Choosing the Best Leverage for $300: A Comprehensive Guide

Best Leverage for $300: Your Ultimate Guide When it comes to investing, one of the key strategies is leveraging. By using leverage, investors can …

Read Article

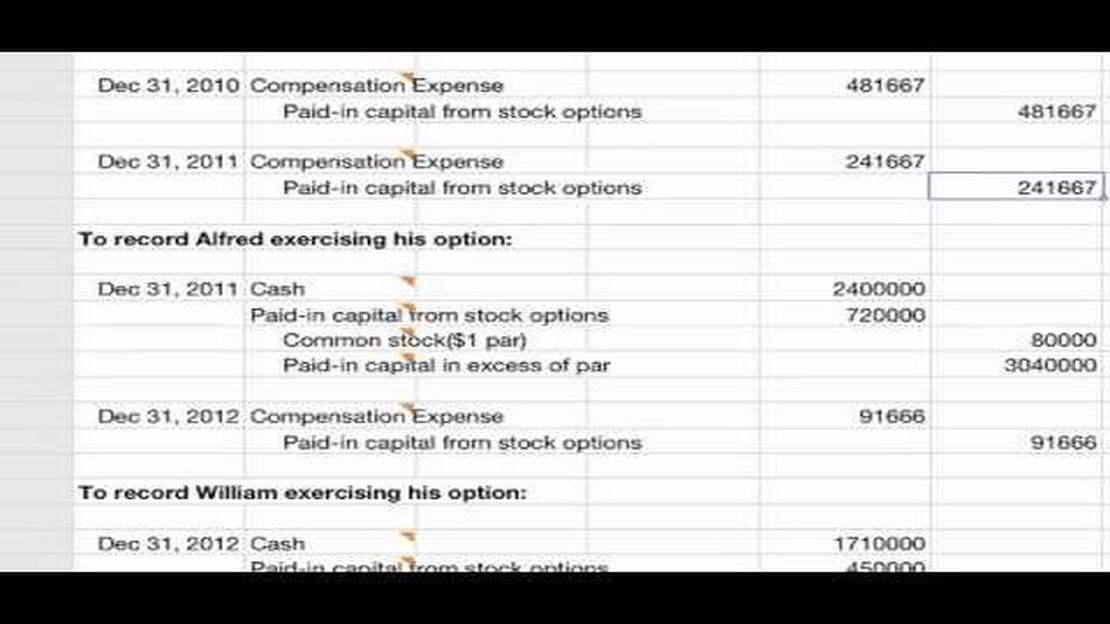

Stock option statements are an essential part of understanding your investments and making informed decisions. For many investors, these statements can be confusing and overwhelming. However, with a little knowledge and guidance, you can easily decode the information and use it to your advantage.

What is a stock option?

A stock option is a contract between two parties that gives the buyer the right, but not the obligation, to buy or sell shares of a stock at a predetermined price within a specific time frame. Stock option statements outline the details of these contracts, providing a snapshot of your investment and its potential value.

Key elements of a stock option statement

When reading a stock option statement, there are a few key elements to pay attention to. First, look for the expiration date, which is the final date by which the option can be exercised. Next, focus on the strike price, which is the price at which the option can be exercised. Finally, take a look at the number of contracts or shares you own, as well as the total cost or value of the option.

Interpreting the statement

Interpreting a stock option statement involves understanding how the information relates to your investment goals and risk tolerance. Consider the expiration date and assess whether it aligns with your investment timeline. Evaluate the strike price and determine if it is feasible given the current market conditions. Finally, calculate the potential profit or loss based on the cost or value of the option.

Remember, stock option statements can be complex, but taking the time to understand them is crucial for successful investing. By familiarizing yourself with the key elements and interpreting the information within the context of your investment strategy, you can make more informed decisions and maximize your returns.

A stock option statement provides important information about your investment and its potential value. By understanding the key elements and interpreting the data within the context of your investment strategy, you can make informed decisions and maximize your returns in the market.

When you receive a stock option statement, there are several key components that you need to understand in order to make informed decisions about your investment. These components include:

1. Option Grant Details: This section of the statement provides information about the stock options that you have been granted. It includes details such as the number of options granted, the exercise price, and the vesting schedule.

2. Vesting Schedule: The vesting schedule outlines the timeline and conditions under which your stock options become exercisable. It is important to closely review the vesting schedule to understand when you will be able to exercise your options.

3. Expiration Date: The expiration date is the date by which you must exercise your stock options. If you fail to exercise your options before the expiration date, they will expire and become worthless.

4. Exercise Price: The exercise price is the price at which you can buy the stock when you exercise your options. It is typically set at a specific price per share at the time of the grant.

Read Also: Parabolic SAR Indicator: An Effective Tool for Scalping Strategy

5. Tax Implications: Stock options have tax implications that you need to be aware of. This section of the statement will provide information about any tax obligations you may have when you exercise your options or sell the underlying stock.

6. Holding Period: The holding period refers to the length of time that you must hold the stock after exercising your options in order to qualify for certain tax benefits. It is important to understand the holding period and any restrictions that may apply.

Read Also: Understanding the Role and Importance of Islamic Foreign Exchange

7. Terms and Conditions: Finally, the stock option statement may include a section with additional terms and conditions that you need to be aware of. These terms and conditions may cover topics such as transferability, restrictions on selling the stock, and the company’s right to repurchase the stock.

By understanding these key components of a stock option statement, you will be better equipped to navigate the complexities of stock option grants and make informed decisions about your investments.

When it comes to understanding your stock option statements, it’s important to know how to interpret the information provided. This will help you make informed decisions about your options and their potential value.

Here are some key things to look for when reading and interpreting stock option statements:

It’s important to note that the value of your options can fluctuate based on various factors, such as the performance of the company and market conditions. It’s always a good idea to consult with a financial advisor or tax professional to fully understand the implications of your stock option statements.

By understanding and interpreting your stock option statements, you can make more informed decisions about your financial future and maximize the potential value of your options.

A stock option statement is a document that outlines the details of stock options granted to an individual. It is important to understand because it provides information on the number of options, exercise price, vesting schedule, and expiration date, which are all crucial factors in determining the value and potential return of the options.

The exercise price on a stock option statement represents the price at which you can purchase the stock in the future if you choose to exercise your options. It is typically set at a price lower than the current market price to provide an incentive for the option holder to exercise the options.

When stock options are vested, it means that the option holder has earned the right to exercise the options. Vesting usually occurs over a specified period of time, such as four years, with a portion of the options vesting each year. Once the options are vested, the option holder can choose to exercise them.

The expiration date on a stock option statement is the date at which the options will expire and can no longer be exercised. It is important to keep track of the expiration date because if the options are not exercised before this date, they will become worthless.

To calculate the potential value of your stock options, you can multiply the number of options by the difference between the current market price and the exercise price. However, it’s important to keep in mind that stock options are subject to various factors such as market volatility and the company’s performance, which can affect their actual value.

A stock option statement is a document provided by a company to its employees or shareholders that outlines the details of the stock options they hold.

Best Leverage for $300: Your Ultimate Guide When it comes to investing, one of the key strategies is leveraging. By using leverage, investors can …

Read ArticleChoosing the Right Moving Averages for Stock Analysis Moving averages are an essential tool for investors and traders who want to analyze the trends …

Read ArticleSwahili Traders: What They Traded and Why It Mattered The Swahili traders were renowned for their extensive network of trade routes that spanned …

Read ArticleIs Forex trading fraud? Forex trading is a popular form of investment that has gained significant attention in recent years. However, with the rise in …

Read ArticleBeginner’s Guide: How to Work in Forex Trading Welcome to the exciting world of forex trading! Whether you’re a beginner looking to dip your toes into …

Read ArticleWhat is the best lot size for $30? When it comes to investing in real estate, deciding on the optimal lot size is a crucial factor that can greatly …

Read Article