Where are stock options reported: A complete guide

Where are stock options reported? Stock options can be an attractive option for individuals looking to invest in the stock market. However, it’s …

Read Article

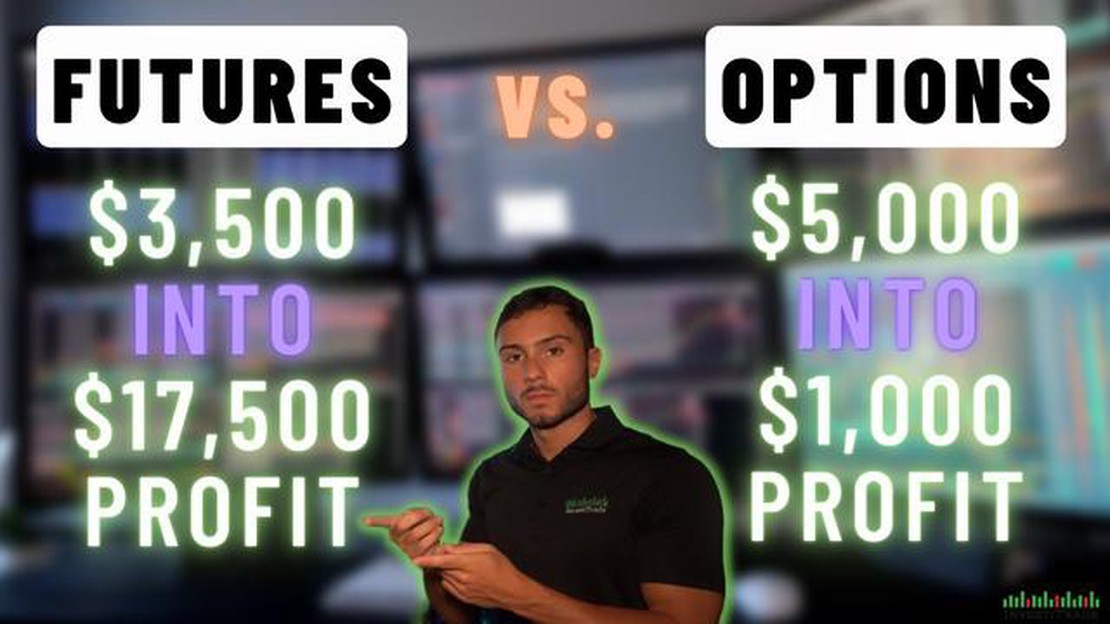

When it comes to forex trading, understanding the distinction between options and futures is crucial. Both options and futures are derivative financial instruments that allow traders to speculate on the movement of currency prices. However, there are several key differences between these two types of contracts that traders need to be aware of in order to make informed decisions.

An option is a contract that gives the holder the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined price (the strike price) within a specified period of time. Traders can buy call options if they believe the price of the currency will rise, or put options if they expect it to fall. Options provide traders with flexibility, as they can choose whether or not to exercise the contract.

On the other hand, a futures contract is an agreement between two parties to buy or sell a specific amount of currency at a future date, at a predetermined price. Unlike options, futures contracts are binding and must be fulfilled by both parties. This means that traders are obligated to buy or sell the currency at the specified price and date.

Another important distinction between options and futures is the cost involved. Options require the payment of a premium, which is the price of the contract. The premium is typically lower than the margin required for trading futures. Futures, on the other hand, require traders to deposit a margin, which is a percentage of the total value of the contract.

Understanding the differences between options and futures in forex trading is crucial for traders to effectively manage risk and make informed investment decisions. By understanding the flexibility and binding nature of these contracts, traders can choose the most suitable instrument for their trading strategies and financial goals.

Options are a type of derivative contract that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined timeframe.

In forex trading, options can be used as a hedging tool to manage risk or as a speculative tool to take advantage of potential market movements.

There are two main types of options in forex trading: call options and put options. A call option gives the holder the right to buy the underlying asset at a specified price, while a put option gives the holder the right to sell the underlying asset at a specified price.

When trading options, traders need to pay a premium to the option seller for the rights associated with the contract. The premium is influenced by various factors, including the strike price, expiration date, volatility of the underlying asset, and the current market conditions.

One of the key advantages of trading options in forex is the ability to limit losses and potential downside risk. By purchasing put options, traders can protect their positions from sharp price declines. Conversely, by purchasing call options, traders can gain exposure to potential price increases.

Read Also: Is floor trading still a thing? Exploring the current state of stock trading

However, it’s important to note that options trading carries risks and may not be suitable for all traders. The value of options contracts can fluctuate, and traders may lose the premium paid if the underlying asset doesn’t move in the desired direction before the expiration date.

In conclusion, options provide traders with additional flexibility in forex trading. They can be used to manage risk, speculate on market movements, and potentially enhance trading strategies. However, traders should carefully consider the risks and benefits before engaging in options trading.

In the world of forex trading, futures contracts are an essential component. Futures are financial contracts that obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price and specified date in the future. These contracts are traded on futures exchanges and are standardized in terms of the quantity, quality, and delivery date of the underlying asset.

Futures in forex trading provide traders with the opportunity to profit from price movements of currencies without actually owning the currencies themselves. This is known as speculating on the future value of a currency. By entering into a futures contract, traders can bet on the appreciation or depreciation of a particular currency against another currency.

One of the key features of futures contracts is the leverage they offer. Traders are only required to deposit a small percentage of the contract value, known as the margin, to enter into a futures position. This allows traders to control a much larger position than they would be able to with the same amount of capital in the spot forex market.

Futures contracts have standardized contract sizes, which vary depending on the currency pair being traded. The most common contract size in forex futures is 100,000 units of the base currency. For example, a futures contract on the EUR/USD currency pair would represent 100,000 euros.

Read Also: Easy steps to remove Bollinger Band from MT4: A comprehensive guide

Another important factor to consider when trading forex futures is the expiration date of the contracts. Futures contracts have a fixed expiration date, usually on a quarterly basis. This means that traders need to close out their positions before the expiration date, by either taking delivery of the underlying currency or offsetting the contract with an opposite position.

| Advantages of Forex Futures | Disadvantages of Forex Futures |

|---|---|

| - High liquidity | - Fixed expiration date |

| - Leverage | - Limited availability of currency pairs |

| - Standardized contract sizes | - Higher transaction costs |

| - Clearing and settlement through a central exchange |

Overall, futures contracts play a vital role in forex trading by offering traders the opportunity to speculate on the future value of currencies with leverage and standardized contract sizes. However, it is important for traders to carefully consider the advantages and disadvantages of trading forex futures before engaging in this type of trading.

Options in forex trading are financial instruments that give traders the right, but not the obligation, to buy or sell a currency pair at a specific price and within a specific time period.

Options give traders the right, but not the obligation, to buy or sell a currency pair, while futures contracts require traders to buy or sell the currency pair at a specific price and time in the future.

The benefit of trading options in forex is that they give traders the flexibility to take advantage of potential price movements without the obligation to execute the trade.

Yes, options can be used for hedging purposes in forex trading. Traders can purchase options to protect against potential losses from unfavorable price movements in the forex market.

Traders should consider their trading goals, risk tolerance, and market conditions when deciding between options and futures in forex trading. Options offer more flexibility, while futures require traders to fulfill the contract at a specific time and price.

Where are stock options reported? Stock options can be an attractive option for individuals looking to invest in the stock market. However, it’s …

Read ArticleUnderstanding Forex VPS: What You Need to Know Are you tired of experiencing a lag in your forex trading due to slow internet connectivity? Are you …

Read ArticleUnderstanding Technical Analysis Strategies Successful trading in the financial markets requires a comprehensive understanding of various analysis …

Read ArticleWhat is the 4 week rule trend trading? Are you looking to gain a better understanding of trend trading? If so, the 4 Week Rule is a crucial concept to …

Read ArticleUnderstanding Forex Micro Accounts for Beginners In the world of foreign exchange trading, a Forex micro account has become increasingly popular among …

Read ArticleMT4 Market Watch: How to Find It and Use It MetaTrader 4, also known as MT4, is one of the most popular trading platforms among forex traders. It …

Read Article