Is SMC the Best Trading Strategy? Exploring the Pros and Cons

Is SMC the Best Trading Strategy? In the world of trading, there are countless strategies that traders employ to make profits in the financial …

Read Article

In time series analysis, the moving average (MA) model is widely used to describe and forecast random processes. The MA model displays a dependence between observations and noise terms, making it useful for understanding and predicting data with unfamiliar patterns.

One of the primary characteristics of the MA model is the unconditional mean, which represents the mean value of the random process over an infinite number of observations. The unconditional mean provides insights into the long-term behavior of the time series and serves as a reference point for interpreting individual observations.

To calculate the unconditional mean of an MA model, it is necessary to consider the model’s parameters, particularly the coefficients of the moving average terms. These coefficients determine the strength and direction of the relationship between observations and noise terms.

The unconditional mean is typically denoted as E(Y), where Y represents the random process. It can be derived by solving a system of equations that equates the expected value of Y to its own value, resulting in a constant value for the unconditional mean. This value can be positive, negative or zero, depending on the values of the MA coefficients.

Understanding the unconditional mean of an MA model is crucial for interpreting its predictions and assessing its long-term behavior. By calculating and analyzing the unconditional mean, researchers and analysts can gain a deeper understanding of the underlying patterns and dynamics of the time series, facilitating better decision-making and forecasting.

Overall, the unconditional mean of the MA model provides a valuable metric for understanding and interpreting the long-term behavior of a random process. By considering the model’s parameters and solving a system of equations, analysts can derive the unconditional mean and gain insights into the relationship between observations and noise terms. This understanding can enhance the accuracy of predictions and inform decision-making processes in various fields.

The unconditional mean is a key concept in understanding the behavior of a time series model, such as an MA model. It represents the average value that the series would take if it were allowed to run infinitely into the future, assuming that all other parameters remain constant. It is an important measure of the long-term behavior of the series.

In an MA model, the unconditional mean can be calculated by taking the mean of the constant term, denoted as μ, in the model equation. This means that if the model equation is written as:

| yt = c + εt |

where yt is the value of the series at time t, c is the constant term, and εt is the random noise term, then the unconditional mean is simply the value of c.

The unconditional mean provides insights into the long-term behavior of the time series. If the unconditional mean is positive, for example, it suggests that the series tends to have higher values on average. Conversely, if the unconditional mean is negative, it suggests that the series tends to have lower values on average.

It is important to note that the unconditional mean is an abstract concept and may not always have a direct interpretation in real-world terms. Nevertheless, it is a useful concept for understanding the behavior of a time series model and can be used to make predictions about the future behavior of the series.

The unconditional mean of a moving average (MA) model is a fundamental concept that helps us understand its behavior and make predictions. To understand the unconditional mean, we need to first understand what a moving average model is.

In time series analysis, a moving average model is a mathematical model that describes the behavior of a time series based on the weighted average of past random shocks or errors. It is often used to model time series data with no or little trend or seasonality.

The unconditional mean of an MA model represents the average level of the time series when all the random shocks or errors are equal to zero. In other words, it is the long-term average of the time series. It is important to note that the unconditional mean is different from the conditional mean, which represents the average level of the time series given the current and past values.

The unconditional mean is usually denoted as μ. It can be calculated using the formula: μ = θ0, where θ0 is the coefficient of the zero-th lag of the MA model. The unconditional mean is also referred to as the intercept or the drift term.

Understanding the unconditional mean is crucial for interpreting the behavior of an MA model. If the unconditional mean is positive, it suggests that the time series tends to have positive values on average. On the other hand, if the unconditional mean is negative, it suggests that the time series tends to have negative values on average. Additionally, the value of the unconditional mean can give insights into the stability and stationarity of the MA model.

Read Also: Exploring the Halal or Haram status of Binary Trading

In summary, the unconditional mean of an MA model represents the long-term average level of the time series when all the random shocks or errors are zero. It provides important information about the behavior, stability, and stationarity of the model.

The unconditional mean, or simply the mean, of an MA model is the expected value of the random variable at any given time. It represents the long-term average value of the process. Understanding the unconditional mean can help us gain insights into the behavior of the MA process.

Mathematically, the unconditional mean of an MA(1) model can be derived as follows:

μ = E(Yt) = E(θ0 + θ1εt-1 + εt),

Read Also: Is Options Income Taxable? Understanding Tax implications of Options Trading

where θ0 and θ1 are the parameters of the MA(1) model.

The mean value of εt-1 is assumed to be zero, as the errors are random and do not have any systematic bias. Therefore, taking the expectation of the above equation, we get:

μ = E(Yt) = E(θ0 + θ1εt-1 + εt) = θ0.

This means that the mean of the MA(1) model is equal to the intercept parameter θ0. In other words, the process has a constant mean value of θ0 regardless of the time index t or the value of the previous error term εt-1.

It is important to note that the mean of an MA(1) model is determined solely by the intercept parameter θ0, and it does not depend on the value of the autoregressive parameter θ1. This characteristic of MA models makes them useful in modeling processes with constant mean values.

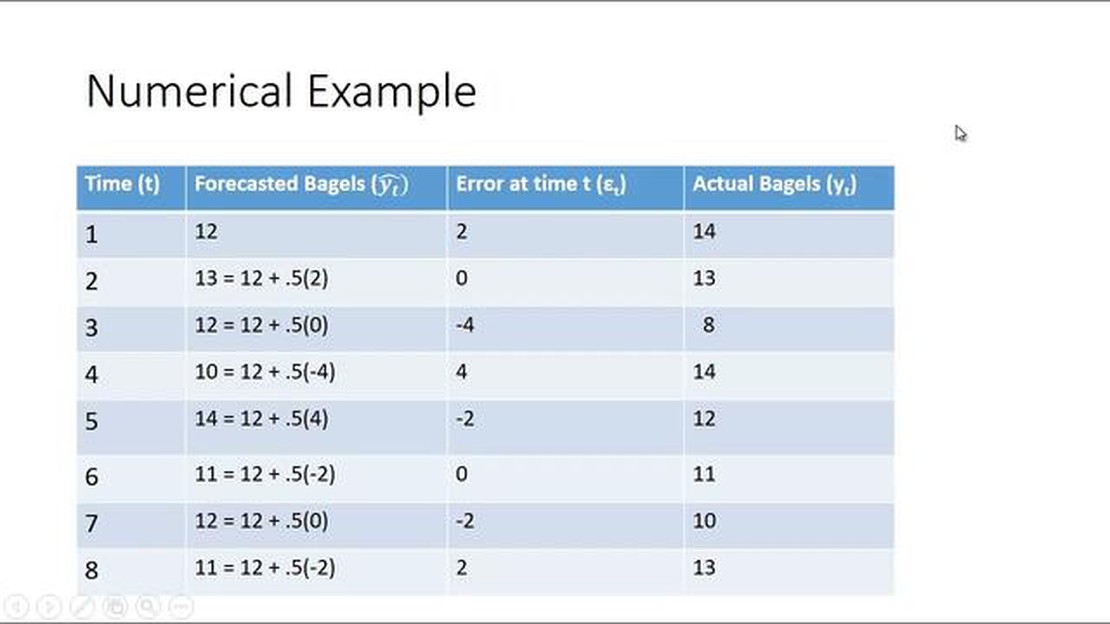

To better illustrate the concept of the unconditional mean, let’s take an example. Suppose we have an MA(1) process given by the equation:

Yt = 1 + 0.5εt-1 + εt,

where εt is a normally distributed random variable with mean zero and variance one. In this case, the unconditional mean of the process is equal to 1, as the intercept parameter is equal to 1.

By simulating the MA(1) process over a large number of time periods, we can observe that the average value of the process converges to the unconditional mean of 1. This demonstrates the concept of the long-term average value or the unconditional mean of the MA(1) process.

In conclusion, the unconditional mean of an MA model represents the long-term average value of the process and is determined solely by its intercept parameter. It provides insights into the behavior and stability of the process over time.

The unconditional mean of the MA model refers to the average value of the series over an infinite period of time, assuming that all the shocks in the series have zero mean.

To calculate the unconditional mean of the MA model, you need to determine the mean of the error term, or the shock component, of the model. This is usually done by solving the equation for the MA model under the assumption that the series is stationary and the shocks have zero mean.

The unconditional mean of the MA model provides important information about the long-term behavior of the series. It helps in understanding the average level of the series over time, assuming that all the shocks have zero mean.

No, the unconditional mean of the MA model remains constant over time, assuming that the shocks have zero mean. It represents the long-term average level of the series and does not depend on the current or past values of the series.

If the unconditional mean of the MA model is different from zero, it indicates that the series has a systematic bias or trend. This means that the average value of the series is consistently different from zero, even in the absence of shocks. It suggests the presence of some underlying factors or processes that influence the series.

Is SMC the Best Trading Strategy? In the world of trading, there are countless strategies that traders employ to make profits in the financial …

Read ArticleIs it profitable to play on the stock exchange? Investing in the stock exchange can be a lucrative venture. With the potential for high returns, many …

Read ArticleUnderstanding the Distinction between Subjective and Objective Trading When it comes to trading in the financial markets, there are two primary …

Read ArticleUnderstanding Stock Options in an Acquisition Stock options play a crucial role in mergers and acquisitions (M&A) transactions, providing a means for …

Read ArticleWhen is the Best Time to Cash In Stock Options? Stock options are a popular form of compensation for employees, giving them the opportunity to …

Read ArticleDownload MT4 on Apple: Step-by-Step Guide Welcome to our step-by-step guide on how to download MT4 on your Apple devices. Whether you own an iPhone, …

Read Article