What Does a Sales Trader Do? Exploring the Role and Responsibilities

What Does a Sales Trader Do? A sales trader is a financial professional who specializes in executing trades on behalf of clients. They play a crucial …

Read Article

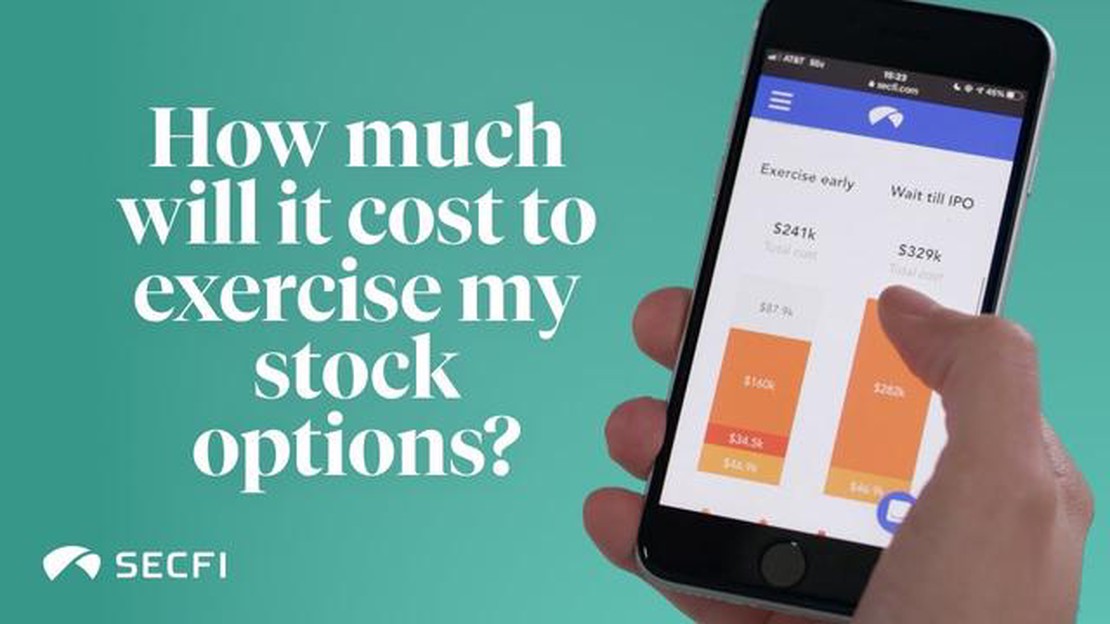

Stock options are a popular form of compensation for employees. They give employees the right to purchase company stocks at a predetermined price, known as the exercise price. When employees exercise their stock options, they acquire ownership of the company’s stocks.

However, exercising stock options is not without costs. One of the main costs is the tax liability that arises from exercising the options. When employees exercise their stock options, they may be subject to ordinary income tax on the difference between the exercise price and the fair market value of the stocks at the time of exercise.

In addition to the tax liability, employees may also incur transaction costs when exercising their stock options. These costs can vary depending on the brokerage firm or financial institution used for the transaction. It is important for employees to consider these transaction costs when deciding whether to exercise their stock options.

Furthermore, there may be restrictions or limitations on when employees can exercise their stock options. Some stock option plans have vesting schedules, which means that employees can only exercise a certain percentage of their options over a period of time. This can result in additional costs if employees have to wait to exercise their options.

In conclusion, while stock options can be a valuable form of compensation, there are costs associated with exercising them. These costs can include tax liabilities, transaction costs, and restrictions on exercising the options. It is crucial for employees to carefully consider these costs before making a decision to exercise their stock options.

Exercising stock options can come with a variety of costs that should be considered before making the decision to exercise. These costs can include:

Read Also: Understanding the Average Convergence Divergence Indicator: A Comprehensive Guide

Before exercising stock options, it is important to carefully consider these costs and evaluate whether the potential benefits outweigh the expenses. Consulting with a financial advisor or tax professional can also provide valuable guidance in navigating the complexities of stock option exercises.

Exercising stock options can have significant tax implications for employees. Depending on the specific type of stock options, employees may be subject to various types of taxes, including:

| Type of Tax | Description |

|---|---|

| Income Tax | When employees exercise their stock options, the difference between the stock’s fair market value and the exercise price is typically treated as taxable compensation and subject to income tax. |

| Alternative Minimum Tax (AMT) | Employees who exercise incentive stock options (ISOs) may also be subject to AMT, which is a separate tax system with its own set of rules. The AMT calculation takes into account the stock option gain and adjusts the employee’s taxable income accordingly. |

| Capital Gains Tax | If employees hold onto their exercised stock options and sell the shares at a later date, they may be subject to capital gains tax on any profits realized. The specific tax rate applied to the capital gains will depend on the length of time the shares were held and the employee’s overall tax situation. |

It is important for employees to consult with a tax professional or financial advisor to fully understand the tax ramifications of exercising their stock options. By doing so, they can make informed decisions and potentially minimize their tax liability.

Stock options are a type of financial instrument that gives employees the right to buy or sell company stock at a certain price within a specific time period. They are often used as a form of compensation, allowing employees to buy shares of the company they work for at a discounted price.

There are several costs associated with exercising stock options. The first cost is the cost of purchasing the stock at the exercise price, which is usually lower than the current market price. In addition, there may be taxes associated with exercising the options, depending on the type of options and the country in which the options are being exercised. Finally, there may be fees or commissions charged by brokers or financial institutions for executing the stock option transaction.

Read Also: Choosing the Best Indicator for Traders: A Comprehensive Guide

The calculation of taxes when exercising stock options can be complex and depends on various factors. In general, the difference between the exercise price and the fair market value of the stock at the time of exercise is considered taxable income. This amount is subject to income tax and, in some cases, additional taxes such as Medicare and Social Security taxes. The specific tax rate will depend on the individual’s income level and the tax laws of the country in which the options are being exercised.

Yes, there are several strategies that can be used to minimize the costs of exercising stock options. One strategy is to carefully time the exercise of the options to take advantage of potential fluctuations in the stock price. By exercising when the stock price is lower, the employee can reduce the cost of purchasing the stock. Another strategy is to sell a portion of the stock immediately after exercising the options to cover the cost of exercising and any associated taxes. This can help to mitigate the financial burden of exercising stock options.

If you choose not to exercise your stock options, they will typically expire worthless after a certain period of time. This means that you will not be able to buy or sell the stock at the exercise price specified in the options. It’s important to carefully consider the expiration date of your options and any vesting requirements before deciding whether or not to exercise them. If you believe that the stock price may increase in the future, it may be beneficial to hold onto the options and potentially exercise them at a later date.

Stock options are financial instruments that give employees the right to buy a certain number of company shares at a predetermined price within a specific time period. They are often used as a form of compensation or incentive for employees.

What Does a Sales Trader Do? A sales trader is a financial professional who specializes in executing trades on behalf of clients. They play a crucial …

Read ArticleUnderstanding Pyramiding in Trading: Strategies and Benefits Pyramiding is a trading technique that involves adding to winning positions after the …

Read ArticleIs option trading halal in India? Islamic finance is a growing field that seeks to align financial transactions with the principles and teachings of …

Read ArticleOwner of MBA forex When it comes to the world of finance and investments, one name that stands out is MBA Forex. This renowned company has made its …

Read ArticleThe Mechanics of an RFQ Platform: A Comprehensive Overview In today’s fast-paced business world, time is of the essence. Companies often find …

Read ArticleBeginner’s Guide to Forex Trading in Qatar If you’re living in Qatar and interested in the world of forex trading, you’ve come to the right place. …

Read Article