Can you trade options on Questrade in Canada? | 2021 Updated Guide

Trading Options on Questrade in Canada: Everything You Need to Know If you’re a Canadian investor looking to trade options, you may be wondering if …

Read Article

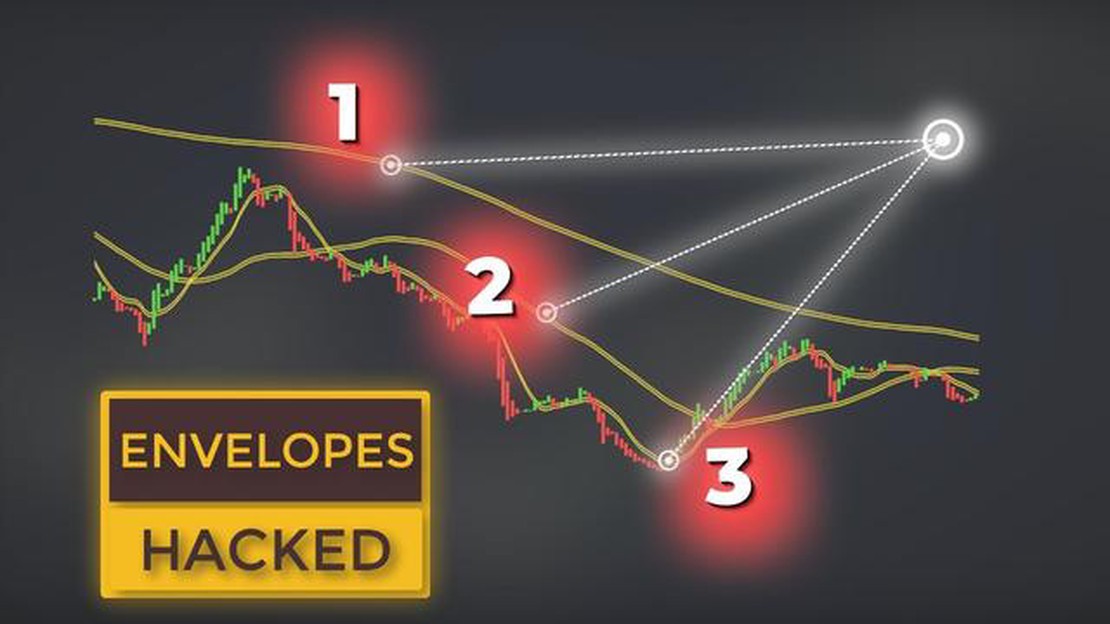

For traders and investors, understanding how to effectively use technical indicators is crucial in making informed decisions. One such indicator that has gained popularity is the Moving Average Envelope (MAE). The MAE is a powerful tool that can help identify trend reversals, spot overbought or oversold conditions, and generate potential trading signals.

So, what exactly is the Moving Average Envelope? In simple terms, it is a pair of lines plotted above and below a moving average, forming a channel. The upper line is typically set a certain percentage above the moving average, while the lower line is set the same percentage below the moving average. The width of the envelope can be adjusted to suit individual preferences and trading strategies.

The primary purpose of the Moving Average Envelope is to provide traders and investors with a visual representation of price volatility. When the price is trending strongly, the distance between the upper and lower lines widens, indicating high volatility. Conversely, during periods of consolidation or low volatility, the distance between the lines narrows.

Why is this important?

By observing the width of the envelope, traders can gauge the potential for a price breakout or reversal. When the price approaches the upper or lower line, it may suggest that the market is reaching extreme conditions, and a reversal may be imminent. This can be a valuable signal for traders to enter or exit trades.

It is worth noting that the Moving Average Envelope is not a standalone indicator and should be used in conjunction with other technical analysis tools. Traders often combine the MAE with other indicators such as oscillators or volume indicators to confirm signals and increase the accuracy of their trading decisions.

In conclusion, mastering the Moving Average Envelope can be a valuable asset for traders and investors. By utilizing this indicator, market participants can gain insights into price volatility, identify potential reversals, and make well-informed trading decisions. However, as with any technical analysis tool, it is important to practice and thoroughly backtest strategies before implementing them in a live trading environment.

Moving Average Envelope Shift is a concept used in technical analysis to analyze price movements in financial markets. It involves utilizing moving averages, which are commonly used to smooth out price data and identify trends over a given period of time.

The moving average envelope is created by plotting two moving averages on a price chart, with one average plotted above the price line and the other below it. The distance between the moving averages and the price line determines the width of the envelope. The concept behind the envelope is to create channels that capture a certain percentage of price movements.

The moving average envelope shift refers to the adjustment made to the position of the moving averages relative to the price line. By shifting the moving averages, traders and investors can modify the width and positioning of the envelope. This allows them to adapt to different market conditions and potentially identify new trading opportunities.

The shift in the moving averages can be adjusted in several ways. It can be shifted to the left or right, which changes the start and end points of the moving averages. It can also be shifted up or down, which changes the position of the moving averages relative to the price line.

Read Also: Understanding CME in Stocks: What You Need to Know

The moving average envelope shift is often used in conjunction with other technical indicators, such as volume analysis and oscillators, to confirm trading signals and improve the accuracy of predictions. By adjusting the envelope based on market conditions, traders and investors can gain insights into potential support and resistance levels, as well as identify possible trend reversals.

Overall, the moving average envelope shift is a versatile tool that allows traders and investors to analyze price movements and identify potential trading opportunities. By adjusting the moving averages within the envelope, it provides a customizable framework to adapt to different market conditions and improve the accuracy of trading strategies.

Read Also: Understanding the CNY to USD Spot Exchange Rate: All You Need to Know

The moving average envelope is a technical analysis tool that is used to create upper and lower bands around a moving average. It is designed to help traders and investors identify potential buy and sell signals, as well as provide support and resistance levels.

The moving average itself is a commonly used indicator that smooths out price data over a specific period of time. It is calculated by taking the average of a set number of previous prices. The moving average envelope takes this concept a step further by plotting two lines above and below the moving average.

The upper band of the envelope is typically set at a certain percentage above the moving average, while the lower band is set at a certain percentage below the moving average. These percentages can vary depending on the trader’s preference and the specific security or market being analyzed.

When the price of the security or market being analyzed reaches the upper band, it is considered overbought, meaning the price may be due for a potential reversal or pullback. Conversely, when the price reaches the lower band, it is considered oversold, meaning the price may be due for a potential rebound or rally. Traders and investors can use these signals to make buy or sell decisions.

In addition to identifying potential buy and sell signals, the moving average envelope can also provide support and resistance levels. When the price of the security or market being analyzed touches the upper band, it can act as a resistance level, preventing the price from moving higher. Conversely, when the price touches the lower band, it can act as a support level, preventing the price from moving lower.

It is important to note that the moving average envelope is not a standalone indicator and should be used in conjunction with other technical analysis tools and indicators to make informed trading and investing decisions. Traders and investors should also consider the overall market environment and other relevant factors before making any decisions based on the moving average envelope.

The moving average envelope shift is a technical analysis tool used by traders and investors to identify potential changes in a security’s trend. It involves plotting a moving average line and two bands above and below it, representing price levels that are deemed overbought or oversold.

The moving average envelope shift is calculated by selecting a period for the moving average line, usually 20 or 50 days, and then multiplying the average by a certain percentage to create the upper and lower bands. For example, if the moving average is $50 and the percentage is 5%, the upper band would be $52.50 and the lower band would be $47.50.

When the price crosses above the upper band in a moving average envelope shift, it is considered a potential signal that the security is overbought. This means that the price may have risen too quickly and could be due for a correction. Traders and investors may view this as a sell signal or an opportunity to take profits.

Traders and investors can use the moving average envelope shift in several ways. They can look for instances where the price crosses above or below the upper and lower bands, signaling potential overbought or oversold conditions. They can also monitor the width of the bands, as a narrowing of the bands may indicate a period of low volatility and a potential upcoming breakout. Additionally, they can use the moving average line as a support or resistance level, with the price bouncing off it or breaking through it.

Trading Options on Questrade in Canada: Everything You Need to Know If you’re a Canadian investor looking to trade options, you may be wondering if …

Read ArticleDiscover the Most Effective Heiken Ashi Strategy for Successful Trading If you’re an aspiring trader looking for a proven strategy to boost your …

Read ArticleBest Day Trading Options in India Day trading has become increasingly popular in India as more and more people seek to take advantage of the …

Read ArticleGuide to Finding the Best Entry in Forex Trading Entering the world of forex trading can be an exciting and potentially profitable venture. However, …

Read ArticleGet Real Crypto for Free: The Ultimate Guide Are you interested in earning cryptocurrencies without investing any money? With the rise of blockchain …

Read ArticleHow Many Monitors Do You Need for Forex Trading? When it comes to forex trading, having the right tools and equipment can make a significant …

Read Article