Understanding the Key Differences Between RFS and RFQ

Understanding the Difference between RFS and RFQ When it comes to procurement processes, two of the most commonly used methods are Request for …

Read Article

Trading is a volatile and high-stakes world, where every second counts and security is of utmost importance. One critical aspect of ensuring secure and reliable trading is the implementation of Transport Layer Security (TLS), a cryptographic protocol that provides secure communication over a computer network. TLS is widely used in various industries, including finance, to protect sensitive data and prevent unauthorized access. In this comprehensive guide, we will delve into the intricacies of TLS and explore its significance in trading.

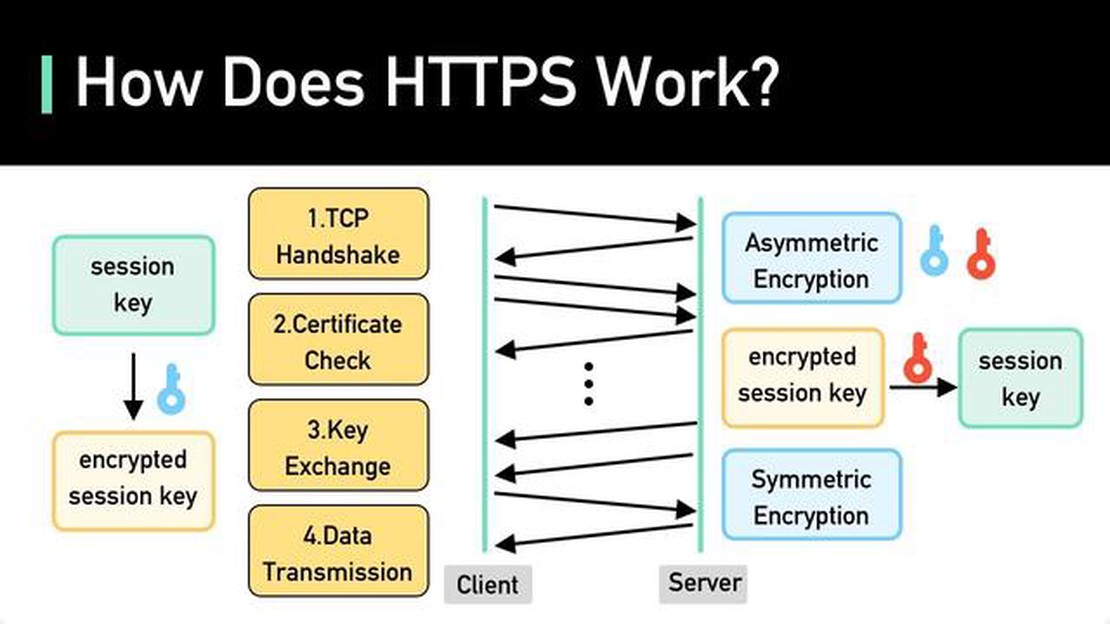

TLS works by establishing an encrypted connection between a client (such as a trader’s computer or a trading platform) and a server (such as a brokerage or exchange). This encryption ensures that the data exchanged between the two parties remains confidential and cannot be intercepted or tampered with by malicious actors. TLS also provides authentication, ensuring that the client is connecting to the intended server and not an impostor.

The significance of TLS in trading cannot be overstated. By using TLS, traders can have peace of mind knowing that their sensitive financial information, such as account credentials and trade orders, are protected from prying eyes. TLS also prevents attackers from altering the data being transmitted, safeguarding against fraudulent activities, such as front-running or unauthorized trade executions.

Front-running: The illegal practice of a broker executing trades on a security for its own account while taking advantage of advance knowledge of pending orders from its customers.

Moreover, TLS plays a vital role in maintaining the integrity and trustworthiness of the trading ecosystem. It ensures that the information transmitted between traders, brokers, and exchanges remains confidential, reducing the risk of insider trading and leaks of sensitive market data. Additionally, TLS protects against man-in-the-middle attacks, where an attacker intercepts and alters communication between two parties, potentially leading to unauthorized access or manipulation of trades.

In conclusion, TLS is an essential aspect of secure trading, providing confidentiality, authentication, and data integrity. Its implementation is crucial for protecting sensitive financial information and maintaining the integrity of the trading ecosystem. By understanding the significance of TLS in trading, traders and market participants can make informed decisions to mitigate risks and stay secure in an increasingly connected and digital trading landscape.

Transport Layer Security (TLS) is a cryptographic protocol that provides secure communication over computer networks. It is commonly used in trading to ensure that data transmitted between parties is protected from unauthorized access or tampering.

TLS establishes an encrypted connection between a client (such as a trader’s device) and a server (such as a trading platform or exchange). This encryption helps to prevent eavesdropping, data interception, and other security risks.

When a trader initiates a trade or accesses trading information, TLS ensures that the data being transmitted is encrypted and cannot be deciphered by anyone other than the intended recipient. This is achieved through the use of encryption algorithms, digital certificates, and secure key exchange.

One of the key components of TLS is the use of certificates. Certificates are used to verify the identity of the server and establish a secure connection. These certificates are issued by trusted Certificate Authorities (CAs) and contain information such as the server’s public key and other identifying details.

In trading, TLS plays a crucial role in maintaining the confidentiality and integrity of sensitive financial and personal information. It helps to protect against unauthorized access to trading accounts, theft of sensitive data, and other malicious activities.

Read Also: 10 Steps to Start Investing Aggressively and Grow Your Wealth

By using TLS in trading, traders can have confidence that their transactions and communications are secure, reducing the risk of fraud and ensuring the confidentiality of their trading activities.

In conclusion, understanding TLS in trading is essential for traders and financial institutions. It provides a secure communication channel, protects against unauthorized access, and helps maintain the integrity and confidentiality of trading information.

Transport Layer Security (TLS) is a cryptographic protocol that provides secure communication over a network. It is the successor to the Secure Sockets Layer (SSL) protocol and is widely used to secure online transactions, including in trading.

TLS ensures that the data sent between a client (such as a web browser) and a server is encrypted and cannot be intercepted or tampered with by unauthorized parties. It establishes a secure connection between the client and the server, allowing for the secure exchange of sensitive information, such as financial transactions, personal data, and trading orders.

Read Also: PNB Rank in India: Everything You Need to Know

When a client connects to a server using TLS, they engage in a handshake process where they exchange digital certificates to verify each other’s identity. This helps prevent man-in-the-middle attacks and ensures that the communication is happening with the intended server.

TLS also provides data integrity, ensuring that the data received is the same as the data sent, and data confidentiality, protecting the content of the communication from being accessed by unauthorized individuals.

Overall, TLS plays a crucial role in trading by providing a secure and reliable environment for financial transactions and sensitive data exchange.

TLS stands for Transport Layer Security and it is a cryptographic protocol that provides secure communication over a computer network. In the trading industry, TLS is used to ensure that all trading activities and transactions are secure and protected from unauthorized access.

In trading, TLS works by establishing a secure connection between the trader’s device and the trading platform. This is done by encrypting the data that is being transmitted between the two parties, making it unreadable to anyone who might intercept it. TLS also verifies the identity of the trading platform, ensuring that the trader is connecting to the correct and legitimate platform.

Using TLS in trading brings several benefits. Firstly, it ensures the privacy and confidentiality of trading activities, as all data is encrypted and secure from unauthorized access. Secondly, it helps to prevent data tampering and manipulation, as TLS verifies the authenticity of the trading platform. Lastly, TLS protects against eavesdropping and ensures that traders can safely transmit sensitive information such as trade orders and personal details.

While TLS is generally considered secure, there are potential risks and vulnerabilities to be aware of. One such risk is the possibility of a Man-in-the-Middle attack, where an attacker intercepts the communication between the trader and the trading platform. Additionally, outdated or improperly configured TLS implementations can also pose security risks. It is important for traders and trading platforms to stay updated on the latest TLS versions and best practices to mitigate these risks.

No, TLS is not the only security measure in trading. While TLS provides secure communication over a network, there are other security measures that traders and trading platforms can implement to enhance security. This can include multi-factor authentication, strong passwords, firewall protection, and regular security audits. The combination of multiple security measures helps to create a robust security infrastructure in trading.

TLS in trading stands for “Transport Layer Security”. It is a cryptographic protocol that ensures secure communication between trading platforms and clients, protecting sensitive information such as account credentials and financial data.

Understanding the Difference between RFS and RFQ When it comes to procurement processes, two of the most commonly used methods are Request for …

Read ArticleWhat is the best strategy for stock trading? Stock trading can be a complex and sometimes unpredictable endeavor. With the ever-changing market …

Read ArticleHow to Avoid Capital Gains Tax on Stocks in the UK Capital gains tax is a levy imposed on the profits made from the sale of assets, including stocks …

Read ArticleUnderstanding Option Delta Calculation In the world of options trading, understanding the concept of delta is essential. Delta measures the rate of …

Read ArticleDoes set and forget work? In today’s fast-paced world, everyone is always looking for ways to save time and effort. This is why the concept of “set …

Read ArticleUnderstanding the Hurst Cycle Trader Strategy Successful trading in the financial markets requires a solid understanding of various strategies and …

Read Article