Can I Trade Gold with Forex.com? A Complete Guide

Trading Gold with Forex.com: Everything you Need to Know Forex.com is a popular online trading platform that offers a wide range of financial …

Read Article

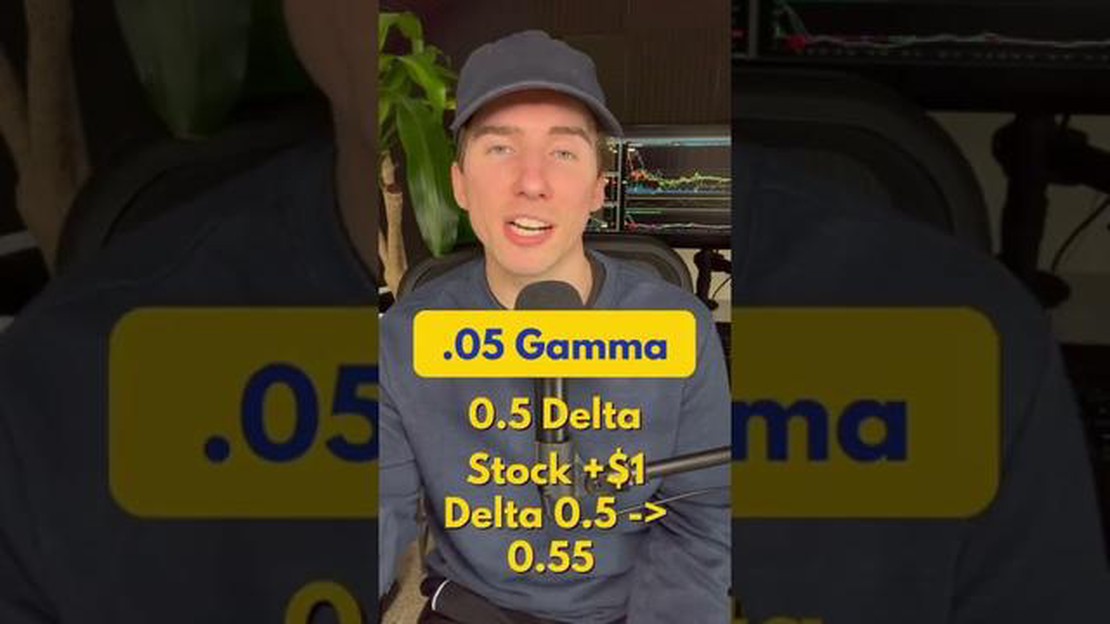

Options trading can be a complex and daunting world, but understanding key concepts is crucial for success. One such concept is premium adjusted delta, a measure that traders use to assess the sensitivity of an option’s price to changes in the underlying asset’s price. This essential metric helps traders gauge the level of risk associated with their options positions and make informed trading decisions.

The premium adjusted delta takes into account not only the delta, which measures the expected change in the option’s price when the underlying asset’s price changes, but also the option’s premium. By factoring in the premium, which represents the cost of buying or selling the option, traders gain a more accurate understanding of how changes in the underlying asset’s price will affect their position.

For example, let’s say an option has a delta of 0.5, indicating that for every $1 change in the underlying asset’s price, the option’s price is expected to change by $0.50. However, if the premium for that option is $2, the premium adjusted delta would be 0.25 ($0.50 divided by $2), indicating that the option’s price is only expected to change by $0.25 for every $1 change in the underlying asset’s price after accounting for the cost of the premium.

Understanding premium adjusted delta allows traders to better manage and hedge their options positions. By evaluating the level of risk associated with a particular option, traders can adjust their strategies accordingly. They can also use this metric to compare different options and choose the ones that align with their risk tolerance and investment objectives.

In conclusion, premium adjusted delta is an essential concept in options trading that provides traders with a more accurate measure of an option’s sensitivity to changes in the underlying asset’s price. By factoring in the option’s premium, traders can make more informed decisions, manage their risk effectively, and optimize their options trading strategies.

Premium Adjusted Delta (PAD) is a concept in options trading that takes into account the volatility of an underlying asset and its effect on the price of the option. Delta, which measures the sensitivity of an option’s price to changes in the price of the underlying asset, is adjusted to reflect the impact of volatility.

The PAD of an option is calculated by multiplying the delta of the option by a volatility adjustment factor. This adjustment factor is based on the implied volatility of the option, which is derived from the market price of the option and represents the market’s expectations for future volatility.

By including the volatility adjustment in the calculation, the PAD provides a more accurate measure of an option’s sensitivity to changes in the price of the underlying asset. This is especially important for options traders who are looking to hedge their positions or make informed decisions based on the expected movement of the underlying asset.

For example, if an option has a delta of 0.5 and a volatility adjustment factor of 1.2, the PAD of the option would be 0.6 (0.5 * 1.2). This indicates that for a $1 change in the price of the underlying asset, the price of the option is expected to change by $0.6, taking into account both the delta and the volatility adjustment.

Read Also: Reasons to Choose a Career in FX Trading

Understanding and utilizing the concept of Premium Adjusted Delta can help options traders better assess the risk and potential profitability of their positions, and make more informed trading decisions. It allows traders to factor in the impact of volatility on option prices, providing a more comprehensive view of an option’s sensitivity to changes in the underlying asset’s price.

Options trading is a complex financial strategy that involves buying and selling options contracts. One key concept that traders need to understand is premium adjusted delta.

Premium adjusted delta is a measure of the sensitivity of an option’s price to changes in the price of the underlying asset. It takes into account not only the option’s delta, which measures the change in the option’s price for a one-point change in the underlying asset’s price, but also the premium paid for the option.

When trading options, it is essential to consider the premium adjusted delta because it provides a more accurate representation of the option’s risk and potential profit. By factoring in the premium, traders can better assess the impact of changes in the underlying asset’s price on the option’s value.

For example, let’s say a trader buys a call option with a delta of 0.5 and a premium of $10. If the underlying asset’s price increases by one point, the option’s price would theoretically increase by $0.50. However, if the premium paid for the option is $10, the option would need to increase by $10.50 in order for the trader to break even. This is because the premium paid reduces the potential profit on the trade.

By considering the premium adjusted delta, traders can make more informed decisions when trading options. They can assess the risk and potential profit of a trade more accurately and determine if the trade meets their risk tolerance and investment objectives.

Read Also: Understanding the Key Differences between Stock Options and Futures Options

| Advantages of using premium adjusted delta: |

|---|

| 1. Provides a more accurate representation of the option’s risk and potential profit. |

| 2. Helps traders assess the impact of changes in the underlying asset’s price on the option’s value. |

| 3. Enables traders to make more informed decisions and better manage their options positions. |

In conclusion, understanding premium adjusted delta is essential for options traders. It helps them assess the risk and potential profit of options trades and make more informed decisions. By factoring in the premium paid for an option, traders can better understand the impact of changes in the underlying asset’s price on the option’s value. Thus, utilizing premium adjusted delta can greatly enhance a trader’s ability to succeed in options trading.

Premium Adjusted Delta is a measure used in options trading to estimate the potential changes in the price of an option in relation to the price of the underlying asset. It takes into account the premium cost of the option and adjusts the delta value accordingly.

Premium Adjusted Delta is important because it provides traders with a more accurate understanding of the potential value and risk of an option. It takes into account the premium cost, which is a crucial component in options trading, and allows traders to make more informed decisions.

Premium Adjusted Delta is calculated by multiplying the regular delta of an option by a factor that represents the ratio of the option’s price to its premium cost. The formula is: Premium Adjusted Delta = Regular Delta * (Option Price / Option Premium).

A high Premium Adjusted Delta indicates that the option’s price is highly sensitive to changes in the price of the underlying asset. This means that a small change in the underlying asset’s price can result in a significant change in the option’s price.

Yes, Premium Adjusted Delta can be negative. A negative Premium Adjusted Delta indicates that the option’s price is inversely related to the price of the underlying asset. This means that as the price of the underlying asset increases, the price of the option decreases, and vice versa.

Premium adjusted delta is a concept in options trading that takes into account the premium paid for an option when calculating its delta. It considers the cost of the option as a factor in determining its overall risk and potential reward.

Trading Gold with Forex.com: Everything you Need to Know Forex.com is a popular online trading platform that offers a wide range of financial …

Read ArticleWho is a momentum trader? Are you looking to maximize your investment profits? Have you considered the strategy of momentum trading? Momentum trading …

Read ArticleHow to Become a Trader in Singapore Are you interested in becoming a trader in Singapore? Trading can be an exciting and lucrative career, allowing …

Read ArticleGuide on Using Bollinger Bands for Trading When it comes to technical analysis in the world of trading, Bollinger Bands are a popular tool used by …

Read ArticleHow to correctly pronounce bulguri Bulgur is a versatile grain that is commonly used in Middle Eastern and Mediterranean cuisines. It is a popular …

Read ArticleHow much is $2000 in yuan? When you want to convert $2000 to Yuan, it is essential to consider the current exchange rate between the United States …

Read Article