Can I Transfer Money from My Forex Card to Bank Account?

How to Transfer Money from Forex Card to Bank Account Many people who travel abroad or frequently engage in international business transactions are …

Read Article

Forex trading is a highly competitive and dynamic market, where traders constantly strive to gain an edge and maximize their profits. One of the key tools in a trader’s arsenal is forward testing. Forward testing is the process of testing a trading strategy in real-time market conditions, with real money, to assess its performance and profitability.

Forward testing allows traders to evaluate the effectiveness of their trading strategies and make necessary adjustments before risking their capital. It helps traders to identify any flaws or weaknesses in their strategies and prevents them from making costly mistakes in the live market.

During forward testing, traders execute their trades in a simulated environment that closely mimics the actual market conditions. They collect data on their trades, including entry and exit points, stop-loss and take-profit levels, and analyze this data to determine the effectiveness of their strategy. By comparing the actual results with the expected results, traders can gain valuable insights into the performance of their strategy and identify areas for improvement.

Forward testing also helps traders to develop discipline and psychological resilience. Trading in a live market can be emotionally challenging, and traders often face pressure to deviate from their strategies due to fear or greed. By forward testing their strategies, traders can build confidence in their approach and develop the discipline to stick to their trading plans, even in the face of market volatility or unexpected events.

In conclusion, forward testing is an essential tool for Forex traders to assess the effectiveness of their strategies and improve their trading performance. It allows traders to gain valuable insights, make necessary adjustments, and develop the discipline and resilience needed to succeed in the competitive world of Forex trading.

Forex trading is a highly competitive and complex market, where the ability to make accurate predictions and execute trades at the right time is crucial for success. Forward testing plays a vital role in helping traders refine their strategies, gain confidence, and improve their overall trading performance.

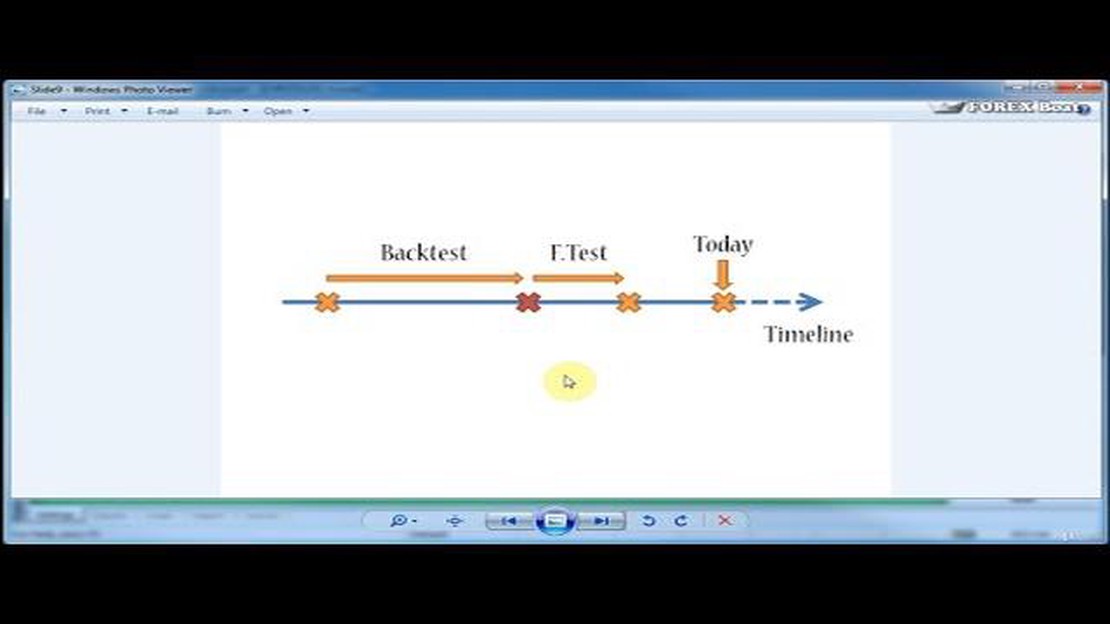

One of the main reasons why forward testing is essential is that it provides traders with real-time market data and live trading conditions. While backtesting allows traders to analyze past data and simulate trading strategies, forward testing allows them to validate their strategies in the current market environment. This ensures that traders are prepared to handle the volatility and unpredictability of live trading.

Forward testing also helps traders identify and correct any flaws or weaknesses in their strategies. By executing trades in real-time and monitoring their outcomes, traders can gain valuable insights into the effectiveness of their strategies and make necessary adjustments. This process of continuous improvement is essential for staying ahead in the forex market.

Another key benefit of forward testing is that it helps traders develop discipline and emotional control. Trading under live market conditions involves handling the pressure, managing emotions, and making quick decisions. By forward testing their strategies, traders can become more accustomed to these conditions and better equipped to handle them. This can ultimately lead to more consistent and disciplined trading.

Furthermore, forward testing allows traders to assess the feasibility and profitability of their strategies. It helps them determine whether their strategies can generate consistent profits over a sustained period. By evaluating the performance of their strategies in real-time, traders can have a realistic expectation of what to expect in terms of returns and adjust their risk management accordingly.

Read Also: Discovering the CEO of GFI: Everything You Need to Know

In conclusion, forward testing is essential for successful forex trading because it offers traders the opportunity to validate and refine their strategies, gain confidence, and improve their overall trading performance. By testing their strategies in real-time, traders can identify weaknesses, develop discipline, and assess the feasibility of their strategies, which are essential for achieving long-term profitability in the forex market.

Forward testing is a crucial component of successful forex trading. It involves testing a trading strategy in real-time market conditions to evaluate its profitability and effectiveness. Unlike backtesting, which uses historical data to simulate trading conditions, forward testing allows traders to analyze the performance of their strategies in a live trading environment.

Forward testing allows traders to assess the viability of their trading strategies and make any necessary adjustments before risking real money. It helps traders understand how their strategies perform in different market conditions, such as trending or ranging markets, high or low volatility, and various timeframes.

To conduct a forward test, traders execute trades based on their predefined strategy, keeping a record of the trades and their outcomes. This data is then analyzed to identify any strengths, weaknesses, or potential improvements in the strategy.

Read Also: Is FX Impact M3 Good? Analyzing its Performance and Features

One key benefit of forward testing is that it provides traders with real-time feedback. Traders can quickly assess the performance of their strategy and make adjustments if needed. This iterative process of testing, evaluating, and refining helps traders fine-tune their strategies over time.

When conducting a forward test, it is important to use a sufficient sample size of trades to obtain reliable statistical results. This helps to ensure that any observed profitability or effectiveness is not simply due to chance or luck. Additionally, traders should use proper risk management techniques and adhere to their predetermined risk tolerance to protect their capital during the testing process.

Forward testing also allows traders to gain confidence in their trading strategies. By analyzing real-time results and making adjustments based on market insights, traders can build trust in their strategies and develop the discipline required for consistent trading success.

In conclusion, forward testing plays a crucial role in forex trading. It allows traders to evaluate the profitability and effectiveness of their strategies in real-time market conditions. By conducting thorough and disciplined forward testing, traders can gain valuable insights, refine their strategies, and increase their chances of success in the highly competitive forex market.

Forward testing is important in forex trading because it allows traders to evaluate the effectiveness and profitability of their trading strategies in real-time market conditions. It helps them identify any flaws or weaknesses in their strategies before using them in live trading, which can ultimately help them make more informed trading decisions and potentially increase their profitability.

Forward testing differs from backtesting in that it involves testing a trading strategy in real-time market conditions using live data, whereas backtesting involves testing a strategy using historical market data. Forward testing provides a more accurate representation of how a strategy will perform in real trading conditions, as it takes into account factors such as market volatility, liquidity, and slippage that cannot be accurately simulated in backtesting.

There are several advantages of forward testing in forex trading. Firstly, it allows traders to assess the effectiveness and profitability of their strategies in real-time market conditions, providing them with valuable insights and feedback. Secondly, it helps traders identify any flaws or weaknesses in their strategies before using them in live trading, which can help prevent potential losses. Lastly, forward testing helps traders gain confidence in their strategies and make more informed trading decisions, potentially increasing their profitability.

The duration of forward testing can vary depending on individual trading strategies and preferences. However, it is generally recommended to conduct forward testing for a sufficient period of time to gather a significant amount of data and assess the performance of the strategy across different market conditions. Ideally, forward testing should be conducted for at least several weeks to several months to ensure the strategy’s effectiveness and profitability.

How to Transfer Money from Forex Card to Bank Account Many people who travel abroad or frequently engage in international business transactions are …

Read ArticleForrest Gump: What Genre Does It Belong To? Forrest Gump is a beloved film that has left audiences questioning its genre. Released in 1994 and …

Read ArticleGuide to Weighted Moving Average Forecasting Accurate forecasting is crucial for businesses in making informed decisions and planning for the future. …

Read ArticleWhat is the 50-day moving average for day trading? In the world of day trading, understanding and utilizing technical indicators is crucial for …

Read ArticleWhat to do with stock options when leaving a company: Options to sell or hold? When you leave a company, one important decision you may face is what …

Read ArticleWhat is the best rate for USD to SGD? Are you planning a trip to Singapore or doing business with Singaporean partners? One of the things you need to …

Read Article