Is Kraken Legit? A Comprehensive Review of the Popular Cryptocurrency Exchange

Is Kraken Legit? Evaluating the Authenticity of the Kraken Exchange When it comes to trading cryptocurrencies, choosing a reliable and trustworthy …

Read Article

When investing in the stock market, it’s important to have a solid understanding of how various factors can impact your portfolio. One such factor is the payment of stock dividends, which can have a significant impact on call options. Understanding how stock dividends affect call options can help investors make informed decisions and manage their risk.

A stock dividend is a dividend payment made by a company in the form of additional shares of stock, rather than cash. This can be seen as a way for a company to share its profits with its shareholders and reward them for their investment. However, the payment of stock dividends can have implications for investors who hold call options on the company’s stock.

Call options give the holder the right, but not the obligation, to buy a specific quantity of a company’s stock at a predetermined price, known as the strike price, on or before a specified expiration date. When a company pays a stock dividend, the number of shares outstanding increases, which can affect the price of the stock. This, in turn, can impact the value of call options.

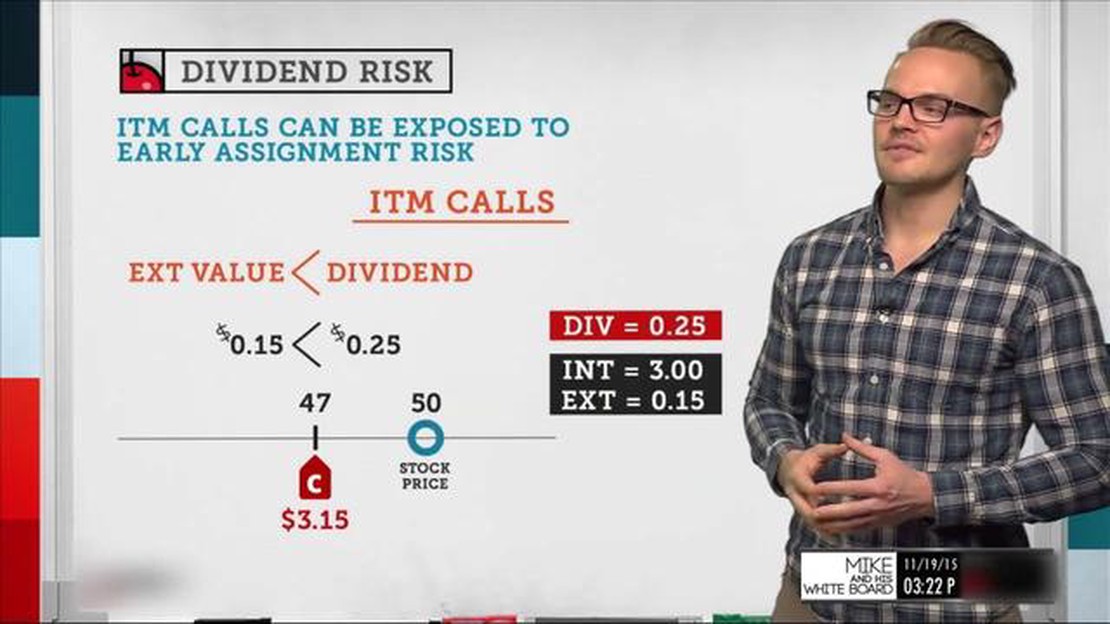

For call option holders, a stock dividend can result in a dilution of the value of their options. This is because the strike price remains the same, but the number of shares that can be purchased at that strike price increases. As a result, the value of the call options may decrease, as the potential for the stock to reach the strike price becomes less likely.

It’s important for investors to monitor stock dividends and their impact on call options, as this can affect their investment decisions. By understanding the relationship between stock dividends and call options, investors can make more informed choices and manage their risk effectively.

Stock dividends and call options are both popular investment strategies in the world of finance. Understanding the relationship between these two concepts can help investors make informed decisions and maximize their returns.

A stock dividend is when a company distributes additional shares of its stock to its existing shareholders. This is usually done as a way to reward shareholders and increase the number of outstanding shares in the market. On the other hand, a call option is a financial contract that gives the holder the right, but not the obligation, to buy a specified amount of a stock at a predetermined price within a specific time period.

One way in which stock dividends can impact call options is through adjustments to the option contract. When a stock dividend is declared, it can lead to a change in the number of shares underlying the option. This is called an adjustment factor, which is often expressed as a fraction. The adjustment factor is calculated by dividing the number of new shares distributed in the dividend by the number of old shares.

The adjustment factor is used to determine the new terms of the call options. For example, if a stock dividend of 10% is declared, and an option contract initially gave the right to buy 100 shares, after the dividend the contract may now give the right to buy 110 shares. This adjustment is important because it affects the value and the exercise price of the options.

Another way in which stock dividends can impact call options is through changes in the underlying stock price. When a company declares a stock dividend, it often leads to a decrease in the stock price. This is because the dividend payout reduces the company’s retained earnings, which can negatively affect investors’ perception of the stock’s value.

Read Also: ITR Form for Option Traders: What You Need to Know

This decrease in stock price can have a direct impact on the value of call options. Since call options give the holder the right to buy the stock at a predetermined price, a decrease in the stock price reduces the potential profit from exercising the option. As a result, the value of the call option decreases.

In conclusion, stock dividends can have a significant impact on call options. The adjustments to the option contract and the changes in the underlying stock price can affect the value and the exercise price of the options, ultimately influencing the potential returns for investors. It is important for investors to consider these factors and assess the potential impact before making investment decisions.

Understanding the impact of stock dividends on call options requires exploring the connection between these two financial instruments. Call options give the holder the right to buy a specific stock, known as the underlying asset, at a predetermined price, known as the strike price, within a specified period of time. Stock dividends, on the other hand, involve a company distributing a portion of its earnings or profits to its shareholders in the form of additional shares of stock.

When a company announces a stock dividend, it can sometimes affect the value of the underlying stock and, consequently, the value of call options that are tied to that stock. This connection stems from the fact that stock dividends increase the number of outstanding shares of stock, leading to a decrease in the price per share. As a result, call options may experience changes in their value.

Read Also: Understanding Unified Margin Trading and Its Benefits

For call options, the impact of stock dividends depends on various factors, including the size of the dividend, the strike price of the option, and the time remaining until expiration. In general, stock dividends tend to have a dilutive effect on call options. This means that the increased number of shares resulting from the dividend can lead to a decrease in the price of the underlying stock, making it less likely that the option will be profitable.

However, it is important to note that the impact of stock dividends on call options can vary depending on the specific circumstances. In some cases, the market may anticipate the stock dividend and adjust the price of the underlying stock and the corresponding call options accordingly. Additionally, the terms of the call option contract, such as the strike price and expiration date, can also influence the impact of stock dividends.

Overall, exploring the connection between stock dividends and call options is essential for investors and traders who utilize these financial instruments. By understanding how stock dividends can impact call options, market participants can make informed decisions and manage their risk effectively.

Stock dividends can have a significant impact on call options. When a company issues a stock dividend, it increases the number of shares available in the market. This increase in supply can result in a decrease in the price of the stock, which can negatively impact the value of call options. Additionally, stock dividends can also change the strike price and the number of shares associated with each call option.

When a company issues a stock dividend, the number of shares available in the market increases. This can lead to a decrease in the stock price, which can negatively impact the value of call options. Additionally, stock dividends can also result in changes to the strike price and the number of shares associated with each call option. It is important for call option holders to consider these factors when assessing the impact of stock dividends on their options.

Stock dividends can potentially decrease the value of call options, but it is not always the case. The impact of stock dividends on call options depends on various factors such as the magnitude of the dividend, the overall market conditions, and the specific terms of the call options. In some cases, the market may react positively to a stock dividend, resulting in an increase in the value of call options. It is important for investors to carefully analyze the specific circumstances before making any conclusions about the impact of stock dividends on call options.

Yes, a stock dividend can potentially significantly change the terms of a call option. When a company issues a stock dividend, it can result in changes to the strike price and the number of shares associated with each call option. These changes can have a direct impact on the value and profitability of the call option. Investors should closely review the terms of their call options and consider the potential impact of any stock dividends on these terms.

When assessing the impact of stock dividends on call options, investors should consider several factors. These include the magnitude of the dividend, the overall market conditions, the terms of the call options, and the specific circumstances of the company issuing the dividend. It is important to analyze how these factors interact and to make an informed decision regarding the potential impact on call options. Consulting with a financial advisor or conducting thorough research can help investors make more informed decisions.

Is Kraken Legit? Evaluating the Authenticity of the Kraken Exchange When it comes to trading cryptocurrencies, choosing a reliable and trustworthy …

Read ArticleUnderstanding Hull Moving Average in Multicharts The Hull Moving Average (HMA) is a popular technical indicator used in Multicharts to analyze price …

Read ArticleWhat is the typical annual inflation rate? Inflation is a crucial economic indicator that measures the rate at which the general level of prices for …

Read ArticleIs Forex Robot Real? Forex trading has become increasingly popular in recent years, with more and more people looking to make profits in the …

Read ArticleBest Markets for Day Trading Day trading is a popular form of trading where traders buy and sell financial instruments within the same trading day. …

Read ArticleWhat is the average Apple stock price for 52 weeks? In this article, we will explore the average stock price of Apple over a span of 52 weeks. Apple, …

Read Article