Understanding Restricted Stock Units at CVS: A Comprehensive Guide

Understanding Restricted Stock Units at CVS Restricted Stock Units (RSUs) are a common form of equity compensation offered to employees at CVS Health …

Read Article

TradeStation is a popular online brokerage platform that allows traders to trade a wide range of financial instruments, including futures options. Futures options can be a valuable addition to any trading strategy, as they offer flexibility and potentially significant profit opportunities. In this guide, we will cover everything you need to know about trading futures options on TradeStation.

Futures options are derivatives that give traders the right, but not the obligation, to buy or sell a futures contract at a predetermined price and date. They are similar to stock options, but instead of trading on individual stocks, they are based on futures contracts, which are agreements to buy or sell an underlying asset at a specific price on a future date.

TradeStation provides traders with a robust platform to trade futures options. The platform offers a wide range of tools and features that can help traders analyze the market, execute trades, and manage their risk. Traders can access real-time market data, advanced charting tools, and customizable trading strategies. TradeStation also offers competitive commission rates, making it an attractive option for traders looking to trade futures options.

Whether you are a beginner or an experienced trader, understanding how to trade futures options on TradeStation is essential. In this guide, we will walk you through the process of opening a TradeStation account, navigating the platform, placing trades, and managing your positions. We will also cover key concepts and strategies related to futures options trading, such as delta, theta, and implied volatility.

Trading futures options on TradeStation can be a profitable venture, but it is important to approach it with knowledge and caution. By familiarizing yourself with the platform and honing your trading skills, you can increase your chances of success in the futures options market. Whether you are looking to hedge your existing positions, speculate on price movements, or generate income, TradeStation offers the tools and resources you need to trade futures options effectively.

Futures options are derivative financial instruments that give traders the right, but not the obligation, to buy or sell a specific futures contract at a predetermined price (strike price) and within a specified time frame.

These options allow traders to speculate on the future price movement of the underlying asset without actually owning the asset itself. They offer a versatile tool for managing risk, hedging positions, and generating potential profits in highly volatile markets.

There are two types of futures options:

Read Also: Gold Price in Singapore Today - Current Rates and Trends2. Put Options: Put options give traders the right to sell a specific futures contract at the strike price within a specified time frame. Traders would typically buy put options if they expect the price of the underlying asset to fall.

It’s important to note that futures options have an expiration date, after which they become worthless. Traders must decide whether to exercise their options before the expiration date if they want to utilize the rights granted by the options contract.

When trading futures options on TradeStation, traders have access to a wide range of contract months, strike prices, and the ability to buy or sell options to open or close positions. TradeStation’s advanced trading platform provides valuable tools and resources for analyzing market conditions and making informed trading decisions.

Understanding futures options is essential for traders looking to take advantage of the potential opportunities and risks associated with these financial instruments. By mastering the concepts and strategies related to futures options, traders can enhance their trading skills and improve their overall trading performance.

Futures options are derivatives contracts that give the holder the right, but not the obligation, to buy or sell a specified futures contract at a predetermined price on or before a specified date. They are similar to stock options, but instead of giving the option to buy or sell a stock, futures options give the option to buy or sell a futures contract.

The futures contract represents an agreement to buy or sell a specific quantity of an underlying asset at a future date. These underlying assets can include commodities such as corn, wheat, oil, or metals, financial instruments such as stock indexes, or other futures contracts.

When trading futures options, the holder of the option can choose to exercise the option or let it expire. If the holder exercises the option, they can then trade the underlying futures contract at the predetermined price. If the holder chooses not to exercise the option, the option expires worthless.

Trading futures options can be a way for traders to speculate on the price movement of the underlying asset, hedge against price fluctuations, or generate income through option premiums. It is important to note that trading futures options involves risks and may not be suitable for all investors.

Read Also: Understanding the Code V for Stock Options: Everything You Need to Know

Key Points:

TradeStation is a powerful trading platform that allows you to trade futures options with ease. If you’re new to TradeStation, here are some steps to help you get started:

Remember, trading futures options involves risk, and it’s important to only trade with funds you can afford to lose. Always conduct thorough research and seek professional advice if needed. With TradeStation, you have a powerful platform to support your trading endeavors.

Futures options are financial derivatives that give traders the right, but not the obligation, to buy or sell a futures contract at a predetermined price and date.

Yes, TradeStation offers the ability to trade futures options. Traders can access a wide range of options contracts on various futures markets.

Futures options work by giving traders the opportunity to profit from the price movement of a futures contract without actually owning the underlying asset. Traders can choose to buy or sell options contracts based on their expectations of future market movements.

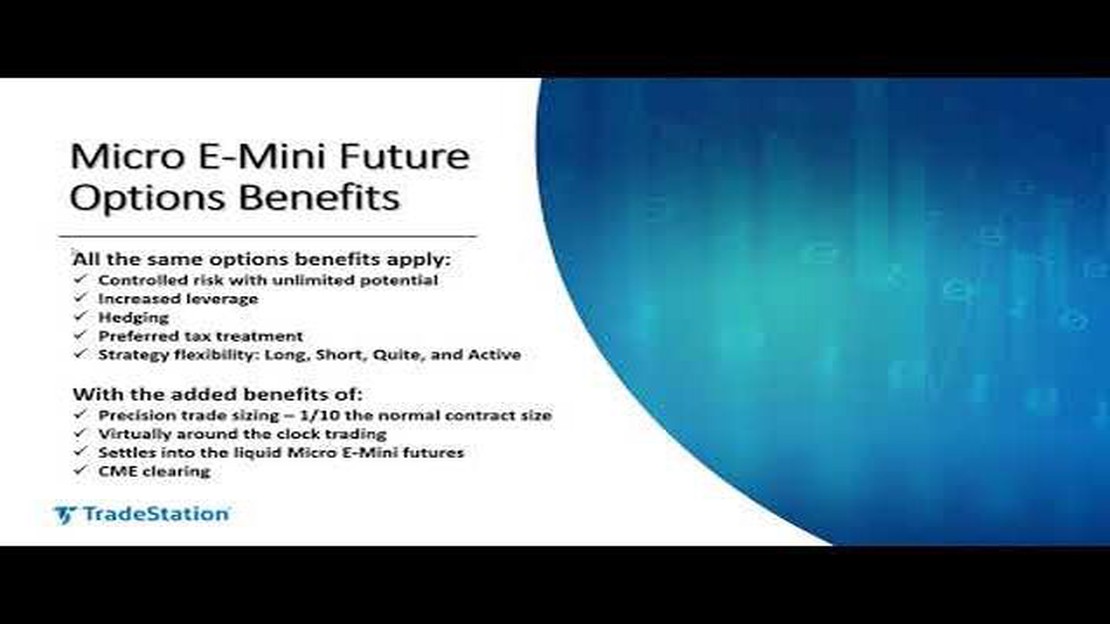

Trading futures options on TradeStation offers several benefits, including access to a wide range of markets, advanced trading tools and analytics, competitive pricing, and efficient execution. Traders can also benefit from the flexibility and leverage offered by options contracts.

Understanding Restricted Stock Units at CVS Restricted Stock Units (RSUs) are a common form of equity compensation offered to employees at CVS Health …

Read ArticleUnderstanding the Rule for SMA Trading When it comes to trading in the stock market, there are numerous strategies and rules that traders follow in …

Read ArticleWhat to expect when selling before T 2 When it comes to selling before T 2, there are several consequences that sellers need to be aware of. T 2, …

Read ArticleIs shorting an option the same as writing an option? When it comes to options trading, there are often different terms that can be confusing for …

Read ArticleShould PE ratio be higher than industry average? When it comes to evaluating the performance and value of a company, there are several factors to …

Read ArticleOperational Hours of the Chicago Board Options Exchange The Chicago Board Options Exchange, also known as CBOE, is one of the largest options …

Read Article