How to Predict the Fundamental Direction of Markets

Predicting Fundamental Direction: A Guide to Financial Forecasting When it comes to investing, one of the most challenging tasks is predicting the …

Read Article

Options trading provides investors with a unique opportunity to capitalize on market volatility and generate profits. However, navigating the world of options can be complex and requires an understanding of various concepts and indicators. Two such indicators, gamma and vanna, play crucial roles in options trading, allowing traders to better assess and manage their risk.

Gamma measures the rate at which an option’s delta changes in relation to the movement of the underlying asset. In other words, it quantifies the sensitivity of an option’s delta to changes in the stock price. It is an important metric for options traders because it helps determine the potential for profit or loss as the underlying asset’s price fluctuates. A higher gamma implies a more significant change in delta for a given change in stock price, making the option more sensitive to price movements. This can be both advantageous and risky, depending on the trader’s strategy and market outlook.

Vanna, on the other hand, is a measure of the rate at which the delta of an option changes in response to changes in implied volatility. While gamma focuses on stock price movement, vanna accounts for the impact of changing market expectations on the option’s delta. Vanna measures the sensitivity of delta to changes in implied volatility, making it a useful tool for assessing how changes in market sentiment can affect an option’s value. This metric is particularly relevant in volatile markets, where sudden shifts in implied volatility can significantly impact option prices.

Understanding the distinction between gamma and vanna is essential for options traders, as it allows them to create more informed trading strategies and manage risk effectively. By analyzing gamma and vanna alongside other key indicators, traders can gain valuable insights into the potential risks and rewards associated with their options trades, helping them make more strategic decisions in the ever-changing market environment.

In conclusion, gamma and vanna are critical indicators in options trading, providing insight into an option’s sensitivity to stock price movements and changing market expectations. By mastering these concepts, options traders can enhance their ability to profit from market volatility and navigate the complexities of options trading with confidence.

Gamma is a measure of how much an option’s delta changes in relation to a $1 change in the underlying asset’s price. It is an important risk management tool that helps options traders understand and manage their exposure to changes in the underlying asset.

Gamma is one of the option Greeks, which are mathematical measures used to assess the risk and potential profitability of options. The other Greeks include Delta, Theta, Vega, and Rho.

Gamma can be thought of as the second derivative of an option’s price with respect to the underlying asset’s price. It measures the curvature of the option’s price curve and indicates how sensitive the option’s delta is to changes in the underlying price.

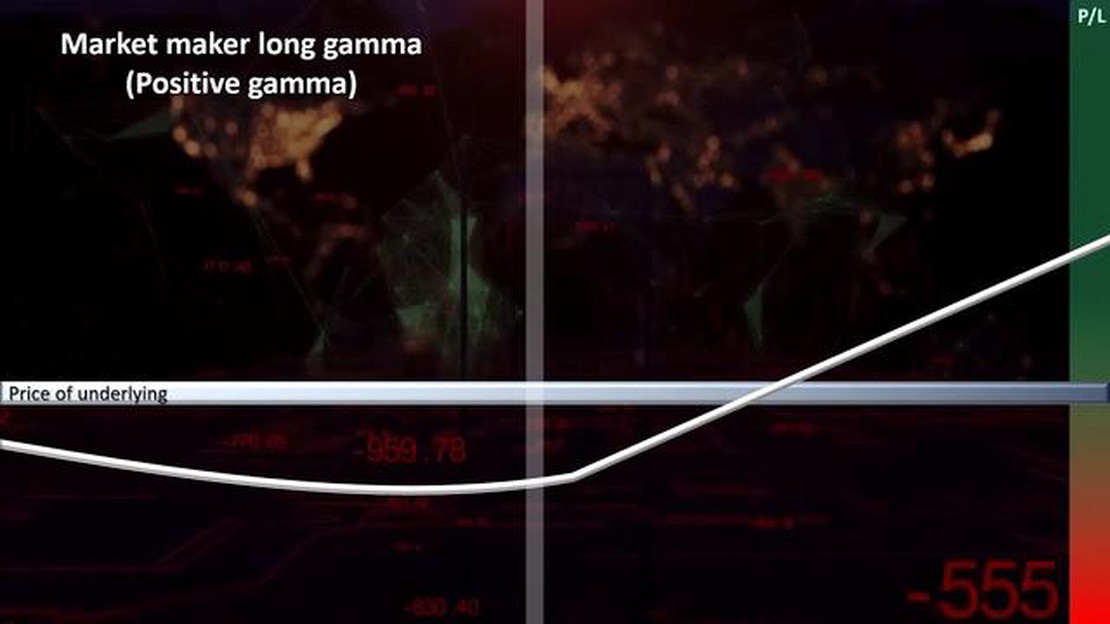

A positive gamma value means that the option’s delta will increase as the underlying asset’s price increases, and vice versa. This can result in accelerated gains or losses for options traders.

Option traders often use gamma to adjust their positions and manage risk. For example, if a trader is long options and wants to reduce their exposure to price movements, they can sell or hedge against the gamma to minimize potential losses.

It is important to note that gamma is not a static measure and will change as the underlying asset’s price and time to expiration change. Traders need to monitor and adjust their positions accordingly to account for gamma risk.

Overall, gamma is a crucial concept for options traders as it helps them understand how sensitive their positions are to changes in the underlying asset’s price. It allows traders to more effectively manage their portfolios and make informed decisions based on market conditions.

Read Also: What enterprise system does Amazon use? | The technology behind Amazon's operations

Vanna is a second-order Greek option, also known as “the skews.” It measures the rate at which the delta of an option changes in response to changes in the underlying asset’s implied volatility. Essentially, Vanna captures the sensitivity of delta to changes in volatility.

Unlike gamma, which measures the rate of change of delta in response to changes in the underlying asset’s price, Vanna specifically focuses on the impact of changes in implied volatility on delta. It quantifies how delta will change if there is a shift in the implied volatility surface.

Vanna is an important risk metric for options traders as it helps them evaluate the potential impact of changes in implied volatility on their positions. By understanding Vanna, traders can adjust their strategies to account for changes in market conditions and mitigate risk accordingly.

Furthermore, Vanna is related to gamma in that it often works in conjunction with gamma to determine the overall risk exposure of an options portfolio. Changes in implied volatility affect both the delta (Vanna) and the delta sensitivity (gamma) of options, making it crucial for traders to consider both of these measures.

In summary, Vanna is a measure of how delta changes as a result of changes in implied volatility. Understanding Vanna helps options traders manage and adjust their positions in response to shifts in market conditions.

Gamma and Vanna are two important concepts in options trading that help traders assess and manage risk. While both are related to the sensitivity of option prices to changes in the underlying asset’s price, there are some key differences between gamma and vanna.

Read Also: Is Gann's Analysis Accurate? Exploring the Reliability of Gann's Techniques

Gamma measures the rate at which an option’s delta changes with respect to a change in the underlying asset’s price. It essentially tells us how much the delta of an option will change for a given change in the underlying asset. Gamma is always positive for long options and negative for short options. It increases as the option approaches expiration.

Vanna, on the other hand, measures the rate at which the delta of an option changes with respect to a change in implied volatility. It tells us how much the delta of an option will change for a given change in implied volatility. Vanna is positive for long calls and short puts, and negative for long puts and short calls. It increases as the option approaches expiration.

The key difference between gamma and vanna is that gamma is concerned with changes in the underlying asset’s price, while vanna is concerned with changes in implied volatility. Gamma helps traders understand how delta will change as the underlying asset’s price moves, while vanna helps traders understand how delta will change as implied volatility changes.

Another difference between gamma and vanna is that gamma is symmetric, meaning it has the same value for both a price increase and a price decrease, while vanna is asymmetric, meaning it has different values for changes in implied volatility depending on whether it goes up or down.

In summary, gamma measures the rate of change of an option’s delta with respect to changes in the underlying asset’s price, while vanna measures the rate of change of an option’s delta with respect to changes in implied volatility. Gamma is symmetric, while vanna is asymmetric. Understanding these key differences can help traders make more informed decisions when trading options.

Gamma and Vanna are both measures of how an option’s price changes in relation to changes in the underlying asset, but they have some distinct differences. Gamma measures the rate of change of an option’s delta, while Vanna measures the rate of change of an option’s delta with respect to changes in volatility.

Gamma is important in options trading because it helps traders understand how the option’s price will change in relation to changes in the underlying asset. It indicates the degree of movement an option’s delta will have in response to a $1 change in the price of the underlying asset.

Vanna differs from gamma in that it measures the sensitivity of an option’s delta to changes in volatility, rather than changes in the underlying asset price. It provides insight into how changes in implied volatility can impact the option’s price and delta.

Yes, gamma and vanna are related to each other. Vanna is actually the rate at which gamma itself changes with respect to changes in volatility. It captures the impact of changes in implied volatility on an option’s delta.

Understanding gamma and vanna can help traders in options trading by giving them insights into how changes in the underlying asset price and volatility can impact the option’s price and delta. This knowledge can assist traders in making informed decisions about when to enter or exit positions, as well as managing their risk.

Gamma and vanna are both measures of how the option price changes in relation to changes in the underlying asset price. However, the key difference is that gamma measures the rate of change of delta, while vanna measures the rate of change of vega. Gamma expresses how much the delta of an option changes for every $1 change in the underlying asset price, while vanna expresses how much the vega of an option changes for every 1% change in implied volatility.

Predicting Fundamental Direction: A Guide to Financial Forecasting When it comes to investing, one of the most challenging tasks is predicting the …

Read ArticleSend Money Through LBC: A Complete Guide If you are living in the Philippines or have family, friends, or business associates residing there, you …

Read ArticleTrading US Options from India with Interactive Brokers: Everything You Need to Know Are you an investor in India looking to trade US options? Look no …

Read ArticleTop In-Demand Jobs in Cyprus Cyprus, a vibrant Mediterranean island, is not only known for its stunning beaches and rich historical sites, but also …

Read ArticleBest Brokers for Professional Forex Traders When it comes to forex trading, having a reliable and experienced broker by your side is crucial. …

Read ArticleBuy Volkswagen Shares in India: A Comprehensive Guide Investing in the stock market can be a lucrative endeavor, especially if you make informed …

Read Article