Does Forex Work at Night? Understanding Trading Hours and Strategies

Does Forex work at night? Forex, or foreign exchange, is a decentralized global market where the world’s currencies are traded. With different time …

Read Article

Options trading can be an exciting and potentially lucrative investment strategy. It allows traders to speculate on the price movement of an underlying asset without actually owning that asset. One common question among options traders is how many shares can be bought using options.

Unlike buying shares directly, options trading provides traders with the ability to control a much larger number of shares with a relatively small amount of capital. This is because options contracts give traders the right, but not the obligation, to buy or sell a specific number of shares at a predetermined price, known as the strike price.

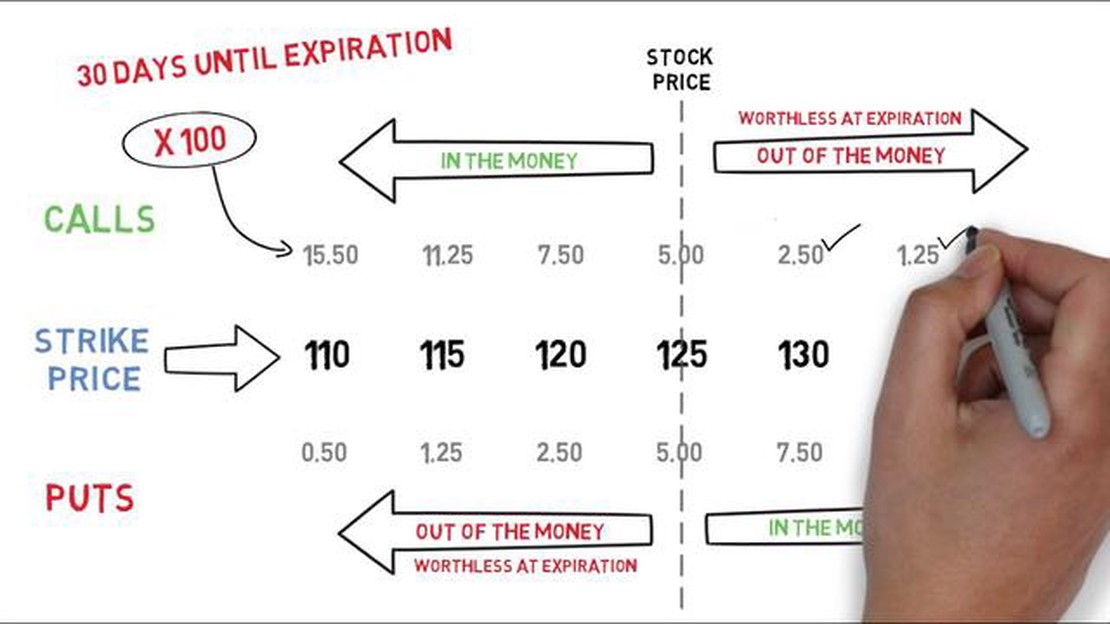

The number of shares that can be bought using options depends on several factors, including the number of options contracts held and the contract’s multiplier. Each options contract typically represents 100 shares of the underlying asset. Therefore, if a trader holds 10 options contracts, they have the right to control 1,000 shares of the underlying asset.

It is important to note that options trading also carries certain risks. The value of an options contract can fluctuate based on factors such as the price of the underlying asset, market conditions, and the time remaining until the option expires. Traders should carefully consider these factors and seek professional advice before engaging in options trading.

To calculate the maximum number of shares you can buy with options, you need to consider several factors. First, you need to know the number of options contracts you hold. Each options contract typically covers 100 shares of the underlying stock.

Next, you need to determine the specific terms of the options contract, including the strike price and the expiration date. The strike price is the price at which you can buy the underlying stock if you choose to exercise your options. The expiration date is the date by which you must exercise the options.

If the current market price of the underlying stock is above the strike price, the options are said to be “in the money.” In this case, you have the right to buy the stock at a lower price, potentially allowing you to make a profit. Conversely, if the market price is below the strike price, the options are “out of the money,” and it may not be advantageous to exercise them.

Once you have determined whether the options are in the money or out of the money, you can calculate the maximum number of shares you can buy by multiplying the number of options contracts by 100. This gives you the total number of shares the options cover.

Read Also: Understanding Buy Signals for RSI: Tips and Strategies

However, keep in mind that exercising options can involve additional costs, such as commissions and fees. It’s important to factor in these costs when calculating the maximum number of shares you can buy.

There are several factors that can affect the number of shares you can buy with options:

It is important to consider these factors when deciding how many shares you can buy with options, as they can significantly impact your investment strategy and potential returns.

When buying shares with options, it is important to consider the risks involved. Here are some key factors to consider:

It is crucial to thoroughly understand the risks and considerations associated with buying shares with options before proceeding. Consulting with a financial advisor or conducting in-depth research can help you make informed investment decisions and mitigate potential risks.

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period.

Read Also: How to Download MT5 from Forex: A Step-by-Step Guide

Yes, options can be used to buy shares of a company. The holder of a call option has the right to buy shares at a predetermined price, known as the strike price.

The number of shares you can buy with options depends on the terms of the options contract. Each options contract typically represents 100 shares of the underlying asset.

Yes, there are limitations on the number of shares you can buy with options. These limitations are set by the options exchange and may vary depending on the specific options contract.

Several factors can affect the number of shares you can buy with options, including the strike price of the options contract, the current market price of the underlying asset, and the expiration date of the options contract.

No, there are limitations on the number of shares that can be bought with options. These limitations vary depending on factors such as the type of option, the underlying asset, and the contract specifications.

The number of shares that can be bought with options is influenced by factors such as the type of option (call or put), the strike price, the expiration date, and the contract size. These factors determine the terms and conditions of the option contract.

Does Forex work at night? Forex, or foreign exchange, is a decentralized global market where the world’s currencies are traded. With different time …

Read ArticleWhy is Lululemon stock so expensive? Lululemon Athletica, the popular athletic apparel retailer, has been a darling of the stock market in recent …

Read ArticleUnderstanding Cyclone Software: Everything You Need to Know Cyclone Software is a cutting-edge technology that aims to revolutionize the way …

Read ArticleAre Telegram Forex Signals Reliable? Forex trading can be a profitable venture for those who have the right knowledge and tools. One popular tool that …

Read ArticleTrading Options on Plus500: Everything You Need to Know If you’re an investor or trader looking to expand your portfolio, you may be wondering if you …

Read ArticleWhat is a GTE in WA? Are you considering studying in Washington State? If so, you may have come across the term “GTE.” But what does GTE stand for, …

Read Article