Understanding stock forex club: All you need to know

What is stock forex club? When it comes to investing in the stock market, many people turn to organizations like the Stock Forex Club to help them …

Read Article

Forecasting and analyzing data play crucial roles in decision-making processes across various industries. To make accurate predictions about future trends, businesses rely on different statistical techniques, such as moving averages and exponential smoothing. While both methods are widely used, they have distinct characteristics that set them apart.

Weighted moving average is a statistical approach that assigns different weights to each data point in a time series. The weights are determined based on their relative importance or significance. This technique provides more weight to recent data points, allowing for a greater responsiveness to changes. It smoothens out fluctuations and, as a result, it may be better at capturing short-term trends. However, it may be less sensitive to long-term patterns due to the weights assigned.

On the other hand, exponential smoothing is a technique that calculates the weighted average of past observations while placing more emphasis on recent data points. It assigns a higher weight to more recent observations and decreases the weight exponentially as the data goes further back in time. This method is useful in situations where the most recent data is most influential in predicting future values. Exponential smoothing is suitable for smoothing out irregularities and capturing long-term trends effectively.

When choosing between weighted moving average and exponential smoothing, it is essential to consider the specific characteristics of the data you are working with and the desired outcome of the analysis. Weighted moving average is often preferred when short-term variations need to be emphasized, while exponential smoothing is more suitable for long-term trend analysis. Both techniques offer valuable insights into time series data and can help businesses make informed decisions.

Weighted moving average (WMA) is a statistical technique used to analyze time series data and calculate a trend line. It is similar to simple moving average (SMA), but assigns different weights to each data point in the calculation.

Unlike SMA, where all data points have equal importance and are given equal weight, WMA assigns different weights to different data points. The weights are typically assigned in a way that gives more importance to recent data points and less importance to older data points. This allows WMA to respond more quickly to changes in the data.

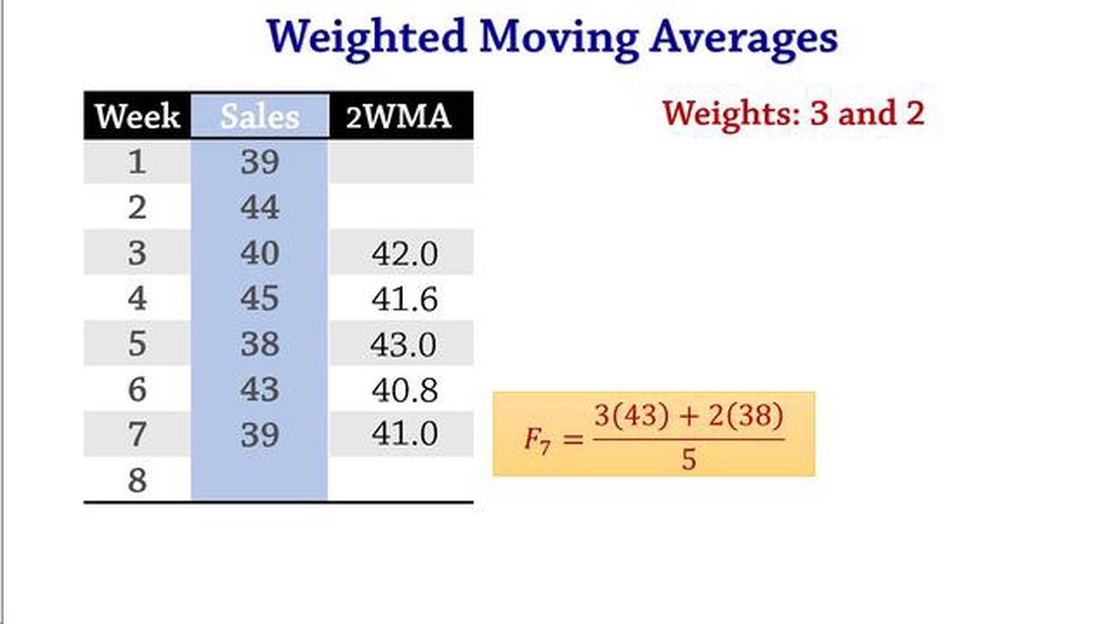

To calculate the WMA, you multiply each data point by its assigned weight and then sum up the weighted values. The weighted values are then divided by the sum of the weights to get the average. The formula for calculating the WMA is as follows:

WMA = (w1 * x1 + w2 * x2 + … + wn * xn) / (w1 + w2 + … + wn)

Where w1, w2, …, wn are the weights assigned to each data point, and x1, x2, …, xn are the corresponding data points.

Read Also: Understanding and Interpreting Covariance Matrix Values: A Comprehensive Guide

By assigning different weights, WMA gives more weightage to recent data, making it more sensitive to short-term fluctuations. This can be helpful in identifying and reacting to trends and changes in data more quickly. However, it can also make WMA more volatile and susceptible to noise and outliers.

Overall, weighted moving average is a useful statistical tool for analyzing time series data and calculating trend lines. It offers a balance between responsiveness to short-term changes and stability by assigning different weights to different data points.

In time series analysis, exponential smoothing is a widely used method for forecasting data points by giving more weight to recent observations. It is a statistical technique that aims to capture and represent the underlying trends and patterns in a dataset. Exponential smoothing assigns exponentially decreasing weights to past observations, with the most recent observation having the highest weight.

The core idea behind exponential smoothing is to reduce the effect of older data points on the forecast, as they may not accurately reflect the current state of the data. By putting more emphasis on recent observations, the method allows for better adaptation to changes and trends in the data.

To calculate the forecast using exponential smoothing, a smoothing factor (often denoted as “alpha”) is applied to the previous observation and the forecasted value. The smoothing factor determines how much weight is given to the most recent observation, with values closer to 1 giving more weight to recent data, and values closer to 0 giving more weight to past data. The choice of the smoothing factor depends on the data and the desired level of responsiveness to changes.

Exponential smoothing is particularly useful for time series data that exhibit a trend, as it helps to capture and forecast the direction of that trend. It can also be applied to data with seasonality, by incorporating additional factors such as seasonality indices or seasonal smoothing factors.

In summary, exponential smoothing is a powerful technique for forecasting time series data by assigning higher weights to recent observations. It allows for better adaptation to changes in the data, especially trends and seasonality. By considering the latest information more heavily, exponential smoothing provides a smoothed representation of the data and helps to make accurate predictions for the future.

Weighted Moving Average (WMA) and Exponential Smoothing are both popular methods used in time series forecasting. They are both used to analyze and predict trends in data, but they have some key differences that set them apart.

Read Also: Is Capital com real or fake? Unveiling the truth about Capital com

Weighted Moving Average:

Exponential Smoothing:

Overall, both Weighted Moving Average and Exponential Smoothing are effective methods for time series forecasting. The choice between the two depends on the specific characteristics of the data, the desired level of complexity, and the experience of the analyst.

Weighted moving average is a forecasting technique that assigns different weights to different time periods in order to calculate the average. The weights assigned are based on their level of importance in the forecast.

Exponential smoothing is a forecasting technique that gives more weight to recent data points, while weighted moving average assigns different weights to different time periods. Exponential smoothing puts a heavier emphasis on recent observations, making it more responsive to changes in the data.

Exponential smoothing is more suitable for short-term forecasts because it gives more weight to recent data points. Since short-term forecasts are often affected by recent trends and changes, exponential smoothing can capture these changes more effectively.

One limitation of weighted moving average is that it requires the selection of appropriate weights for the time periods. If the weights are not chosen correctly, it can result in inaccurate forecasts. Additionally, weighted moving average assumes that the patterns observed in the past will continue in the future, which may not always be the case.

Yes, both weighted moving average and exponential smoothing can be used for time series data. Time series data is a sequence of observations collected over time, and these forecasting techniques are specifically designed to analyze and predict future values based on past observations.

What is stock forex club? When it comes to investing in the stock market, many people turn to organizations like the Stock Forex Club to help them …

Read ArticleRobinhood Weekly Options: Everything You Need to Know If you’re an investor or trader looking for a platform to trade options, you’ve probably heard …

Read ArticleExploring the 15-minute Forex Strategy Are you interested in trading on the Forex market but feel overwhelmed by the complexity and time commitment it …

Read ArticleIs Meta Trader 5 a broker? When it comes to online trading, one name that stands out is Meta Trader 5. It is a popular platform used by traders all …

Read ArticleBest Time for Trading EUR USD The EUR/USD currency pair is one of the most popular and heavily traded currency pairs in the forex market. Traders from …

Read ArticleWhy is IPA famous? India Pale Ale, or IPA, is a beer style that has gained tremendous popularity in recent years. It has become a favorite among craft …

Read Article