Is There Tax on Forex Trading? | How Taxes Impact Forex Traders

Is there tax on Forex trading? Forex trading is a popular and potentially lucrative investment option for many individuals. However, like any other …

Read Article

When it comes to forex trading, time plays a crucial role in determining potential profits or losses. Understanding the mechanics of forex time is essential for any trader looking to navigate the fast-paced world of currency trading. In this comprehensive guide, we will explore the various aspects of forex time, including market hours, trading sessions, and how to best utilize timing for successful trades.

One of the key factors to consider is the global nature of the forex market, which operates 24 hours a day, five days a week. This constant activity ensures that traders have ample opportunities to enter and exit trades, regardless of their time zone. However, it’s important to note that not all trading sessions offer the same level of liquidity and volatility, making it crucial to understand the various forex market hours.

Forex market hours are divided into four main trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Each session has its own unique characteristics, with overlapping periods offering increased trading volume and volatility. Traders can take advantage of these overlaps to capitalize on potential market moves and maximize their profits.

Timing is everything in forex trading, and having a thorough understanding of the mechanics of forex time can make a significant difference in a trader’s success. By identifying the most active trading sessions, recognizing patterns, and taking advantage of high liquidity periods, traders can increase their chances of making profitable trades. Stay tuned as we delve deeper into the intricacies of forex time and uncover valuable tips and strategies to help you navigate the dynamic world of currency trading.

Forex time, also known as FX time or foreign exchange time, refers to the specific operating hours during which the forex market is open for trading. The forex market is a global decentralized market for the trading of currencies, where participants buy, sell, and exchange different currencies based on their fluctuating values.

Unlike other financial markets that have specific opening and closing hours, the forex market operates 24 hours a day, five days a week. This means that forex time refers to the period when the market is actively traded and accessible to traders worldwide.

Read Also: Understanding Credit Spread Strategies for Successful Investing

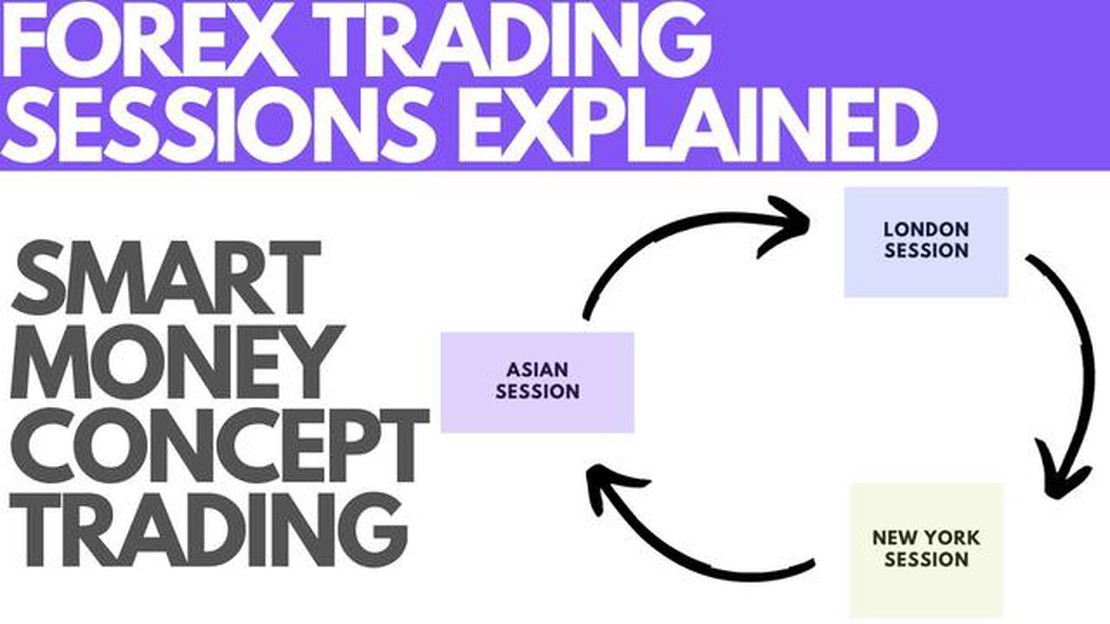

The forex market is open from Sunday night to Friday night, allowing traders from different time zones to participate at any time during the working week. The forex time is divided into three major trading sessions: the Asian session, the European session, and the North American session. Each session overlaps with the next one, creating periods of increased trading activity and liquidity.

Understanding forex time is essential for traders as it helps them identify the optimal times to enter and exit trades. Traders who are active during periods of high trading volumes are more likely to find better liquidity and tighter spreads, increasing their chances of executing profitable trades.

It’s important to note that while the forex market is open 24 hours a day, not all currency pairs are equally active during all sessions. Certain currency pairs may exhibit higher volatility and trading activity during specific sessions. Traders need to consider the characteristics of different trading sessions and currency pairs when planning their trading strategies.

In conclusion, forex time refers to the operating hours of the forex market, which are 24 hours a day, five days a week. Understanding forex time and the characteristics of different trading sessions is crucial for traders looking to optimize their trading strategies and take advantage of the market’s varying levels of activity and liquidity.

One of the most crucial aspects of forex trading is understanding forex time. Forex time refers to the specific hours and days when the forex market is open for trading. It is important for traders to be aware of forex time as it directly impacts their ability to execute trades and make informed decisions.

Here are a few reasons why understanding forex time is essential:

Read Also: Understanding the Autocorrelation Function (ACF) of the MA(1) Process

In conclusion, understanding forex time is crucial for any forex trader. By being aware of the different trading sessions, market volatility, and liquidity levels, traders can make informed decisions and maximize their profitability. It is important to stay updated with forex time and adjust trading strategies accordingly to optimize trading outcomes.

Forex time refers to the specific time frame during which the forex market is active and participants can trade currency pairs. Understanding the mechanics of forex time is crucial because it allows traders to determine the best times to enter or exit trades, as well as identify high volatility periods and potential trading opportunities.

Yes, forex time is divided into different trading sessions including the Asian session, the European session, and the American session. Each session has its own characteristics, such as different levels of liquidity and volatility, which can significantly impact trading strategies and decisions.

Determining the best times to trade in the forex market requires understanding the overlap between different trading sessions. The highest trading activity and liquidity typically occur during session overlaps, such as the overlap of the European and American sessions. Additionally, traders should consider economic news releases and events that may impact currency pairs to identify optimal trading windows.

Yes, forex time can greatly influence currency pair volatility. During active trading sessions, such as the overlap between the European and American sessions, currency pairs tend to experience higher volatility due to increased trading activity and market participation. Traders should be aware of these periods to take advantage of potential profit opportunities or adjust their risk management strategies accordingly.

Is there tax on Forex trading? Forex trading is a popular and potentially lucrative investment option for many individuals. However, like any other …

Read ArticleUnderstanding the Trading Strategy: A Comprehensive Guide Trading in financial markets requires a well-defined approach and a set of strategies to …

Read ArticleWhat did Cavs give up in trade? The Cleveland Cavaliers recently made a significant move, trading away multiple players in a deal that has sent …

Read ArticleLBMA Gold Price Fixing Time LBMA Gold Price Fixing refers to the process of determining the daily price of gold as a benchmark for the global gold …

Read ArticleReasons why the majority of CFD traders end up losing money Trading Contracts for Difference (CFD) can be a lucrative investment strategy, but it also …

Read ArticleUnderstanding Forex as an Investment The foreign exchange market, commonly referred to as Forex or FX, is the largest financial market in the world. …

Read Article