Trading Gold with $10: Is it Possible? Learn How to Get Started

Is it possible to trade gold with $10? Gold has always been considered a safe haven for investors and traders, especially in times of economic …

Read Article

Spot price and forward price are two important concepts in the world of finance and investment. While they both refer to the price of an asset, they have distinct meanings and implications. Understanding the difference between spot and forward prices is crucial for anyone involved in trading, hedging, or portfolio management.

The spot price refers to the current market price of an asset, such as a commodity or a financial instrument, at the time of immediate purchase or sale. It represents the price at which an asset can be bought or sold for immediate delivery and settlement. The spot price is influenced by various factors, including supply and demand dynamics, market sentiment, economic indicators, and geopolitical events. Traders and investors closely monitor spot prices to make informed decisions about buying or selling assets.

The forward price, on the other hand, pertains to the future price of an asset that is agreed upon today for delivery and settlement at a later date. It is a calculated price that takes into account factors such as the spot price, interest rates, time to delivery, storage costs, and market expectations. The forward price is often used in the context of futures contracts, which are agreements to buy or sell assets at a predetermined price on a specified future date. By using forward prices, market participants can manage risks and lock in future prices for their assets.

It is important to note that the forward price is not necessarily equal to the spot price. In fact, the difference between the two prices, known as the forward premium or discount, reflects market expectations and interest rate differentials. If the forward price is higher than the spot price, it indicates a forward premium and suggests that market participants expect the price of the asset to increase in the future. Conversely, if the forward price is lower than the spot price, it indicates a forward discount and implies that market participants expect the price of the asset to decrease in the future.

Understanding the distinction between spot price and forward price is crucial for effectively managing financial risk, implementing trading strategies, and making informed investment decisions. By considering both spot and forward prices, market participants can gain insights into market expectations, hedging opportunities, and potential profit or loss scenarios. Whether you are a trader, investor, or risk manager, having a solid understanding of these concepts is essential for navigating the complex world of finance and maximizing your returns.

Understanding the difference between spot price and forward price is crucial for investors and traders in commodities markets. These two concepts represent different aspects of pricing for a given commodity, and understanding them can help make informed decisions when buying or selling.

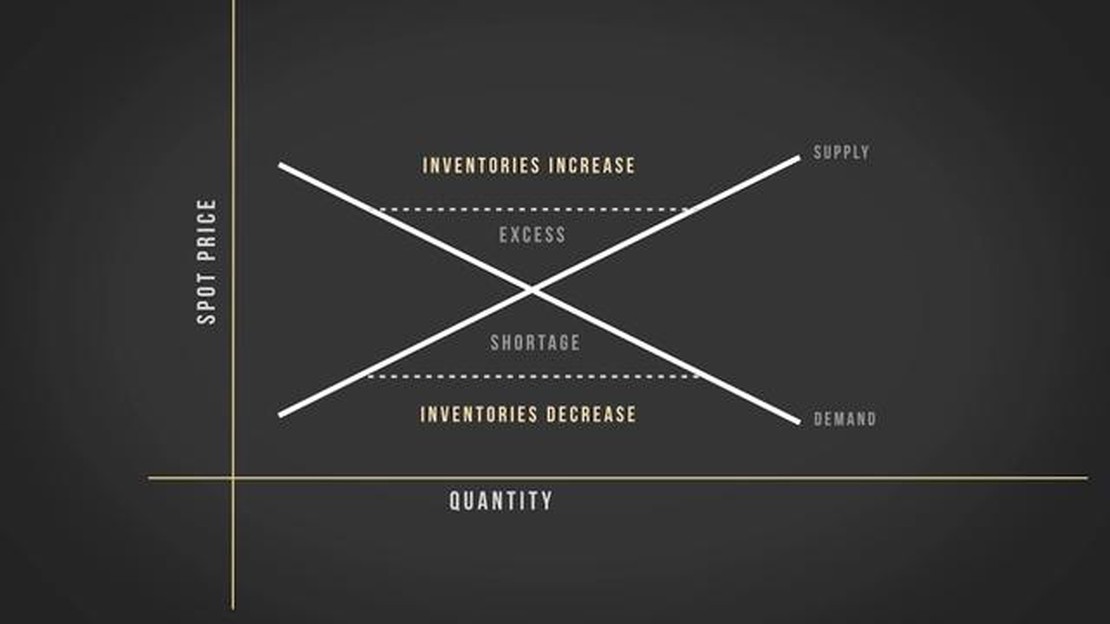

The spot price refers to the current market price at which a commodity is bought or sold for immediate delivery or settlement. It is the price at which a commodity can be bought or sold “on the spot,” hence its name. The spot price is determined by the forces of supply and demand in the marketplace and can fluctuate throughout the trading day.

On the other hand, the forward price represents the expected future price of a commodity at a specified future date. It is a price agreed upon today for a future delivery or settlement. Forward prices are derived from the spot price and take into account factors such as interest rates, storage costs, and market expectations for future supply and demand.

Read Also: Learn how to trade EUR USD and maximize your profits

One key difference between spot price and forward price is the timing of the transaction. Spot price transactions occur immediately, with the buyer and seller exchanging the commodity and payment at the spot price. In contrast, forward price transactions involve a commitment to buy or sell the commodity at a future date. This allows market participants to hedge against price fluctuations and manage their exposure to market risks.

Another difference lies in the pricing dynamics. Spot prices are influenced by short-term factors such as changes in supply and demand, weather conditions, geopolitical events, and market sentiment. On the other hand, forward prices reflect market expectations and take into account anticipated changes in fundamentals over the specified time horizon.

It’s important to note that spot and forward prices can diverge due to factors such as storage costs, interest rates, and market expectations. This creates opportunities for arbitrage and trading strategies based on the expected convergence or divergence of these prices.

In conclusion, while both spot price and forward price are important in commodities markets, they represent different aspects of pricing. Spot price is the current market price for immediate delivery, while forward price is the expected future price for a specified future date. Understanding the distinctions between these two prices can be valuable when making investment or trading decisions.

Several factors can affect both spot price and forward price:

| Factors | Description |

|---|---|

| Supply and Demand | The basic law of supply and demand applies to both spot price and forward price. If demand exceeds supply, prices tend to rise. If supply exceeds demand, prices tend to fall. |

| Market Conditions | The overall market conditions, such as economic indicators, geopolitical factors, and natural disasters, can have a significant impact on both spot and forward prices. These conditions can create uncertainty and volatility in the market, leading to price fluctuations. |

| Interest Rates | Interest rates can affect the cost of financing and carry costs associated with holding a commodity position. Changes in interest rates can influence the pricing of both spot and forward contracts. |

| Storage Costs | If a commodity needs to be stored for a period of time before delivery, storage costs can impact the pricing of both spot and forward contracts. Higher storage costs can lead to higher forward prices. |

| Transportation Costs | Transportation costs can affect the pricing of both spot and forward contracts, especially for commodities that require shipping or delivery. Increases in transportation costs can result in higher prices. |

| Seasonality | Seasonal factors can influence the pricing of both spot and forward contracts for certain commodities. For example, the demand for heating oil tends to increase during the winter, leading to higher prices during that season. |

Read Also: Is CNH a good stock to buy? - Stock Market Analysis

It’s important to consider these factors when trading or investing in commodities, as they can have a significant impact on the prices of spot and forward contracts.

The spot price is the current price at which an asset can be bought or sold for immediate delivery, while the forward price is the price at which an asset can be bought or sold for delivery at a specified future date.

Spot and forward prices differ because they take into account factors such as interest rates, storage costs, and market expectations for the future price of the asset.

Investors can use spot and forward prices to make investment decisions and hedge against price fluctuations. For example, if an investor expects the price of an asset to increase in the future, they may choose to buy the asset at the spot price and sell it at the higher forward price.

No, spot and forward prices are important factors, but they are not the only ones. Other factors such as supply and demand dynamics, economic conditions, and market sentiment also play a role in determining the price of an asset.

Spot and forward prices can be used for various types of assets, including commodities, currencies, and financial instruments. However, the availability of spot and forward markets may vary depending on the asset.

Is it possible to trade gold with $10? Gold has always been considered a safe haven for investors and traders, especially in times of economic …

Read ArticleIs forex board waterproof? Forex board, also known as foamex or foam board, is a popular material used for various applications, including signage, …

Read ArticleIs Forex Titan Exchange Legit? Forex trading has become increasingly popular in recent years, attracting both seasoned traders and newcomers to the …

Read ArticleExclusion Items for AMT: A Comprehensive Guide When it comes to paying taxes, most people are familiar with the regular tax system. However, there is …

Read ArticleBest Indicator Showing Buying and Selling Pressure When it comes to trading in the stock market, understanding buying and selling pressure is crucial. …

Read Article2023 Patriots Trade: Who Was Traded? The New England Patriots have been no strangers to trades in the offseason, and 2023 is shaping up to be no …

Read Article