Find out the current exchange rate of 1 dollar to Tehran currency

What is the exchange rate of 1 dollar in Tehran currency? If you’re planning a trip to Tehran or have any financial transactions involving the Tehran …

Read Article

Stock options are a popular form of compensation for employees, allowing them to purchase company stock at a predetermined price. When it comes to accounting for stock options, companies have two methods to choose from: the intrinsic method and the fair value method.

The intrinsic method of accounting for stock options calculates the value of the options based on the difference between the current market price and the exercise price. This method is simple and straightforward, as it only takes into account the intrinsic value of the options.

Under the intrinsic method, if the exercise price is lower than the current market price, the options are considered in-the-money, and the value is expensed on the company’s income statement. On the other hand, if the exercise price is higher than the market price, the options are out-of-the-money and no expense is recorded.

While the intrinsic method is easier to understand and implement, it has its limitations. It does not take into consideration the time value of money or the probability of the options being exercised. As a result, it may not accurately reflect the true economic value of the options.

In contrast, the fair value method takes into account not only the intrinsic value but also the time value of money and the probability of the options being exercised. This method is more complex and requires the use of option pricing models to determine the fair value of the options.

Overall, understanding the intrinsic method of accounting for stock options is crucial for companies and investors alike. While it may be simpler, it is important to weigh the benefits and limitations of this method before making a decision on how to account for stock options.

When it comes to accounting for stock options, it is important to understand the basics of how these financial instruments are valued and accounted for. Stock options represent the right to purchase a certain number of shares of a company’s stock at a predetermined price, known as the exercise or strike price, for a specified period of time.

Stock options are typically granted to employees as part of their compensation packages, offering them the opportunity to share in the company’s success and benefit from its future growth. From an accounting standpoint, stock options are considered a form of non-cash compensation and are valued based on their fair market value at the time of grant.

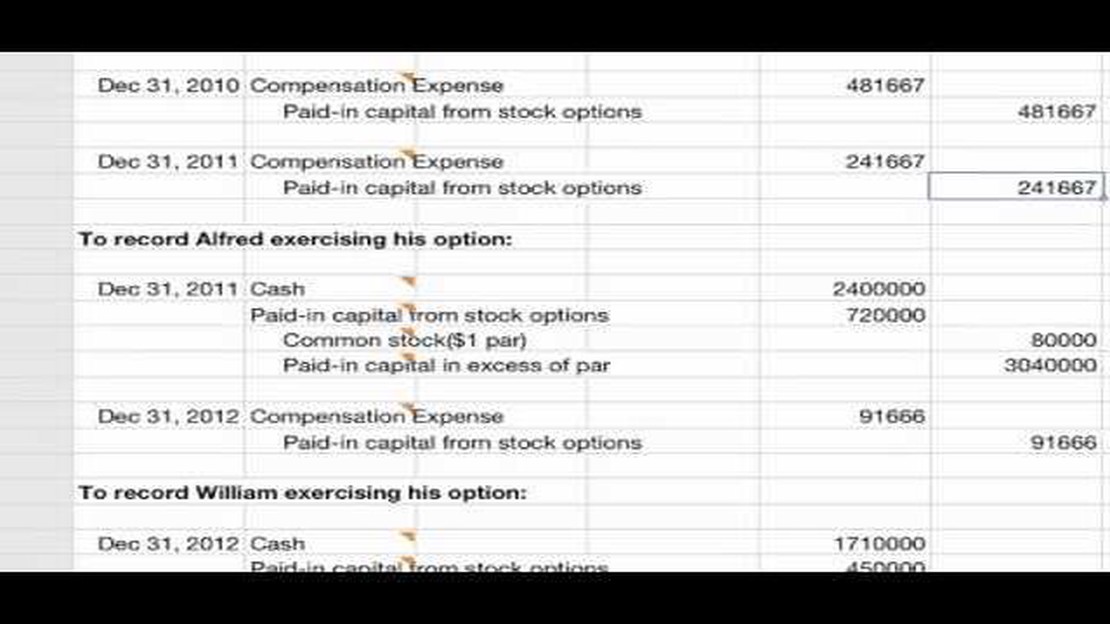

When a company grants stock options to employees, it incurs an expense that needs to be recognized on its financial statements. This expense is typically measured using an option pricing model, such as the Black-Scholes model, which takes into account factors such as the stock price, exercise price, volatility, time to expiration, and risk-free interest rate.

Read Also: Understanding ECN Trading: All You Need to Know

Once the fair value of the stock options has been determined, the expense is recognized over the period during which the options vest, based on the principles of accrual accounting. This means that the expense is recognized gradually over time, rather than all at once.

Companies are required to disclose information about their stock option grants and related expenses in their financial statements. This typically includes details such as the number of options granted, the exercise price, the fair value of the options, and the vesting schedule. The disclosure of stock options is important for investors and other stakeholders to understand the potential dilution and impact on the company’s financial performance.

In conclusion, stock options accounting involves valuing and recognizing the expense of stock options granted to employees. Understanding the basics of stock options accounting is crucial for companies to accurately reflect the value of these financial instruments on their financial statements.

Calculating the intrinsic value for stock options is essential for investors to make informed decisions. Intrinsic value represents the amount of profit that can be gained by exercising an option and immediately selling the underlying stock at its current market price.

To calculate the intrinsic value, it is necessary to know two key values: the strike price and the market price of the stock. The strike price is the price at which the buyer of the option can purchase the underlying stock, and the market price is the current price at which the stock is trading in the market.

If the market price of the stock is higher than the strike price of the option, it means the option is in-the-money. In this case, the intrinsic value is the difference between the two prices. For example, if the market price of the stock is $50 and the strike price of the option is $40, the intrinsic value would be $10.

On the other hand, if the market price of the stock is lower than the strike price, the option is out-of-the-money. In this situation, the intrinsic value is zero because there is no profit to be gained by exercising the option.

It’s important to note that the intrinsic value only represents the profit potential of the option and does not take into account the time value or any other factors that may affect the value of the option. Investors should consider these additional factors when making decisions about whether to exercise or trade their stock options.

Read Also: What is another name for automated trading system?

In conclusion, calculating the intrinsic value for stock options is a crucial step in analyzing the profit potential of the options. By comparing the strike price and the market price of the stock, investors can determine whether the options are in-the-money and calculate the potential profit that can be gained by exercising the options.

The intrinsic method of accounting for stock options is a method of valuing and recognizing the cost of employee stock options as an expense on the income statement. It calculates the difference between the market price of the stock and the exercise or strike price of the options.

The intrinsic method of accounting for stock options differs from the fair value method in that it only considers the difference between the market price and exercise price, while the fair value method takes into account various factors such as volatility and time value to determine the options’ fair value.

Companies may choose to use the intrinsic method of accounting for stock options because it is a more simplified approach compared to the fair value method. It can be easier to understand and implement, especially for smaller companies with limited resources.

One potential drawback of using the intrinsic method of accounting for stock options is that it does not capture the full economic value of the options, as it does not consider factors such as time value and volatility. This can lead to a potentially understated expense and a distorted view of the company’s financial performance.

Yes, there are regulatory requirements and accounting standards related to the intrinsic method of accounting for stock options. These requirements are set by accounting standard boards, such as the Financial Accounting Standards Board (FASB) in the United States, and companies are required to adhere to these standards when reporting their financial statements.

The intrinsic method of accounting for stock options is a method used to determine the fair value of stock options. It calculates the difference between the market price of the stock and the exercise price of the options. If the market price is higher than the exercise price, the options have intrinsic value.

The intrinsic method of accounting for stock options differs from the fair value method in how it calculates the value of the options. The intrinsic method only considers the difference between the market price and the exercise price, while the fair value method takes into account additional factors such as the time value of money and volatility of the stock.

What is the exchange rate of 1 dollar in Tehran currency? If you’re planning a trip to Tehran or have any financial transactions involving the Tehran …

Read ArticleLearn about SMC Trading: Understanding Its Basics and Benefits SMC Trading is a leading company in the field of online trading and investment. With …

Read ArticleDo Forex Indicators Really Work? Forex trading is a highly popular way to invest and profit from the global currency market. Traders are constantly …

Read ArticleWhat is SNB? SNB stands for Swiss National Bank, the central bank of Switzerland. Established in 1907, the SNB is responsible for the monetary policy …

Read ArticleWhat Will be the Trend in Forex in 2023? The foreign exchange market, or Forex, is a dynamic and ever-changing market that sees trillions of dollars …

Read ArticleBest Hours to Trade Gold Trading gold can be a lucrative investment opportunity, but timing is crucial. The fluctuations in the price of gold …

Read Article