Step-by-Step Guide: How to Trade on IG Index | Expert Tips and Strategies

Trading on IG Index: A Comprehensive Guide Welcome to our step-by-step guide on how to trade on IG Index. Whether you’re a beginner or an experienced …

Read Article

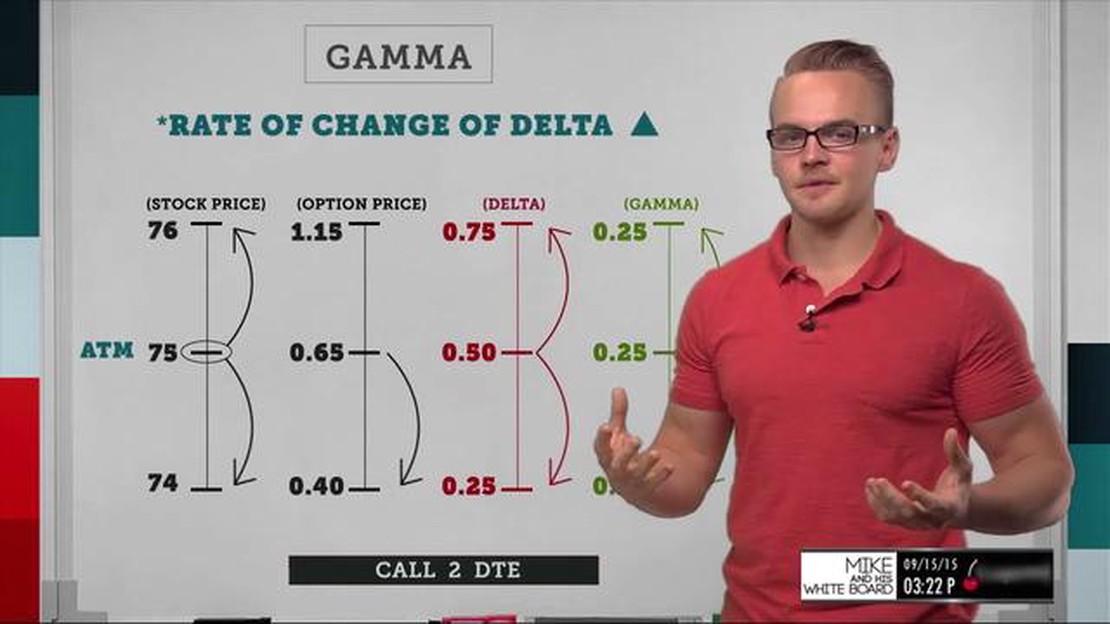

The concept of gamma is crucial to understanding the behavior of options and their prices. Gamma measures how fast the delta of an option changes in relation to the price movement of the underlying asset. Put simply, gamma determines the rate at which an option’s delta increases or decreases as the price of the underlying stock or index changes.

Options with the highest gamma will have the most significant changes in delta relative to the movement of the underlying asset. This means that these options are highly responsive to price changes and can see significant swings in value.

When an option has a high gamma, it indicates that the option will have a higher delta when the price of the underlying asset moves in favor of the option. Conversely, when the price of the underlying asset moves against the option, the delta will decrease at a faster rate. This volatility in delta can lead to rapid changes in an option’s price.

Traders who are looking to take advantage of short-term price movements may be interested in options with high gamma. These options can offer the potential for quick profits, but they also come with increased risk. The higher the gamma, the more sensitive the option’s price will be to changes in the underlying asset’s price.

In options trading, gamma is a measure of how much the delta of an option changes based on a one-point change in the price of the underlying asset. It represents the rate at which an option’s delta will change in relation to changes in the underlying asset’s price. Gamma helps traders understand how quickly an option’s delta will change as the price of the underlying asset fluctuates.

Gamma is a second-order derivative and is one of the Greeks, which are mathematical calculations used to quantify the risk and behavior of options. It is important to understand gamma because it has a significant impact on option prices and the profitability of options strategies.

Options with high gamma have a more significant change in delta for every one-point move in the underlying asset’s price. This means that as the price of the underlying asset moves, the delta of the option will change more rapidly. Options with low gamma will have a slower rate of change in delta for the same price movement in the underlying asset.

Traders who are bullish on a particular stock or asset may seek options with high gamma to take advantage of potential larger gains as the price of the underlying asset moves higher. Conversely, traders who are bearish may prefer options with low gamma to mitigate the risk of larger losses if the price of the underlying asset moves in the opposite direction.

It is important to note that gamma is not static and can change throughout the life of an option. As the expiration date approaches, an option’s gamma will typically increase, reflecting the growing importance of delta changes closer to expiration. This can impact the behavior of option prices and the effectiveness of options strategies.

Overall, gamma plays a crucial role in options trading and understanding its impact is essential for option traders. By considering gamma, traders can better assess the risk-reward profile of different options strategies and make more informed trading decisions.

In the world of options trading, understanding gamma is crucial for successfully navigating the complexities of the market. Gamma measures how sensitive an option’s delta is to changes in the price of the underlying asset. Simply put, it quantifies the rate at which the delta of an option changes in relation to the movement of the underlying asset.

Gamma is particularly important because it plays a significant role in determining the risk and potential profitability of an options position. High gamma options are those that have delta values that change rapidly with small movements in the underlying asset, while low gamma options have delta values that change more slowly.

Read Also: Step-by-Step Guide: How to Open a ZB Bank Account

By understanding gamma, traders can better assess the potential risks and rewards associated with different options positions. For example, high gamma options have the potential for large profits if the price of the underlying asset moves significantly in the desired direction, but they also come with increased risk as the delta can quickly change if the price moves against the desired direction. On the other hand, low gamma options are less risky but also have less profit potential if the price of the underlying asset moves in the desired direction.

It is important to note that gamma is not constant; it changes as the price of the underlying asset changes. This means that traders need to regularly monitor the gamma of their options positions to stay informed about the potential risks and rewards associated with those positions.

Overall, gamma is a key concept in options trading that can greatly impact the value and risk of an options position. By understanding how gamma affects an option’s delta and how delta, in turn, affects an option’s value, traders can make more informed decisions and increase their chances of success in the options market.

Gamma is a metric that measures the rate of change of an option’s delta in relation to the price movement of the underlying asset. It is an important factor to consider when evaluating option prices and their potential for profit.

Read Also: Forex Trading for Beginners: Essential Tips and Strategies

When gamma is high, it means that the delta of an option is extremely sensitive to small movements in the price of the underlying asset. This can lead to significant price changes in the option itself, creating increased opportunities for profitability.

For example, if an option has a gamma of 0.1, it means that its delta will increase by 0.1 for every $1 movement in the price of the underlying asset. This can have a significant impact on the option’s price, especially if the underlying asset experiences large price swings.

On the other hand, when gamma is low, it means that the delta of an option is less sensitive to price movements in the underlying asset. This usually occurs when the option is deep out-of-the-money or deep in-the-money. In these cases, the option’s price will not change as much in response to changes in the underlying asset’s price.

Investors and traders can use gamma as a tool to assess the potential risks and rewards of trading options. High gamma options can offer the opportunity for substantial profits, but they also come with increased risk. Low gamma options, on the other hand, may be less volatile but offer less potential for large profits.

It’s important to consider gamma alongside other metrics, such as delta and theta, to fully understand the dynamics of option pricing. By analyzing the impact of gamma on option prices, traders can make more informed decisions and better manage their risk.

Gamma is calculated as the second derivative of the options price with respect to the underlying asset’s price. It measures the rate of change in an option’s delta in relation to a change in the underlying asset’s price.

The highest gamma value a stock option can have is 1.0. This means that for every $1 increase in the underlying asset’s price, the option’s delta will increase by 1.0.

Gamma affects the price of an option by influencing its delta. When gamma is high, the delta of an option changes rapidly with even small movements in the underlying asset’s price. This can cause the option’s price to increase or decrease more drastically compared to options with lower gamma.

Options with high gamma are considered riskier because their prices can change rapidly in response to small movements in the underlying asset’s price. This can lead to larger losses if the market movements are unfavorable. However, high gamma can also offer higher potential profits if the market moves in the option holder’s favor.

Investors can use gamma to their advantage in options trading by understanding how changes in the underlying asset’s price can impact their option positions. They can adjust their strategies accordingly, such as buying options with high gamma when they anticipate large price movements in the underlying asset, or utilizing strategies that allow them to benefit from changes in delta and gamma.

Trading on IG Index: A Comprehensive Guide Welcome to our step-by-step guide on how to trade on IG Index. Whether you’re a beginner or an experienced …

Read Article7 Stock Exchanges You Need to Know About Stock exchanges are crucial to the global economy as they provide a platform for the buying and selling of …

Read ArticleMinimum Deposit for CMC Markets UK When it comes to trading, one of the most important factors to consider is the minimum deposit required by the …

Read ArticleMinimum withdrawal from AvaTrade: Everything you need to know AvaTrade is a leading online trading platform that allows users to trade various …

Read ArticleWhy Selling Options Can Be Risky Selling options is a popular strategy among experienced traders looking to generate income or hedge against potential …

Read ArticleHow much ground coffee can I bring to the United States? When traveling to the United States, coffee enthusiasts often wonder how much ground coffee …

Read Article