7 Steps to Learn How to Trade Stocks | Beginner's Guide

Beginner’s Guide: Learning to Trade Stocks Trading stocks can be a rewarding and profitable way to invest your money. However, for beginners, the …

Read Article

The process of mergers and acquisitions (M&A) involves various financial strategies and instruments that help companies achieve their growth objectives. One such instrument that plays a vital role in M&A transactions is options. Options provide companies with the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a specified period of time.

In the context of M&A, options allow companies to secure future access to key assets or businesses that might be crucial for their long-term success. By acquiring options, companies can protect themselves from potential risks and uncertainties associated with market conditions or regulatory changes. Options also enable companies to gain control over valuable assets without immediately committing significant financial resources.

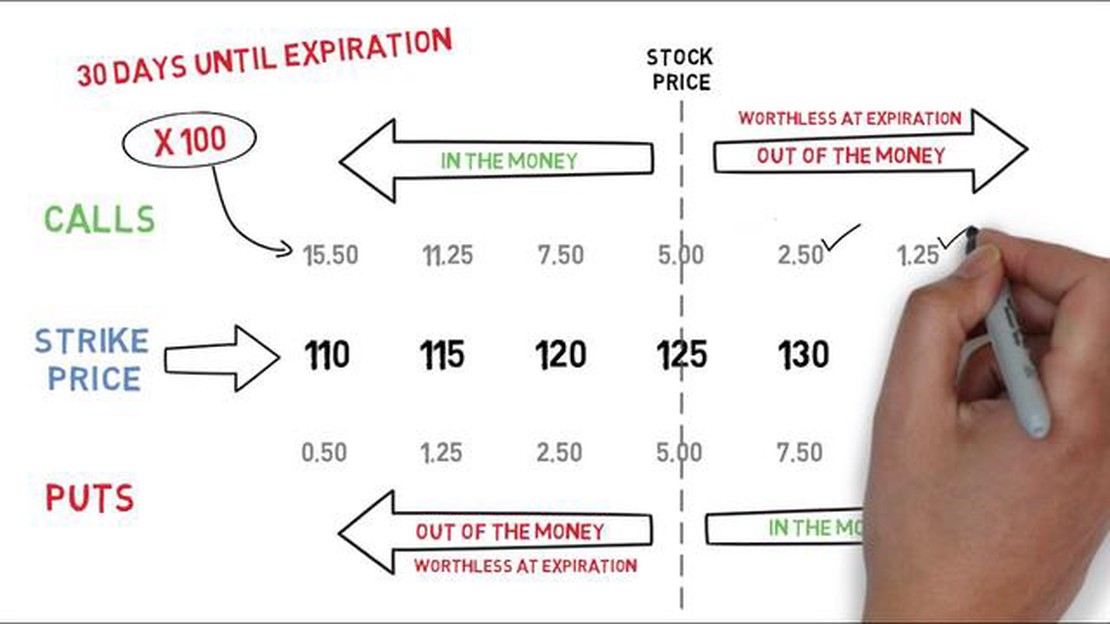

Options in M&A transactions can take various forms, such as call options or put options, depending on whether the company wants the right to buy or sell the asset. These options can be structured in different ways to meet the specific requirements of the transaction. For example, companies can negotiate the exercise price, the expiration date, and the terms of the option contract.

“Options provide companies with the flexibility and strategic advantage they need to navigate the complex landscape of mergers and acquisitions.”

Understanding the concept of options in M&A is essential for both buyers and sellers involved in these transactions. By considering the implications and potential benefits of options, companies can make informed decisions and maximize the value of their M&A deals. Therefore, it is crucial for business professionals to have a solid understanding of options and their role in M&A transactions, allowing them to capitalize on opportunities and manage risks effectively.

Options in M&A refer to a strategic tool that allows a company to purchase or sell another company’s stock at a predetermined price within a specified timeframe. These options can be included as part of a merger or acquisition deal and provide the buyer with the choice to acquire additional shares or sell their existing shares at a later date.

Options in M&A can serve various purposes and are often used to incentivize key stakeholders, such as executives or employees, to participate in a deal. By offering options to these individuals, companies can align their interests with those of the acquiring company and motivate them to contribute to the success of the merger or acquisition.

Options can also be used as a defensive measure in M&A transactions. By including options in a deal, the acquiring company can establish a potential future ownership stake in the target company. This gives the acquirer the flexibility to increase its ownership in the future, protecting against the target company being acquired by a competitor.

Options in M&A are important because they provide flexibility and strategic advantages to the acquiring company. They allow the buyer to control the timing and price at which they can purchase additional shares or sell their existing shares. This flexibility can be crucial in maximizing the value of the deal and achieving the desired strategic objectives.

Read Also: What is an Example of a PI System? Our Top Picks

Furthermore, options can help retain key talent and incentivize employees to contribute to the post-merger integration process. By offering options to employees of the target company, the acquiring company can motivate them to stay with the organization and work towards a successful integration.

In conclusion, options in M&A are a valuable tool that can be used to align interests, provide flexibility, protect against competition, and incentivize key stakeholders. Understanding and utilizing options effectively can contribute to the success of a merger or acquisition and help achieve the desired strategic outcomes.

Options are a crucial aspect of mergers and acquisitions (M&A) deals. They refer to the right, but not the obligation, to buy or sell a certain asset or security at a predetermined price within a specified period. In M&A transactions, options are often used to provide flexibility and mitigate risks.

Mergers and Acquisitions involve the consolidation of companies through various strategic transactions. They typically include mergers, acquisitions, consolidations, and tender offers. M&A deals are often aimed at achieving synergies and growth opportunities.

Options in M&A allow parties to a transaction to have the choice to engage in certain activities or events in the future. For example, in a merger deal, the acquirer may have the option to purchase additional shares from the target company at a predetermined price within a specified timeframe.

Options for Buyers and Sellers can be used in various ways in an M&A deal. For buyers, options can provide the opportunity to acquire additional assets or shares, expand their business offerings, or minimize risks. Sellers, on the other hand, can use options to secure potential future sales at a favorable price.

Benefits and Risks of using options in M&A transactions need to be carefully assessed. Options provide flexibility and the ability to adapt to changing circumstances. However, they also involve risks, such as potential losses if the predetermined price becomes unfavorable.

Legal and Financial Considerations play a crucial role in the use of options in M&A deals. It is important to establish clear terms and conditions, including the exercise price, expiration date, and any limitations or restrictions. Additionally, legal and tax implications should be carefully evaluated before entering into option agreements.

Read Also: Is NRG a good ETF to buy? - Expert analysis and recommendations

Conclusion

In summary, understanding the basics of options in M&A is essential for both buyers and sellers. Options provide flexibility and can be used strategically to achieve various goals in an M&A transaction. However, careful consideration of the associated benefits and risks, as well as legal and financial implications, is crucial for successful implementation.

Options in M&A, or mergers and acquisitions, refer to the rights or opportunities that a company has to purchase or sell shares or assets of another company at a predetermined price within a specific timeframe.

Options play a crucial role in M&A transactions as they provide flexibility and strategic advantages to companies. They allow companies to explore potential acquisition opportunities, hedge against market fluctuations, and secure future rights to buy or sell assets.

In M&A, options can be structured in various ways. For example, a company may grant options to its employees, allowing them to purchase company stock at a predetermined price. Alternatively, a company may hold options to acquire a competitor’s business or assets. The exercise of options is typically governed by predetermined conditions and timelines.

The use of options in M&A can provide several benefits. They allow companies to manage risks, as options can act as a form of insurance against unfavorable market conditions. Options also provide companies with strategic flexibility, enabling them to pursue potential acquisitions or divestments without immediately committing to a full transaction.

Yes, there are risks associated with options in M&A. For example, if a company holds options to purchase another company at a predetermined price, but the market price of the target company’s shares significantly increases, the acquiring company may incur a loss if it decides to exercise the options. Additionally, options can be complex financial instruments, so companies need to carefully analyze and evaluate the potential risks before entering into option agreements.

Beginner’s Guide: Learning to Trade Stocks Trading stocks can be a rewarding and profitable way to invest your money. However, for beginners, the …

Read ArticleUnderstanding the Basics of Order Book Forex When it comes to trading in the foreign exchange market, understanding the forex order book is essential. …

Read ArticleCan You Make Money on the Stock Market? Investing in the stock market can be a challenging endeavor, but it is indeed possible to make money and …

Read ArticleUnderstanding the EWM Formula in Pandas In the world of data analysis and time series forecasting, moving averages play a crucial role in …

Read ArticleUnderstanding CPA in Trading: Key Concepts and Benefits When it comes to trading, understanding the concept of Cost Per Acquisition (CPA) is crucial …

Read ArticleUnderstanding the Liquidity Zone Indicator When it comes to trading in financial markets, understanding liquidity is crucial. Liquidity refers to the …

Read Article