Discover the CEO of the Art of Living | The Leadership Behind the Organization

Who is the CEO of the Art of Living? The Art of Living is a globally renowned organization that aims to improve the overall well-being and happiness …

Read Article

Trading forex trends can be a profitable strategy for experienced traders and newcomers alike. Understanding how to identify and leverage trends can help traders make informed decisions and maximize their potential for success in the forex market.

One key tip for trading forex trends is to use technical analysis to identify and confirm the direction of the trend. This can be done by analyzing price charts and using indicators such as moving averages, trend lines, and oscillators. By identifying the overall trend direction, traders can enter positions that align with the trend and increase their chances of profiting.

Another important strategy is to have a solid risk management plan in place. Trading forex trends can be volatile, and it’s important to protect your capital by setting appropriate stop-loss orders. By determining the maximum amount you are willing to lose on a trade, you can limit your risk and avoid significant losses.

It’s also crucial to stay updated on market news and economic events that could impact currency prices. By staying informed, traders can anticipate potential trend reversals or accelerations and adjust their trading strategies accordingly. Keeping a close eye on economic indicators, central bank announcements, and geopolitical events can provide valuable insights into market trends and help traders make more informed decisions.

Remember, trading forex trends requires patience and discipline. It’s important to follow your trading plan and avoid impulsive decisions based on short-term market fluctuations. By staying focused on long-term trends and using proper risk management techniques, traders can increase their chances of success in the forex market.

Introduction paragraph…

| Subheading 1 | Subheading 2 |

|---|---|

| Table data 1 | Table data 2 |

| Table data 3 | Table data 4 |

Conclusion paragraph…

Identifying forex trends is a crucial skill for successful trading. Here are some tips to help you recognize and interpret forex trends:

1. Use trendlines:

Draw trendlines on your forex charts to visually identify the direction of the trend. Connect at least two swing highs or swing lows to form a trendline. An upward trendline indicates an uptrend, while a downward trendline suggests a downtrend.

2. Moving averages:

Apply moving averages to your charts to smooth out price data and reveal the underlying trend. The 200-day moving average is commonly used to identify the long-term trend, while the 50-day moving average can help identify intermediate-term trends.

3. Look for higher highs and higher lows:

In an uptrend, look for the price to make higher highs and higher lows. This indicates that buying pressure is strong and the trend is likely to continue. In a downtrend, observe lower highs and lower lows, indicating selling pressure and a potential continuation of the downtrend.

4. Check for breakouts:

Keep an eye out for breakouts above resistance levels or below support levels. Breakouts can indicate a potential trend reversal or a continuation of the existing trend.

Read Also: How much is 500 Iraqi dinar in Indian rupee? - Latest exchange rate

5. Pay attention to volume:

Volume can provide valuable insights into forex trends. In an uptrend, increasing volume on up days and decreasing volume on down days is a sign of strength. Similarly, in a downtrend, increasing volume on down days and decreasing volume on up days can confirm the bearish trend.

6. Use indicators:

Utilize technical indicators such as the relative strength index (RSI), moving average convergence divergence (MACD), or stochastics to confirm the presence of a trend. These indicators can help identify overbought or oversold conditions, potential trend reversals, or the strength of the existing trend.

7. Monitor economic news:

Keep track of economic news releases and their impact on currency pairs. Strong economic data can support an uptrend, while weak data can contribute to a downtrend.

Remember, no single method guarantees accurate trend identification. It is important to consider multiple factors and use a combination of tools and techniques to increase the probability of correctly identifying and trading forex trends.

Trading forex trends can be profitable if you have the right strategies in place. Here are some effective strategies to help you trade forex trends:

Read Also: Understanding the Mechanics of Phantom Shares: How do they Work?

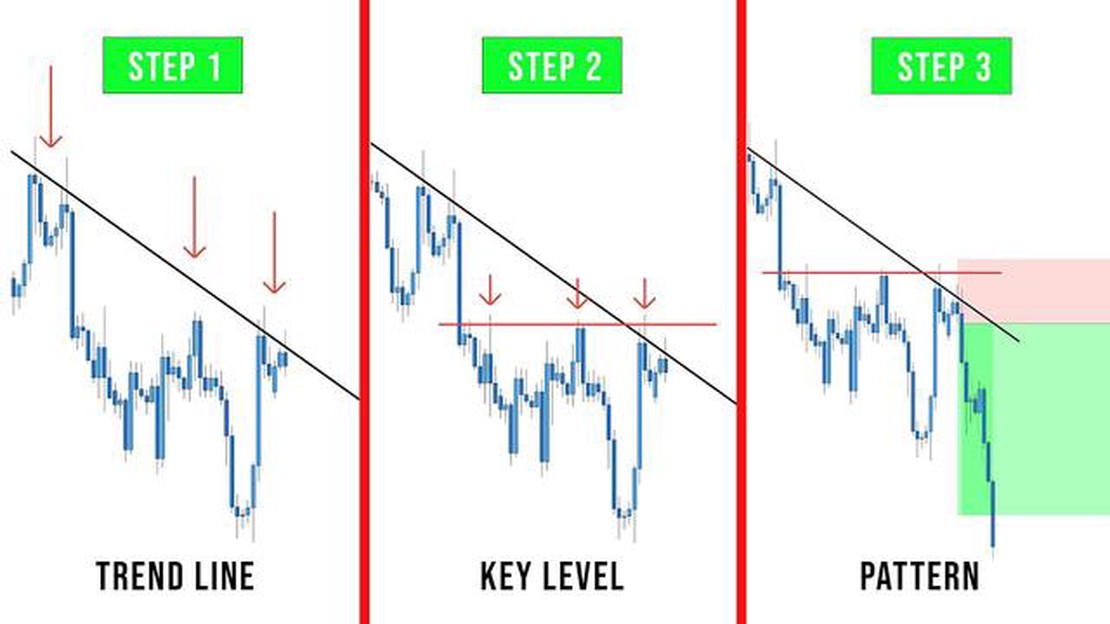

1. Trend identification: The first step in trading forex trends is to identify them. Look for price movements that consistently move in one direction, either up or down. Use technical indicators such as moving averages or trend lines to identify trends.

2. Trend confirmation: Once you have identified a potential trend, confirm it using other indicators or chart patterns. Look for signs of higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

3. Entry and exit points: Determine the best entry and exit points for your trades. You can use trend lines or support and resistance levels to identify these points. Enter a trade when the price breaks above a trend line in an uptrend, or below a trend line in a downtrend. Exit the trade when the price reaches a significant support or resistance level.

4. Risk management: Always manage your risk when trading forex trends. Set a stop-loss order to limit your potential losses if the trend reverses. Use proper position sizing based on your account size and risk tolerance. Consider implementing trailing stops to protect your profits as the trend continues.

5. Trend following: Instead of trying to predict when a trend will start or end, simply follow the trend and ride it as long as it lasts. This strategy can be more profitable and less stressful than trying to time the market.

6. Multiple time frame analysis: Use multiple time frames to gain a better understanding of the trend. For example, if you’re trading on a daily chart, look at the weekly and monthly charts to see the bigger picture. This can help you avoid false trends and increase your chances of success.

7. Keep up with economic news: Stay informed about economic news and events that can impact currency markets. Economic indicators, central bank announcements, and geopolitical events can all influence forex trends. Adjust your trading strategy accordingly to avoid unnecessary risks.

8. Practice and learn: Practice trading forex trends using a demo account before risking real money. This will help you refine your strategies and gain confidence in your trading abilities. Continuously learn and adapt your strategies based on market conditions and your own trading experience.

Remember, trading forex trends requires patience, discipline, and proper risk management. Stick to your strategies and always stay focused on long-term profitability.

Forex trading is the buying and selling of currencies on the foreign exchange market. It involves speculating on the rise and fall of currency prices and making profits from these movements.

Forex trends refer to the general direction in which the currency prices are moving over a certain period of time. They can be upward, downward, or even sideways.

There are several strategies for trading forex trends. One popular strategy is trend following, where traders identify the direction of the trend and enter trades in the same direction. Another strategy is trend reversal, where traders try to identify the end of a trend and enter trades in the opposite direction.

There are several ways to identify forex trends. One common method is to use trendlines, which are drawn on a price chart to connect the highs or lows of an asset. Another method is to use moving averages, which calculate the average price over a specified period of time and help to smooth out price fluctuations.

Some tips for trading forex trends include: always trade with the trend, use proper risk management techniques, set realistic profit targets, and stay updated with market news and events that can impact currency prices.

Forex trading is the act of buying and selling currencies against each other in an attempt to make a profit. It involves taking advantage of the fluctuations in exchange rates.

Forex trends are the general direction in which a currency pair is moving. They can be classified as either uptrends, downtrends, or sideways trends.

Who is the CEO of the Art of Living? The Art of Living is a globally renowned organization that aims to improve the overall well-being and happiness …

Read ArticleTips to Enhance Your Execution Skills in Trading Trading in the financial markets can be a challenging and complex endeavor. To achieve success, …

Read ArticleWhen is the right time to sell call options? Trading in options can be a lucrative venture, but it requires careful timing and strategic …

Read ArticleDoes the SEC regulate options? The Securities and Exchange Commission (SEC) is a regulatory body in the United States that is responsible for …

Read ArticleUnderstanding Rule 10b5-1 Sell to Cover: A comprehensive guide When it comes to insider trading regulations, Rule 10b5-1 is an important piece of …

Read ArticleHow to Utilize Trend Trader Strategy Trend trader strategy is an investment approach that aims to capitalize on the long-term trends in financial …

Read Article