Understanding the Forex Order Book: How It Works and Why It Matters

Understanding the Basics of Order Book Forex When it comes to trading in the foreign exchange market, understanding the forex order book is essential. …

Read Article

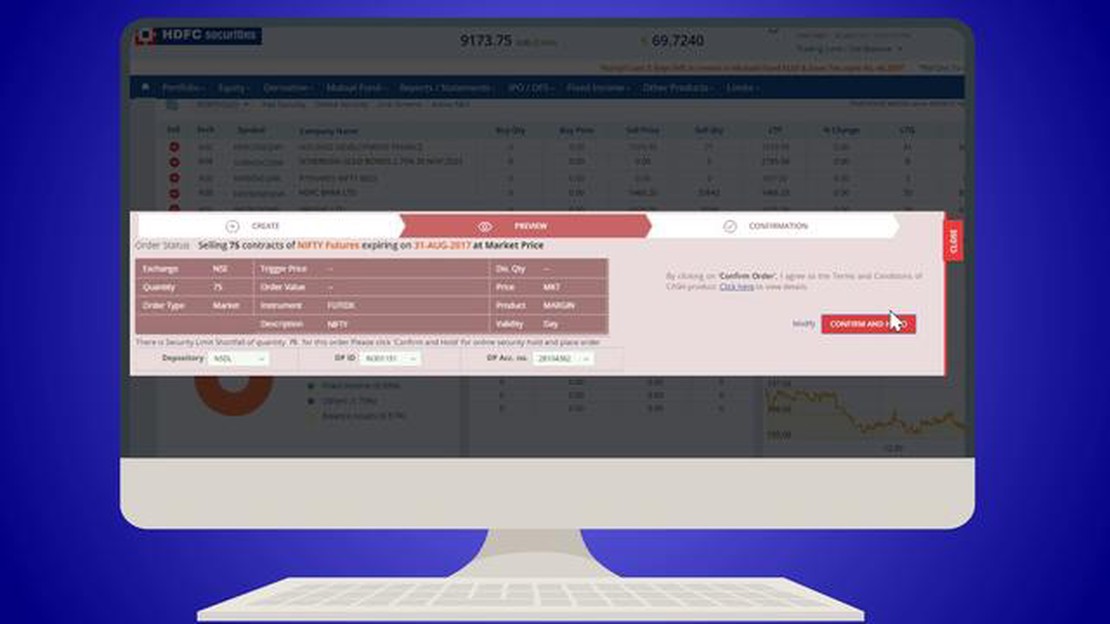

When it comes to investing in the stock market, it’s essential to have a good understanding of the various financial instruments available. Two popular options for investors are futures and options. These derivative contracts can be highly profitable if used correctly, but they also come with their own set of risks. In this comprehensive guide, we will explore the concept of futures and options in HDFC Securities, one of the leading brokerage firms in India.

First, let’s define what futures and options are. Futures are contracts that oblige the buyer to purchase an asset or the seller to sell an asset at a predetermined price and date in the future. On the other hand, options give the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price and date. These contracts provide flexibility and can be used for speculation, hedging, and arbitrage.

When trading futures and options through HDFC Securities, it’s important to understand the various strategies that can be implemented. In this guide, we will discuss the different types of futures and options trading strategies, such as long and short positions, hedging strategies, and spread trading. We will also cover the potential risks and rewards associated with each strategy, along with the necessary precautions to be taken.

Furthermore, we will delve into the key factors to consider when trading futures and options, such as understanding market trends, conducting in-depth research on specific assets, and managing risk. HDFC Securities provides various tools and resources to assist investors in making informed decisions, and we will explore these resources in detail.

By the end of this comprehensive guide, readers will have a solid understanding of the intricacies of futures and options trading in HDFC Securities. Whether you are a beginner looking to venture into these markets or an experienced investor seeking to enhance your knowledge, this guide will provide you with valuable insights and actionable strategies.

Futures and options are financial instruments that allow investors to trade and hedge against future price movements of various underlying assets such as stocks, commodities, or foreign currencies. These derivative contracts are often used by speculators or hedgers to manage risk or to take advantage of potential price movements.

Futures:

| Futures | Options |

|---|---|

| Futures are standardized contracts that obligate the buyer to purchase an asset, and the seller to sell the asset, at a predetermined price and at a specific future date. | Options are contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price and within a specific time period. The seller, on the other hand, is obligated to fulfill the contract if the buyer decides to exercise the option. |

| Futures contracts are traded on organized exchanges, such as the National Stock Exchange of India (NSE) or the Bombay Stock Exchange (BSE). | Options contracts are also traded on organized exchanges, such as the NSE or the BSE. |

| Investors can take long or short positions in futures contracts, depending on their market outlook. Long positions involve buying contracts in anticipation of price increases, while short positions involve selling contracts in anticipation of price decreases. | Investors can take long or short positions in options contracts as well. Long positions involve buying call options in anticipation of price increases or buying put options in anticipation of price decreases. Short positions involve selling call or put options to collect premiums. |

Both futures and options can be used for hedging purposes, allowing investors to protect against adverse price movements in their portfolios. They can also be used for speculative purposes, allowing investors to profit from price fluctuations without owning the underlying assets.

Read Also: Regulators of National Australia Bank Limited: A Comprehensive Guide

It is important to understand the risks associated with trading futures and options, as they involve leverage and can result in substantial losses if not managed properly. It is recommended to seek professional advice and to thoroughly understand the terms and conditions of these contracts before engaging in trading activities.

When it comes to trading futures and options on HDFC Securities, there are several key considerations that investors should keep in mind. These considerations can help investors make informed decisions and minimize risks while trading in the derivatives market.

One of the first considerations is to understand the basics of futures and options. It is important to grasp the concept of these financial instruments and how they work before diving into trading. This can help investors navigate the complexities of the derivatives market and make more informed trading decisions.

Another important consideration is to have a well-defined trading strategy. This involves setting clear goals, risk tolerance, and entry and exit points for trades. Having a strategy in place can help investors stay disciplined and avoid making impulsive decisions based on market fluctuations or emotions.

It is also crucial to conduct thorough research and analysis before making any trading decisions. This includes analyzing market trends, studying historical data, and staying updated with news and events that can impact the derivatives market. This research can help investors identify potential trading opportunities and make more informed decisions.

Additionally, investors should also consider the risk management aspect of trading futures and options. This involves setting stop-loss orders to limit potential losses, diversifying positions to spread the risk, and managing leverage responsibly. Implementing risk management strategies can help investors protect their capital and minimize potential losses.

Moreover, it is essential to stay updated with the rules and regulations governing futures and options trading on HDFC Securities. This includes understanding margin requirements, settlement procedures, and other relevant regulations. Adhering to these regulations can help investors avoid any legal or compliance issues.

| Key Considerations for Trading Futures and Options: |

|---|

| 1. Understand the basics of futures and options. |

| 2. Develop a well-defined trading strategy. |

| 3. Conduct thorough research and analysis. |

| 4. Implement effective risk management strategies. |

| 5. Stay updated with rules and regulations. |

Read Also: Discover the 315 Trading Strategy: A Powerful Tool for Traders

By considering these key factors, investors can approach futures and options trading on HDFC Securities with more confidence and improve their chances of success in the derivatives market.

Futures and options are financial instruments that allow investors to speculate on the price movement of an underlying asset without actually owning it.

When trading futures, investors enter into a contract to buy or sell an asset at a specified price on a future date. The price of the asset is determined by supply and demand in the market.

The main difference between futures and options is that futures obligate the buyer or seller to complete the transaction on a specified date, while options give the buyer the right, but not the obligation, to buy or sell the asset.

To trade futures and options on HDFC Securities, you need to open a trading account and activate the derivative segment. Once your account is set up, you can start placing orders for futures and options through the trading platform provided by HDFC Securities.

Trading futures and options involves risks such as market volatility, liquidity risk, and the potential loss of your investment. It is important to have a thorough understanding of the market and proper risk management strategies before engaging in such trading activities.

Futures and options are financial instruments offered by HDFC Securities that allow investors to speculate on the future price movements of various assets such as stocks, commodities, currencies, etc.

Understanding the Basics of Order Book Forex When it comes to trading in the foreign exchange market, understanding the forex order book is essential. …

Read ArticleUnderstanding the Mechanics of UVXY UVXY, which stands for Ultra VIX Short-Term Futures ETF, is an exchange-traded fund that aims to provide investors …

Read ArticleUnderstanding the Super Trend Non-Repaint Indicator Are you tired of using lagging indicators that provide old and unreliable trading signals? If so, …

Read ArticleFunctions of Foreign Exchange Department of a Bank In today’s interconnected global economy, foreign exchange plays a vital role in facilitating …

Read ArticleOptions Trading on Leveraged ETFs Explained: Can You Do It? Options trading can be a complex and risky endeavor, but for those willing to take the …

Read ArticleIs it possible to pay with Swish on Forex? In today’s global economy, foreign currency exchange (Forex) transactions are a common occurrence. With the …

Read Article