Understanding the Meaning of a 20 pip Spread in Forex Trading

Understanding the 20 Pip Spread: Explained and Demystified Forex trading is a popular investment option for many individuals around the world. It …

Read Article

A knock-in option on the foreign exchange market (FX) is a type of derivative that only becomes active or “knocked in” if a specific barrier is breached. This barrier can be either a price level or a time period. Once the barrier is breached, the option is activated and the buyer has the right, but not the obligation, to execute the contract.

The purpose of a knock-in option is to provide traders with the opportunity to take advantage of unique market conditions or events. For example, if a trader believes that a certain currency will experience a significant movement after a particular event, they can purchase a knock-in option to profit from this potential scenario.

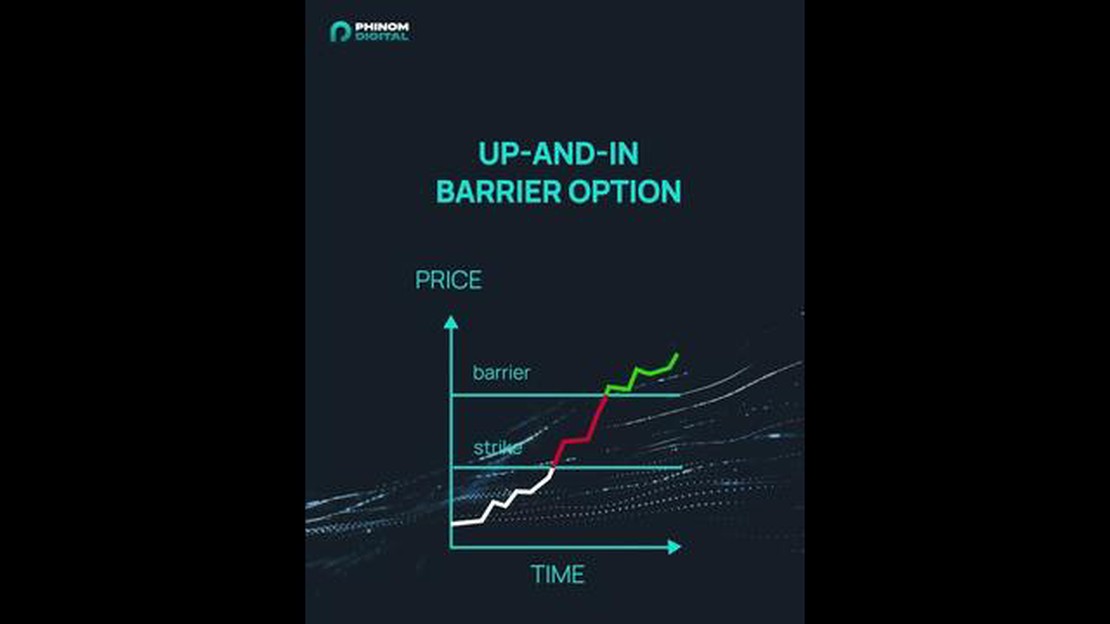

There are two main types of knock-in options: up-and-in and down-and-in. An up-and-in knock-in option becomes active when the price of the underlying asset rises above a predetermined level, while a down-and-in knock-in option becomes active when the price falls below a predetermined level.

It is important to note that knock-in options have a lower premium compared to standard options, since there is a condition that needs to be met in order for the option to become active.

In conclusion, knock-in options provide traders with a unique opportunity to profit from specific market conditions or events in the foreign exchange market. These options can be customized to suit individual trading strategies and risk tolerance levels. As with any derivative, it is important for traders to fully understand the terms and conditions of knock-in options before entering into any contracts.

A knock-in option is a type of option contract that becomes active or “knocks in” only when a specified price level is reached. It is a derivative instrument commonly used in the foreign exchange (FX) market.

The key feature of a knock-in option is the price barrier, which is set above or below the current market price. When the underlying asset, in this case a currency pair, reaches or crosses the designated price barrier, the option is activated and starts to function as a regular option.

Knock-in options come with different types of barriers. For example, an up-and-in option has a price barrier above the current market price, while a down-and-in option has a price barrier below the market price. The barrier can be adjusted based on the trader’s strategy and market expectations.

Once the price barrier is breached, knock-in options behave similarly to other types of options. Buyers have the right, but not the obligation, to buy or sell the underlying currency pair at a predetermined price, known as the strike price, before or on the option’s expiration date.

Knock-in options are popular among traders who want to profit from specific price movements or events. They provide traders with the flexibility to limit their risk exposure and capitalize on market opportunities. However, they also come with certain risks, including the possibility of the price barrier not being reached, resulting in the option expiring worthless.

Read Also: Discover the Impact of Dubai Expo 2023: Everything You Need to Know

Overall, knock-in options can be a valuable tool for traders looking to manage their FX risk or speculate on price movements within a predetermined range. Understanding the basics of knock-in options is essential for traders considering incorporating them into their trading strategy.

Knock-In options are a type of derivative contract that give traders the right, but not the obligation, to enter into a specified foreign exchange (FX) trade at a predetermined price level. These options are known as “knock-in” because they only become active or “knock-in” when the price of the underlying currency pair reaches a certain level.

One of the primary features of knock-in options is that they provide traders with the ability to set a barrier level, also known as the “knock-in” level. This barrier is usually set above or below the current market price, depending on whether it is a call or put option. Once the underlying currency pair reaches or crosses this barrier level, the option is activated and the trader can then begin to participate in the FX trade.

Knock-in options on FX offer several benefits to traders. Firstly, they provide an opportunity to enter into a trade at a predetermined exchange rate, which can be beneficial for hedging purposes. This allows traders to protect themselves against adverse movements in the currency market, providing a level of security and predictability.

Read Also: Discover the Triple RSI Strategy: A Powerful Tool for Trading Success

Furthermore, knock-in options can be customized to suit the specific needs and preferences of individual traders. They provide flexibility in terms of the barrier level, the expiration date, and the strike price. This customization allows traders to tailor the option to their risk appetite and market expectations, increasing the potential for profit and minimizing potential losses.

Another advantage of knock-in options is that they can be used to create complex trading strategies. Traders can combine knock-in options with other derivative instruments to create spreads, hedges, or multi-leg strategies. This versatility enables traders to take advantage of market opportunities and manage risk in a more sophisticated manner.

However, it is important to note that knock-in options also come with certain risks. If the underlying currency pair fails to reach or cross the barrier level before the expiration date, the option becomes worthless and the trader loses the premium paid. This means that timing and market analysis are crucial when trading knock-in options, and traders should carefully assess the probability of the barrier being “knocked-in” within the given timeframe.

In conclusion, knock-in options on FX offer a range of features and benefits for traders. They provide an opportunity to enter into a specified FX trade at a predetermined price level, offering security, flexibility, and the potential for profit. However, traders must also be aware of the risks involved and carefully assess market conditions when considering the use of knock-in options.

A knock-in option on FX is a type of option contract where the option comes into existence (knocks in) only if a specified barrier price is reached or breached before the option’s maturity date.

A knock-in option on FX works by setting a specific barrier price, and if the spot exchange rate reaches or exceeds that barrier price before the option’s maturity date, the option becomes active and can be exercised.

If the barrier price is not reached or breached before the option’s maturity date, the knock-in option remains inactive and cannot be exercised.

The advantages of using knock-in options on FX include the potential for higher returns compared to traditional options, as well as the ability to customize the barrier price and choose specific market conditions for the option to become active.

Yes, knock-in options on FX are commonly used in the foreign exchange market as they provide traders and investors with additional flexibility and potential profit opportunities.

Understanding the 20 Pip Spread: Explained and Demystified Forex trading is a popular investment option for many individuals around the world. It …

Read ArticleBest Leverage Options for $3000 Trading with leverage can be a powerful strategy for maximizing returns in the financial markets. By utilizing …

Read ArticleBenefits of issuing warrants instead of shares for companies When it comes to raising capital, companies have various options to consider. While …

Read ArticleBest Way to Trade the Dow Jones: Tips and Strategies Trading the Dow Jones is an exciting and potentially profitable endeavor. However, it can also be …

Read ArticleTrading Futures on CME Group: All You Need to Know Welcome to our comprehensive guide on trading futures on the CME Group. Whether you’re a seasoned …

Read ArticleGuide to Trading Forex in the Philippines Forex trading has gained significant popularity in the Philippines in recent years. With its potential for …

Read Article