Exploring the Possibility of Cashless Exercise of Stock Options

Cashless Exercise of Stock Options: Is it Possible? Cashless exercise of stock options is a method used by employees to exercise their stock options …

Read Article

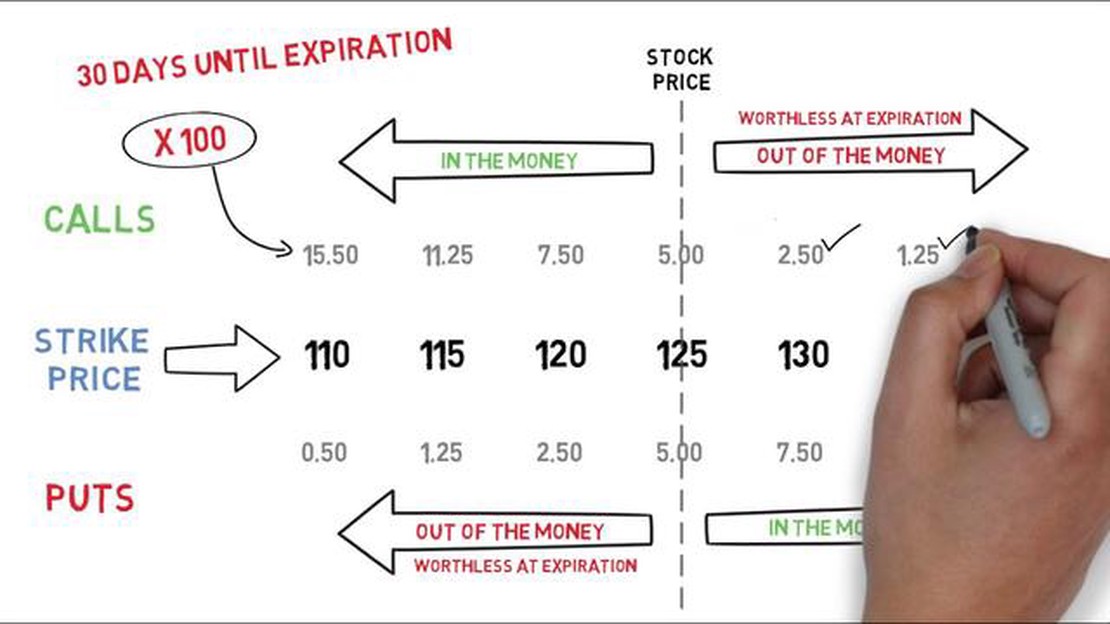

In the world of finance, options are a popular and widely misunderstood derivative instrument. Options give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, known as the strike price, within a specified period of time. This period is known as the settlement period, and it plays a crucial role in the options trading process.

The settlement period for options can vary depending on the type of option and the market in which it is traded. Generally, options are classified as either European-style or American-style options. European-style options can only be exercised at expiration, while American-style options can be exercised at any time before expiration. As a result, the settlement period for European-style options is typically shorter than that of American-style options.

Typically, the settlement period for options ranges from a few days to a few months. This gives the holder of the option time to exercise their right before the option expires. During this period, the price of the underlying asset may fluctuate, affecting the value of the option. Traders and investors closely monitor the settlement period to make informed decisions on when to exercise or sell their options.

It is important to note that the settlement period for options is different from the settlement date. The settlement date refers to the date on which the actual transaction of buying or selling the underlying asset takes place. This is typically two business days after the trade date.

Understanding the settlement period for options is crucial for anyone interested in trading or investing in options. It is important to consider the length of the settlement period, the type of option, and the market conditions when making decisions about buying or selling options. By having a clear understanding of the settlement period, investors can navigate the complex world of options trading with confidence.

The settlement period for options refers to the timeframe within which the delivery of the underlying asset or cash settlement must occur after the exercise or expiration of the options contract. It is a crucial aspect of options trading and varies depending on the type of option and the exchange where it is traded.

For physically settled options, where the underlying asset is delivered upon exercise, the settlement period represents the time it takes for the buyer and seller to complete the transaction. This period can range from one to several days, depending on the specifics of the options contract.

In the case of cash-settled options, no physical delivery of the underlying asset occurs, and settlement is made in cash. The settlement period for such options is typically shorter compared to physically settled options, often occurring the next business day after exercise or expiration.

The settlement period serves several purposes in options trading. It allows sufficient time for the exchange or clearinghouse to process the transaction, validate the exercise or expiration, and ensure the appropriate transfer of funds or assets between the buyer and seller.

During the settlement period, the parties involved in the options contract must fulfill their obligations promptly to avoid any potential conflicts or defaults. The timeframe is designed to provide all necessary parties a reasonable period to settle the transaction smoothly and efficiently.

It’s worth noting that the settlement period may also be influenced by regulatory requirements or market practices specific to a particular exchange or jurisdiction. Traders and investors should be aware of these factors and account for them when engaging in options trading.

In conclusion, the settlement period for options is the timeframe within which the delivery or cash settlement must occur after the exercise or expiration of the options contract. It is a critical component of options trading and ensures the smooth processing and completion of transactions.

Read Also: Understanding Forex Oil Trading: A Comprehensive Guide

Options settlement refers to the process by which the terms of an options contract are fulfilled between the buyer and the seller. It involves the exchange of the underlying asset at a specified price, known as the strike price, on or before a predetermined date, known as the expiration date.

The settlement period for options can vary depending on the type of option contract. There are two main types of settlement: physical settlement and cash settlement.

Physical settlement: In a physical settlement, the buyer of the option exercises their right to buy or sell the underlying asset, and the seller is obligated to deliver or take delivery of the asset. This type of settlement is common for options on commodities, such as metals or agricultural products.

Cash settlement: In a cash settlement, the value of the option contract is settled in cash, based on the difference between the strike price and the market price of the underlying asset at expiration. Cash settlement is more common for options on financial instruments, such as stocks or indices.

To facilitate the settlement process, there is a clearinghouse involved in options trading. The clearinghouse acts as an intermediary, ensuring that the obligations of both parties are fulfilled. It also helps to reduce counterparty risk and improve market transparency.

It’s important for options traders to understand the settlement period and how it can affect their trading strategy. Some traders may prefer options with longer settlement periods to allow for more time for the price of the underlying asset to move in their favor. Others may prefer shorter settlement periods for a more rapid turnover of their positions.

In conclusion, options settlement refers to the process of fulfilling the terms of an options contract. It can involve either physical settlement, where the underlying asset is exchanged, or cash settlement, where the contract is settled in cash. Understanding the settlement period is vital for options traders to effectively manage their trading activities.

When it comes to options trading, the settlement period refers to the time it takes for the financial transaction to be completed. This includes the transfer of ownership between the buyer and the seller, as well as the exchange of funds.

Read Also: Is binary trading legal in Singapore? Find out the regulations and laws on binary options trading in Singapore

The length of the settlement period can vary depending on the type of option and the exchange on which it is traded. In general, the settlement period for options is shorter compared to other financial instruments like stocks.

For equity options, which are options based on stocks or exchange-traded funds (ETFs), the settlement period is typically two business days after the trade date, known as T+2. This allows enough time for the parties involved to process the transaction and ensures a smooth transfer of ownership.

However, it’s important to note that the settlement period can also be shorter for certain types of options. For example, index options may have a settlement period of just one business day, known as T+1. This is because index options are cash-settled, meaning that no physical delivery of the underlying assets is required.

Overall, the length of the settlement period for options is designed to ensure timely and efficient completion of trades, while also taking into account the complexities of the options market. It’s important for options traders to be aware of the settlement period for the specific options they are trading and to plan their trading strategies accordingly.

Disclaimer: This article is for informational purposes only and should not be considered as financial or investment advice.

The settlement period for options is the timeframe within which the financial obligations of the option contract are fulfilled. It refers to the time between the expiry of the options contract and the actual settlement of the transaction.

The length of the settlement period for options varies depending on the type of option and the exchange on which it is traded. For standardized options on most U.S. exchanges, the settlement period is typically one business day after the expiry of the contract. However, some options contracts may have longer settlement periods, such as weekly or monthly options, which settle on a predetermined date after expiration.

Sure! Let’s say you hold a call option on a stock that expires on Friday. The settlement period for this option would be the following Monday, as most U.S. options settle on the next business day after expiry. On Monday, the financial obligations of the option contract would be fulfilled, and if the option is in-the-money, you would receive the agreed-upon payout.

Yes, there are some exceptions to the standard settlement period for options. For example, some options contracts, such as weekly options, may have a shorter settlement period, settling on the same day as expiry. Additionally, options contracts traded on international exchanges may have different settlement periods, depending on the rules and regulations of the specific exchange.

If you do not settle your options during the settlement period, you may face certain consequences depending on the terms of the options contract and the rules of the exchange. In some cases, the options contract may expire worthless, and you would lose any potential value or premium associated with the option. It is important to be aware of the settlement period and fulfill your financial obligations in a timely manner.

The settlement period for options is the time frame within which the buyer and seller need to fulfill their obligations. In most cases, the settlement period for options is one business day after the trade date.

Cashless Exercise of Stock Options: Is it Possible? Cashless exercise of stock options is a method used by employees to exercise their stock options …

Read ArticleUnderstanding Discounted Stock Option 409A: All You Need to Know In today’s fast-paced and highly competitive business environment, offering employee …

Read ArticleUnderstanding Employee Stock Options Employee stock options can be a valuable asset for employees and a powerful tool for companies to attract and …

Read ArticleWhat is the best forex price alert app for iPhone? If you’re a Forex trader and use an iPhone, having access to reliable price alerts is crucial for …

Read ArticleWhat is the typical annual inflation rate? Inflation is a crucial economic indicator that measures the rate at which the general level of prices for …

Read ArticleIs New York Trading Session Open Now? The New York Stock Exchange (NYSE) is one of the world’s largest and most prestigious stock exchanges. It is …

Read Article