Is Forex Game Legit? The Ultimate Guide to Forex Trading Safety

Is Forex game legit? Forex trading has gained immense popularity in recent years, attracting traders from all walks of life. With the promise of high …

Read Article

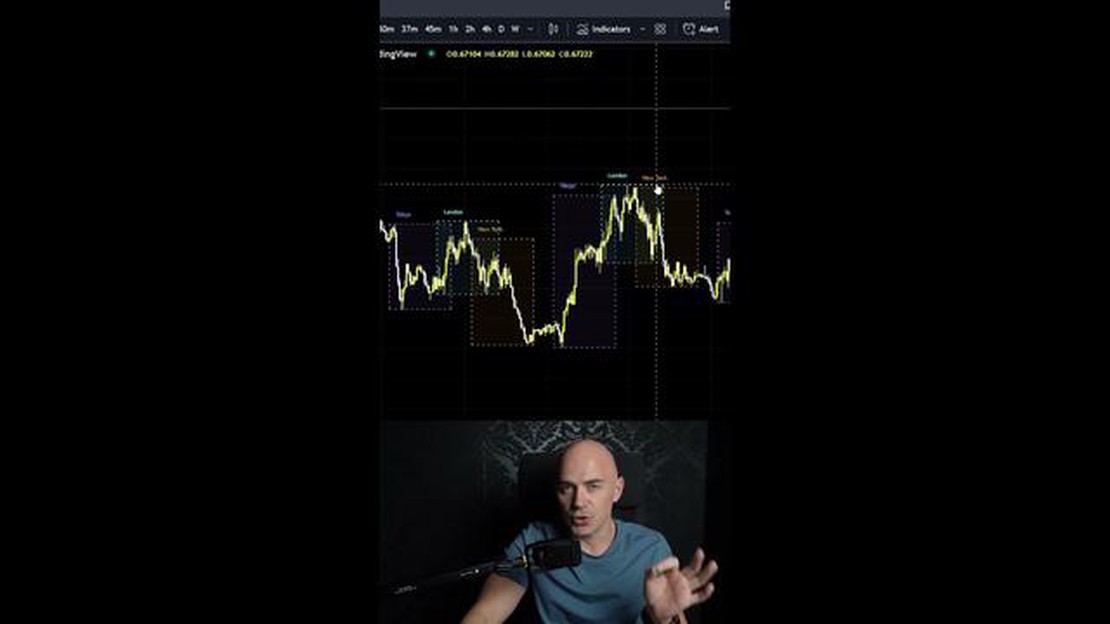

Forex markets operate around the clock, enabling traders to access the market at any time. However, certain trading sessions overlap, offering increased liquidity and potential trading opportunities. Understanding these overlapping hours is crucial for those looking to maximize their profits in the forex market.

One of the most significant overlaps occurs between the London and New York trading sessions. These two financial centers are considered the largest in the world, with the majority of forex transactions taking place during their operating hours. During the overlap, market activity tends to be higher, leading to tighter spreads and increased trading volumes.

Another important overlap is between the Tokyo and London trading sessions. While not as significant as the London-New York overlap, this period still offers ample trading opportunities. The Tokyo session is known for its intense trading activity, primarily due to the participation of major financial institutions and hedge funds.

Traders should also pay attention to the New York and Sydney overlap. Although these two sessions are not as influential as the London-New York overlap, they still offer potential trading opportunities. The Sydney session begins early in the Asian trading session, while the New York session closes, allowing traders to take advantage of market movements during this time.

Understanding when the forex markets overlap can help traders strategize their trading activities and capitalize on high liquidity and market volatility. It is important to note that market conditions can vary during these overlaps, so traders should continuously monitor and adapt their strategies accordingly.

Forex trading operates around the clock, with different trading sessions taking place in different parts of the world. One of the key factors to consider when trading forex is the overlapping trading hours between various markets. Understanding these overlap periods can help traders take advantage of increased volatility and liquidity in the forex market.

There are four major forex trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Each session has its own characteristics and market participants, but it is during the overlap periods that trading activity tends to be the highest.

The most significant overlap occurs between the London and New York sessions, which is often referred to as the “golden hours” of forex trading. During this time, traders from both Europe and the United States are actively participating in the market, leading to increased trading volume and volatility.

Another important overlap occurs between the Tokyo and London sessions. This overlap can be particularly attractive for traders as it combines the liquidity of the Asian market with the volatility of the European market. Traders can take advantage of price movements influenced by both Asian and European economic news and events.

The Sydney session overlaps with both the Tokyo and London sessions, although the trading volume during this time tends to be lower compared to the other overlap periods. Traders can still monitor the market and look for trading opportunities, especially if there is significant news or economic data released during this time.

It’s important to note that not all currency pairs exhibit the same level of volatility and liquidity during overlap periods. Major currency pairs tend to be the most active during these times, while exotic currency pairs may have lower trading volume and liquidity.

To help traders identify the best times to trade, the following table shows the overlap periods between the major forex trading sessions:

Read Also: Is Weekend Trading Possible in Binary Options?

| Session | Open (GMT) | Close (GMT) | Overlap with Other Sessions |

|---|---|---|---|

| Sydney | 10:00 PM | 7:00 AM | Tokyo, London |

| Tokyo | 12:00 AM | 9:00 AM | Sydney, London |

| London | 8:00 AM | 5:00 PM | Tokyo, New York |

| New York | 1:00 PM | 10:00 PM | London, Sydney |

By understanding the forex market overlaps, traders can plan their trading strategies accordingly and take advantage of the increased liquidity and volatility during these periods. It’s important to keep in mind that trading during overlap periods also carries certain risks, as sudden price movements can occur due to unexpected news or events.

Overall, being aware of the forex market overlaps and knowing the characteristics of each trading session can help traders make more informed trading decisions and potentially increase their chances of success.

Forex market overlaps occur when two or more major financial centers are open at the same time. During these overlap periods, there is an increase in trading activity, resulting in higher liquidity and volatility in the forex market. Traders should pay attention to these overlaps as they can provide valuable trading opportunities.

One of the main reasons why forex market overlaps are important for traders is because they offer the highest liquidity. Liquidity refers to how easily and quickly an asset can be converted into cash without affecting its price. During overlap periods, there are more participants in the market, including banks, financial institutions, and individual traders, leading to increased liquidity. This means that traders can execute their trades with ease and at the desired price.

Another reason why forex market overlaps are important is because they can result in higher volatility. Volatility refers to the price fluctuations of an asset over a certain period of time. Higher volatility often leads to greater profit potential, as it creates more trading opportunities. During overlap periods, traders can take advantage of the increased volatility to make profits through day trading or swing trading strategies.

Read Also: Forex Trading in Europe: Learn Whether It's Permitted and How to Get Started

Furthermore, forex market overlaps allow traders to access multiple market sessions simultaneously. Each major financial center has its own unique trading hours, and during overlaps, traders have the opportunity to trade in multiple markets at once. For example, during the overlap of the London and New York sessions, traders can take advantage of the increased activity in both the European and American markets. This allows traders to diversify their trading and potentially maximize their profits.

Lastly, forex market overlaps also offer traders the opportunity to react quickly to market-moving news and events. During overlap periods, news releases and economic data from multiple countries may occur simultaneously. Traders who are actively monitoring the markets during overlaps can quickly analyze the impact of these news releases and adjust their trading strategies accordingly. This ability to react quickly to market events can be crucial in achieving profitable trades.

| Benefits of Forex Market Overlaps for Traders |

|---|

| Increased liquidity |

| Higher volatility |

| Access to multiple market sessions |

| Quick reaction to market-moving news |

In conclusion, forex market overlaps are important for traders due to the increased liquidity, higher volatility, access to multiple market sessions, and the ability to react quickly to market-moving news. Traders should be aware of the overlap periods and consider incorporating them into their trading strategies to make the most of these opportunities.

The forex market is open 24 hours a day, 5 days a week. However, the trading activity and liquidity can vary at different times of the day.

Forex markets overlap when two or more markets are open at the same time. The most important overlap occurs between the London and New York markets, which is when the highest trading volume and volatility in the market are typically observed.

Forex market overlap is significant because it leads to increased trading activity and liquidity, which can result in more opportunities for traders. During the overlap, the market is more active and there is a higher chance of finding good trading opportunities.

Yes, there are several specific times during the day when forex markets overlap. The London and New York markets overlap from 8:00 AM to 12:00 PM EST, the Tokyo and Sydney markets overlap from 7:00 PM to 2:00 AM EST, and the London and Tokyo markets overlap from 3:00 AM to 4:00 AM EST.

There are several advantages of trading during forex market overlap. Firstly, there is increased liquidity, which means there are more buyers and sellers in the market, making it easier to enter and exit trades. Secondly, there is higher volatility, which can lead to bigger price moves and more profit potential. Lastly, there are more trading opportunities available during the overlap, as different market sessions have different characteristics and trading strategies can be employed based on these characteristics.

The forex market operates 24 hours a day, 5 days a week. However, there are specific trading hours where the market is most active and liquidity is highest. These hours are typically during the overlap of different forex market sessions.

Is Forex game legit? Forex trading has gained immense popularity in recent years, attracting traders from all walks of life. With the promise of high …

Read ArticleUnderstanding the Bid-Ask Spread for Natural Gas Prices When it comes to trading natural gas, one key concept that every investor should understand is …

Read ArticleComparing Forex Trading and Affiliate Marketing: Which is the Better Option? When it comes to making money online, there are countless options …

Read ArticleExploring the Future of Moving Averages When it comes to predicting the future, there are many tools and techniques that can be utilized. One such …

Read ArticleMethods to Verify a Trading Strategy Developing a successful trading strategy is only the first step in becoming a profitable trader. In order to have …

Read ArticleUnderstanding Dividends on Stock Options When it comes to investing in stocks, dividends are an important factor to consider. Dividends are payments …

Read Article