Understanding the Distinction: Performance Rights vs. Options

Performance Rights vs Options: Understanding the Key Differences In the world of finance, there are various investment instruments that can be …

Read Article

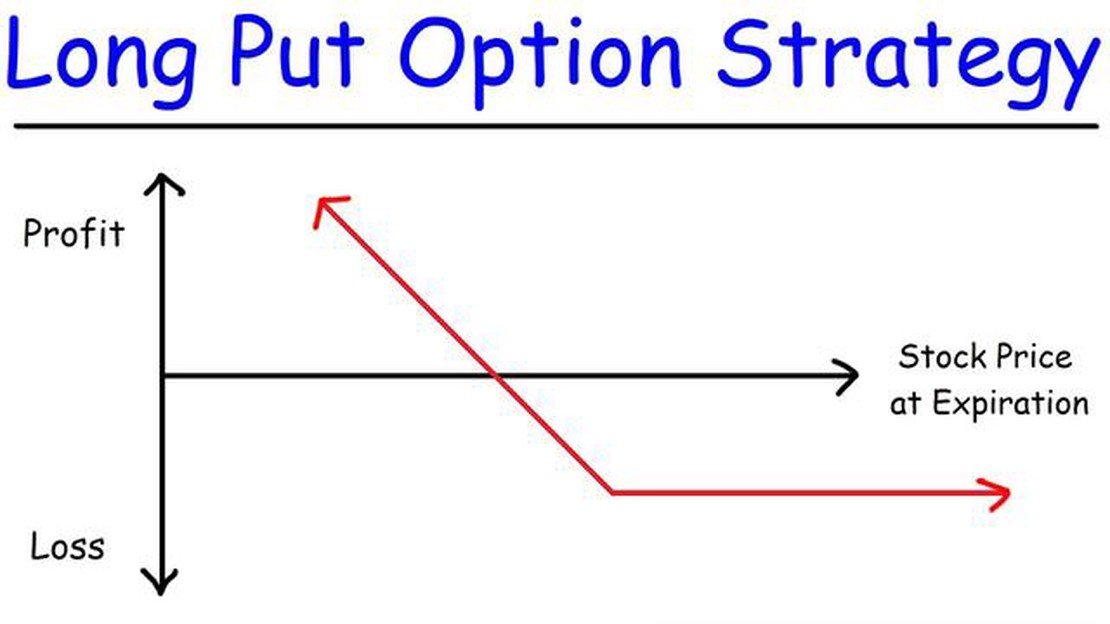

A long put option is a type of financial contract that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a predetermined price within a certain timeframe. This type of option is typically used as a hedging strategy to protect against a potential drop in the price of the underlying asset.

When an investor purchases a long put option, they are essentially betting that the price of the underlying asset will decrease. The maximum gain on a long put option is the difference between the strike price of the option and the lowest possible price the underlying asset can reach, multiplied by the number of shares or contracts the option covers.

The maximum gain on a long put option is achieved when the price of the underlying asset drops to zero. At this point, the option holder can exercise the option and sell the asset at the strike price, resulting in maximum profit. However, it is important to note that in reality, the price of an asset rarely drops to zero, so achieving the maximum gain on a long put option is unlikely.

A long put option is a type of options contract that gives the holder the right, but not the obligation, to sell a specific quantity of an underlying asset at a predetermined price, known as the strike price, within a defined time period. This type of option is considered a bearish strategy, as it profits when the price of the underlying asset decreases.

When an investor purchases a long put option, they are essentially betting that the price of the underlying asset will decline before the option expires. If the price does indeed decrease below the strike price, the holder of the put option can exercise their right to sell the asset at the higher strike price and make a profit.

The maximum gain on a long put option occurs when the price of the underlying asset falls to zero. In this scenario, the holder of the put option can sell the asset at the high strike price, even though the asset is essentially worthless. This difference between the strike price and the zero value of the asset is the maximum gain for the put option holder.

It’s important to note that the holder of a long put option has the right, but not the obligation, to exercise the option. If the price of the underlying asset does not decrease as anticipated, the holder may choose not to exercise the option and will only lose the premium paid for the option.

Long put options can be used by investors to hedge against downside risk in their portfolios or to profit from a decline in the price of a specific asset. It is important for investors to understand the risks involved and to carefully consider their investment goals and risk tolerance before trading options.

The maximum gain on a long put option is the profit that can be made if the price of the underlying asset drops to zero. When an investor purchases a put option, they are buying the right to sell the underlying asset at a specified strike price within a certain time frame.

If the price of the underlying asset decreases below the strike price, the put option becomes profitable. The maximum gain occurs when the price of the underlying asset drops to zero, as this allows the investor to exercise the option and sell the asset for the strike price.

For example, let’s say an investor purchases a put option on a stock with a strike price of $50. If the stock price drops to zero, the investor can exercise the option and sell the stock for $50 per share, even though it is now worthless. This means the investor would make a maximum gain of $50 per share.

Read Also: Who is the Boss of Forex? Unveiling the Top Forex Influencers

It’s important to note that the maximum gain on a long put option is limited to the difference between the strike price and zero, as the price of the underlying asset cannot drop below zero. If the price of the underlying asset does not drop below the strike price, the put option will expire worthless and the investor will lose the premium paid to purchase the option.

Understanding the maximum gain on a long put option is essential for investors to assess their potential profit and risk when trading options. It allows investors to make informed decisions and develop effective strategies based on their market outlook and risk tolerance.

Read Also: Does RBC offer options trading? Find out here!

When it comes to the maximum gain on a long put option, there are several factors that can impact the final outcome. These factors include:

| Strike Price | The strike price of the put option is the price at which the holder of the option has the right to sell the underlying asset. The maximum gain on a long put option is achieved when the price of the underlying asset is below the strike price at expiration. The further the price of the underlying asset falls below the strike price, the higher the maximum gain. |

| Premium Paid | The premium paid for the put option is the cost of purchasing the option. The maximum gain on a long put option is calculated by subtracting the premium from the difference between the strike price and the price of the underlying asset at expiration. The higher the premium paid, the lower the maximum gain. |

| Time to Expiration | The time to expiration of the put option is the period remaining until the option contract expires. The maximum gain on a long put option decreases as the time to expiration decreases. This is because the price of the underlying asset has less time to fall below the strike price. |

| Volatility | Volatility refers to the degree of variation in the price of the underlying asset. The maximum gain on a long put option is higher when there is higher volatility in the market. This is because higher volatility increases the likelihood of the price of the underlying asset falling below the strike price. |

| Transaction Costs | Transaction costs, such as commissions and fees, can also impact the maximum gain on a long put option. These costs reduce the overall profitability of the trade, and therefore, can lower the maximum gain. |

By considering these factors, investors can better understand and evaluate the potential maximum gain on a long put option. It is important to analyze these factors before entering into any options trades to make informed investment decisions.

A long put option is a type of options contract that gives the holder the right, but not the obligation, to sell a specific amount of an underlying asset at a predetermined price, known as the strike price, within a specified time frame.

A long put option gives the holder the right to sell the underlying asset at the strike price. If the price of the underlying asset drops below the strike price, the holder can exercise the option and sell the asset at a profit. If the price of the asset does not drop below the strike price, the holder may choose not to exercise the option and let it expire worthless.

The maximum gain on a long put option is unlimited. If the price of the underlying asset drops to zero, the option holder can sell the asset at the strike price, regardless of its current value. This allows the holder to profit from the difference between the strike price and the current value of the asset.

No, there is no limit to how much you can earn from a long put option. The potential gains are unlimited if the price of the underlying asset drops significantly. However, it’s important to note that the value of the option itself can also change, so the ultimate profit or loss will depend on the individual circumstances of the trade.

Yes, there are risks associated with a long put option. If the price of the underlying asset does not drop below the strike price, the option may expire worthless and result in a loss. Additionally, the value of the option itself can fluctuate due to various factors such as time decay, changes in volatility, and market conditions. It’s important for investors to carefully consider these risks before entering into a long put option.

A long put option is a type of options contract that gives the holder the right, but not the obligation, to sell an underlying asset at a specified price within a specific time frame.

Performance Rights vs Options: Understanding the Key Differences In the world of finance, there are various investment instruments that can be …

Read ArticleBest Broker for Beginners Choosing the right broker is one of the first and most important steps for beginners in the world of online trading. With so …

Read ArticleTrading in a bear market: Challenges and Opportunities In the world of finance, a bear market is characterized by declining prices and a pessimistic …

Read ArticleUnderstanding FX Credit Risk: A Comprehensive Guide Foreign exchange (FX) credit risk is an important and complex concept in the world of finance. It …

Read ArticleWhat is the formula for zero-phase filter? Zero-phase filters play a crucial role in various areas of signal processing and digital filtering. These …

Read ArticleUnderstanding Tick Volume in Forex Trading When it comes to trading in the foreign exchange market, understanding volume is crucial. One key aspect of …

Read Article