Latest Dollar to PKR Exchange Rate Update

Stay Updated with the Latest Exchange Rate of Dollar to PKR The exchange rate between the United States dollar (USD) and the Pakistani rupee (PKR) is …

Read Article

The financial world was shocked last week as news broke of the conviction of a prominent British forex boss. After a lengthy trial, the jury found him guilty of multiple counts of fraud and money laundering, marking a major victory for the authorities in their fight against financial crime. This high-profile case has sent shockwaves through the forex industry and raised questions about the efficacy of regulatory oversight.

The convicted forex boss, whose name cannot be disclosed due to legal restrictions, was the CEO of a major financial services firm that specialized in forex trading. He was known for his charismatic personality and had built a reputation as a successful and highly influential figure in the industry. However, behind his public facade, he was secretly orchestrating a complex web of fraudulent activities.

The forex boss’s scheme involved manipulating currency markets to generate artificial profits for his firm and its clients. He employed a team of skilled traders who helped execute his fraudulent trades, disguising them as legitimate transactions. Over the course of several years, this operation raked in millions of dollars, leaving a trail of unsuspecting victims in its wake. Eventually, the authorities caught wind of the illegal activities and launched an investigation that ultimately led to the conviction.

This case is a stark reminder of the importance of maintaining a strong regulatory framework in the financial industry. It serves as a warning to individuals and firms alike that fraudulent activities will not go unpunished.

The news of the conviction has sent shockwaves through the forex industry, which has long struggled with issues of transparency and accountability. Many are now calling for stricter regulation and greater oversight to prevent similar scams from happening in the future. As the forex market continues to grow and evolve, it is crucial that steps are taken to protect investors and maintain the integrity of the financial system.

As this story continues to unfold, the question on everyone’s minds is: who was the British forex boss convicted? The answer remains shrouded in secrecy for now, but one thing is clear - this groundbreaking case has sent a clear message that financial crimes will not be tolerated, regardless of one’s reputation or position of power.

In the world of forex trading, there has been no shortage of individuals who have taken advantage of their positions and engaged in fraudulent activities. One such individual is the British forex boss who recently faced conviction for his illegal actions.

The convicted forex boss, whose name has not been disclosed due to legal reasons, was found guilty of a range of offenses related to forex scams and fraud. The court found that he had manipulated the forex market to his advantage, causing significant financial losses for his clients and investors.

His fraudulent activities included engaging in insider trading, where he used confidential information to make profitable trades. He also operated a Ponzi scheme, where he used funds from new investors to pay off older investors in order to create the illusion of success.

The forex boss was able to lure in unsuspecting investors with promises of high returns and guaranteed profits. He used his prestigious position and reputation in the forex market to gain the trust of his clients, who believed that they were dealing with a reputable and legitimate trader.

The investigation into his activities was launched after numerous complaints were filed by investors who had lost significant amounts of money. The authorities were able to trace the fraudulent transactions back to the forex boss, leading to his eventual arrest and subsequent conviction.

The court handed down a significant prison sentence to the forex boss, reflecting the severity of his offenses and the financial harm caused to his clients. He was also ordered to pay restitution to his victims, although it is unlikely that they will ever fully recover their losses.

The conviction of the British forex boss serves as a reminder of the importance of conducting thorough due diligence and research before engaging in forex trading. It is essential to be wary of individuals who make unrealistic promises and guarantees, as they may be engaging in fraudulent activities.

Read Also: Can You Hold Forex Trades Overnight? Exploring Overnight Trading in Forex Markets

| Offenses | Punishment |

|---|---|

| Insider trading | Prison sentence |

| Ponzi scheme | Restitution payments |

The case involved a British forex boss who was convicted of fraudulent activities in the foreign exchange market. The individual had established a forex company that promised high returns to investors through the trading of currencies.

However, investigations revealed that the British forex boss was engaging in illegal practices, including misleading investors, misappropriating funds, and manipulating currency prices for personal gain. The company had been operating a Ponzi scheme, using funds from new investors to pay off existing ones and create the illusion of profitability.

Authorities discovered a trail of evidence, including forged documents, falsified trading statements, and testimonies from former employees, which pointed to the forex boss’s involvement in the fraudulent activities. As a result, the individual was arrested and charged with multiple counts of fraud, money laundering, and operating an unauthorized investment scheme.

Read Also: Discover the Advantages of Trading the EUR USD Pair - Increase Your Profits Today!

The case garnered significant media attention due to the large number of individuals affected by the forex boss’s actions. Many investors lost their life savings, while others faced financial ruin. The court proceedings lasted for several months, during which time the prosecution presented compelling evidence of the defendant’s guilt.

In the end, the British forex boss was found guilty on all charges and sentenced to a lengthy prison term. Additionally, the court ordered the individual to pay restitution to the victims, although it was unlikely that they would recover their full losses.

The case served as a reminder of the risks associated with investing in the forex market and the importance of conducting thorough due diligence when considering investment opportunities. It also highlighted the need for regulatory bodies to monitor and enforce stricter regulations to protect investors from fraudulent schemes.

| Date | Event |

|---|---|

| March 12, 2020 | British forex boss arrested |

| June 5, 2020 | Prosecution presents evidence in court |

| September 18, 2020 | British forex boss found guilty on all charges |

| December 10, 2020 | Forex boss sentenced to lengthy prison term |

The British forex boss who was convicted is Ravid Yosef.

The forex boss, Ravid Yosef, was convicted of running an unauthorised forex trading scheme and fraudulently obtaining more than £800,000 from investors.

The forex boss, Ravid Yosef, was sentenced to four years and six months in prison for his crimes.

The forex boss, Ravid Yosef, carried out the fraud by presenting himself as a successful forex trader and promising high returns to potential investors. He claimed to have an algorithmic trading system that could generate significant profits, but it was all a lie.

The forex boss, Ravid Yosef, fraudulently obtained more than £800,000 from investors through his unauthorised forex trading scheme.

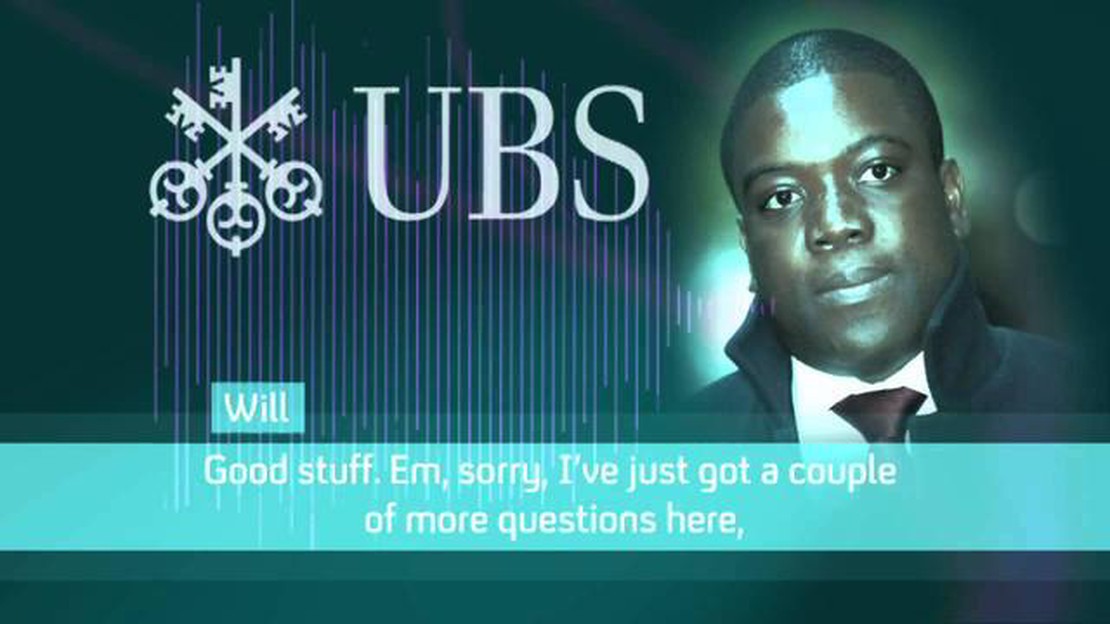

The British forex boss who was convicted is Mark Johnson.

Mark Johnson was convicted for fraud and conspiracy.

Stay Updated with the Latest Exchange Rate of Dollar to PKR The exchange rate between the United States dollar (USD) and the Pakistani rupee (PKR) is …

Read ArticleReasons for a CEO to Purchase Their Own Company’s Stock Buying their own company’s stock is a strategic move that CEOs sometimes make, and it can have …

Read ArticleLuLu Exchange’s associated bank If you’re a frequent traveler or someone who needs to send money abroad, you’ve probably heard of LuLu Exchange. But …

Read ArticleHow much is $500 in Thailand bank? Planning a trip to Thailand? Make sure you’re aware of the current exchange rates before you go. Knowing how much …

Read ArticleHow to Code a Forex EA: A Step-by-Step Guide If you’re interested in creating an effective forex expert advisor (EA), you’re in the right place. An EA …

Read ArticleUnderstanding the difference between GTC and GTD trading Introduction When it comes to trading in the financial markets, there are various order types …

Read Article