Do you need 25,000 in buying power to day trade?

Is $25,000 in Buying Power Required for Day Trading? Day trading can be an exciting and potentially lucrative way to make money in the stock market. …

Read Article

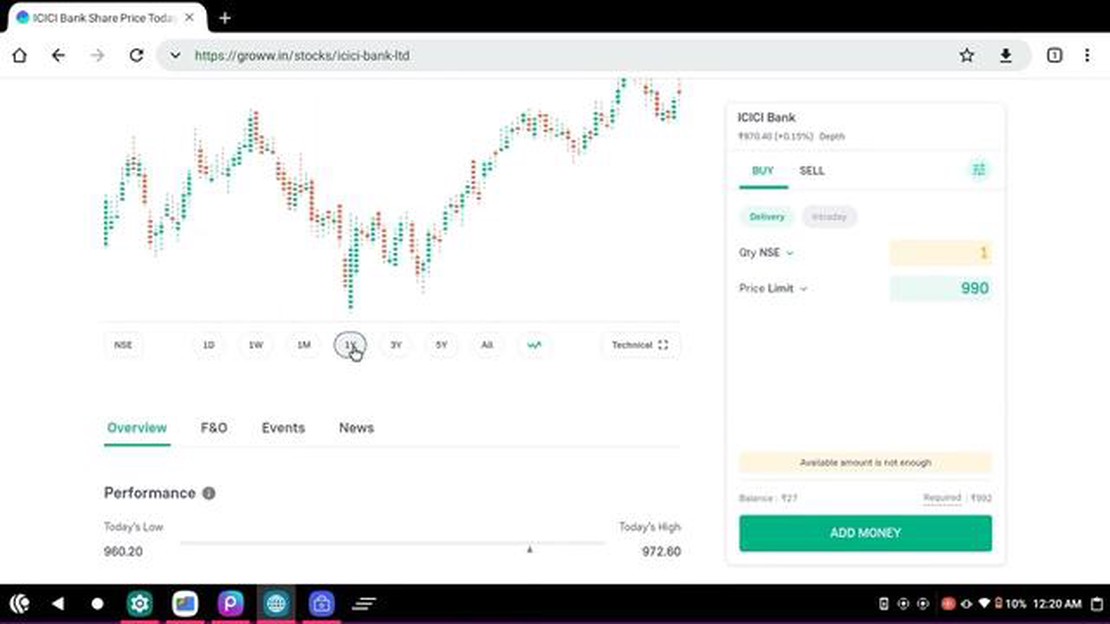

When it comes to trading options, one important factor to consider is the lot size. The lot size refers to the number of units of the underlying asset that are included in each option contract. In the case of Icici Bank options, the lot size is a crucial factor that traders should be aware of.

The lot size of Icici Bank options is determined by the exchange on which they are traded. Typically, the lot size of Icici Bank options is 500 shares. This means that each option contract represents the right to buy or sell 500 shares of Icici Bank stock.

Knowing the lot size of Icici Bank options is essential for several reasons. Firstly, it helps traders determine how many option contracts they need to buy or sell to achieve their desired exposure to Icici Bank stock. Secondly, it affects the cost of trading, as the premium paid or received for each option contract is multiplied by the lot size.

Important Note: The lot size of Icici Bank options is subject to change. It’s always advisable to check with the exchange or your broker for the most up-to-date information before placing any trades.

Understanding the lot size of Icici Bank options is crucial for both new and experienced traders. It allows them to effectively plan their trades, manage risk, and make informed decisions based on the number of shares represented by each option contract.

Options are financial instruments that give investors the right, but not the obligation, to buy or sell assets at a predetermined price and within a specific time frame. In the case of Icici Bank options, they provide investors with the opportunity to trade options based on the stock of Icici Bank, one of India’s leading private sector banks.

Icici Bank options have a lot size, which refers to the number of shares that can be bought or sold in a single contract. The lot size for Icici Bank options depends on the stock price and is determined by the exchange on which the options are traded. Typically, the lot size for Icici Bank options ranges from 100 to 1000 shares.

It is important for investors to understand the lot size of Icici Bank options before trading them. The lot size affects the cost of the options and the potential profit or loss. For example, if the lot size is 100 shares and the stock price is $50, each contract represents the right to buy or sell 100 shares of Icici Bank stock at $50 per share.

Investors can trade Icici Bank options through various strategies such as buying or selling calls and puts, and employing different trading strategies like straddles, strangles, and spreads. It is crucial to have a good understanding of these strategies and their potential risks and rewards before trading Icici Bank options.

Before trading Icici Bank options or any other options, investors should also consider factors such as market conditions, volatility, and their own risk tolerance. It is essential to conduct thorough research, consult with financial advisors, and assess one’s own investment goals and objectives.

Read Also: Understanding the Impact of Yield on Currency Movements

In conclusion, understanding Icici Bank options requires knowledge of the lot size and various trading strategies. By acquiring the necessary information and considering important factors, investors can make more informed decisions and potentially benefit from trading Icici Bank options.

The lot size of ICICI Bank options refers to the number of underlying shares that each options contract represents.

In the case of ICICI Bank, the lot size for options contracts is typically 1,000 shares.

This means that when you trade ICICI Bank options, each contract you buy or sell represents the right to buy or sell 1,000 shares of ICICI Bank’s underlying stock.

The lot size is an important factor to consider when trading options, as it determines the number of shares you would be trading if the options contract is exercised or assigned.

It’s important to note that the lot size for options contracts may vary for different stocks and different exchanges.

Read Also: Forex Markets That Trade on Weekends: What You Need to Know

Therefore, it’s always a good idea to check the lot size of a specific stock’s options before trading.

When trading options on Icici Bank, it is important to have key information that can help you make informed decisions. Here are some key details you should know:

By understanding these key details about Icici Bank options, you can make more informed trading decisions and potentially increase your chances of success in the options market.

The minimum lot size for ICICI Bank options is 500 shares.

No, the lot size for ICICI Bank options is fixed at 500 shares. You cannot trade options with a lot size of 100 shares.

There is no maximum lot size for ICICI Bank options. You can trade options in multiples of the lot size, i.e., 500 shares.

Yes, you can trade ICICI Bank options in a multiple of the lot size, which is 500 shares. So, you can trade options in a lot size of 1000 shares.

No, you do not need to own 500 shares of ICICI Bank stock to trade options. Options are derivative instruments that allow you to buy or sell the underlying asset without actually owning it.

Is $25,000 in Buying Power Required for Day Trading? Day trading can be an exciting and potentially lucrative way to make money in the stock market. …

Read ArticleAre managed futures a good investment? Managed futures are a type of investment strategy that involves trading futures contracts with the guidance of …

Read ArticleUnderstanding Disqualifying Disposition and its Impact on Shares When it comes to stock options and employee stock purchase plans, one important …

Read ArticleUnderstanding the Hurst Cycle Trader Strategy Successful trading in the financial markets requires a solid understanding of various strategies and …

Read ArticleHow much is 1 VGX worth in dollars? Are you interested in knowing the current value of 1 VGX in dollars? Look no further! In this article, we will …

Read ArticleHow to Gain Profit from Nifty? If you’re looking to maximize your profit from Nifty, the popular stock market index in India, you’ve come to the right …

Read Article