What are Options in Forex? Understanding the Basics of Forex Options

Understanding Forex Options: What They are and How They Work Forex options are a popular derivative instrument in the foreign exchange market. They …

Read Article

When it comes to analyzing financial data, there are various methods and techniques that can be used. One popular method is the Simple Moving Average (SMA), which is widely used in technical analysis to identify trends and potential price reversals.

The Simple Moving Average is calculated by adding up a set of values over a specific period of time and then dividing the sum by the number of values. For example, a 10-day SMA would be calculated by adding up the closing prices of the last 10 days and then dividing the sum by 10. This gives you the average price over that period of time.

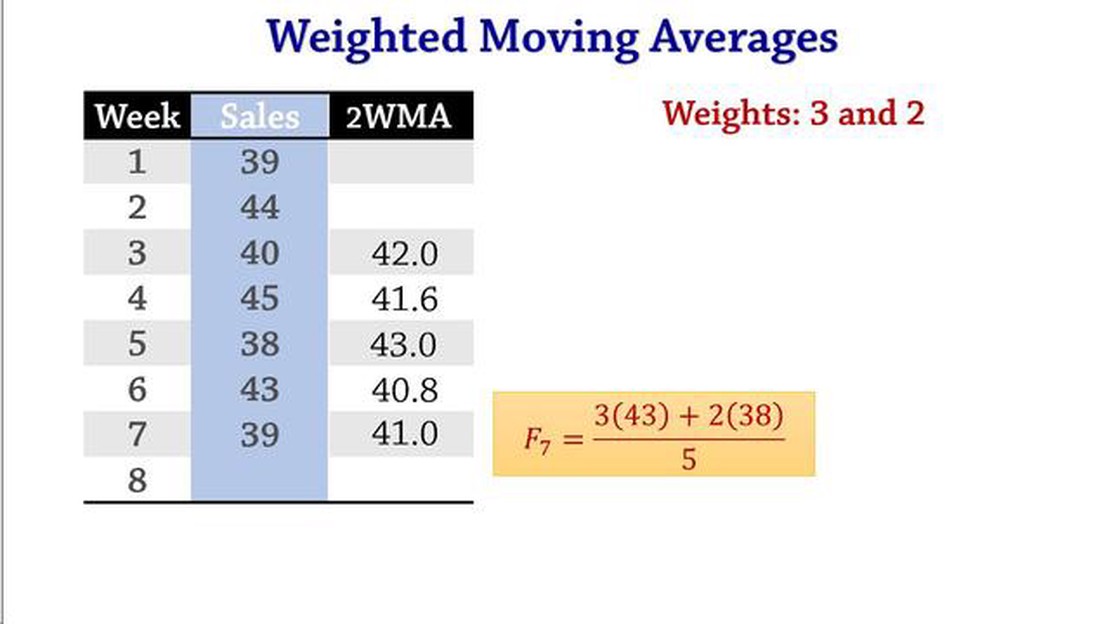

However, some traders and analysts argue that the Simple Moving Average should actually be considered a weighted average. They argue that since the most recent data points are more relevant and should carry more weight, the Simple Moving Average should give more importance to the most recent prices.

By giving more weight to the most recent data, a weighted average could potentially provide a more accurate representation of the current market conditions.

On the other hand, proponents of the traditional Simple Moving Average argue that giving more weight to the most recent data would make the average more volatile and less stable. They believe that the equal weighting approach of the SMA provides a smoother representation of the overall trend.

Ultimately, the choice between using a Simple Moving Average as a weighted average or an equal-weight average comes down to personal preference and the specific needs of the trader or analyst. Both methods have their advantages and disadvantages, and it is important to understand the assumptions and limitations of each approach when interpreting the results.

The Simple Moving Average (SMA) is a technical indicator used in financial analysis to analyze the price trend of a security or asset over a specified period of time. It is a widely used indicator in technical analysis and is used by traders and investors to make informed decisions.

The SMA is calculated by adding up the closing prices of a security over a specified period of time and then dividing the sum by the number of periods. For example, to calculate the SMA over a 10-day period, you would add up the closing prices of the security over the past 10 days and divide the sum by 10.

The SMA is a simple and straightforward indicator that is easy to understand and interpret. It can be used to identify trends and reversals in the price of a security. When the price is above the SMA, it is considered bullish, indicating an upward trend, while when the price is below the SMA, it is considered bearish, indicating a downward trend.

One of the advantages of using the SMA is that it is not affected by outliers or extreme values, as it calculates an average of the prices over a specified period of time. This makes it a reliable indicator for determining the overall trend of a security.

However, the SMA has limitations as well. Since it is a simple average, it gives equal weight to all data points, regardless of their recency. This means that older data points have the same impact on the calculation as newer ones, which can result in lagging signals.

Overall, the SMA is a useful tool for traders and investors to analyze price trends and make informed decisions. While it has its limitations, it is still widely used in financial analysis and can provide valuable insights into the market.

Read Also: Recording ESOP on a Balance Sheet: Step-by-Step Guide

In conclusion, the Simple Moving Average is a widely used technical indicator in financial analysis. It is calculated by adding up the closing prices of a security over a specified period of time and dividing the sum by the number of periods. The SMA can be used to identify trends and reversals in the price of a security and is not affected by outliers. However, it gives equal weight to all data points, which can result in lagging signals.

When considering the simple moving average (SMA), one might wonder if it is a weighted average or not. In fact, the answer is quite simple: the SMA is not a weighted average. Unlike the exponential moving average (EMA) which assigns different weights to each data point, the SMA gives equal weight to all data points within the specified time period.

This means that when calculating the SMA, each data point has the same impact on the average. For example, if we are calculating the 5-day SMA for a stock’s closing prices, each of the five prices will be given equal weight. This is in contrast to the EMA, where more recent data points are given greater weight.

Some traders and analysts prefer the SMA over the EMA because it provides a more balanced view of price movements over time. By giving equal weight to all data points, the SMA can help smooth out short-term fluctuations and provide a clearer trend line.

Read Also: Is eToro a good platform for day trading?

However, it is important to note that the SMA may not be as responsive to recent price changes as the EMA. This is because the EMA assigns greater weight to more recent data, allowing it to react more quickly to changes in price.

Ultimately, the choice between the SMA and EMA depends on the trader’s individual preferences and trading strategy. Both types of moving averages have their own advantages and disadvantages, and it is up to the trader to decide which one best suits their needs.

The Simple Moving Average (SMA) is one of the most widely used technical indicators in stock market analysis. It offers several benefits to traders and investors:

Overall, the Simple Moving Average is a versatile tool that can assist traders in making informed decisions by providing insights into the trend, support and resistance levels, entry and exit signals, and potential reversals in the market. It can be used in combination with other technical indicators and analysis methods to enhance trading strategies and improve the accuracy of predictions.

A simple moving average is a calculation used to analyze and predict trends in data. It is a common technique used in technical analysis to smooth out short-term fluctuations and highlight long-term trends.

A simple moving average is calculated by taking the arithmetic mean of a set of data points over a specific period of time. The formula is: SMA = (Sum of data points over the specified period) / (Number of data points in the period).

No, a simple moving average is not a weighted average. It gives equal weight to all data points in the specified period.

The advantage of using a simple moving average is that it can help to identify and smooth out trends in data. It can provide a clearer picture of the overall direction of the data, making it easier to make predictions or decisions based on the trends.

While a simple moving average can indicate trends and provide information about the general direction of data, it should not be solely relied upon to predict future data. It is just one tool in a larger analysis toolkit and has limitations.

A simple moving average is a calculation used to analyze data points by creating a series of averages of different subsets of the full data set. It is commonly used in technical analysis to identify trends in stock prices or other financial indicators.

A simple moving average is calculated by summing up a certain number of data points and dividing the sum by the number of data points. For example, a 5-day simple moving average would be calculated by adding up the closing prices of the last 5 days and dividing by 5.

Understanding Forex Options: What They are and How They Work Forex options are a popular derivative instrument in the foreign exchange market. They …

Read ArticleWhich bank offers the highest fixed deposit interest rate in Malaysia? When it comes to investing your hard-earned money, finding a reliable and …

Read ArticleForex Pairs with Positive Correlation In the world of Forex trading, understanding the correlations between different currency pairs can be incredibly …

Read ArticleKey Elements to Include in Your Trading Journal Keeping a trading journal is a crucial part of becoming a successful trader. It allows you to analyze …

Read ArticleWhat happens to options on ex-dividend date? Options are derivative financial instruments that give traders the right, but not the obligation, to buy …

Read ArticleIs Korean won cheaper than rupee? When it comes to comparing currency values, many factors come into play. One of the most important factors is the …

Read Article