When Can You Sell Stock Options? Explained

When Can You Sell Stock Options? Stock options are a popular investment tool that allows individuals to participate in the potential growth of a …

Read Article

When it comes to financial investments, there are various strategies that investors can employ to mitigate risk and potentially maximize returns. One such strategy is known as the risk reversal option strategy. This comprehensive guide aims to provide a thorough understanding of this strategy and its implications for investors.

The risk reversal option strategy involves the simultaneous buying of options and selling of options in order to create a position that is delta neutral. This means that the overall delta of the position is zero, resulting in the strategy being unaffected by small changes in the underlying asset’s price.

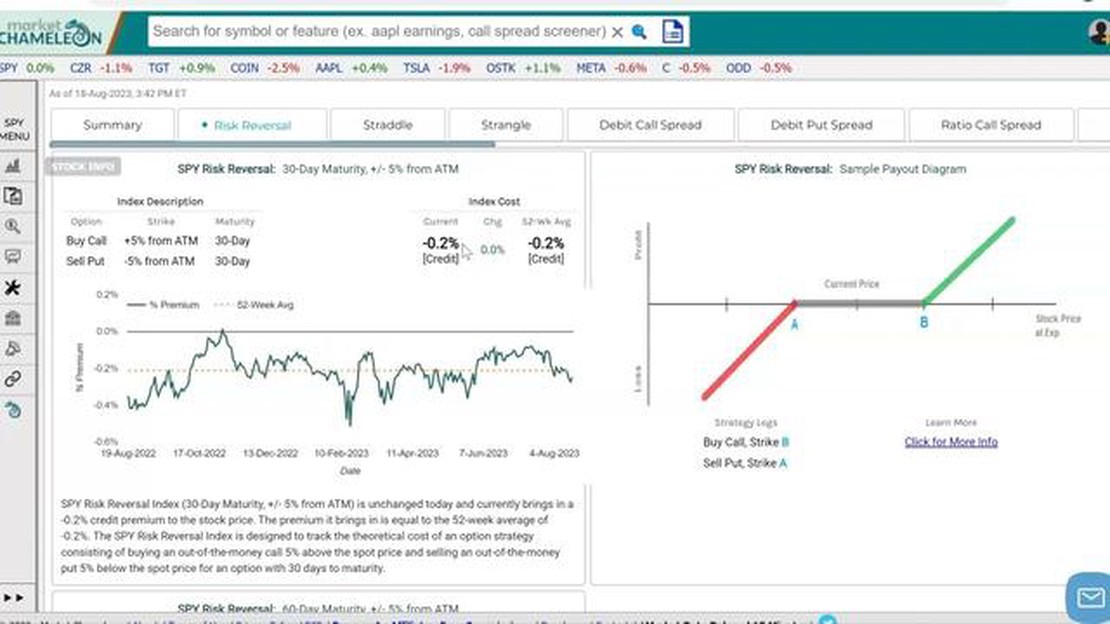

By engaging in the risk reversal option strategy, investors can protect their downside risk while still benefiting from potential upside gains. This is achieved through the combination of buying a call option, which gives the investor the right to buy the underlying asset at a specified price within a defined timeframe, and selling a put option, which obligates the investor to buy the underlying asset at a predetermined price.

One of the key advantages of the risk reversal option strategy is its flexibility. Investors can adjust the strike prices and expiration dates of the options to suit their risk tolerance and market expectations. Additionally, this strategy can be used in both bullish and bearish market conditions, making it suitable for different market environments.

In conclusion, understanding the risk reversal option strategy is essential for investors looking to diversify their portfolios and manage risk. By combining the purchase of call options with the sale of put options, investors can create a delta-neutral position that offers potential upside gains while protecting against downside risk. As with any investment strategy, it is important for investors to thoroughly analyze market conditions and assess the potential risks and rewards before implementing the risk reversal option strategy.

The risk reversal option strategy, also known as a bullish risk reversal, is an options trading strategy that seeks to profit from an increase in the price of the underlying asset. It involves buying a call option and selling a put option, both with the same expiration date, but with different strike prices.

By buying a call option, the trader has the right to buy the underlying asset at the strike price on or before the expiration date. By selling a put option, the trader has the obligation to buy the underlying asset at the strike price if the option is exercised. The strike price of the call option is typically higher than the strike price of the put option.

When implementing a risk reversal strategy, the premium received from selling the put option helps offset the cost of buying the call option. This can make the overall cost of the strategy lower, increasing the potential profit if the price of the underlying asset rises.

Read Also: When was screen-based trading introduced?

The risk reversal strategy is considered bullish because it involves buying a call option, which benefits from a rising market. By selling a put option, the trader is taking on the risk of buying the underlying asset at a potentially lower price if the option is exercised. However, by choosing the strike prices wisely, the trader can limit the potential downside risk.

Traders use the risk reversal strategy when they have a bullish outlook on the market and want to participate in potential upside movement of the underlying asset. It is often used as an alternative to simply buying the underlying asset or buying a call option outright, as it allows for a lower cost entry into the market.

It is important for traders to carefully consider the potential risks and rewards of the risk reversal strategy before implementing it. Factors such as the volatility of the underlying asset, the time to expiration, and the difference in strike prices should all be taken into account when determining the optimal strike prices to use.

In conclusion, the risk reversal option strategy is a bullish strategy that involves buying a call option and selling a put option. It allows traders to profit from potential price increases in the underlying asset while offsetting some of the cost through the premium received from selling the put option. It can be an attractive strategy for traders with a bullish outlook on the market who want to limit their risk and potentially increase their profit.

Read Also: 1 US Dollar to PKR Open Market Exchange Rate

The risk reversal option strategy offers several benefits and advantages to investors, allowing them to manage and mitigate risk while potentially generating profits. Here are some of the key benefits of employing the risk reversal option strategy:

Overall, the risk reversal option strategy provides investors with a versatile tool to manage risk, generate income, and potentially profit from market movements. However, it is important for investors to fully understand the risks and potential drawbacks associated with the strategy before implementing it.

A risk reversal option strategy is a financial strategy that involves buying an out-of-the-money put option and selling an out-of-the-money call option on the same underlying asset.

A risk reversal option strategy works by using a combination of put and call options to create a position that has limited risk and potential for profit. The strategy is typically used to hedge against potential downside risk or to profit from an expected increase in the price of the underlying asset.

The benefits of using a risk reversal option strategy include the ability to limit downside risk, the potential for profit from an increase in the price of the underlying asset, and the flexibility to tailor the strategy to specific market conditions and investment goals.

The risks associated with a risk reversal option strategy include limited potential profit if the price of the underlying asset stays within a certain range, the possibility of losses if the price of the underlying asset moves against the desired direction, and the potential for transaction costs and fees.

A risk reversal option strategy is typically used when an investor wants to hedge against potential downside risk or when they have a bullish outlook on the price of the underlying asset and want to profit from an expected increase in its price.

When Can You Sell Stock Options? Stock options are a popular investment tool that allows individuals to participate in the potential growth of a …

Read ArticleUnderstanding Rollover in Forex Trading In the world of forex trading, rollovers play a crucial role in determining the profitability and risk …

Read ArticleWhat is the value of 1 lot of gold? Gold has always been a valuable and sought-after precious metal, revered for its beauty and rarity. For centuries, …

Read ArticleUnderstanding the Significance of the 0.01 Lot Size in a Micro Account Forex trading can be a complex and daunting endeavor, especially for beginner …

Read ArticleBest Timeframe for Accurate RSI Signals The Relative Strength Index (RSI) is a popular technical indicator used by traders to identify overbought and …

Read ArticleInvesting in JPX: A Step-by-Step Guide Investing in the JPX (Japan Exchange Group) can be a rewarding venture for beginners looking to grow their …

Read Article