Which Celebrities Trade Forex? 10 Famous Faces Who Have Mastered the Currency Market

Celebrities trading forex: Who’s in on the action? Forex trading, also known as foreign exchange trading, has become increasingly popular in recent …

Read Article

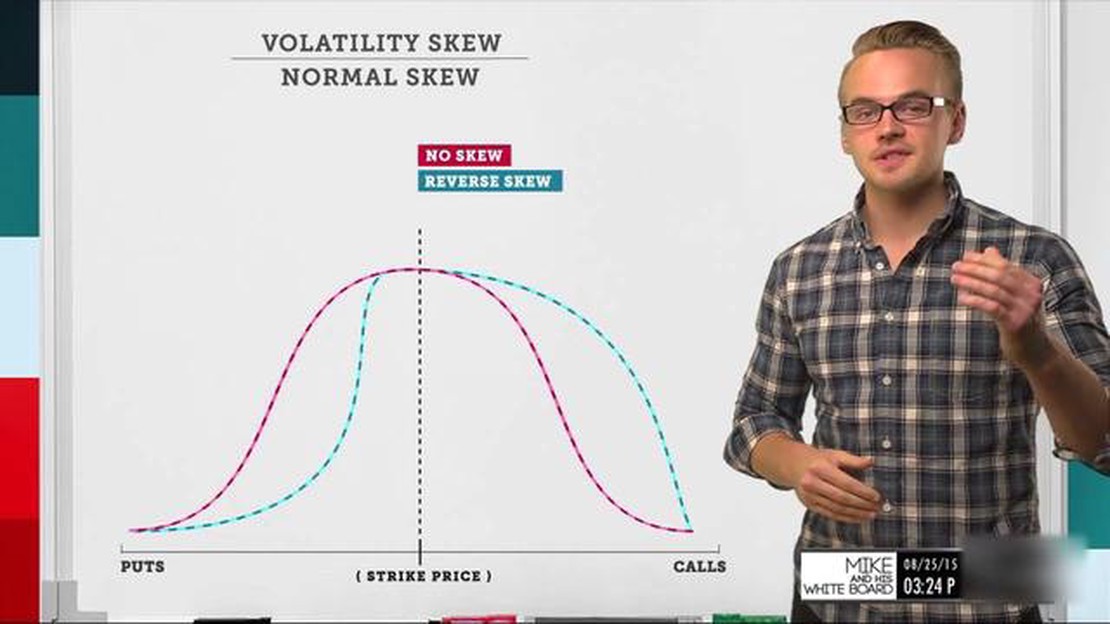

In the world of finance and investing, two key terms that often come up are “skew” and “volatility.” These terms play a crucial role in understanding and evaluating market dynamics and risk. While they may seem similar, it is important to distinguish between the two, as they have distinct meanings and implications.

Skew refers to the asymmetry or skewness of a probability distribution. It measures the degree to which the distribution is tilted towards one tail or the other. In finance, skew is often used to describe the shape of the return distribution of an investment or a portfolio. A positive skew indicates that the distribution has a longer right tail, meaning there is a higher probability of extreme positive returns. Conversely, a negative skew implies a longer left tail, indicating a higher likelihood of extreme negative returns.

On the other hand, volatility is a measure of how much the price of an asset fluctuates over a given period of time. It quantifies the degree of uncertainty or risk associated with an investment. Volatility is typically calculated using statistical models, such as standard deviation or variance. Higher volatility is generally associated with greater price fluctuations and is often seen as an indication of higher risk. Conversely, lower volatility suggests a more stable and predictable market.

While both skew and volatility are indicators of risk, they provide different perspectives. Skew measures the likelihood and magnitude of extreme events, while volatility measures the overall level of price fluctuation. Understanding these distinctions is crucial for investors and financial professionals to adequately assess and manage risk in their portfolios.

In statistics, the term “skew” refers to the asymmetry of a probability distribution. It measures the extent to which a distribution deviates from being symmetrical. A symmetrical distribution has a skewness of zero.

Skewness can be positive or negative, indicating whether the distribution is skewed to the right or left, respectively. A positive skew means that the tail of the distribution is longer on the right side, while a negative skew indicates a longer left tail.

When analyzing financial data, skew is often used to assess the risk and return characteristics of an investment. It can provide insights into the likelihood of extreme positive or negative returns. For example, a positively skewed distribution may suggest that there is a higher probability of large positive returns.

Skewness can be calculated using various formulas, such as Pearson’s first coefficient of skewness or the Fisher-Pearson standardized moment coefficient. These formulas take into account the mean, standard deviation, and other statistical parameters of the distribution.

Skewness is an important concept in options trading, as it can help traders assess the potential profitability and risk of different options strategies. Understanding skew can provide valuable insights into the behavior of the underlying asset and the volatility of its price.

Read Also: Is it Cheaper to Exchange Money in the US or Europe? Find Out the Best Option!

Overall, skew is a useful statistical measure for understanding the shape and characteristics of probability distributions. It is an important tool in financial analysis and risk management, helping investors and traders make informed decisions based on the asymmetry of data.

| Skewness | Distribution Shape |

|---|---|

| 0 | Symmetrical |

| Positive | Skewed to the right (longer right tail) |

| Negative | Skewed to the left (longer left tail) |

In finance, skew refers to the measure of the asymmetry or lack of symmetry in the distribution of returns for a given asset or portfolio. It is a statistical term that helps investors understand the probability of extreme events or outliers happening in the market.

Skewness is calculated using the third standardized moment of a distribution and provides insight into whether the returns of an investment are normally distributed, positively skewed, or negatively skewed.

A positively skewed distribution means that the tail on the right side of the distribution is longer or fatter than the left side, indicating a higher probability of positive returns. This suggests that there is greater potential for large gains, but also a higher likelihood of extreme losses.

On the other hand, a negatively skewed distribution has a longer or fatter tail on the left side, indicating a higher probability of negative returns. This suggests a higher likelihood of small losses but also a higher potential for large gains.

Skewness is an important tool for risk analysis and portfolio management. It helps investors better understand the potential risks and rewards associated with an investment. By incorporating skewness into their analysis, investors can make more informed decisions and manage their portfolios more effectively.

| Skewness | Distribution Shape | Interpretation |

|---|---|---|

| 0 | Normal distribution | Returns are symmetrical |

| Positive skew | Tail on the right side | Higher potential for large gains, higher likelihood of extreme losses |

| Negative skew | Tail on the left side | Higher potential for large gains, higher likelihood of small losses |

Read Also: How much does it cost to ship a Balikbayan box? Find out the shipping rates and fees.

Skew in finance refers to the asymmetry observed in the distribution of a particular variable, such as returns or prices. It measures the degree of distortion from a symmetrical distribution and indicates whether extreme events are more likely to occur on one side of the distribution than the other.

Skewness and volatility are different concepts in finance. Skewness measures the asymmetry in the distribution of a variable, while volatility measures the extent of fluctuations or variability in the value of a variable over time. Skewness focuses on the shape of the distribution, while volatility focuses on the magnitude of changes in the variable.

A positive skew indicates that the distribution of a variable has a longer tail on the right side, or in simpler terms, it means that the variable has more extreme positive values. In finance, a positive skew may suggest that there are more frequent small losses, but occasional large gains.

Yes, a variable can have both positive skew and high volatility. Positive skewness refers to the shape of the distribution, indicating more extreme positive values. Volatility, on the other hand, measures the magnitude of changes in the variable. So, a variable can have a distribution with a longer tail on the right side (positive skew) and experience large fluctuations (high volatility).

In finance, skewness is often measured using the Pearson moment coefficient of skewness or the Fisher-Pearson standardized moment coefficient of skewness. Volatility is commonly measured using metrics such as standard deviation, variance, or the average true range (ATR).

Skew and volatility are two different measures of risk in financial markets. Skew refers to the asymmetry of the distribution of returns, while volatility measures the amount of fluctuation in those returns.

Skew is typically calculated using statistical methods, such as the skewness formula. This formula takes into account the mean, standard deviation, and third moment of the return distribution to determine the skewness of the data. Positive skewness indicates a distribution with a longer right tail, while negative skewness indicates a distribution with a longer left tail.

Celebrities trading forex: Who’s in on the action? Forex trading, also known as foreign exchange trading, has become increasingly popular in recent …

Read ArticleGuide to Intraday Options Trading Options trading is a complex and exciting field that can offer lucrative opportunities for investors. Among the …

Read ArticleUnderstanding Currency Options: Examples and Explanations When it comes to international trade and investments, currency exchange rates play a crucial …

Read Article2023 Day Trading Rules: Everything You Need to Know Day trading has become increasingly popular in recent years, thanks to advancements in technology …

Read ArticleDiscover the Benefits of the Auto Fibonacci Target Indicator Welcome to XYZ Website, where we introduce you to the incredible Auto Fibonacci Target …

Read ArticleHow much is $100 US in Denmark? When traveling to Denmark, it is important to consider the currency exchange rate in order to effectively manage your …

Read Article