Find out the current dollar buying rate in Malaysia

Current Dollar Buying Rate in Malaysia If you’re planning to visit Malaysia or have any business dealings involving Malaysian currency, it’s important …

Read Article

Stop Loss (SL) is a crucial concept in forex trading that every trader needs to understand. It is a risk management tool that helps traders limit their losses and protect their capital. Without a proper understanding of SL, traders are exposed to significant risks and may face devastating losses.

SL is an order placed by a trader to automatically close a trade at a predetermined price level. It serves as a safety net, ensuring that traders exit a trade if the market moves against them beyond a certain point. By setting a SL level, traders define the maximum amount of money they are willing to lose on a trade.

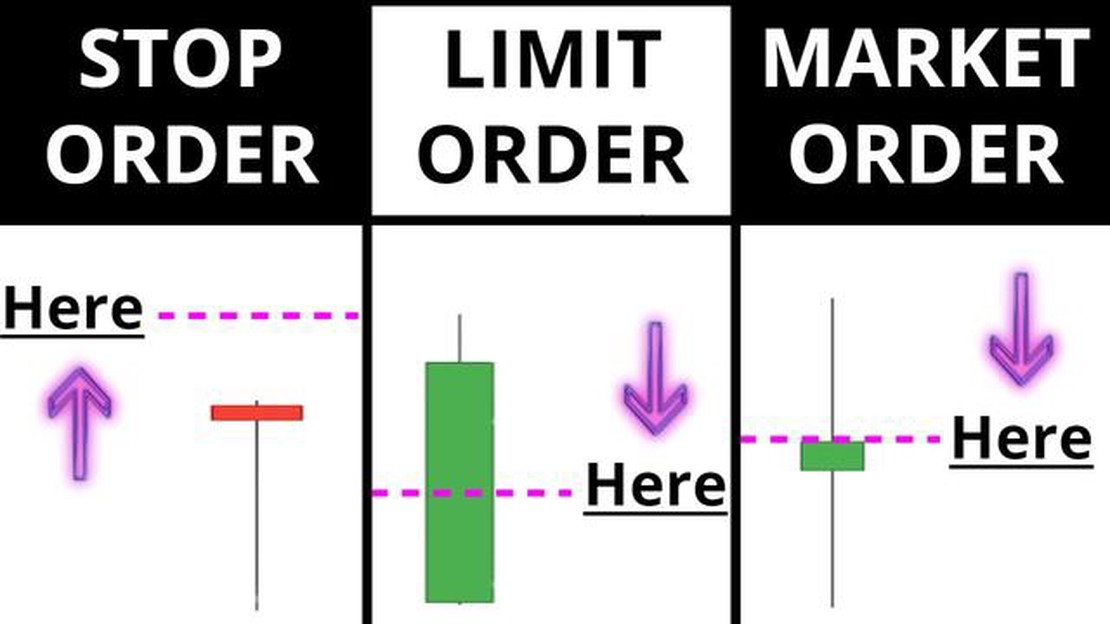

An SL order is typically placed below the entry price for a long (buy) trade and above the entry price for a short (sell) trade. This is to protect traders from excessive losses in case the market moves in the opposite direction. Traders can set the SL level based on their risk appetite, trading strategy, and market conditions.

When the market reaches the SL level, the trade is automatically closed, stopping any further losses. This feature makes SL an essential tool for traders, especially in volatile markets where sudden price movements can wipe out an entire trading account. By using SL effectively, traders can minimize their risk and protect their investment capital.

In conclusion, understanding SL in forex trading is crucial for every trader. It is a risk management tool that helps protect traders from excessive losses and ensures the longevity of their trading career. By setting a proper SL level and using it effectively, traders can mitigate risks and increase their chances of success in the forex market.

In the world of Forex trading, risk management plays a crucial role in determining the success of a trader. One of the essential tools for managing risks is the Stop Loss (SL) order.

A Stop Loss order is an instruction given to a broker to automatically close a trade when the price reaches a specific level. It helps protect traders from significant losses and limits the amount of money they are willing to risk on a particular trade.

When setting a Stop Loss order, traders must consider various factors, such as their risk tolerance, trading strategy, and market conditions. It is crucial to determine a suitable Stop Loss level to avoid being stopped out prematurely or experiencing excessive losses.

The Stop Loss level is typically set below the entry price for a long trade and above the entry price for a short trade. This ensures that if the market moves against the trader’s position, the trade will be automatically closed, limiting the potential loss.

Traders can use different methods to determine the appropriate Stop Loss level. Some common approaches include using technical indicators, support and resistance levels, or a fixed percentage of the trading account’s equity.

It is essential to note that while a Stop Loss order helps protect traders from excessive losses, it does not guarantee that losses will be limited to the Stop Loss level. During volatile market conditions or if there are gaps in price movements, the actual execution price may differ from the Stop Loss level.

Traders should also consider the concept of slippage, which refers to the difference between the expected Stop Loss level and the actual execution price. Slippage can occur during periods of high market volatility or when there is insufficient liquidity. It is crucial to choose a reputable broker with a reliable execution policy to minimize the risk of slippage.

In conclusion, understanding and correctly using the Stop Loss (SL) order is vital for successful Forex trading. Traders must determine an appropriate Stop Loss level based on their risk tolerance and market conditions to effectively manage risks and protect their capital.

Stop Loss (SL) is an important risk management tool used in forex trading to limit the potential losses on a trade. It is a predetermined price level at which a trader exits a position to prevent further losses.

The purpose of setting a stop loss is to protect a trader’s capital and to minimize the impact of potential market fluctuations. By placing a stop loss order, a trader can define the maximum amount of money they are willing to lose on a trade, eliminating the need for continuous monitoring of the market.

Read Also: What is Superx Crypto? A Comprehensive Guide to the Revolutionary Digital Currency

When a trader enters a trade, they can set a stop loss order at a specific price level. If the market moves against their position and reaches that price, the stop loss order is triggered, and the position is automatically closed. This helps traders avoid emotional decision-making and the risk of losing more money than they can afford.

Stop loss orders are particularly useful in volatile markets, where prices can change rapidly. They act as a safety net, providing traders with a level of protection and increasing the efficiency of their trading strategy.

It is important for traders to determine an appropriate stop loss level based on their risk tolerance and trading strategy. Setting a stop loss too tight may result in premature exit from a trade, while setting it too wide may expose the trader to larger losses. Traders should consider market volatility, historical price movements, and support/resistance levels when setting their stop loss level.

In summary, a stop loss is an essential tool for managing risk in forex trading. It helps traders limit potential losses, protect their capital, and make more informed trading decisions.

Read Also: Discover the Truth: Can Forex Really Make You Money?

Stop Loss is a crucial tool in forex trading that every trader should understand and utilize. It is an order placed by a trader to limit their potential losses in a trade. By setting a Stop Loss level, traders can define the maximum amount of money they are willing to lose on a trade.

The importance of Stop Loss in forex trading cannot be overstated. Here are some key reasons why implementing a Stop Loss strategy is essential:

3. Maintain Discipline: Stop Loss helps traders maintain discipline and stick to their trading plan. It prevents traders from holding onto losing positions for too long, hoping for a reversal. By cutting losses and moving on to the next trade, traders can maintain objectivity and avoid emotional attachment to trades.

4. Risk-Reward Ratio: Stop Loss enables traders to calculate and maintain a favorable risk-reward ratio. By setting a Stop Loss, traders can determine their potential loss in relation to their desired profit. This ratio helps traders assess the viability of a trade and make informed decisions based on potential rewards and risks.

3. Maintain Discipline: Stop Loss helps traders maintain discipline and stick to their trading plan. It prevents traders from holding onto losing positions for too long, hoping for a reversal. By cutting losses and moving on to the next trade, traders can maintain objectivity and avoid emotional attachment to trades.

4. Risk-Reward Ratio: Stop Loss enables traders to calculate and maintain a favorable risk-reward ratio. By setting a Stop Loss, traders can determine their potential loss in relation to their desired profit. This ratio helps traders assess the viability of a trade and make informed decisions based on potential rewards and risks.

In conclusion, understanding and implementing a Stop Loss strategy is of paramount importance in forex trading. It not only ensures effective risk management but also helps traders preserve their trading capital, maintain discipline, and evaluate the risk-reward ratio. Trading without a proper Stop Loss is like sailing a ship without a compass – it can lead to significant losses and jeopardize one’s trading career.

A Stop Loss in forex trading is a predetermined level at which a trader sets an order to exit a trade in order to limit their potential losses. It is an important risk management tool that helps traders protect their capital.

Using a Stop Loss in forex trading is important because it helps traders limit their potential losses. It acts as a safety net, preventing traders from losing more money than they can afford. It also helps traders stick to their trading plan and avoid emotional decisions.

To set a Stop Loss in forex trading, you need to specify the price at which you want your trade to be automatically closed if it goes against you. This can be done by placing a Stop Loss order with your broker. You can enter the desired price level or set it as a percentage of your account balance.

A trailing Stop Loss in forex trading is a type of Stop Loss order that moves with the market as the trade becomes profitable. It is designed to lock in profits while allowing the trade to continue running as long as the market keeps moving in the trader’s favor. It adjusts the Stop Loss level automatically based on a predetermined trail amount.

The benefits of using a trailing Stop Loss in forex trading include the ability to lock in profits as the market moves in your favor, while still allowing for potential further gains. It helps traders protect their profits and minimize losses. It also eliminates the need for constant monitoring of the market and manual adjustments of the Stop Loss level.

A stop loss in forex trading is an order placed by a trader to limit their losses on a particular trade. It is essentially a predefined price level at which the trader’s position will be automatically closed if the market moves against them.

A stop loss works by automatically closing a trader’s position if the market moves against them to the pre-set stop loss level. This helps limit the trader’s losses and protect their capital. When the stop loss is triggered, the trader’s position is closed and they exit the market.

Current Dollar Buying Rate in Malaysia If you’re planning to visit Malaysia or have any business dealings involving Malaysian currency, it’s important …

Read ArticleIs it possible for Indians to trade on CME? The Chicago Mercantile Exchange (CME) is a global derivatives marketplace that offers a wide range of …

Read ArticleIs margin trading more profitable? Margin trading is an investment strategy that allows traders to borrow funds to increase their buying power and …

Read ArticleForeign Currency Exchange in Kenya: A Guide to Banks that Offer Services Kenya is a popular tourist destination and a hub for international business, …

Read ArticleBest options strategies for day trading Day trading can be a highly profitable venture, but it requires a solid strategy and an understanding of the …

Read ArticleAwards for Moneta Markets Moneta Markets, a leading online trading platform, has received numerous awards for its exceptional services and commitment …

Read Article