Understanding the Basics of EFX Trading: An Ultimate Guide

Understanding EFX Trading: A Comprehensive Guide EFX Trading, also known as Electronic Foreign Exchange Trading, is a popular method of trading …

Read Article

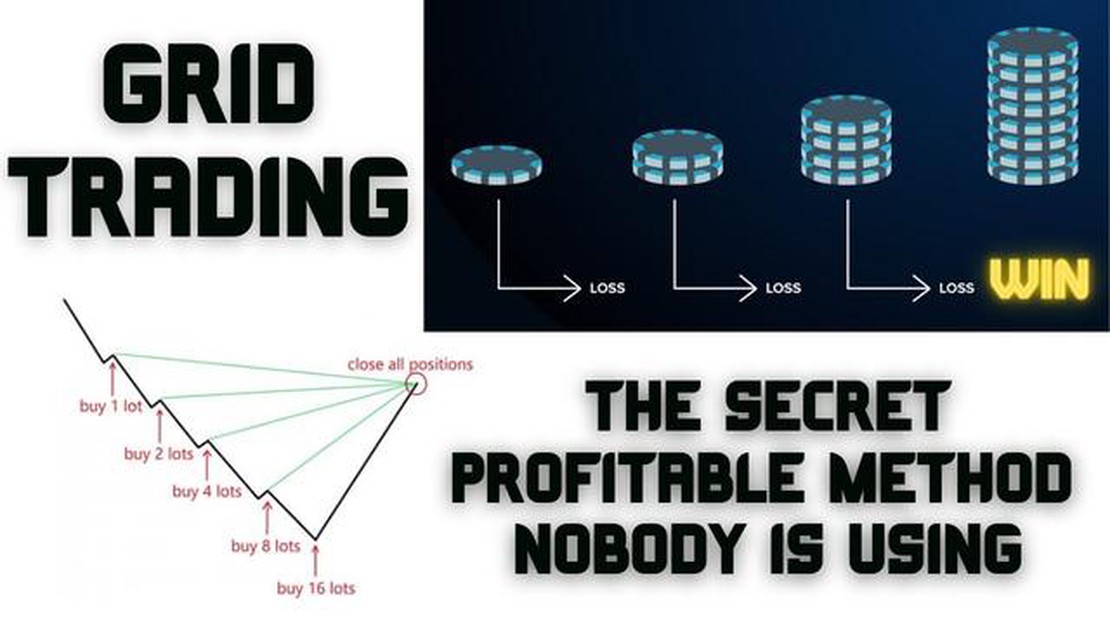

Grid trading is a popular strategy among Forex traders who aim to capitalize on the volatility of currency markets. This strategy involves setting up a grid of buy and sell orders at specific price levels, with the goal of profiting from the price movements between those levels. However, for grid trading to be successful, one needs to choose the right currency pairs. The choice of currency pairs plays a crucial role in determining the potential profit and risk in a grid trading strategy.

When it comes to selecting the top Forex pairs for grid trading, there are several key factors to consider. Firstly, liquidity is of utmost importance. The most actively traded currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, offer high liquidity and tight spreads, making them ideal choices for grid trading. These pairs are highly liquid due to the significant trading volume and participation from major financial institutions and banks. As a result, grid traders can enter and exit positions with ease, ensuring minimal slippage and maximizing profit potential.

In addition to liquidity, volatility is another critical consideration when choosing currency pairs for grid trading. Volatile currency pairs provide more trading opportunities, as they tend to experience larger price movements. This volatility creates the necessary price range for grid trading strategies to profit from. Pairs such as GBP/JPY, NZD/USD, and AUD/JPY are known for their high volatility, making them attractive choices for grid traders. However, it is important to note that higher volatility also comes with increased risk, so proper risk management is essential when trading these pairs.

It is crucial to note that past performance does not guarantee future results, and thorough analysis of market conditions is required before executing any grid trading strategy.

Another factor to consider when selecting currency pairs for grid trading is correlation. Some pairs exhibit a strong positive or negative correlation, meaning that their price movements tend to move in tandem or opposite directions. Correlated pairs, such as EUR/USD and GBP/USD, can be traded together in a grid, allowing traders to increase their profit potential by capturing the movements of both pairs simultaneously. However, this also increases the risk, as losses can be magnified if both pairs move against the trader’s positions. Therefore, it is essential to understand the correlation between pairs and adjust the grid accordingly to manage risk effectively.

In conclusion, choosing the top Forex pairs for successful grid trading requires careful consideration of liquidity, volatility, and correlation. Currency pairs with high liquidity, such as EUR/USD and GBP/USD, are ideal choices for grid trading due to their tight spreads and ease of execution. Volatile pairs, such as GBP/JPY and AUD/JPY, provide more trading opportunities but come with increased risk. Finally, understanding the correlation between currency pairs allows traders to optimize their grid strategy and maximize profit potential. With the right pair selection and proper risk management, grid trading can be a profitable strategy in the Forex market.

When determining the top Forex pairs for successful grid trading, there are several factors that traders should consider. These factors will help traders choose the best currency pairs for maximum profit potential.

Read Also: Is Currency Trading Real? Unveiling the Truth Behind Forex Trading2. Liquidity: Liquidity is another crucial factor to consider. Traders should choose currency pairs that have high liquidity to ensure that they can enter and exit trades easily. High liquidity also helps ensure that slippage is minimized, which can impact profitability. 3. Trends and patterns: Traders should analyze the long-term trends and patterns of currency pairs before selecting them for grid trading. It is important to choose pairs that exhibit clear and predictable trends and patterns to maximize the effectiveness of grid trading strategies.

4. Correlations: Traders should also consider the correlation between currency pairs. Correlated currency pairs may move in tandem, which can increase the risk of grid trading. It is generally advisable to select currency pairs that have a low correlation to diversify risk and increase the potential for profit. 5. Fundamental factors: Traders should also consider fundamental factors that can impact currency pairs. This includes factors such as economic indicators, interest rates, geopolitical events, and central bank policies. A thorough understanding of these fundamental factors can help traders choose currency pairs that are more likely to exhibit strong trends and patterns.

Read Also: Is GoDaddy a good company to work for? Find out the truth about career opportunities at GoDaddy

By considering these factors, traders can increase their chances of selecting the top Forex pairs for successful grid trading. It is important to conduct thorough research and analysis to determine which currency pairs offer the best opportunities for profitable grid trading strategies.

Some of the top forex pairs for grid trading include EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CAD.

The best currency pair for grid trading can be determined by analyzing historical data, volatility, and correlation between different currency pairs. Additionally, it is important to consider the specific grid trading strategy being used and how it aligns with the characteristics of the currency pair.

Some factors to consider when choosing a currency pair for grid trading include liquidity, volatility, trading session overlaps, fundamental factors affecting the currency, and the grid trading strategy being used.

EUR/USD and GBP/USD are popular choices for grid trading because they are highly liquid currency pairs with significant trading volume. They also have a relatively low spread, making them cost-effective for grid trading strategies. Additionally, these pairs often exhibit strong trends and can provide ample opportunities for grid trading.

While any currency pair can technically be used for grid trading, it is important to consider the characteristics of the currency pair and how it aligns with the grid trading strategy being used. Some currency pairs may be more suitable for grid trading due to their liquidity, volatility, and correlation with other currency pairs.

Grid trading is a strategy in Forex that involves placing orders at regular intervals and at predetermined levels above and below the current market price. It aims to capture small price movements in the market while managing the risk. It can be implemented in both trending and ranging market conditions.

Understanding EFX Trading: A Comprehensive Guide EFX Trading, also known as Electronic Foreign Exchange Trading, is a popular method of trading …

Read ArticleWhat is the Best Indicator for XAUUSD? If you are interested in trading XAUUSD, also known as gold, in 2022, you need to be equipped with the right …

Read ArticleCost of Forex Exchange: Explained Foreign exchange, or Forex, refers to the global marketplace where various currencies are traded. It is the largest …

Read ArticleHow does shifting data affect standard deviation? The standard deviation is a statistical measure that quantifies the amount of variability or …

Read ArticleBest Strategy for Binary Options Binary options trading is a popular and potentially profitable way to invest in the financial markets. However, in …

Read ArticleMastering Option Trading: Expert Tips and Strategies Option trading can be a lucrative and exciting way to invest your money, but it can also be a …

Read Article