outcomes.

When traders let their emotions dictate their actions, they often make rash decisions like buying or selling options without doing proper research or analysis. This can lead to significant losses as they are not making informed choices based on market conditions and trends.

Read Also: Can I Teach Myself a Trade? Learn New Skills and Build a Successful Career

For example, a trader might panic and sell their options prematurely if they see the market taking a downward turn. This knee-jerk reaction is driven by fear of losing more money, but it can result in missing out on potential gains if the market rebounds. On the other hand, greed can cause traders to hold onto losing options for too long, hoping for a turnaround that may never come.

To avoid making emotional trading decisions, it is important for traders to have a well-defined plan and stick to it. This includes setting clear entry and exit points, as well as determining risk management strategies. By having a plan in place, traders can remove emotions from the decision-making process and rely on objective criteria for their trades.

| Emotional Trading Decisions | How to Turn It Around |

|---|---|

| Emotional decisions are impulsive and not based on logical analysis or a well-thought-out strategy. | Create a well-defined plan and stick to it, including setting clear entry and exit points. |

| Emotional decisions are driven by fear, greed, and other emotions that cloud judgment. | Remove emotions from the decision-making process and rely on objective criteria for trades. |

| Traders may panic and sell options prematurely, missing out on potential gains. | Stay calm and make decisions based on market conditions and trends, rather than impulsive reactions. |

| Greed can cause traders to hold onto losing options for too long. | Set clear risk management strategies and stick to them, cutting losses when necessary. |

By recognizing the role that emotions play in trading and taking steps to control them, traders can significantly improve their chances of success in option trading. Emotion-free trading allows for more objective decision-making and reduces the risk of impulsive actions that can lead to financial losses.

There are several reasons why you may be losing money in option trading. One possible reason is that you are not properly managing your risk. Another reason could be that you are not doing enough research and analysis before making trades. Additionally, you may not be following a solid trading plan or strategy. Finally, emotional decision-making can also lead to losses in option trading.

To turn your losses around in option trading, you need to take a step back and evaluate your current approach. Are you properly managing your risk? Are you doing thorough research and analysis before making trades? It’s also important to have a solid trading plan in place and stick to it. Consider seeking professional advice or educational resources to further enhance your trading skills.

Some common mistakes that can lead to losses in option trading include not properly managing risk, making impulsive decisions based on emotions rather than analysis, not doing enough research before making trades, and not having a clear trading plan or strategy. It’s important to avoid these mistakes and instead approach option trading with discipline and logic.

Managing risk in option trading involves several strategies. One approach is to set stop-loss orders to limit potential losses. Another strategy is to diversify your portfolio by spreading your trades across different assets or sectors. It’s also important to avoid investing more than you can afford to lose. Additionally, consider using options strategies, such as buying protective puts or selling covered calls, to hedge against potential losses.

There are several tips for successful option trading. Firstly, take the time to thoroughly research and analyze potential trades before making a decision. Develop a trading plan and stick to it, avoiding impulsive decisions based on emotions. Proper risk management is crucial, so use stop-loss orders and diversify your portfolio. Continuously educate yourself on option trading strategies and consider seeking professional advice if needed. Finally, practice discipline and patience, as success in option trading takes time and experience.

Foreign Currency Options Trading Locations Foreign currency options have become an increasingly popular investment tool for traders looking to …

Read ArticleTrading with MACD: A Comprehensive Guide The Moving Average Convergence Divergence (MACD) indicator is a popular and widely used tool in technical …

Read ArticleUnderstanding the Difference Between Spot Price and Forward Price Spot price and forward price are two important concepts in the world of finance and …

Read ArticleRp1 000,000 If in Dollar how much? Have you ever wondered how much Rp1 000,000 would be if it were converted to US dollars? With exchange rates …

Read ArticleIG Forex and MT4: What You Need to Know If you are a Forex trader, you have probably heard of MetaTrader 4 (MT4), one of the most popular trading …

Read ArticleFree Forex Books: Best Sources to Download for Free When starting out in the forex market, it is important to have a solid understanding of the basic …

Read Article