Which Timeframe is Better for Scalping? Find Out Here!

Choosing the Best Timeframe for Scalping Forex Markets Scalping is a popular trading strategy that involves making small, quick trades in order to …

Read Article

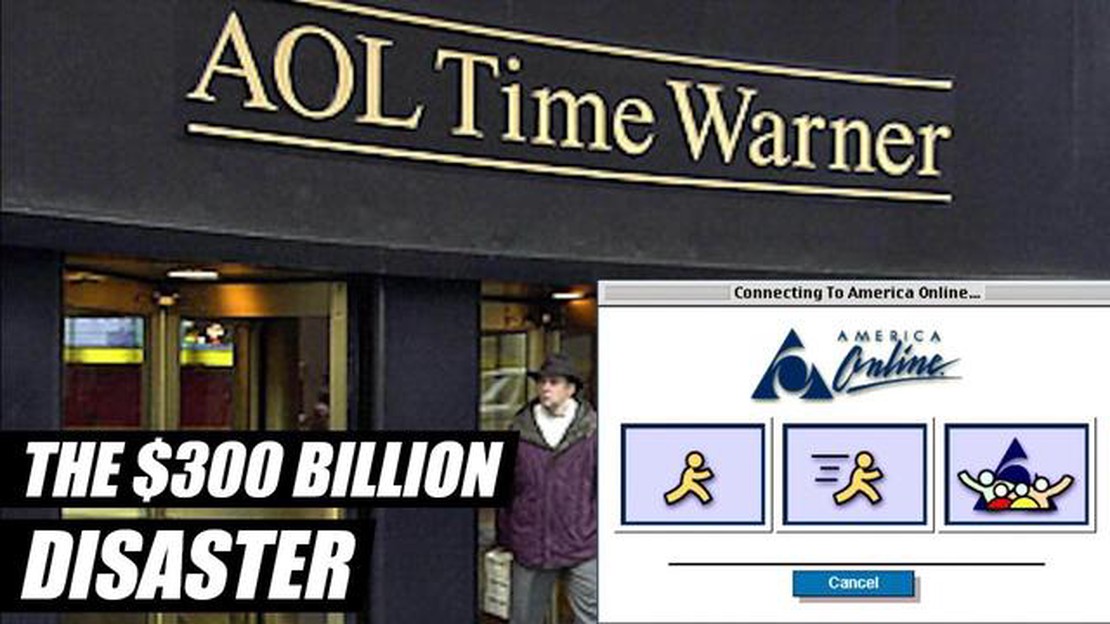

AOL, or America Online, was once a prominent internet service provider and media company during the early days of the internet boom. Founded in 1983, AOL quickly became one of the top players in the industry, providing dial-up internet access to millions of users worldwide. At its peak, AOL was valued at over $200 billion, making it one of the most valuable companies at the time.

During its heyday, AOL’s stock price experienced significant fluctuations, reflecting the company’s rapid growth and subsequent decline. One of the most noteworthy milestones in AOL’s stock history was its all-time high price. In the early 2000s, AOL’s stock reached an impressive peak, climbing to an astonishing value.

However, as the internet landscape evolved and broadband internet became more accessible, AOL’s dial-up business model became obsolete. This led to a decline in the company’s revenue and a subsequent drop in its stock price. AOL eventually merged with Time Warner in 2001, marking the end of an era for the pioneering internet company.

Despite its eventual decline, AOL’s highest stock price serves as a testament to the company’s once-dominant position in the internet industry. It also highlights the rapid evolution of technology and how even the most successful companies can become outdated in a short period of time.

AOL’s stock price has seen significant fluctuations over the years. In the late 1990s, during the dot-com boom, AOL’s stock price reached its highest point. On July 25, 1999, AOL’s stock price hit a peak of $94.76 per share. At that time, AOL was one of the leading internet service providers and a major player in the online world.

However, the dot-com bubble eventually burst, impacting AOL’s stock price. By the early 2000s, AOL’s stock price had dropped significantly, trading at less than $10 per share. The decline was attributed to various factors, including increased competition and the company’s failure to adapt to changing market trends.

In 2001, AOL merged with Time Warner, hoping to leverage synergies and revitalize its stock price. However, the merger did not meet expectations, and AOL’s stock price continued to decline. By 2002, AOL’s stock price had fallen to around $8 per share.

In the following years, AOL faced further challenges as it struggled to transition from a dial-up internet provider to an online media and advertising company. This had a negative impact on AOL’s stock price, which reached a low point of around $8 per share in 2009.

Over the years, AOL’s stock price has experienced ups and downs, reflecting changes in the company’s business strategy and market conditions. Today, AOL is no longer a standalone company, as it has been acquired by Verizon Communications. However, its historical stock price serves as a reminder of its prominent role during the early days of the internet.

Note: Stock prices mentioned in this article are based on historical data and may not reflect current market conditions. Investors should conduct their own research and seek professional advice before making any investment decisions.

AOL’s stock price has been influenced by a variety of factors since its inception. Some of the key factors that have influenced the company’s stock price include:

| Factor | Description |

|---|---|

| Financial Performance | The company’s financial performance, including factors such as revenue growth, profit margins, and cash flow, can impact investor confidence and ultimately the stock price. |

| Competition | AOL operates in a competitive industry, with other companies vying for market share. Changes in market dynamics, shifts in consumer preferences, and the emergence of new technologies can all impact AOL’s stock price. |

| Strategic Partnerships and Acquisitions | AOL’s partnerships and acquisitions can affect its stock price. Successful strategic initiatives and partnerships can boost investor confidence and drive up the stock price, while unsuccessful ventures can have the opposite effect. |

| Regulatory Environment | Changes in regulations and policies that impact the telecommunications and media industries can impact AOL’s stock price. This includes changes in net neutrality regulations, privacy laws, and government policies affecting the industry. |

| Industry Trends | Trends within the telecommunications and media industries, such as the shift towards digital media consumption and the rise of streaming services, can impact AOL’s stock price. Investors may adjust their expectations and valuations of the company based on these trends. |

| Overall Market Conditions | The overall economic and market conditions can impact AOL’s stock price. Factors such as interest rates, inflation, and investor sentiment towards the market as a whole can influence investor willingness to buy or sell AOL shares. |

These are just a few of the many factors that can influence AOL’s stock price. It’s important for investors to consider these factors and conduct thorough research before making investment decisions.

When it comes to tech companies, AOL was once a major player in the industry. However, compared to some of the giants we see today, its stock price pales in comparison.

For instance, Apple, one of the most valuable companies in the world, had a stock price that peaked at over $232 per share in October 2018. This is well above AOL’s highest stock price of $95.82 per share.

Read Also: Best Phones for Forex Trading in [current year]: Top Smartphones Reviewed

Another tech giant, Microsoft, also surpassed AOL with its highest stock price reaching $115.61 per share in 1999.

Amazon, now known as one of the most successful companies globally, had a stock price of over $3,500 per share in July 2021, which is more than 35 times higher than AOL’s highest stock price.

Read Also: Understanding the Two Types of Clearing: A Comprehensive Overview

These comparisons highlight the significant growth and dominance of these tech companies compared to AOL, demonstrating the ever-evolving nature of the industry.

As of now, AOL’s stock price is $X.XX per share, which represents an increase of X% compared to the previous year. This upward trend can be attributed to various factors, including the company’s strategic partnerships, technological advancements, and solid financial performance.

AOL’s stock price has been influenced by the overall market conditions, as well as specific events related to the company. For example, the announcement of a new product or service, a change in leadership, or a major acquisition can all impact the stock price.

Looking ahead, analysts are optimistic about the future prospects of AOL’s stock price. The company’s focus on diversifying its revenue streams and expanding into new markets is expected to drive growth and increase shareholder value.

Furthermore, AOL’s strong brand recognition and loyal customer base give it a competitive edge in the digital media industry. As consumer preferences continue to shift towards online platforms and digital content, AOL is well-positioned to capitalize on these trends.

However, it is important to note that the stock market is inherently unpredictable, and AOL’s stock price may be subject to volatility in the future. Investors should carefully consider their investment decisions and consult with a financial advisor before making any transactions.

In summary, AOL’s stock price has shown a positive trend in recent years, and analysts have a favorable outlook for its future performance. With its strategic initiatives and strong market positioning, AOL has the potential to deliver value to its shareholders in the long term.

AOL’s highest stock price was $95.81 per share.

AOL reached its highest stock price on December 9, 1999.

AOL’s stock price reached a high point due to the dot-com bubble in the late 1990s.

Yes, AOL’s stock price declined significantly after reaching its highest point.

Several factors contributed to the decline of AOL’s stock price, including the bursting of the dot-com bubble and increasing competition in the Internet industry.

AOL’s highest stock price was $95.81 per share.

AOL reached its highest stock price on December 9, 1999.

Choosing the Best Timeframe for Scalping Forex Markets Scalping is a popular trading strategy that involves making small, quick trades in order to …

Read ArticleExploring the Bloomberg GSAM FX Carry Index The Bloomberg GSAM FX Carry Index is a widely used financial tool that provides insights into the …

Read ArticleIs Binary Trading Real or Fake? Binary trading has gained significant popularity in recent years, attracting both experienced traders and beginners …

Read ArticleSwing Trading Strategies for Weekly Options Swing trading is a popular strategy among options traders, as it allows for short-term trades that …

Read ArticleUnderstanding the Rate of Interest in Options Trading Options trading is a complex financial instrument that offers investors the opportunity to …

Read ArticleWho is the best stock option trader? Stock options trading is a highly competitive and lucrative field, with traders aiming to maximize profits by …

Read Article