Is Olymp Trade Halal in Islam? Exploring its Compliance with Islamic Financial Principles

Is Olymp trade halal in Islam? Islamic finance is guided by the principles of Shariah law, which prohibits certain activities such as usury and …

Read Article

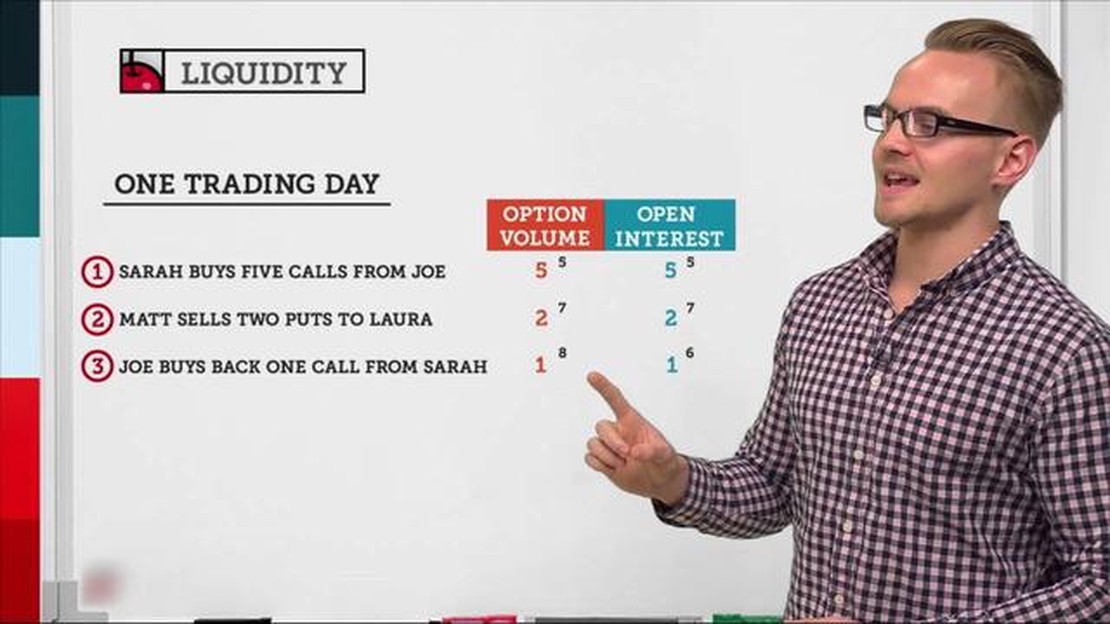

Option trading can be an exciting and profitable endeavor, but it can also be quite complex and intimidating for beginners. One important concept that new traders must understand is open interest. Open interest refers to the total number of outstanding options contracts in the market.

When a trader opens a new options contract, it increases the open interest for that particular contract. Conversely, when a trader closes their position, the open interest decreases. Open interest is a key indicator of market liquidity and can provide valuable insights into the supply and demand dynamics of the options market.

Open interest is particularly important because it can help traders gauge the level of participation and interest in a particular option. High open interest indicates that there is a large amount of money at stake and a greater possibility of substantial price movements. On the other hand, low open interest suggests that there is less interest and trading activity surrounding that option.

Additionally, open interest can also be used to identify trends and potential reversals in the market. An increase in open interest, accompanied by a significant price movement, may signal a strong market trend. Conversely, a decrease in open interest could indicate that market sentiment is shifting and a reversal may be imminent.

As a beginner in option trading, it is crucial to understand the concept of open interest and its implications. By paying attention to open interest levels and changes, you can gain valuable insights into market sentiment, liquidity, and potential price movements. It is always recommended to conduct thorough research and analysis before making any trading decisions, and understanding open interest is a key part of that process.

In conclusion, open interest is an important concept for beginners to grasp when venturing into option trading. It provides a snapshot of market activity and can help traders make informed decisions. By monitoring open interest levels and changes, traders can gain a better understanding of market trends and potential reversals. With careful analysis and a solid understanding of open interest, beginners can navigate the options market with more confidence and improve their chances of success.

Open interest is a term commonly used in options trading that refers to the total number of open or outstanding contracts at any given time. It represents the total number of contracts that have been bought or sold, but have not yet been closed out or exercised.

Open interest is an important indicator as it provides valuable information about the liquidity and the overall activity in the options market. It helps traders and investors analyze the level of interest or participation in a particular option, and can be used as a tool to gauge market sentiment.

The open interest is calculated by adding up the number of contracts held long (bought) and the number of contracts held short (sold) for a particular option. For example, if there are 100 contracts bought and 50 contracts sold, the open interest would be 150.

It is important to note that open interest is not the same as volume. Volume refers to the total number of contracts traded during a specific period, whereas open interest represents the total number of contracts in existence. Therefore, open interest can remain the same even if there is no trading activity, as long as no contracts are closed or exercised.

Open interest can fluctuate over time as contracts are opened or closed. An increase in open interest may indicate that new positions are being established or that existing positions are being rolled over or increased. Conversely, a decrease in open interest may suggest that positions are being closed out or reduced.

Traders often use open interest to identify potential support or resistance levels for an option. If there is a large open interest at a particular strike price, it can indicate that there is significant interest or activity in that option, and it may act as a strong support or resistance level.

Overall, open interest is a valuable tool for options traders and investors, as it provides insights into the level of activity and interest in a particular option. By analyzing open interest, traders can gain a better understanding of market sentiment and make more informed trading decisions.

Read Also: Is XM trading legit? Find out the truth about XM trading

| Open Interest | Volume |

|---|---|

| Represents the total number of open or outstanding contracts | Represents the total number of contracts traded during a specific period |

| Provides information about the liquidity and overall activity in the options market | Does not provide information about market sentiment or interest |

| Can fluctuate as contracts are opened or closed | Can change rapidly as contracts are traded |

Open interest is a crucial concept in option trading that refers to the total number of outstanding or open contracts in a specific option. It represents the total number of option contracts that have not been exercised, closed, or expired.

Open interest plays a significant role in providing valuable information to traders and analysts. Here are some key reasons why open interest is important in option trading:

1. Market Strength and Price Movements: High open interest indicates a highly liquid market with a large number of participants. It suggests that there is significant interest and activity in that particular option. When open interest increases, it usually indicates that traders anticipate price movements and are actively participating in the market. On the other hand, declining open interest might suggest a lack of interest or a decrease in market activity.

Read Also: How to Successfully Trade with Pending Orders: A Step-by-Step Guide

2. Option Liquidity: Open interest is directly proportional to liquidity. A liquid options market allows traders to easily enter or exit positions without affecting the price significantly. Higher open interest implies better liquidity, making it easier for traders to buy or sell options at fair prices.

3. Support and Resistance Levels: Open interest can help identify significant support and resistance levels in option trading. These levels are points on a chart where the price of an option tends to reverse or consolidate. When there is high open interest near a specific price level, it indicates that there is significant trading activity at that level, making it a potential support or resistance level.

4. Option Trading Strategies: Open interest provides insights into market sentiment and the popularity of different option trading strategies. For example, a significant increase in open interest for call options may indicate a bullish sentiment, while a rise in open interest for put options might suggest a bearish sentiment. Traders can analyze open interest to gauge market sentiment and adjust their trading strategies accordingly.

5. Option Expiry and Roll-Overs: Open interest plays a crucial role during option expiry and roll-over periods. Traders often monitor open interest to determine the likelihood of contract expirations or roll-overs. High open interest near the expiry date suggests that many traders are holding positions, while low open interest indicates a lack of interest or potential contract rollovers.

Overall, open interest is a valuable metric in option trading as it provides insights into market sentiment, liquidity, and potential support or resistance levels. By understanding and analyzing open interest, traders can make informed decisions and develop effective trading strategies.

Open interest in option trading refers to the total number of outstanding options contracts that are held by market participants at the end of each trading day. It includes both open long positions (buyers of options) and open short positions (sellers of options).

Open interest represents the total number of contracts that are still open and have not been closed or exercised, while volume represents the total number of contracts traded during a specific time period. Open interest is a cumulative figure that changes throughout the trading day, while volume can fluctuate within a single trading session.

Open interest is important in option trading as it provides valuable information about the liquidity and activity levels of specific options contracts. High open interest suggests that there is more trading interest and potential for liquidity in those options, while low open interest may indicate a lack of interest or limited liquidity.

Open interest can be used in option trading strategies as a tool for assessing market sentiment and identifying potential support or resistance levels. For example, if there is a high open interest for calls at a specific strike price, it may indicate bullish sentiment and serve as a resistance level for the underlying asset. Traders can also use changes in open interest to monitor the flow of new money into or out of an options contract.

Several factors can affect open interest in option trading, including changes in market sentiment, the introduction of new options contracts, expiration dates, and overall trading activity. Additionally, large institutional trades or hedging strategies can also impact open interest. Understanding these factors can help traders interpret changes in open interest and make more informed trading decisions.

Open interest in option trading refers to the total number of outstanding or open contracts for a particular option. It represents the number of contracts that have been bought or sold but have not yet been closed out by an offsetting trade or exercise. Open interest is used by traders to gauge market sentiment and determine the liquidity of options.

Is Olymp trade halal in Islam? Islamic finance is guided by the principles of Shariah law, which prohibits certain activities such as usury and …

Read ArticleWhat is the minimum account to trade options? Options trading can be a highly profitable investment strategy, but it’s important to understand the …

Read ArticleIs scalping safe? Scalping, a trading strategy that involves buying and selling securities within a short timeframe to profit from small price …

Read ArticleHow to short GBP? If you are interested in forex trading, one strategy that you may consider is shorting GBP. Shorting, or short selling, involves …

Read ArticleIntroduction to Zig Zag Signal Indicator in Forex Forex trading can be a daunting task, with so many indicators and tools available to help traders …

Read ArticleUnderstanding the Significance of Bollinger Bands in Trading In the world of technical analysis, Bollinger Bands are a widely used tool for analyzing …

Read Article