Understanding the ANZ Conversion Fee: Everything You Need to Know

Understanding the ANZ Conversion Fee When it comes to traveling or making purchases overseas, understanding currency conversion fees is crucial. ANZ, …

Read Article

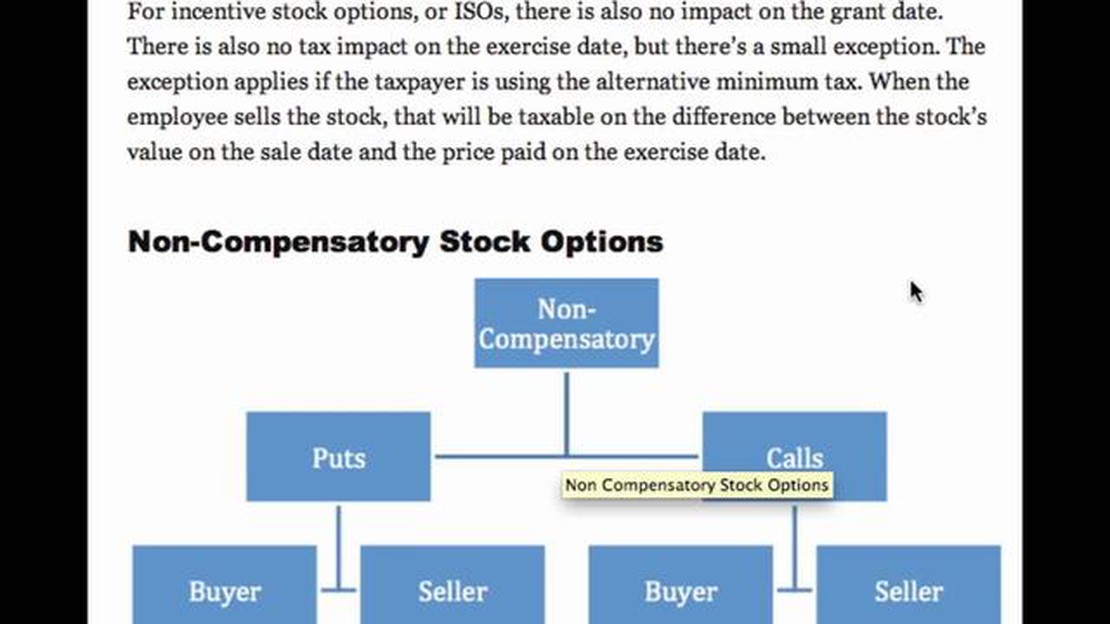

Stock options have long been a popular tool for companies to incentivize and reward their employees. However, not all stock options are created equal. Non-compensatory stock options, in particular, have their own unique set of rules and requirements that both employers and employees should be aware of. In this article, we will explore everything you need to know about non-compensatory stock options.

Non-compensatory stock options are a type of stock option that is not granted as part of an employee’s compensation package. Unlike compensatory stock options, which are typically awarded to employees as a form of additional compensation, non-compensatory stock options are often offered to external stakeholders, such as investors or partners.

One key difference between compensatory and non-compensatory stock options is the tax treatment. While compensatory stock options are subject to specific tax rules, non-compensatory stock options are generally treated as an investment. This means that the tax consequences for non-compensatory stock options may differ from those of compensatory stock options.

It is important to note that non-compensatory stock options are typically subject to certain restrictions and limitations. For example, they may have a minimum holding period or require the shareholder to meet specific eligibility criteria. These restrictions are often put in place to protect the interests of the company and its shareholders.

In conclusion, understanding non-compensatory stock options is essential for both employers and employees. By familiarizing yourself with the rules and requirements associated with non-compensatory stock options, you can maximize the benefits and minimize the risks associated with this type of investment.

Non-compensatory stock options are a type of investment tool that allows individuals to buy or sell shares of stock at a specific price within a certain time frame. Unlike compensatory stock options, which are typically given to employees as part of their compensation package, non-compensatory stock options are available to the general public.

These options can be used for a variety of purposes, such as hedging against potential losses or speculating on the future price of a stock. They are often seen as a way for individuals to participate in the stock market without having to buy and sell actual shares of stock.

Non-compensatory stock options have some key characteristics that set them apart from compensatory options. First, non-compensatory options do not grant any ownership rights or voting rights to the holder. They are purely financial instruments that allow individuals to profit from fluctuations in stock prices.

Second, non-compensatory stock options are typically traded on an exchange, such as the Chicago Board Options Exchange (CBOE). This means that their value is determined by market forces and can fluctuate throughout the trading day.

Finally, non-compensatory stock options have a specific expiration date, after which they become worthless. This means that individuals must exercise their options before this date if they want to realize any potential gains.

Overall, non-compensatory stock options can be a valuable tool for individuals looking to diversify their investment portfolio or speculate on the future price of a stock. However, it’s important for individuals to understand the risks involved and to carefully consider their investment objectives before trading these options.

Non-compensatory stock options are a type of stock option that is typically offered to investors rather than employees. Unlike compensatory stock options, which are given as part of an employee’s compensation package, non-compensatory stock options are typically used by companies to attract and reward investors.

Here are some key features of non-compensatory stock options:

Read Also: Why MetaTrader is no longer available and what are the alternatives?

| Feature | Description |

|---|---|

| Vesting Period | Non-compensatory stock options may have a vesting period, which is a specified amount of time that must pass before the options can be exercised. This can help incentivize long-term investment in the company. |

| Exercise Price | The exercise price of non-compensatory stock options is typically set at or above the market value of the company’s stock at the time the options are granted. This ensures that the options have value and are not immediately exercisable for a profit. |

| Expiration Date | Non-compensatory stock options have an expiration date, which is the date by which the options must be exercised. If the options are not exercised before the expiration date, they typically become worthless. |

| Limited Transferability | Non-compensatory stock options are often non-transferable, meaning they cannot be sold or transferred to another party. This helps prevent individuals from using the options for short-term speculative purposes. |

| No Voting Rights | Unlike compensatory stock options, non-compensatory stock options do not typically come with voting rights. This means that investors who hold these options do not have a say in the company’s decision-making processes. |

| No Tax Consequences | Non-compensatory stock options are generally not subject to taxation when granted or exercised. However, it is important for investors to consult with a tax advisor to fully understand their individual tax obligations. |

Overall, non-compensatory stock options provide companies with a flexible tool for attracting and rewarding investors, while also providing potential benefits to the investors themselves. It is important for both companies and investors to carefully consider the terms and conditions of non-compensatory stock options before entering into any agreements.

Non-compensatory stock options can offer several benefits to both the company and the individual investor. However, they also come with their own set of risks that must be carefully considered.

1. Diversification: Non-compensatory stock options allow investors to diversify their investment portfolio by providing additional investment opportunities outside of traditional stocks and bonds. This can help spread risk and potentially increase the overall return on investment.

2. Potential for Higher Returns: Non-compensatory stock options provide the opportunity for investors to potentially earn higher returns compared to traditional investments. This is particularly true in cases where the underlying stock or asset experiences significant price appreciation.

3. Flexibility and Control: Non-compensatory stock options provide investors with greater flexibility and control over their investment decisions. Investors may have the ability to choose the assets they want to invest in, the timing of their investments, and the option to exercise or sell their options based on market conditions.

4. Tax Advantages: Non-compensatory stock options may offer tax advantages in certain situations. Depending on the type of option and the holding period, investors may be able to benefit from preferential tax treatment, such as long-term capital gains rates.

1. Loss of Investment: Investing in non-compensatory stock options involves a certain level of risk, and there is no guarantee that the investment will be profitable. Investors may lose some or all of their investment if the underlying stock or asset performs poorly.

Read Also: Simple 5-step guide to finding the mean absolute deviation

2. Limited Liquidity: Non-compensatory stock options may have limited liquidity, meaning it can be difficult to buy or sell the options at a desired price. This lack of liquidity can make it challenging to exit positions or take advantage of investment opportunities in a timely manner.

3. Volatility: Non-compensatory stock options can be subject to significant price volatility. The value of the options can fluctuate based on market conditions, and investors may experience large swings in the value of their investment.

4. Complexity: Non-compensatory stock options can be complex financial instruments, requiring a thorough understanding of the terms, conditions, and risks associated with the options. Investors should carefully review the terms and consult with a financial advisor before investing.

Overall, non-compensatory stock options can be a valuable addition to an investment portfolio, offering potential benefits such as diversification, higher returns, flexibility, and tax advantages. However, it is important for investors to carefully consider and assess the risks involved before investing in non-compensatory stock options.

Non-compensatory stock options are stock options that are not granted to employees or other service providers as part of their compensation package. Instead, these options are typically offered to investors and other stakeholders in the company as a way to incentivize investment and align the interests of shareholders.

Non-compensatory stock options work by giving the holder the right to purchase a certain number of shares in a company at a set price, known as the exercise price, within a specified time period. Unlike compensatory stock options, non-compensatory options are not tied to the performance of the employee or service provider, but rather to the performance of the underlying company.

Non-compensatory stock options can offer several benefits to investors. First, they provide the opportunity for potential financial gain if the stock price of the underlying company increases. Second, they can provide a way for investors to align their interests with the company’s management and other shareholders. Finally, these options can offer a form of compensation for investors who are willing to take on the risk associated with investing in a particular company.

Yes, non-compensatory stock options can be risky. Investing in any stock carries inherent risks, and non-compensatory options are no exception. The value of these options is directly tied to the performance of the underlying company, and if the company’s stock price decreases, the value of the options may also decrease or even become worthless. It is important for investors to carefully evaluate the potential risks and rewards before investing in non-compensatory stock options.

Before investing in non-compensatory stock options, it is important to consider several factors. First, investors should carefully evaluate the financial health and prospects of the underlying company. Second, investors should assess their own risk tolerance and determine if they are comfortable taking on the potential risks associated with these options. Additionally, investors should carefully review the terms and conditions of the options, including the exercise price, expiration date, and any restrictions or limitations on the options.

Non-compensatory stock options are a type of stock option granted to employees or key personnel that are not intended to provide additional compensation for their work. Instead, they are usually used as a way to align employees’ interests with the company’s performance and to incentivize them to work towards the company’s long-term success.

Non-compensatory stock options differ from compensatory stock options in that they are not given as a form of additional compensation for employees’ work. Non-compensatory stock options are typically used to align employees’ interests with the company’s long-term success, while compensatory stock options are given as a form of payment for services rendered.

Understanding the ANZ Conversion Fee When it comes to traveling or making purchases overseas, understanding currency conversion fees is crucial. ANZ, …

Read ArticleWhat is the name of ING Vysya bank? ING Vysya Bank was a banking institution that operated in India. The bank was a part of the larger ING Group, an …

Read ArticleOptions and Tax Loss Harvesting: How do they Impact Taxes? Options trading can be a complex and risky investment strategy, but it also offers …

Read ArticlePython and Its Role in Trading In recent years, Python has emerged as a powerful tool in the world of trading, disrupting traditional methods and …

Read ArticleUnderstanding the Moving Average in Management In the fast-paced world of business and management, companies are constantly seeking ways to stay ahead …

Read ArticleIs the CBOE still in operation? The Chicago Board Options Exchange (CBOE) has a long history in the financial industry, serving as a central hub for …

Read Article