Octafx Official in Indonesia: What You Need to Know

Is Octafx Official in Indonesia? Octafx is a popular international forex broker that has recently become official in Indonesia. This means that …

Read Article

The weighted average method is a commonly used technique in financial management that allows companies to calculate the average cost of inventory. This method takes into account both the quantity and the cost of each item in inventory, giving a more accurate representation of the overall cost.

By using the weighted average method, companies are able to better track the value of their inventory and make informed decisions about pricing, production, and purchasing. This method is particularly useful in industries where the cost of inventory can fluctuate significantly, such as retail or manufacturing.

To calculate the weighted average cost, companies multiply the quantity of each item by its cost and then sum up these values for all items in inventory. This total cost is then divided by the total quantity of items to get the weighted average cost per unit.

For example, let’s say a company has 100 units of Product A, which cost $10 each, and 200 units of Product B, which cost $15 each. The weighted average cost per unit would be calculated as (10010 + 20015)/(100+200) = $13.33.

The weighted average method provides a more accurate reflection of the actual cost of inventory compared to other methods such as the FIFO (first-in, first-out) or LIFO (last-in, first-out) methods. This is because it takes into account the cost of each individual item and the quantity of each item in inventory.

In conclusion, the weighted average method is a vital tool in financial management as it allows companies to determine the average cost of their inventory accurately. This method helps companies make informed decisions about pricing, production, and purchasing based on the true cost of their inventory.

The weighted average method is a financial calculation that is used to determine the average cost of inventory. It is commonly used in financial management to provide a more accurate representation of the cost of goods sold and the value of inventory.

This method is particularly useful when a company has inventory with varying costs. It takes into consideration the quantity and the cost of each item in the inventory to calculate the weighted average cost.

In order to calculate the weighted average cost, you need to know the quantity and the cost of each item in the inventory. First, you multiply the quantity of each item by its cost. Then, you sum up these values for all the items in the inventory. Finally, you divide this sum by the total quantity of all the items to obtain the weighted average cost.

The weighted average method is especially beneficial when prices of goods fluctuate over time. By taking into account the quantity and cost of each item, it provides a more accurate snapshot of the inventory’s value at a specific point in time.

This method is commonly used in various industries, including manufacturing, retail, and wholesale. It helps businesses make informed decisions about pricing, inventory management, and financial reporting.

Read Also: PHP to AED Exchange Rate in Dubai: Find Out the Latest Conversion Rate

In conclusion, the weighted average method is a financial calculation that determines the average cost of inventory by taking into account both the quantity and the cost of each item. It provides a more accurate representation of the value of inventory and helps businesses make informed financial decisions.

The Weighted Average Method is a financial management technique used to calculate the average cost of inventory. It takes into account the quantity and cost of each unit of inventory purchased or produced at different times.

This method assigns a weighted average cost to each unit of inventory based on the total cost of inventory available and the total quantity of inventory on hand. The weighted average cost is calculated by dividing the total cost of inventory by the total quantity of inventory.

Under the Weighted Average Method, when new inventory is purchased or produced, it is added to the existing inventory at the weighted average cost. This ensures that the cost of inventory reflects the average cost of all units in stock, rather than the specific cost of the newly purchased units.

This method is commonly used in businesses with continuous production or purchasing activities, such as manufacturing companies and retailers. It provides a more accurate representation of the cost of inventory and helps in making sound financial decisions.

One of the advantages of using the Weighted Average Method is that it smoothens out the impact of price fluctuations. It reduces the effects of sudden price increases or decreases on the cost of inventory, as the weighted average cost considers the costs of all units in stock.

Overall, the Weighted Average Method is an important tool in financial management for calculating the average cost of inventory. It provides a more accurate representation of the cost of inventory and helps businesses in making informed decisions regarding pricing, budgeting, and inventory management.

The weighted average method is widely used in financial management for various purposes. Its application can be found in areas such as inventory valuation, cost accounting, and cost of capital calculations.

Read Also: What to Include in Your Trading Journal: Essential Metrics to Track

One of the key applications of the weighted average method is in inventory valuation. This method is used to determine the average cost of inventory items, taking into account the different purchase prices and quantities purchased over a specific period of time. By using the weighted average method, companies can more accurately determine the value of their inventory for financial reporting purposes.

In cost accounting, the weighted average method is used to calculate the average cost per unit of production. This information is crucial for determining the cost of goods sold, as well as for setting product prices and evaluating profitability. By using the weighted average method, companies can better understand their production costs and make informed decisions regarding pricing and profitability.

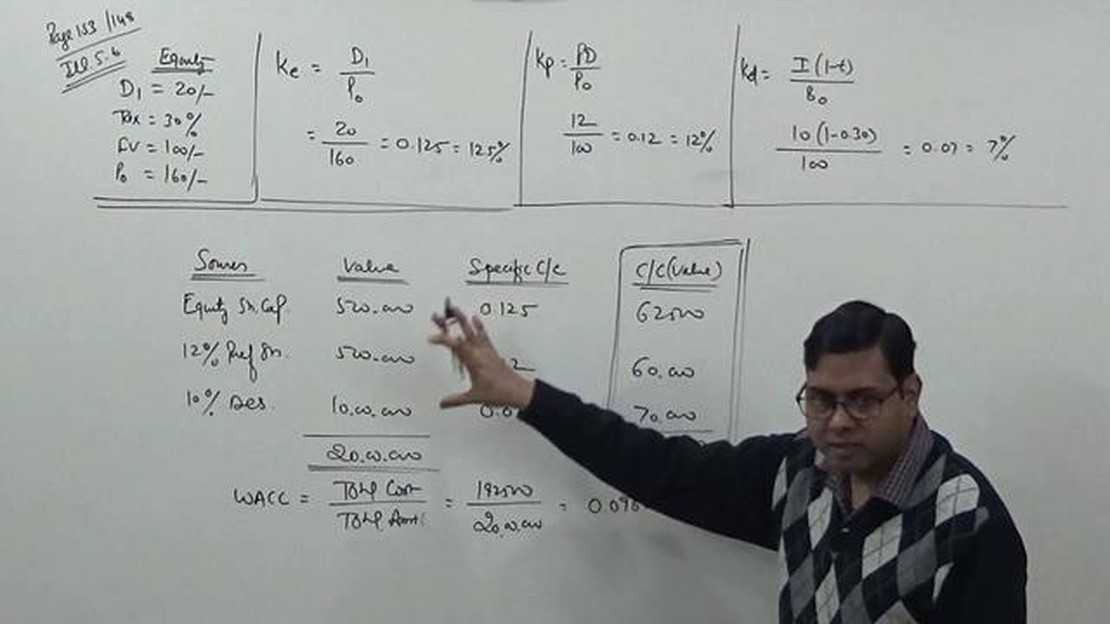

Another important application of the weighted average method is in calculating the weighted average cost of capital (WACC). WACC is a measure of a company’s overall cost of financing and is used to evaluate investment opportunities. By using the weighted average method, companies can determine the average cost of their debt and equity financing sources, taking into account their respective weights in the company’s capital structure.

| Benefits of the Weighted Average Method |

|---|

| Improved accuracy in inventory valuation |

| More accurate determination of production costs |

| Enhanced decision-making in pricing and profitability |

| Better evaluation of investment opportunities through WACC calculation |

In conclusion, the weighted average method finds widespread application in financial management due to its ability to provide more accurate and reliable calculations in inventory valuation, cost accounting, and cost of capital calculations. Its benefits include improved accuracy, better decision-making, and enhanced evaluation of investment opportunities.

The weighted average method is a technique used in financial management to calculate the average cost of inventory based on the different costs assigned to different units of inventory.

The weighted average method takes into account the quantity and cost of each unit of inventory. It multiplies the quantity of each unit by its cost and then adds up these values. The sum is then divided by the total quantity of inventory to find the average cost.

The weighted average method is used because it provides a more accurate representation of the average cost of inventory when there are different costs associated with different units. It helps in making informed decisions regarding pricing, budgeting, and forecasting.

The advantages of using the weighted average method include simplicity in calculations, smooths out price fluctuations, and provides a more accurate average cost for decision-making purposes. It is also widely accepted and recognized by accounting standards.

Yes, there are limitations to the weighted average method. It assumes that all units of inventory are identical, which may not be the case in reality. It may also not be suitable for inventory items with significantly different costs or for industries where specific identification is required.

Is Octafx Official in Indonesia? Octafx is a popular international forex broker that has recently become official in Indonesia. This means that …

Read ArticleCalculating average in VB: a comprehensive guide Calculating the average of a set of numbers is a fundamental task in many programming languages, …

Read ArticleWhat is MIFX app for? Welcome to [Your Website Name], where we explore the latest apps and technologies that can enhance your financial journey. In …

Read ArticleEffective Advertising Strategies for Trading Are you looking for ways to attract more customers and increase your trading business? Advertising is the …

Read ArticleUnderstanding NIFTY Option Trading: Everything You Need to Know Option trading in the NIFTY (National Stock Exchange Fifty) can be a profitable way to …

Read ArticleCalculating Weighted Moving Average Volume: A Comprehensive Guide Weighted Moving Average Volume (WMAV) is a popular technical analysis tool used by …

Read Article