How to Write Options in IBKR: A Comprehensive Guide

How to Write Options in Ibkr Options trading can be a lucrative investment strategy, but it’s important to understand the mechanics of writing options …

Read Article

Foreign exchange (FX) rates play a crucial role in international trade and finance. They determine the value of one currency relative to another, and are constantly changing due to various economic factors. Forward FX rates, in particular, are an important aspect of the currency market as they allow market participants to lock in an exchange rate for a future date. However, understanding forward FX rates quoting can be complex and confusing for many.

Forward FX rates are quoted differently from spot rates, which represent the current market rate for immediate delivery of currencies. Forward rates take into account the interest rate differential between the two currencies being traded, and are calculated based on the expectations of future exchange rate movements. These rates are quoted for different time periods, ranging from a few days to several years.

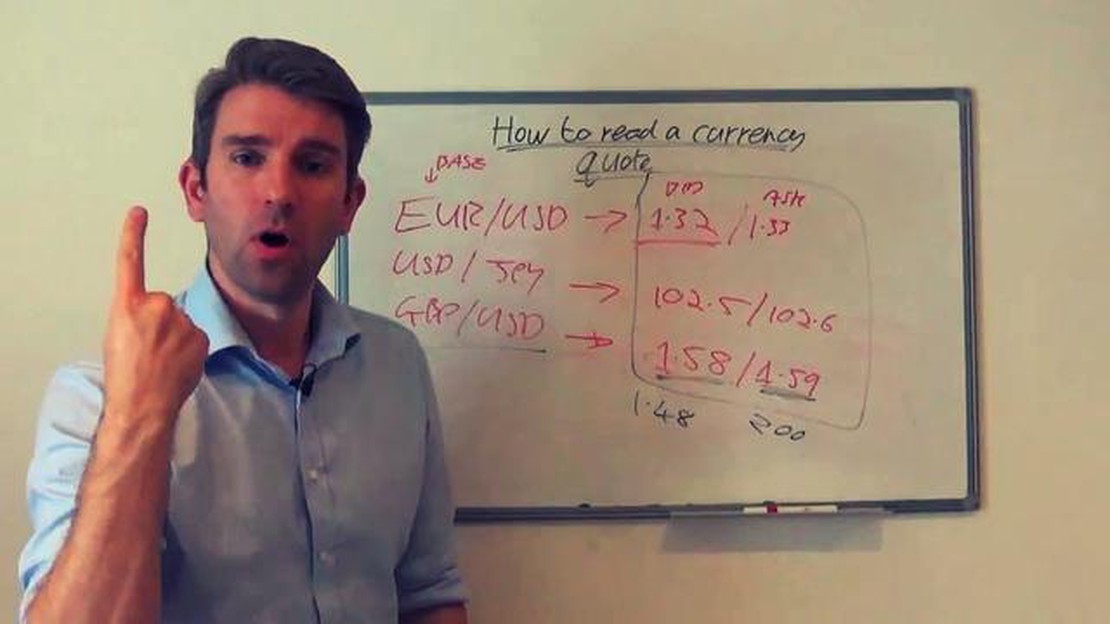

When looking at a forward FX rate quote, it is important to understand its components. The first currency listed is known as the “base currency”, while the second currency is the “quote currency”. The rate itself represents the number of units of the quote currency that can be exchanged for one unit of the base currency. For example, a forward FX rate of 1.2500 for EUR/USD means that 1.25 USD can be exchanged for 1 EUR.

The quoting convention for forward FX rates may vary depending on the market and the currency pair being quoted. In some cases, the base currency is fixed, while the quote currency is variable. This is known as “direct quoting”. In other cases, the quote currency is fixed, while the base currency is variable. This is called “indirect quoting”. It is crucial to understand the quoting convention being used in order to interpret the forward FX rate correctly.

Overall, understanding forward FX rates quoting is essential for anyone involved in international trade or finance. By comprehending the components of a forward FX rate quote and the quoting convention being used, market participants can make informed decisions about future exchange rate movements and effectively manage their currency risk.

A forward foreign exchange (FX) rate is a financial instrument that allows market participants to lock in an exchange rate for a future date. It is the agreed upon rate at which one currency can be exchanged for another currency at a future date.

Forward FX rates are useful for businesses and individuals who engage in international trade and want certainty about the future cost of foreign currency transactions. They provide protection against fluctuations in exchange rates and allow parties to plan ahead with confidence.

Forward FX rates are typically quoted for different time periods, such as one month, six months, or one year. The rates are determined through a combination of market forces and interest rate differentials between the two currencies.

When quoting a forward FX rate, market participants will often specify the base currency (the currency being exchanged) and the counter currency (the currency being received). The forward FX rate will indicate how many units of the counter currency are needed to exchange for one unit of the base currency.

It’s important to note that forward FX rates can be influenced by a variety of factors, including market expectations, economic and political events, and interest rate differentials. These rates are not set in stone and can change as new information becomes available.

Read Also: Understanding the Sources of Trading Profits: Exploring the Origins of Financial Success

Understanding forward FX rates is crucial for anyone involved in international trade or currency speculation. By having a clear understanding of these rates, market participants can better manage their currency exposure and make informed decisions.

Forward foreign exchange (FX) rates are an important tool in international finance. They allow businesses and individuals to hedge against currency risk by locking in an exchange rate for a future transaction.

When trading currency pairs, such as USD/EUR or GBP/JPY, the current exchange rate between the two currencies is known as the spot rate. However, if you need to exchange currency at a future date, you can use a forward FX rate.

A forward FX rate is a rate that is agreed upon now but will be executed at the agreed upon date in the future. It is determined by the interest rate differentials between the two currencies involved.

Let’s say you want to exchange USD for EUR in six months’ time. The spot rate today is 1 USD = 0.88 EUR. However, you are worried that the exchange rate may move against you in the next six months, so you decide to lock in a forward FX rate of 1 USD = 0.90 EUR.

If the spot rate in six months’ time is higher than the forward rate you agreed upon, you will have saved money by using a forward FX rate. However, if the spot rate is lower, you will have lost money compared to just using the spot rate.

Read Also: Is NMDC Stock Overvalued or Undervalued? Experts Weigh In

Forward FX rates are quoted as two rates: the bid rate and the ask rate. The bid rate is the rate at which a buyer is willing to buy the foreign currency, and the ask rate is the rate at which a seller is willing to sell the foreign currency.

Overall, understanding forward FX rates is important for anyone involved in international trade or finance. By utilizing forward FX rates, businesses and individuals can mitigate the risk of currency fluctuations and plan their future transactions with more certainty.

A forward FX rate is a currency exchange rate that is agreed upon today, but will be executed at a future date. It allows companies and individuals to hedge against potential currency fluctuations in order to minimize risks.

A forward FX rate is quoted as the amount of one currency that will be exchanged for another currency at a future date. It consists of two prices: the bid price, which is the price at which the buyer agrees to buy the currency, and the ask price, which is the price at which the seller agrees to sell the currency.

Forward FX rates are determined by several factors, including interest rate differentials, inflation rates, economic indicators, political stability, and market expectations. These factors influence the demand and supply of currencies, and ultimately affect the exchange rates.

No, forward FX rates are not fixed. They are subject to changes in the underlying factors that determine exchange rates, such as interest rates and economic conditions. Therefore, forward FX rates can fluctuate before the transaction is executed.

Using forward FX rates allows businesses and individuals to manage the risks associated with currency fluctuations. It provides a predictable exchange rate, which can help in budgeting, planning, and minimizing potential losses. Additionally, it can be used for hedging purposes to protect against adverse currency movements.

A forward FX rate is the exchange rate at which a currency can be bought or sold for delivery in the future. It allows businesses and individuals to lock in a specific exchange rate for a future transaction.

How to Write Options in Ibkr Options trading can be a lucrative investment strategy, but it’s important to understand the mechanics of writing options …

Read ArticleUnderstanding Historical Volatility Tradingview Volatility is a key concept in trading that can greatly influence investment decisions. To make …

Read ArticleUnderstanding the Position Ratio in Forex Trading In the world of forex trading, understanding the importance of position ratio is crucial for …

Read ArticleIs Forex Trading Legal for South Africans? Forex trading has become increasingly popular in South Africa, with many people looking to make money from …

Read ArticleUnderstanding UTP in Trading When it comes to trading, having a comprehensive understanding of UTP (Unlisted Trading Privileges) is essential. UTP is …

Read ArticleIs RoboForex a Good Choice for Traders? RoboForex is a popular forex broker that has been providing financial services since 2009. With its wide range …

Read Article