How Long Does It Take to Receive a Balikbayan Box? Find Out Now!

How long does it take to receive a balikbayan box? Are you planning to send a balikbayan box to your loved ones in the Philippines? One of the most …

Read Article

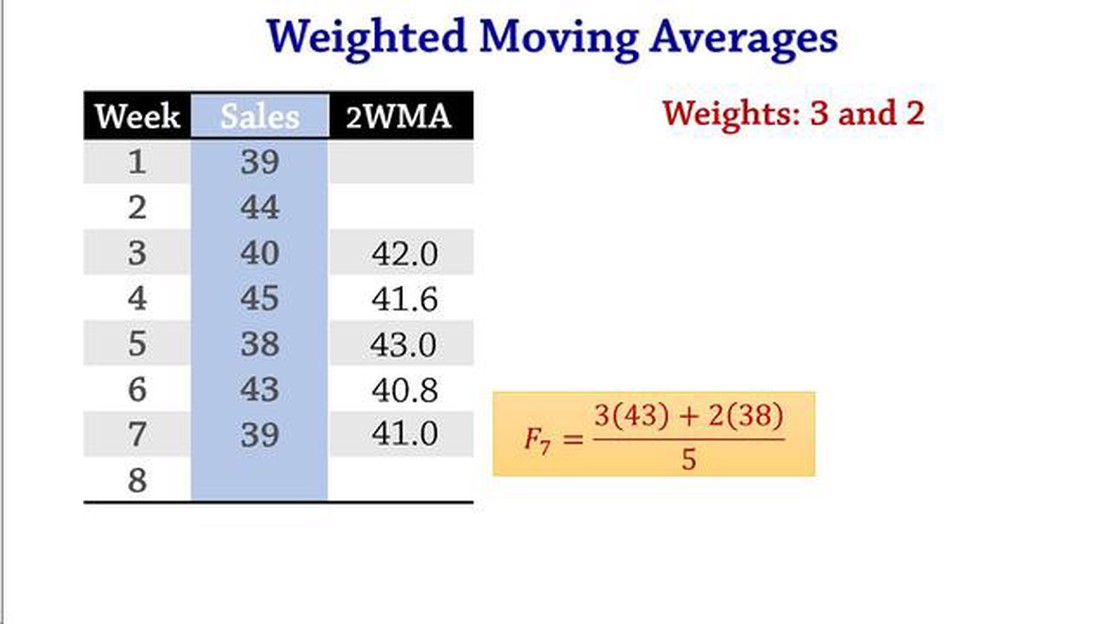

The accurate forecasting of future trends is crucial for businesses to make informed decisions and plan for the future. One method that has proven to be effective in forecasting is the Weighted Moving Average (WMA) method. WMA is a statistical technique that assigns different weights to historical data points, giving more importance to recent data and less to older data.The WMA method takes into account different factors that may influence future trends and assigns appropriate weights to each data point. This allows businesses to capture trends and patterns in the data more accurately and make more informed decisions. By giving more weight to recent data, the WMA method takes into account any recent changes or fluctuations in the market, making the forecasts more accurate.

Using the WMA method for forecasting involves calculating the weighted average of a specific number of data points, with the most recent data points receiving the highest weight. This ensures that the forecasts are more responsive to recent changes in the market. By adjusting the weights assigned to different data points, businesses can fine-tune the forecasts and make them more accurate.

In conclusion, the Weighted Moving Average method is a powerful tool for accurate forecasting. By assigning different weights to historical data points, this method captures trends and patterns more effectively. With its ability to give more weight to recent data, the WMA method ensures that forecasts are more responsive to changes in the market. Ultimately, businesses can rely on the WMA method to make informed decisions and plan for the future with confidence.

The weighted moving average method is an effective forecasting technique that can provide more accurate predictions by giving greater importance to recent data points. There are several reasons why you should consider using this method for your forecasting needs:

5. Versatility: The weighted moving average method can be applied to a wide range of data sets and situations. Whether you are forecasting sales, stock prices, or demand for a product, this method can be adapted to suit your needs and provide accurate predictions.

5. Versatility: The weighted moving average method can be applied to a wide range of data sets and situations. Whether you are forecasting sales, stock prices, or demand for a product, this method can be adapted to suit your needs and provide accurate predictions.

In conclusion, the weighted moving average method is a powerful tool for accurate forecasting. Its ability to give more weight to recent data points, its flexibility, smoothed forecasts, easy implementation, and versatility make it a valuable technique for any organization or individual looking to make informed predictions.

The weighted moving average method is a forecasting technique that takes into account the importance of recent data points in making accurate predictions. It assigns different weights to different data points based on their significance and combines them to calculate the forecast.

Unlike a simple moving average that assigns equal weights to all data points, the weighted moving average method considers the fact that recent data points are more relevant and informative for forecasting future trends. It gives more weight to the most recent data and progressively reduces the weight of older data.

Read Also: Is Spread betting profitable? Discover the potential profitability of spread betting

By assigning higher weights to recent data points, the weighted moving average method is better able to capture sudden changes or trends in the data, making it especially useful for predicting short-term fluctuations or seasonal variations. It provides a smoother and more responsive forecast compared to other forecasting methods.

The weights assigned to each data point in the weighted moving average are typically based on a pre-defined weighting scheme. This scheme can be linear, quadratic, or any other mathematical formula that reflects the desired importance or relevance of each data point.

Read Also: Is Reuters an Exchange? Understanding the Role of Reuters in the Financial Market

To calculate the weighted moving average, multiply each data point by its corresponding weight, sum up the products, and divide by the sum of the weights. The result is the forecast value for the desired time period.

This method is commonly used in various industries and applications, including finance, economics, sales, and inventory management. It helps businesses make more informed decisions by providing accurate predictions that reflect the most recent trends in the data.

Benefits of the Weighted Moving Average Method:

Overall, the weighted moving average method is a powerful forecasting technique that incorporates the importance of recent data in making accurate predictions. Its ability to capture short-term trends and fluctuations makes it a valuable tool for businesses seeking to optimize their forecasting capabilities.

The weighted moving average method is a forecasting technique that assigns different weights to different periods of historical data. It calculates the average of the most recent data points, with more weight given to the more recent data.

The weighted moving average method differs from the simple moving average method in that it assigns different weights to different periods of data, whereas the simple moving average method assigns equal weights to all data points.

The purpose of assigning different weights to different periods of data in the weighted moving average method is to place more emphasis on recent data points, as they are generally considered to be more indicative of future trends.

The weights in the weighted moving average method are typically determined based on a subjective assessment of the importance of each period of data. For example, more weight might be given to recent data if it is believed to be more relevant.

The weighted moving average method is considered to be more accurate for forecasting because it places more emphasis on recent data, which is generally more indicative of future trends. This allows for better adaptation to changes in the underlying dynamics of the data.

The weighted moving average method is a forecasting technique that assigns different weights to different historical data points. It gives more importance to recent data points and less importance to older data points.

How long does it take to receive a balikbayan box? Are you planning to send a balikbayan box to your loved ones in the Philippines? One of the most …

Read ArticleDo hedge funds invest in forex? Forex, or foreign exchange, is one of the largest and most liquid financial markets in the world. It involves the …

Read ArticleChoosing the Optimal Timeframe for Intraday Options Trading When it comes to intraday options trading, choosing the right timeframe is crucial for …

Read ArticleBeginner’s Guide: Learning to Trade Stocks Trading stocks can be a rewarding and profitable way to invest your money. However, for beginners, the …

Read ArticleDo non-qualified stock options expire? Non-qualified stock options (NSOs) are a popular form of employee compensation that give employees the right to …

Read ArticleHow to Determine the Active Tab in jQuery When working with tabbed interfaces, it is often necessary to determine which tab is currently active. This …

Read Article