Understanding Premium Adjusted Delta: An Essential Concept in Options Trading

Understanding Premium Adjusted Delta: Key Parameters and Applications Options trading can be a complex and daunting world, but understanding key …

Read Article

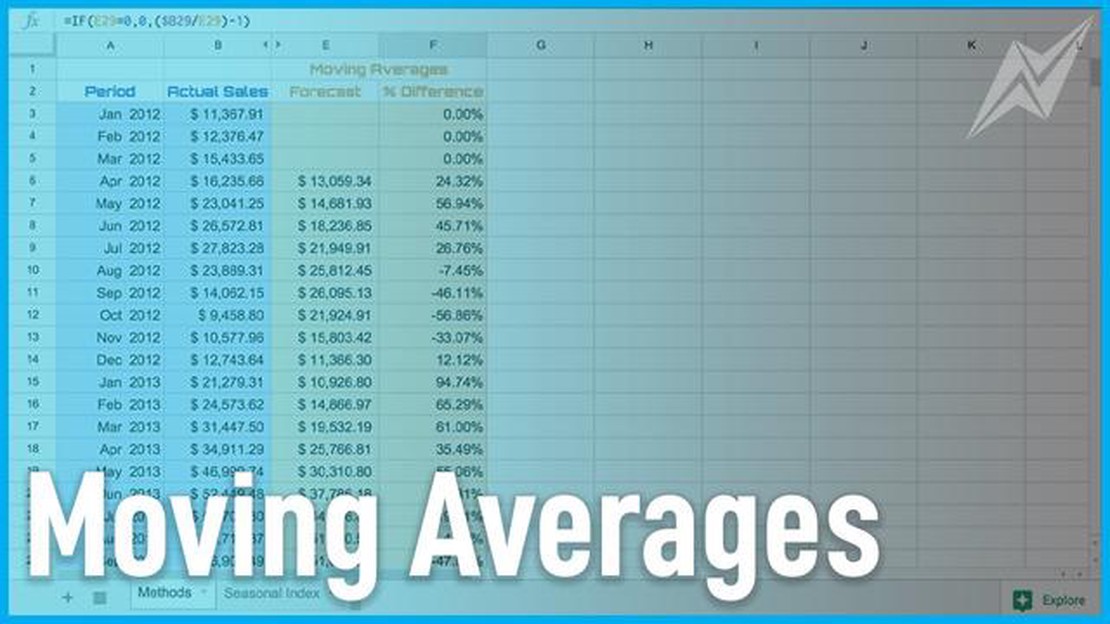

Moving averages are one of the most commonly used statistical tools in forecasting. They allow analysts to smooth out fluctuations in data and identify trends, making them a powerful tool for predicting future outcomes. By calculating the average of a series of data points over a specific time period, moving averages provide a clearer picture of the underlying patterns in the data.

One of the main benefits of using moving averages in forecasting is their ability to filter out noise and reveal long-term trends. This is particularly useful when dealing with volatile or unpredictable data, such as stock prices or sales figures. By taking the average of a series of data points, moving averages reduce random fluctuations and highlight the underlying direction of the data, making it easier to identify potential future trends and patterns.

Another advantage of using moving averages is their simplicity and ease of use. Unlike other forecasting methods that require complex mathematical models or extensive data analysis, moving averages can be calculated and interpreted by anyone with basic statistical knowledge. This makes them accessible to a wide range of users, from experienced analysts to casual observers, and allows for quick and efficient forecasting.

In addition, moving averages are versatile and can be applied to various types of data and time frames. They can be used to forecast short-term trends, such as daily or weekly fluctuations, or long-term trends, such as annual or quarterly patterns. By adjusting the time period over which the average is calculated, analysts can adapt the model to the specific characteristics of the data and optimize its forecasting accuracy.

In conclusion, moving averages offer several advantages in forecasting. They help filter out noise and reveal long-term trends, they are simple and easy to use, and they can be applied to different types of data and time frames. Whether used by experienced analysts or casual observers, moving averages are a powerful tool for predicting future outcomes and improving overall forecasting accuracy.

Moving averages are a popular tool in forecasting because they offer several advantages over other forecasting methods. Here are some key benefits of utilizing moving averages:

In conclusion, utilizing moving averages in forecasting offers numerous benefits. They help smooth out data, predict future trends, remove seasonal variations, identify turning points, and are simple to use. Incorporating moving averages into forecasting models can enhance the accuracy and reliability of predictions, leading to better decision-making and planning.

Using moving averages can greatly enhance forecast accuracy by smoothing out fluctuations in the data and providing a more stable trend line. By calculating the average of a certain number of past data points, moving averages can help identify patterns and trends, making it easier to predict future values.

One of the advantages of using moving averages is that they can help reduce noise and random variations in the data. By taking the average of multiple data points, the impact of outliers or unusual data values can be minimized, resulting in a more accurate forecast.

Another advantage of using moving averages is that they can help identify long-term trends in the data. By looking at the average over a larger time frame, moving averages can reveal underlying patterns and cycles that may not be apparent when looking at individual data points. This can be especially useful when forecasting for seasonal or cyclical data.

Read Also: Discover the Indicators Bill Williams Created to Boost Your Trading Strategy | SiteName

Additionally, moving averages can provide a more stable trend line by smoothing out short-term fluctuations in the data. This can help forecasters make better decisions based on the larger picture rather than reacting to temporary spikes or dips in the data.

However, it is important to note that moving averages are not without limitations. They can lag behind sudden changes or shifts in the data, as they are calculated based on past values. This means that moving averages may not be suitable for forecasting rapidly changing or highly volatile data.

Overall, using moving averages can be a valuable tool for enhancing forecast accuracy. By reducing noise, identifying trends, and providing a stable trend line, moving averages can help forecasters make more informed predictions and better plan for the future.

One of the key advantages of using moving averages in forecasting is the ability to identify trends and patterns in the data. By calculating the average values over a specific time period, moving averages smooth out short-term fluctuations and noise, allowing analysts to focus on the underlying trend.

Read Also: What Percent of 25 Year Olds Live at Home? Exploring the Living Arrangements of Young Adults

Moving averages help to highlight long-term changes in the data and can provide insights into the overall direction of the variable being analyzed. By plotting the moving averages on a graph, analysts can visually identify upward or downward trends, as well as periods of stability or volatility.

In addition to identifying trends, moving averages can also help to detect patterns in the data. For example, if the moving average shows a consistent increase or decrease over time, it suggests a linear pattern. On the other hand, if the moving average fluctuates around a central value, it indicates a cyclic or seasonal pattern.

By understanding the trends and patterns revealed by moving averages, analysts can make more informed forecasts. They can assess the likelihood of a trend continuing or changing direction, and adjust their forecasts accordingly. This can be particularly valuable in industries such as finance, where accurate predictions can have significant financial implications.

A moving average is a statistical calculation that is used to analyze data points over a certain period of time. It helps to smooth out fluctuations and identify trends in the data. In forecasting, moving averages can be used to predict future values based on past trends.

There are several advantages of using moving averages in forecasting. Firstly, they help to eliminate random fluctuations in the data, making it easier to identify underlying trends. Secondly, moving averages are relatively simple to calculate and understand. Thirdly, they can be used to identify changes in trends over time, which can be helpful in predicting future values.

Yes, there are some limitations of using moving averages in forecasting. Firstly, moving averages are based on past data, so they may not accurately predict future values if there are sudden or unexpected changes in the data. Secondly, moving averages may not be suitable for forecasting short-term fluctuations or seasonal patterns. Lastly, the choice of the time period for calculating the moving average can impact the accuracy of the forecast.

Moving averages can be used for various types of data, such as stock prices, sales figures, or weather data. However, it is important to consider the characteristics of the data and choose an appropriate time period for calculating the moving average. For example, shorter time periods may be suitable for data with high volatility, while longer time periods may be better for data with slower trends.

Yes, there are alternative methods to moving averages for forecasting. Some commonly used methods include exponential smoothing, regression analysis, and time series decomposition. These methods may provide more accurate forecasts in certain situations or for specific types of data. It is important to consider the nature of the data and choose the most appropriate method for forecasting.

Moving averages are statistical indicators used in forecasting to analyze data trends over a specific time period.

Understanding Premium Adjusted Delta: Key Parameters and Applications Options trading can be a complex and daunting world, but understanding key …

Read ArticleExample of a Circular Buffer A circular buffer, also known as a ring buffer or circular queue, is a data structure that is used for efficiently …

Read ArticleWhat is the ideal stop loss for day trading? Day trading can be an exciting and profitable way to invest in the financial markets. However, it can …

Read ArticleExplore the Top Automated Stock Trading Software Options Investing in the stock market can be both exciting and daunting. With so many variables to …

Read ArticleWays to Avoid ECN Fees Electronic Communication Network (ECN) fees are a common concern for traders, as they can eat into profits and impact overall …

Read ArticleQuintal of Corn Price: Discover the Current Market Rates The quintal of corn price is a significant factor for farmers and consumers alike. Corn is …

Read Article