Understanding the differences between American and European stock options contracts

Stock Options Contracts: American or European? Stock options contracts are financial instruments that give the holder the right, but not the …

Read Article

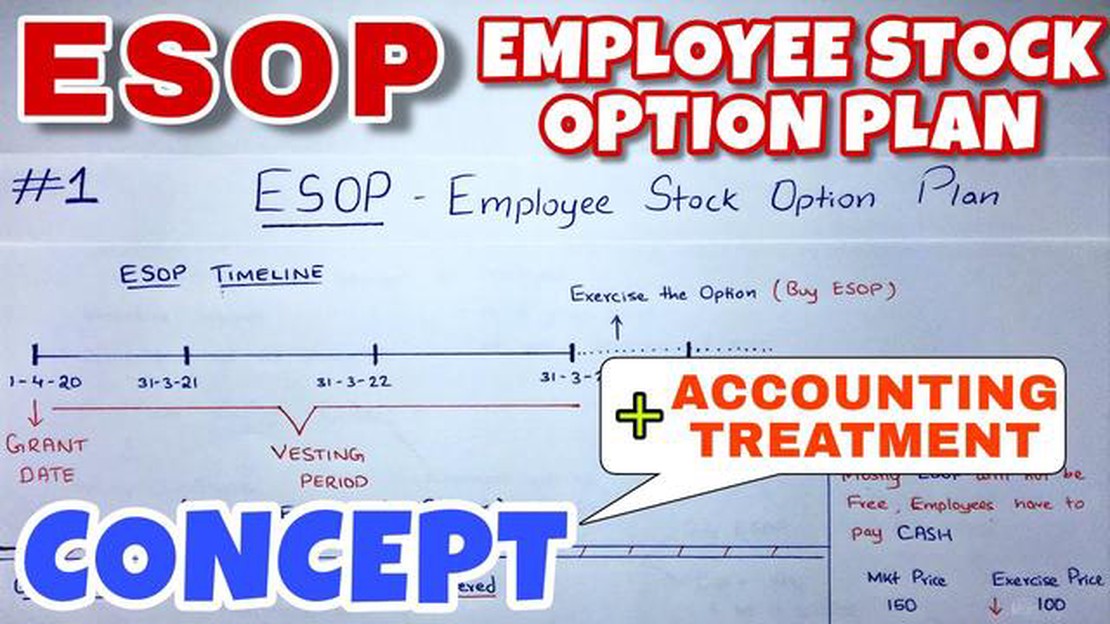

Employee stock option schemes are a popular form of compensation in many companies. These schemes provide employees with the opportunity to purchase company stocks at a discounted price, usually below the prevailing market rate. Understanding the journal entries for such schemes is essential for both employees and employers to properly account for these transactions.

When an employee is granted stock options, it creates an expense for the company. This expense is recognized over the vesting period, which is the period during which the employee becomes eligible to exercise the options. The total expense is calculated based on the fair value of the options at the time of grant, taking into account any applicable forfeiture rate.

Once the expense is recognized, it is recorded in the company’s financial statements. This is done through a journal entry, where the expense is debited to the compensation expense account and credited to the stock options liability account. The compensation expense is typically classified as a non-cash expense since it does not involve any actual outflow of cash at the time of recognition.

As employees exercise their stock options, the liability account is reduced by the fair value of the exercised options, and the common stock or additional paid-in capital account is increased. This is done through another journal entry, where the stock options liability account is debited, and the common stock or additional paid-in capital account is credited.

Understanding the journal entries for an employee stock option scheme is crucial for accurate financial reporting and compliance with accounting standards. It allows both employees and employers to track the impact of these schemes on the company’s financial position and performance.

When it comes to an employee stock option scheme, understanding the journal entries is crucial. These entries help track and record the various transactions and events related to the scheme, providing valuable information for financial reporting.

There are different journal entries that need to be made at various stages of the employee stock option scheme. Let’s take a look at the main types of journal entries that are typically encountered:

| Journal Entry | Description |

|---|---|

| Grant Date Entry | Records the granting of stock options to employees. This entry reflects the increase in the company’s common stock and the corresponding increase in the stock options liability. |

| Expense Recognition Entry | Recognizes the expense associated with the stock options granted to employees over the vesting period. This entry reflects the decrease in the stock options liability and an increase in the stock-based compensation expense. |

| Exercise Date Entry | Records the exercise of stock options by employees. This entry reflects the decrease in the stock options liability and an increase in the common stock and additional paid-in capital accounts. |

| Forfeiture Date Entry | Records the forfeiture of stock options by employees. This entry reflects the decrease in the stock options liability and a decrease in the stock-based compensation expense. |

| Expiration Date Entry | Records the expiration of stock options that were not exercised by employees. This entry reflects the decrease in the stock options liability. |

These journal entries provide transparency and accuracy in accounting for the employee stock option scheme. By clearly documenting the various transactions and events, companies can ensure compliance with financial reporting standards and convey meaningful information to shareholders and stakeholders.

Read Also: How much money do you need to start trading options?

It is important for companies to consult with accounting professionals and follow the relevant accounting guidelines and regulations when making journal entries for employee stock option schemes.

An employee stock option scheme, also known as an employee share purchase plan, is a benefit program that some companies offer to their employees. This scheme allows employees to purchase a certain number of company shares at a predetermined price, typically lower than the market value. The purpose of this scheme is to provide employees with an opportunity to invest in the company and share in its growth and success.

When an employee exercises their stock options, they purchase the stock at the agreed-upon price. This transaction is recorded as a journal entry in the company’s books, and it has implications for both the employee and the company.

From the employee’s perspective, exercising stock options can have tax implications. The difference between the market price of the stock at the time of exercise and the exercise price is known as the “bargain element.” This amount is subject to income tax and potentially other taxes, such as capital gains tax. It’s important for employees to understand the tax implications of exercising their stock options and consult with a tax professional if necessary.

From the company’s perspective, granting stock options to employees is an expense that must be accounted for in the financial statements. The fair value of the options granted is recorded as an expense over the vesting period, typically through a method called “fair value accounting.” This expense is recognized in the income statement, which affects the company’s profitability.

Overall, an employee stock option scheme can be a valuable benefit for both employees and companies. It provides employees with the opportunity to participate in the company’s success and potentially benefit from its growth. At the same time, it allows companies to incentivize and reward employees while also managing the impact on their financial statements.

Read Also: Understanding the costs of holding forex positions overnight

Key Points:

An employee stock option scheme is a program where employees of a company are granted the right to purchase a certain number of company shares at a specific price, usually lower than the market price.

In an employee stock option scheme, eligible employees are granted options to purchase company shares. These options usually have a vesting period, during which the employee needs to meet certain criteria, such as staying with the company for a certain number of years. Once the options vest, the employee can exercise them by purchasing the shares at the predetermined price. If the market value of the shares is higher than the exercise price, the employee can sell them and make a profit.

Journal entries are records of financial transactions in a company’s accounting system. They include details about the date, accounts involved, and amounts of the transaction. Journal entries are used to maintain accurate and organized financial records.

Journal entries are important for an employee stock option scheme because they help track the financial impact of granting, vesting, and exercising employee stock options. They provide a clear record of the company’s expenses, equity dilution, and any potential tax implications. Journal entries also ensure compliance with accounting standards and regulations.

The main journal entries for an employee stock option scheme include the initial grant of options, the periodic expense recognition as options vest, the exercise of options, and any adjustments required for changes in the fair value of the options. Each of these journal entries helps capture the financial impact of the employee stock option scheme on the company’s books.

An employee stock option scheme is a program that allows employees to purchase company stock at a predetermined price within a specified period of time.

Stock Options Contracts: American or European? Stock options contracts are financial instruments that give the holder the right, but not the …

Read ArticleAre Binary Options Profitable? Binary options have gained popularity in recent years as a way to make money online. But are they really profitable? …

Read Article2023 Patriots Trade: Who Was Traded? The New England Patriots have been no strangers to trades in the offseason, and 2023 is shaping up to be no …

Read ArticleForex Trader Job Description: What You Need to Know Forex trading, also known as foreign exchange trading, is a fast-paced and dynamic market that …

Read ArticleWhat is P& When it comes to technology and computer science, the term “P&” is often mentioned. But what exactly is P&? In simple terms, it refers to a …

Read ArticleShould You Trade Longer Time Frames? Discover the Pros and Cons When it comes to trading in financial markets, choosing the right time frame can …

Read Article