Can stock options be exercised before expiration?

Exercising Stock Options Before Expiration: Is it Possible? Stock options are financial instruments that give individuals the right to buy or sell a …

Read Article

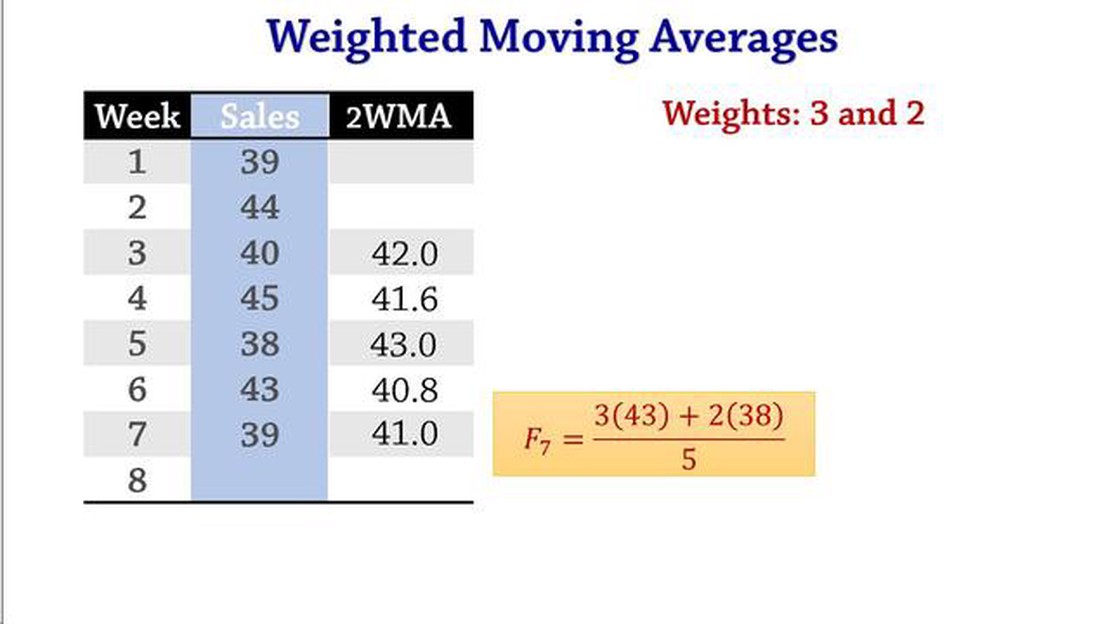

When it comes to analyzing data, it is essential to use the right tools and techniques to gain meaningful insights. One such technique that can be highly beneficial is a weighted moving average. Unlike a simple moving average, which gives equal weight to all data points, a weighted moving average assigns different weights to different data points based on their importance or relevance.

By using a weighted moving average, you can give more weight to recent data points and less weight to older ones. This allows you to focus on the most relevant information and reduce the impact of outliers or irrelevant data. It is particularly useful when analyzing time-series data, as it helps in identifying trends and making accurate predictions.

Weighted moving averages are commonly used in various fields such as finance, economics, and market research. They provide a more accurate representation of the underlying data and help in making informed decisions. Whether you are analyzing stock prices, economic indicators, or consumer behavior, a weighted moving average can provide valuable insights and help you in your analysis.

In addition to its accuracy and relevance, a weighted moving average is also relatively easy to calculate and interpret. You can assign weights based on your domain knowledge or statistical analysis, allowing you to customize the moving average to suit your specific needs. With the right choice of weights, you can effectively smooth out noise in the data and identify meaningful patterns and trends.

Weighted Moving Average (WMA) is a popular technical indicator used in financial analysis and forecasting. It offers several benefits that make it a valuable tool for traders and investors. Here are some of the key advantages of using WMA:

In conclusion, Weighted Moving Average is a powerful tool that offers several benefits in financial analysis. With its ability to smooth out outliers, provide increased relevance to recent data, offer flexibility in customization, improve trend identification, and enhance timing, WMA can greatly assist traders and investors in making informed decisions and achieving better trading results.

The use of a weighted moving average can significantly improve the accuracy of your analysis. Unlike a simple moving average, which gives equal weight to all data points, the weighted moving average assigns higher weights to more recent data points and lower weights to older data points. This means that the weighted moving average is more responsive to recent changes in the data, making it more accurate in reflecting the current trend or pattern.

By giving more weight to recent data, the weighted moving average reduces the lag in the analysis. This is particularly useful when analyzing time-sensitive data or when trying to capture short-term trends. Instead of waiting for a significant number of data points to accumulate before a trend becomes apparent, the weighted moving average can detect changes more quickly.

Read Also: Who are the top competitors to Xe com? Find out here

Furthermore, the weights assigned to each data point in the weighted moving average can be adjusted to reflect the significance or relevance of the data. Important data points can be given higher weights, while less important data points can be given lower weights. This allows for a more customizable and tailored analysis that takes into account the specific characteristics of the data being analyzed.

Overall, the use of a weighted moving average can improve the accuracy of your analysis by reducing lag, capturing short-term trends, and providing a customizable approach to data weighting. Whether you are analyzing financial data, sales data, or any other type of time series data, incorporating a weighted moving average into your analysis can provide valuable insights and improve decision-making.

One of the main advantages of using a weighted moving average in your analysis is that it helps you better recognize trends in your data. The weighted moving average gives more importance to recent data points, allowing you to capture the most recent changes in the trend.

Unlike a simple moving average, where all data points are weighted equally, the weighted moving average assigns higher weights to more recent data points and lower weights to older data points. This means that the weighted moving average is more responsive to recent changes in the data.

By giving more importance to recent data points, the weighted moving average helps you identify trends more accurately. It smooths out the noise in the data and focuses on the overall direction of the trend. This can be especially useful in analyzing financial data, where there may be a lot of volatility and short-term fluctuations.

Additionally, the weighted moving average allows you to adapt to changing trends more quickly. If the trend suddenly shifts, the weighted moving average will respond faster compared to a simple moving average, which may take longer to reflect the new trend.

Read Also: Discover the Optimal Time to Trade Oil Futures for Maximum Profits

In summary, using a weighted moving average in your analysis improves your ability to recognize trends by giving more weight to recent data points and smoothing out short-term fluctuations. It helps you capture the most recent changes in the trend and adapt to changing trends more quickly, making it a valuable tool in trend analysis and forecasting.

A weighted moving average is a type of moving average that assigns different weights to the data points in the calculation. The weights can be used to emphasize certain data points more than others, giving them a greater influence on the average.

Weighted moving average can be particularly useful when there is a need to give more importance to recent data points. This can be beneficial in cases where recent trends or changes in the data are considered more significant than older data points. In contrast, the simple moving average treats all data points equally.

The specific weights used in a weighted moving average are determined by the analyst or the programmer. The weights can be based on various factors, such as the importance of recent data, the volatility of the data, or certain predetermined criteria. The choice of weights can vary depending on the specific purpose of the analysis.

Yes, weighted moving average can be used for forecasting. By assigning appropriate weights to the data points, a weighted moving average can provide a forecast that gives more weight to recent data, capturing the latest trends and changes in the data. However, it is important to note that the accuracy of the forecast depends on the choice of weights and the underlying data patterns.

While weighted moving average has its benefits, it also has some limitations. One limitation is the subjective nature of assigning weights, as it can introduce bias in the analysis. Additionally, the choice of weights can significantly impact the results, and selecting the wrong weights could lead to inaccurate or distorted averages. It is important to carefully consider the weighting scheme based on the specific requirements of the analysis.

Exercising Stock Options Before Expiration: Is it Possible? Stock options are financial instruments that give individuals the right to buy or sell a …

Read ArticleUnderstanding the differences between Ofx and Wise When it comes to international money transfers, there are many options available for individuals …

Read ArticleIs Trading Central Signals Worth Using? Are you looking for a reliable trading tool to enhance your investment strategy? If so, you may have come …

Read ArticleChoosing the Optimal Timeframe for Intraday Options Trading When it comes to intraday options trading, choosing the right timeframe is crucial for …

Read ArticleIs Forex Trading for Everyone? Debunking Common Myths Are you dreaming of financial independence and the ability to work from anywhere in the world? …

Read ArticleWhat is FX journal? When it comes to forex trading, keeping track of your trades and analyzing your performance is crucial for improving your …

Read Article