Understanding Rollover Fees: A Comprehensive Guide

Understanding Rollover Fees: An Overview When it comes to trading in the financial markets, there are various factors that traders need to consider. …

Read Article

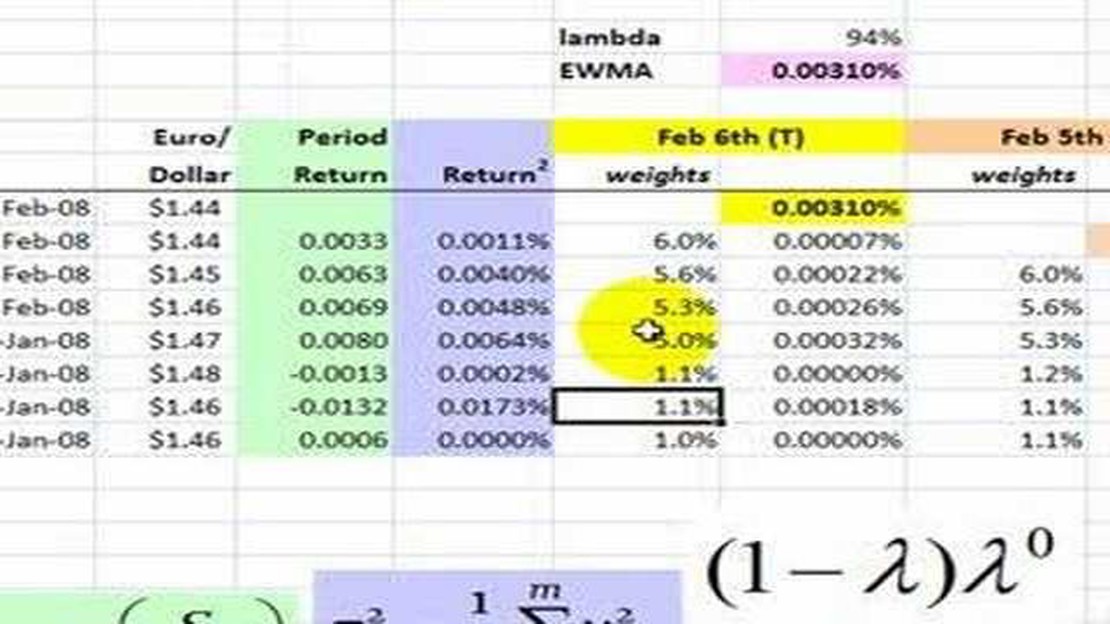

The Exponential Weighted Moving Average (EWMA) is a statistical method commonly used in finance and engineering to analyze time series data. It is used to assign different weights to different data points in the series, with more recent data points receiving higher weights.

By using a weighting scheme that exponentially decreases the importance of older data, the EWMA provides a more accurate representation of the underlying trend or pattern in the data. This makes it particularly useful in applications such as forecasting, where it is important to give more weight to recent observations.

The EWMA is often used in financial analysis to calculate moving averages of stock prices or other financial metrics. A moving average is a powerful tool for smoothing out short-term fluctuations and identifying long-term trends. The exponential weighting of the EWMA allows it to react quickly to recent changes in the data, making it especially valuable in volatile markets.

The EWMA can also be used for risk management purposes, such as estimating the volatility of financial instruments. The volatility of an asset is a measure of its price fluctuations over a specific period of time. By applying the EWMA to historical price data, analysts can calculate a volatility estimate that gives more weight to recent market movements.

Read Also: Is Crypto Trading Halal in Islam? Understanding its Compatibility with Islamic Principles

Overall, the Exponential Weighted Moving Average is a versatile statistical tool that has a wide range of applications. From smoothing out time series data to forecasting future values and estimating volatility, the EWMA is an important tool for analysts and researchers in various fields.

Exponential Weighted Moving Average (EWMA) is a statistical method used to calculate the moving average of a data set while giving more weight to recent observations and less weight to older observations. This type of moving average is commonly used in finance and investing to analyze the trend and predict future values.

EWMA is particularly useful in situations where there is a need to place more emphasis on recent data points. By assigning exponentially decreasing weights to older observations, EWMA allows for a more accurate representation of the current state of the data set, which can be especially important in rapidly changing environments.

In addition to finance and investing, EWMA can also be applied in various other fields, such as sales forecasting, supply chain management, and quality control. Its flexibility and ability to adapt to different data sets make it a versatile tool for analyzing and forecasting trends.

In conclusion, EWMA is a statistical method used to calculate the moving average of a data set by giving more weight to recent observations. It is commonly used in finance and investing for trend analysis, data smoothing, and forecasting. However, its applications extend beyond finance and can be useful in other fields as well.

The Exponential Weighted Moving Average (EWMA) method has several benefits that make it a popular choice for analyzing time series data:

Overall, the benefits of using EWMA make it a versatile and powerful tool for analyzing time series data, providing valuable insights into trends, patterns, and changes in underlying data.

EWMA stands for Exponential Weighted Moving Average. It is a statistical method used to analyze time series data, where more recent observations are given greater weightage than older ones.

Read Also: What is the Bulls Moving Average Algorithm? | Explained

The EWMA is calculated by multiplying each observation by a weight, which decreases exponentially as the observations get older. The weights are typically determined using a smoothing factor, which determines how quickly the weights diminish.

EWMA is used for smoothing time series data and reducing the impact of random fluctuations and outliers. It provides a smoothed estimate of the underlying trend in the data, making it easier to identify patterns and trends. EWMA is commonly used in finance, quality control, and forecasting.

Understanding Rollover Fees: An Overview When it comes to trading in the financial markets, there are various factors that traders need to consider. …

Read ArticleIs NDX the Same as Nasdaq? The Nasdaq is a global electronic marketplace for buying and selling securities, while NDX is a specific index that …

Read ArticleThe Golden Rule of Stock Trading: Key Principles to Follow In the fast-paced world of stock trading, one must navigate through a complex maze of …

Read ArticleCan You Grow a $100 Dollar Forex Account? Many people wonder if it’s possible to grow a $100 dollar forex account into a significant amount of money. …

Read ArticleWhat is the 4 week rule trend trading? Are you looking to gain a better understanding of trend trading? If so, the 4 Week Rule is a crucial concept to …

Read ArticleDocuments required for foreign exchange If you’re planning a trip abroad or need to send money internationally, it’s important to understand the …

Read Article