Is Chipotle a good long term investment? Expert analysis and forecast

Is Chipotle a good long term stock? When it comes to investing in the fast-food industry, Chipotle has been a standout player for years. Known for its …

Read Article

In the field of forecasting, accuracy is crucial for businesses to make informed decisions. Smoothing techniques are widely used to analyze historical data and make forecasts, helping organizations predict future trends and allocate resources effectively. These techniques involve eliminating noise and irregularities in the data, enabling analysts to identify underlying patterns and trends.

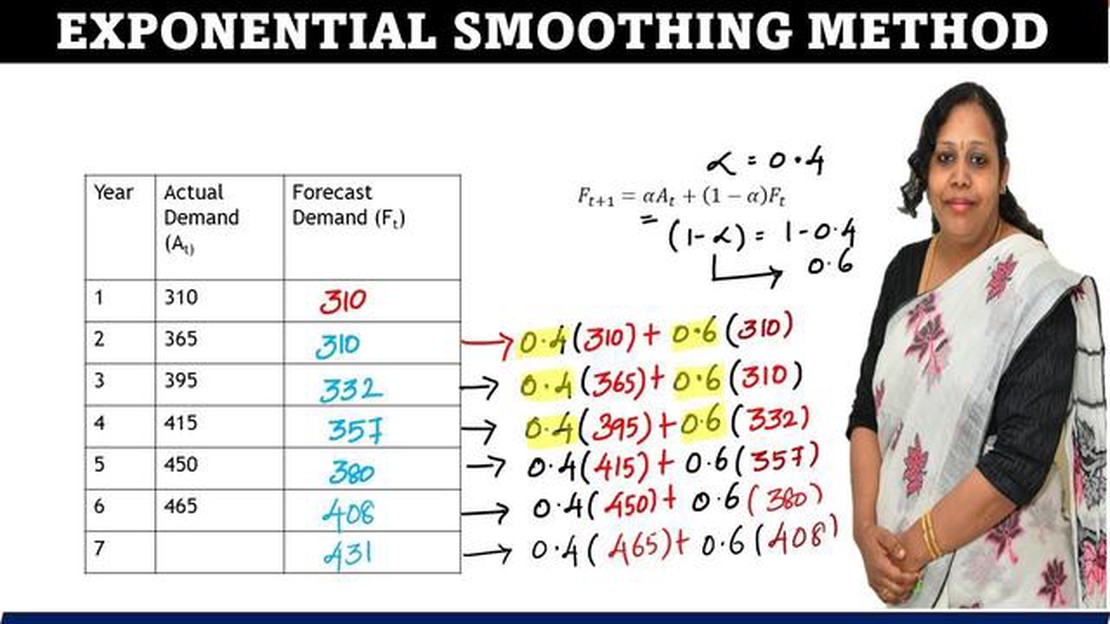

One popular smoothing technique is the moving average, which calculates the average value of a group of data points over a specified time interval. This helps to smooth out short-term fluctuations and emphasize long-term trends. Another commonly used technique is exponential smoothing, which assigns exponentially decreasing weights to previous data points. This method gives more weight to recent observations, reflecting the belief that recent data is more relevant for forecasting future values.

Smoothing techniques also include trend analysis, which identifies and predicts the direction and magnitude of future trends. This technique is particularly useful for analyzing time series data and can help businesses anticipate and respond to changing market conditions. Additionally, seasonal smoothing techniques take into account seasonal patterns and fluctuations to produce accurate seasonal forecasts.

By using smoothing techniques in forecasting, businesses can gain valuable insights and improve their decision-making processes. These techniques provide a systematic and objective way to analyze data and generate reliable forecasts, reducing uncertainty and helping businesses optimize their operations. Whether it’s predicting product demand, managing inventory, or forecasting market trends, smoothing techniques play a vital role in helping organizations stay competitive in a dynamic business environment.

Overall, smoothing techniques are powerful tools for forecasting, allowing businesses to analyze historical data and predict future trends accurately. With the ability to eliminate noise, emphasize patterns, and account for seasonality, these techniques provide valuable insights that inform critical decision-making processes. By incorporating smoothing techniques into their forecasting practices, businesses can gain a competitive edge and react swiftly to changing market conditions, ultimately leading to improved operational efficiency and increased profitability.

Smoothing is a key technique used in forecasting to remove noise and fluctuations from a time series data set. It helps to identify and understand the underlying patterns and trends in the data, making it easier to make accurate predictions about future values.

Smoothing methods work by calculating the average or weighted average of a certain number of past observations to obtain a smoothed value for a given time period. This smoothed value is then used as an estimate for future data points.

There are several different smoothing techniques that can be used, depending on the characteristics of the data and the level of noise present. Some common smoothing techniques include Simple Moving Average (SMA), Weighted Moving Average (WMA), Exponential Smoothing (ES), and Holt-Winters Exponential Smoothing.

Simple Moving Average calculates the average of a fixed number of past observations, giving equal weight to each observation. Weighted Moving Average assigns different weights to each observation based on their relative importance. Exponential Smoothing assigns exponentially decreasing weights to the past observations, with more recent observations having a higher weight. Holt-Winters Exponential Smoothing is a more advanced technique that incorporates seasonality and trends into the smoothing process.

Smoothing techniques are often used in time series forecasting applications such as sales forecasting, demand forecasting, and stock price forecasting. They help to eliminate random fluctuations and focus on the underlying patterns in the data, improving the accuracy of the forecasts.

Read Also: Can You Trade Options on Leveraged ETFs? A Comprehensive Guide

In conclusion, smoothing in forecasting is a valuable technique that helps to reduce noise and uncover underlying trends in time series data, enabling more accurate predictions for the future. By applying different smoothing methods, analysts can choose the most appropriate technique for their specific data set and forecasting goals.

Smoothing techniques are widely used in forecasting due to their various advantages. These techniques offer several benefits that make them a valuable tool for analysts and decision-makers. Here are some of the advantages of smoothing techniques:

1. Simple and easy to understand: Smoothing techniques, such as simple moving average and exponential smoothing, are straightforward and easy to comprehend. They do not require complex mathematical calculations or advanced statistical knowledge, making them accessible to non-experts.

2. Versatile: Smoothing techniques can be applied to various types of time series data, including regular and irregular patterns. They can be used for short-term and long-term forecasting, making them versatile tools in forecasting applications.

3. Efficiency: Smoothing techniques are computationally efficient and can handle large datasets efficiently. They do not require excessive computational resources, which makes them suitable for real-time and online forecasting applications.

4. Flexibility: Smoothing techniques can be easily adjusted and adapted to specific forecasting needs. Analysts can modify the smoothing parameters, such as the window size or the smoothing factor, to fine-tune the forecasting model and improve its accuracy.

Read Also: Activate Your CIMB ATM Card Overseas: Easy Steps and Quick Guide

5. Noise reduction: Smoothing techniques can effectively reduce the impact of random variations or noise in the time series data. By averaging out the fluctuations and outliers, smoothing techniques provide a clearer and more stable signal, which improves the accuracy of the forecasts.

6. Trend detection: Smoothing techniques can help identify and extract underlying trends in the time series data. By smoothing out the short-term fluctuations, analysts can focus on the long-term patterns and make more informed decisions based on the overall trend.

Overall, smoothing techniques offer significant advantages in forecasting, including simplicity, versatility, efficiency, flexibility, noise reduction, and trend detection. These advantages make them a valuable tool for analysts and decision-makers in various industries.

Some common smoothing techniques used in forecasting include simple moving average, weighted moving average, exponential smoothing, and Holt’s linear exponential smoothing.

Simple moving average is a technique that calculates the average of a given number of data points in a time series to create a smooth line. It is calculated by summing the values of the data points and dividing it by the number of data points.

Weighted moving average differs from simple moving average in that it assigns different weights to each data point. This means that the more recent data points can have a higher weight and therefore more influence on the forecast.

Exponential smoothing is a technique that gives more weight to recent data points while making the forecast. It calculates the forecast by taking a weighted average of the current and previous forecast with different weights assigned to each data point.

Holt’s linear exponential smoothing is an extension of exponential smoothing that takes into account the trend in the data. It includes two components - the level component, which represents the average value of the time series, and the trend component, which represents the slope of the time series.

The purpose of smoothing techniques in forecasting is to eliminate noise and random fluctuations in the data, making it easier to identify underlying trends and patterns. This allows for more accurate predictions and forecasts.

Is Chipotle a good long term stock? When it comes to investing in the fast-food industry, Chipotle has been a standout player for years. Known for its …

Read ArticleThe Ruling of Trading in Islam Islam provides clear guidance on various aspects of life, including trade and commerce. Understanding the rulings and …

Read ArticleIs Trading Uranium Possible? Exploring the Possibilities and Challenges As one of the most valuable and highly regulated commodities in the world, …

Read ArticleCan I sell my employee stock options? Employee stock options can be a valuable benefit offered by companies to their employees. These options give …

Read ArticleInvesting Tips: How to Invest Money Wisely Investing money can seem like a daunting task, especially for beginners who have little to no knowledge …

Read ArticleIs there a monthly fee for forex? Trading on the foreign exchange market, also known as forex, can be a lucrative endeavor. However, before you dive …

Read Article