What is the Optimal Lot Size for a $200 Account?

What lot size should I use for a 200 dollar account? When trading in the forex market, one important factor to consider is the lot size, which refers …

Read Article

When it comes to analyzing the performance of a stock, one key metric that traders and investors pay close attention to is the Relative Strength Index (RSI). The RSI is a technical indicator that measures the strength and speed of a stock’s price movement, helping to identify potential overbought or oversold conditions. In this article, we will take a closer look at the RSI value of Axis Bank, one of India’s largest private sector banks.

Axis Bank has been a popular choice among investors due to its strong fundamentals and consistent growth over the years. However, understanding the RSI value can provide further insights into the stock’s current market sentiment and potential future price movements. The RSI is calculated using a formula that takes into account the average gains and losses over a specific period of time, typically 14 days.

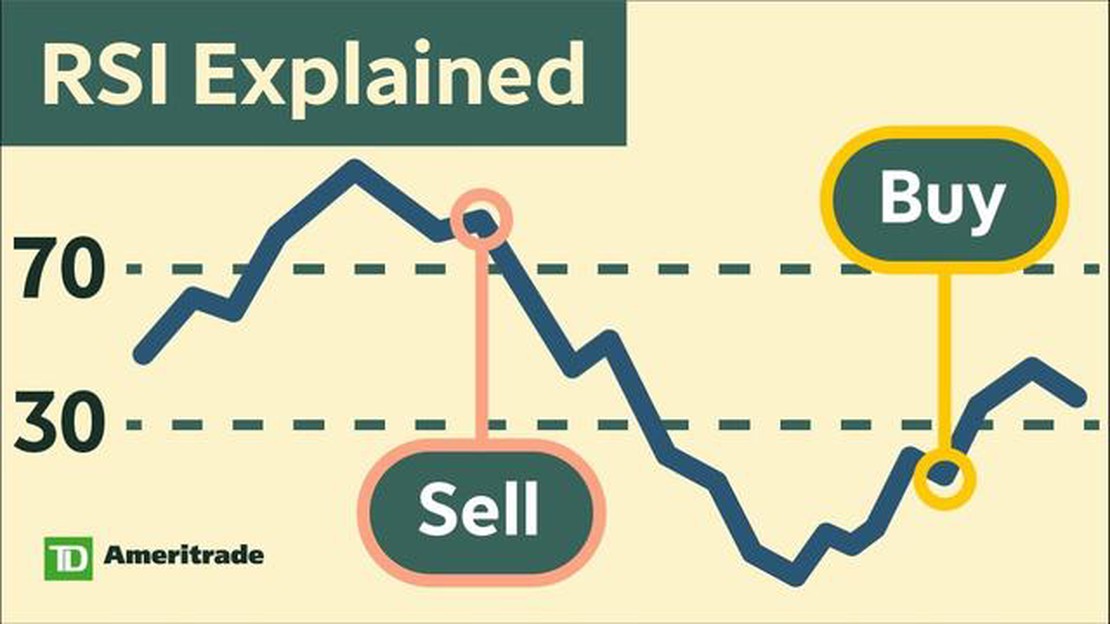

A high RSI value, usually above 70, indicates that the stock may be overbought and could be due for a pullback. On the other hand, a low RSI value, typically below 30, suggests that the stock may be oversold and could be due for a rebound. By analyzing the RSI value of Axis Bank, traders and investors can get a better understanding of the stock’s current momentum and make more informed decisions.

It’s important to note that the RSI is just one tool in a trader’s arsenal and should not be used in isolation to make investment decisions. It should be used in conjunction with other technical indicators, as well as fundamental analysis, to get a more comprehensive view of the stock’s potential. By combining various tools and strategies, traders can enhance their trading acumen and increase their chances of success in the market.

The Relative Strength Index (RSI) is a technical indicator that measures the speed and change of price movements. It is used by traders and investors to determine if a stock or asset is overbought or oversold. In the case of Axis Bank, the RSI value can provide valuable insights into the current market sentiment and potential future price movements.

The RSI value of Axis Bank can be interpreted on a scale of 0 to 100. A value above 70 typically indicates that the stock is overbought and may be due for a price correction. On the other hand, a value below 30 suggests that the stock is oversold and may be due for a price rebound. Traders often look for these extreme RSI values as potential buying or selling opportunities.

Read Also: Can US Clients Trade with City Index? Frequently Asked Questions

It is important to note that the RSI value is not a standalone signal and should be used in conjunction with other technical indicators and analysis. Traders also need to consider the overall market conditions, the company’s fundamentals, and any relevant news or events that may impact the stock’s price.

With regards to Axis Bank, a thorough analysis of the RSI value can provide valuable insights into the stock’s recent price trends and potential future direction. By monitoring the RSI value over time, traders and investors can identify potential buying or selling opportunities and make informed decisions.

In conclusion, understanding the RSI value of Axis Bank is crucial for traders and investors to assess the stock’s current market sentiment and potential future price movements. By incorporating the RSI value into their analysis, traders can make more informed trading decisions and maximize their returns.

RSI (Relative Strength Index) is a key technical indicator used in financial analysis to evaluate the strength and weakness of a security or an investment. It helps in identifying overbought or oversold conditions, indicating potential trend reversals.

The RSI value ranges from 0 to 100 and is calculated based on the average gain and average loss over a specified period of time. A high RSI value suggests that the security is overbought, meaning that it is trading at an inflated price and may be due for a price correction. On the other hand, a low RSI value indicates that the security is oversold, indicating that it is trading at a discounted price and may be due for a price rebound.

The RSI value can be used to confirm the strength of a trend or identify potential trend reversals. For example, if a security is in an uptrend and the RSI value reaches above the 70 level, it may indicate that the security is overbought and the uptrend may be losing momentum. Conversely, if a security is in a downtrend and the RSI value falls below the 30 level, it may indicate that the security is oversold and the downtrend may be losing momentum.

It is important to note that the RSI value should be used in conjunction with other technical indicators and fundamental analysis to make informed investment decisions. It is not a standalone indicator and should be considered as part of a broader analysis.

In summary, the RSI value is an important tool in financial analysis as it helps in identifying potential trend reversals and overbought or oversold conditions. By understanding the RSI value, investors and traders can make more informed decisions and manage risk effectively.

Read Also: Is a Vertical Put Spread Bullish? Explained in Detail

The current RSI value of Axis Bank is 55.78.

A RSI value of 55.78 is considered to be in the neutral range for Axis Bank. It indicates that the stock is not overbought or oversold at the moment.

The RSI value of Axis Bank has been increasing recently, indicating a positive momentum in the stock.

A RSI value of 55.78 suggests that the stock of Axis Bank is currently in a relatively stable position and there is no extreme buying or selling pressure. However, it does not provide a clear indication of the future performance of the stock.

What lot size should I use for a 200 dollar account? When trading in the forex market, one important factor to consider is the lot size, which refers …

Read ArticleUnderstanding the Mechanics of Open Interest in Futures Trading Futures trading is a complex and dynamic form of investment that allows individuals to …

Read ArticleWhere is the XM broker server? When choosing a forex broker, one important factor to consider is the location of their servers. This is because the …

Read ArticleEFX Full Form - Explained When it comes to acronyms, EFX is one that you might come across in various contexts. But what does EFX stand for? In this …

Read ArticleIs it possible to exchange money at the airport? When traveling internationally, one of the most common questions that arises is whether or not it is …

Read ArticleWhat is the cash prize for the HFM? The HFM competition is one of the most prestigious and highly anticipated events in the world of finance. Every …

Read Article