Is making money from forex a reality or myth?

Is Forex Trading a Lucrative Way to Make Money? In the world of investing and financial markets, forex trading has become increasingly popular. Many …

Read Article

The centered moving average is a widely used statistical technique that smooths out data to identify trends or patterns. It is particularly useful in time series analysis where there are fluctuations and noise that can obscure underlying patterns. By calculating the average of a set of data points, with the current observation in the center, the centered moving average provides a more accurate estimate of the underlying trend.

One of the key benefits of using a centered moving average is that it helps to reduce random noise in the data. This is especially important when analyzing financial or economic data, as noise can distort the interpretation of trends and lead to incorrect conclusions. By smoothing out the data, the centered moving average allows analysts to focus on the underlying signal and make more informed decisions.

Another advantage of the centered moving average is its ability to identify turning points or reversals in trends. By calculating the average of a set of data points, the centered moving average places more weight on the recent observations, making it more responsive to changes in the data. This can help analysts to identify when a trend is losing steam or when a new trend is emerging, enabling them to make more timely decisions.

In addition, the centered moving average is a simple and easy-to-understand technique that can be applied to a wide range of data sets. It does not require complex calculations or assumptions, making it accessible to both beginners and experienced analysts. Furthermore, it can be easily customized by adjusting the window size, allowing analysts to fine-tune the level of smoothing based on their specific needs and objectives.

Overall, the centered moving average is a powerful tool in data analysis that provides a smoother estimate of the underlying trend, reduces noise, and helps to identify turning points in the data. Whether you are analyzing financial data, economic indicators, or any other time series data, the centered moving average can enhance your analysis and improve your decision-making process.

So, next time you are working with data that has fluctuations and noise, consider using a centered moving average to uncover the hidden patterns and gain deeper insights into your data.

A centered moving average is a powerful tool for analyzing time series data. It is a variation of the simple moving average in which the average value is calculated based on a window of values centered around the data point. This method offers several advantages over other types of moving averages.

One advantage of using a centered moving average is that it helps to smooth out sudden fluctuations in the data. By taking into account the values on both sides of the data point, it provides a more balanced view of the overall trend. This can be particularly useful when dealing with noisy or erratic data.

Another advantage is that a centered moving average is less sensitive to outliers. Outliers are data points that deviate significantly from the average, and they can have a strong impact on the results of a moving average calculation. By considering the values before and after the data point, a centered moving average reduces the influence of outliers and provides a more stable estimate of the underlying trend.

Furthermore, a centered moving average can help in identifying turning points or reversals in the data. By comparing the values before and after a data point, it can reveal patterns and changes in the direction of the trend. This can be valuable for forecasting future trends or making informed decisions based on historical data.

Read Also: Discover the Top Forex Mentor in South Africa for Optimal Trading Success

In addition, a centered moving average can be easily adjusted to reflect different time periods or data frequencies. By changing the length of the window, analysts can focus on shorter-term or longer-term trends, depending on the needs of their analysis. This flexibility allows for a more granular examination of the data and can lead to more accurate insights.

Overall, utilizing a centered moving average can improve the quality of data analysis by providing a smoother representation of the underlying trend, reducing the influence of outliers, identifying turning points, and allowing for flexible analysis. It is a valuable tool for anyone working with time series data and seeking more accurate and reliable results.

Read Also: Discover the Most Traded Forex Pair with High Volume in the Market

One of the key benefits of using a centered moving average is its ability to enhance data smoothness. By calculating the average of a specified number of data points, the centered moving average provides a more stable and less volatile representation of the data.

This enhanced data smoothness is particularly useful when analyzing time-series data or any data that exhibits fluctuations or noise. The centered moving average smooths out these fluctuations, making it easier to identify the underlying trends and patterns in the data.

Additionally, the enhanced data smoothness provided by the centered moving average can be valuable when making predictions or forecasting future values. Since the moving average provides a more stable representation of the data, it can help eliminate the effect of short-term fluctuations and provide a clearer picture of the long-term trends.

The enhanced data smoothness can also be beneficial in reducing the impact of outliers or extreme values. By calculating the average of a subset of data points, the centered moving average can help minimize the impact of these outliers, resulting in a more reliable and accurate representation of the overall data.

Overall, the enhanced data smoothness provided by using a centered moving average can help improve data analysis and decision making by providing a more stable and less volatile representation of the data. Whether analyzing time series data, making predictions, or reducing the impact of outliers, the centered moving average is a valuable tool in enhancing data smoothness.

A centered moving average is a type of moving average that places equal weight on both past and future data points, resulting in a smooth line that better reflects the overall trend of the data.

Using a centered moving average has several benefits. Firstly, it reduces the lag between the moving average line and the actual data, making it more responsive to changes in the trend. Secondly, it provides a more accurate representation of the overall trend by considering both past and future data points. Lastly, it helps to filter out short-term fluctuations, making it easier to identify the long-term trend.

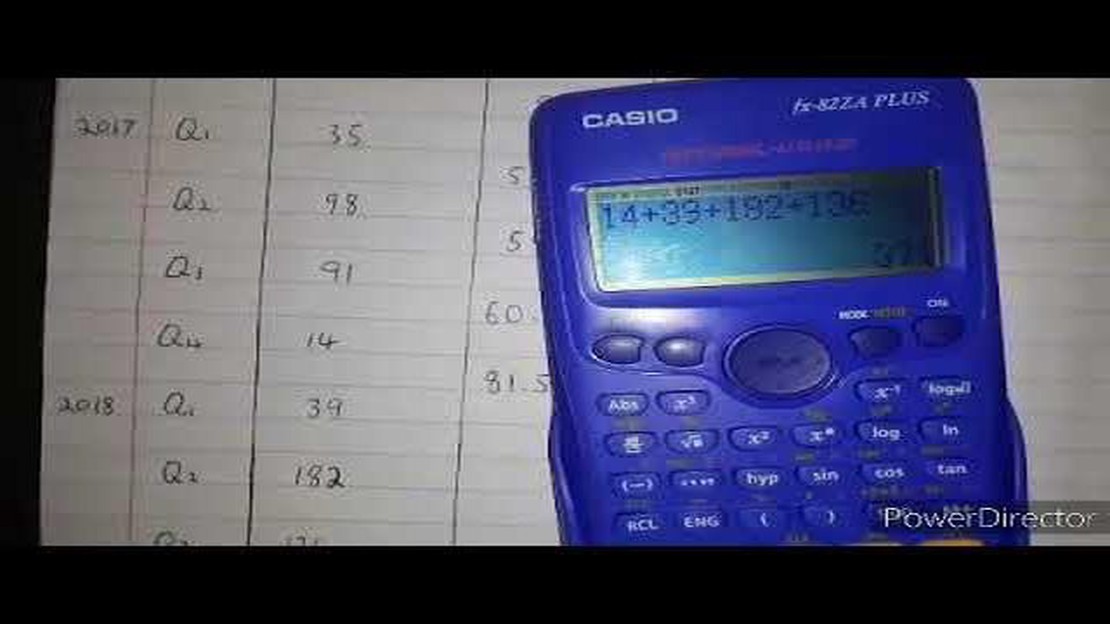

To calculate a centered moving average, you take the average of a certain number of data points, with an equal number of points on either side. For example, a 5-day centered moving average would be calculated by taking the average of the 2 days before and after the current day, as well as the current day itself.

While centered moving averages can be useful, they also have some limitations. One limitation is that they may not accurately capture sudden changes or outliers in the data. Another limitation is that the choice of the number of data points used in the calculation can greatly affect the results, so it’s important to carefully consider this parameter. Additionally, centered moving averages are not suitable for all types of data, such as data with a high degree of randomness.

Is Forex Trading a Lucrative Way to Make Money? In the world of investing and financial markets, forex trading has become increasingly popular. Many …

Read ArticleWhat is the equation for FIR filter in Matlab? The finite impulse response (FIR) filter is a popular digital filter used in signal processing …

Read ArticleWhat is Sanjeev Kapoor’s net worth? Sanjeev Kapoor, the renowned Indian chef, has gained worldwide recognition for his culinary expertise and …

Read ArticleDiscovering the Magpul x22 Takedown Stock: Everything You Need to Know Are you tired of the standard stock on your rifle? Looking for an upgrade that …

Read ArticleIs TradeStation part of TradingView? When it comes to online trading platforms, TradeStation and TradingView are two of the most well-known names in …

Read ArticleIs Zara listed in stock market? Zara, the popular Spanish fashion retailer, is one of the most recognizable brands in the world. With its fast-fashion …

Read Article