Should I pay in MXN or USD? A guide to making the best currency choice

Should I pay in MXN or USD? When traveling to Mexico, one of the common questions that arises is whether it is better to pay in Mexican Pesos (MXN) or …

Read Article

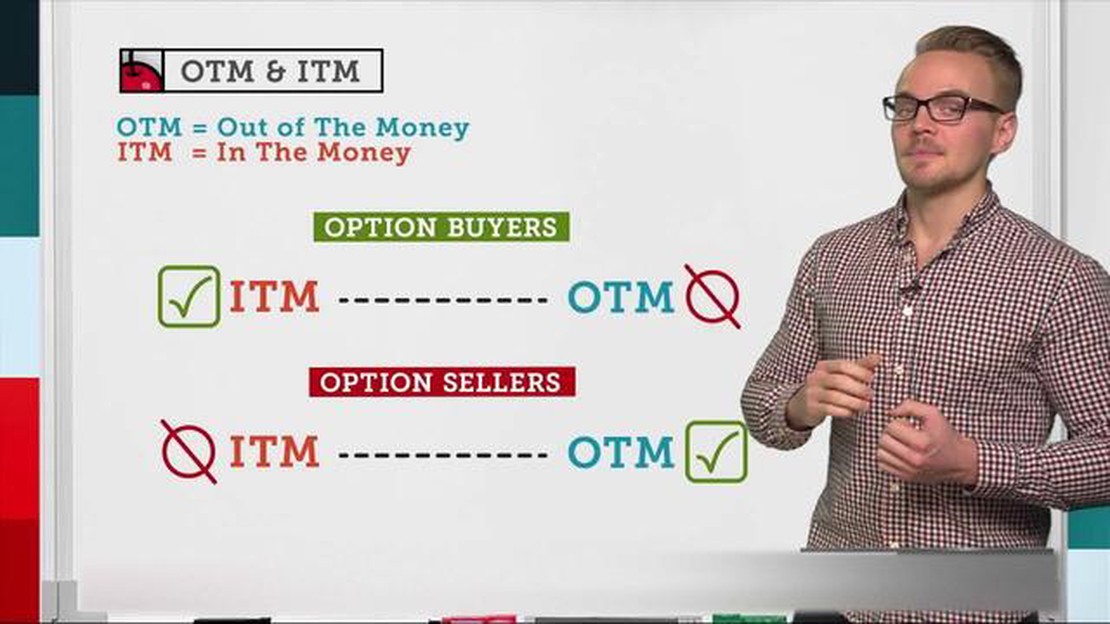

When trading options, it is important to understand the concept of being “out of the money.” Simply put, an option is considered out of the money when the current price of the underlying asset is not favorable for the option holder to exercise the option and make a profit. This means that the option has no intrinsic value and is essentially worthless.

For call options, being out of the money occurs when the strike price is higher than the current market price of the underlying asset. In this case, the option holder would not exercise the option because it would result in a loss. On the other hand, for put options, being out of the money happens when the strike price is lower than the current market price of the underlying asset. Again, the option holder would not exercise the option because it would not result in a profit.

Being out of the money does not mean that the option holder has lost all of their investment. The option holder can still sell the option to recoup some of their initial investment, although it may be at a loss. Alternatively, they may choose to hold onto the option in the hopes that the market conditions will change in their favor and the option will become profitable. However, it is important to note that the value of options typically declines as they move further out of the money.

When it comes to options trading, the concept of being “out of the money” refers to the status of an option contract that has no intrinsic value. An option is considered to be out of the money when the current price of the underlying asset is not favorable for the option’s holder to exercise the contract.

There are two main types of options: call options and put options. A call option gives the holder the right, but not the obligation, to buy the underlying asset at a specified strike price. On the other hand, a put option gives the holder the right, but not the obligation, to sell the underlying asset at a specified strike price.

For a call option to be out of the money, the current price of the underlying asset must be lower than the strike price. This means that if the option holder were to exercise the call option, they would be buying the asset at a higher price than its current market value, resulting in a loss. As a result, there is no incentive for the option holder to exercise the call option when it is out of the money.

Similarly, for a put option to be out of the money, the current price of the underlying asset must be higher than the strike price. In this case, if the option holder were to exercise the put option, they would be selling the asset at a lower price than its current market value, also resulting in a loss. Therefore, there is no benefit for the option holder to exercise the put option when it is out of the money.

When an option is out of the money, it has no intrinsic value. However, it may still have time value, which is determined by factors such as the time remaining until expiration, market volatility, and interest rates. The time value of an option provides the potential for the option to become profitable if the price of the underlying asset moves in the desired direction before expiration.

Read Also: Exchange Rate of Euro and Dollar: Latest Updates and Predictions

Out of the money options are often considered riskier than options that are in the money or at the money. This is because out of the money options have a lower probability of becoming profitable before expiration. Nevertheless, they can still be used by traders and investors for various strategies, such as betting on a significant price move or hedging existing positions.

In conclusion, understanding out of the money options is crucial for options traders. It signifies that the current price of the underlying asset is not favorable for the option holder to exercise the contract. While out of the money options have no intrinsic value, they may still have time value and can be utilized in different trading strategies.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Options trading carries a high level of risk, and individuals should seek professional financial advice before making any investment decisions.

In options trading, if an option is “out of the money,” it means that the option does not currently have any intrinsic value. An option is considered to be out of the money when the current price of the underlying asset is below the strike price for a call option, or above the strike price for a put option.

For example, let’s consider a call option on stock XYZ with a strike price of $50. If the current price of XYZ is $45, the call option would be out of the money because the stock price is lower than the strike price. In this case, exercising the call option would not result in a profit as the option has no intrinsic value.

Similarly, for a put option on stock XYZ with a strike price of $50, if the current price of XYZ is $55, the put option would be out of the money. The stock price is higher than the strike price, so exercising the put option would not result in a profit.

When an option is out of the money, the option holder does not have any obligation to exercise the option before the expiration date. Instead, the option holder may choose to let the option expire worthless, as exercising the option would result in a loss.

It is important for options traders to be aware of whether an option is in the money, at the money, or out of the money, as this can impact their trading decisions. Options that are out of the money typically have lower premiums than options that are in the money or at the money, as they have a lower likelihood of being exercised and resulting in a profit.

Read Also: Is Forex a Spot or Future? Explained in Depth

If an option is out of the money, it means that the current market price of the underlying asset is lower than the strike price of the option (for a call option) or higher than the strike price (for a put option). In other words, the option does not have any intrinsic value and would not be profitable if exercised at the current market price.

When an option is out of the money, it generally has a lower value compared to options that are in the money or at the money. This is because there is no intrinsic value in the out of the money option, and its value is solely based on the time value component. The further out of the money an option is, the cheaper it tends to be.

Technically, an out of the money option can become profitable if the price of the underlying asset moves in the right direction. If the price of the underlying asset moves enough to bring the option in the money before it expires, the option holder can make a profit by exercising the option or selling it at a higher price. However, the likelihood of this happening decreases the further out of the money the option is.

Buying out of the money options can be risky, as there is a higher chance that the option will expire worthless. However, out of the money options also tend to be cheaper compared to in the money options, which can be attractive to traders looking for lower-cost speculative opportunities. It ultimately depends on your risk tolerance and trading strategy.

There are various strategies that can be used with out of the money options, such as buying them as speculative plays, using them as part of spread strategies, or selling them as part of income generation strategies. Each strategy has its own pros and cons, and it is important to have a solid understanding of options and market dynamics before employing any strategy involving out of the money options.

If an option is out of the money, it means that the option contract has no intrinsic value and would result in a loss if it were exercised immediately. In the case of a call option, it means that the strike price is higher than the current market price of the underlying asset. For a put option, it means that the strike price is lower than the current market price.

Should I pay in MXN or USD? When traveling to Mexico, one of the common questions that arises is whether it is better to pay in Mexican Pesos (MXN) or …

Read ArticleUnderstanding Flash Orders: Definition and Implications Flash orders are a controversial practice in the world of trading. This article will explore …

Read ArticleCalculating average in VB: a comprehensive guide Calculating the average of a set of numbers is a fundamental task in many programming languages, …

Read ArticleAccounting Hedging Options: A Comprehensive Guide Accounting hedging is an essential practice in the financial world that allows businesses to …

Read ArticleHow to Contact Nedbank Customer Service As a customer of Nedbank, it is important to know how to reach their customer service department for any …

Read ArticleTrading in ZAR: Everything You Need to Know If you are interested in forex trading, you may be wondering if you can trade in South African Rand (ZAR). …

Read Article