Should You Use Trailing Stop Losses? Pros and Cons Explained

Is Using Trailing Stop Losses a Good Idea? Implementing a stop-loss strategy is essential for any trader or investor, as it helps to minimize …

Read Article

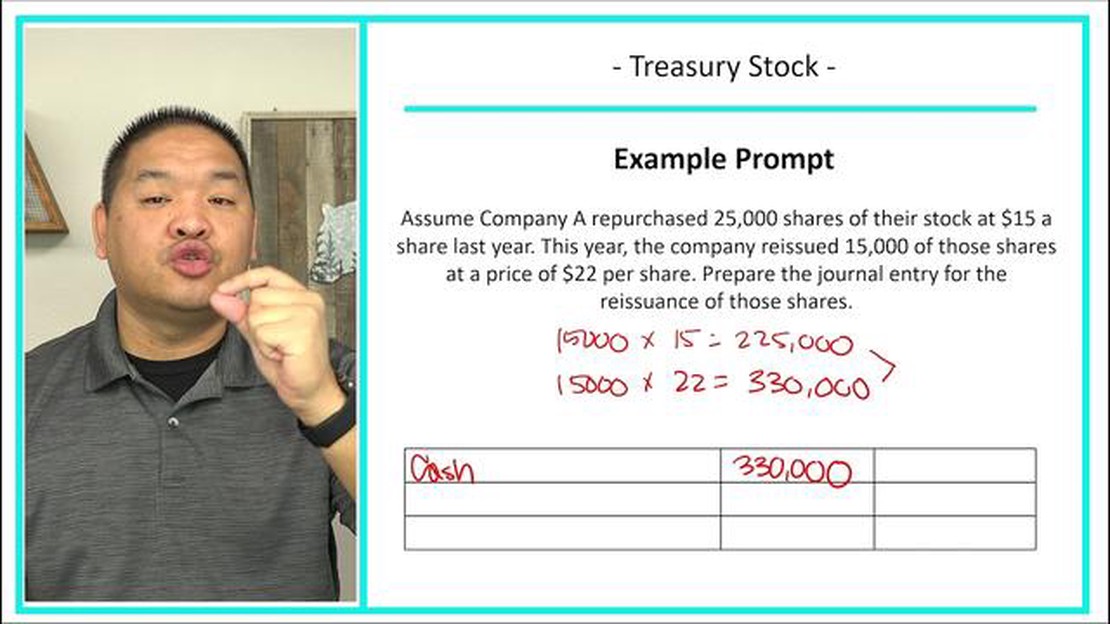

Treasury stock reissuance is the process of selling back previously repurchased shares of a company’s stock. When a company repurchases its own shares and later resells them to new investors, it needs to properly record this transaction in its financial statements. The accounting treatment for treasury stock reissuance involves several steps that need to be followed meticulously.

Step 1: Determine the cost of treasury stock reissued

The first step in recording treasury stock reissuance is to determine the cost of the shares being reissued. This cost is usually the original purchase price of the treasury stock, including any transaction costs incurred during the repurchase.

Step 2: Calculate the gain or loss on reissuance

Next, calculate the difference between the cost of the treasury stock being reissued and the amount received from the new investors. If the amount received is higher than the cost, a gain on reissuance is recognized. Conversely, if the amount received is lower, a loss on reissuance is recognized.

Step 3: Update the treasury stock account

In this step, the treasury stock account is adjusted to reflect the reissuance. The number of shares reissued is deducted from the treasury stock account, and the cost of the shares is deducted from the treasury stock cost account.

Step 4: Record the gain or loss on reissuance

Finally, the gain or loss on reissuance is recorded in the company’s income statement. The gain or loss is calculated by multiplying the difference between the amount received and the cost of reissuance by the number of shares reissued.

It is important for companies to accurately record treasury stock reissuance to provide transparency to investors and ensure compliance with accounting standards.

By following these step-by-step guidelines, companies can properly and accurately record treasury stock reissuance in their financial statements. This ensures that the reissuance is reflected in the company’s equity and income statement, providing a clear picture of the company’s financial position to both internal and external stakeholders.

Treasury stock reissuance refers to the process of a company selling its previously repurchased and held treasury stock back to the public or shareholders. When a company repurchases its own stock, it becomes treasury stock and is accounted for separately on the balance sheet. The decision to reissue treasury stock can be influenced by various factors, such as the company’s need for additional capital or its desire to improve its financial ratios.

There are a few key considerations to understand when it comes to treasury stock reissuance:

Once the decision to reissue treasury stock has been made, the company needs to properly account for the transaction. This involves updating the treasury stock account on the balance sheet to reflect the sale of the reissued stock, as well as recording any gain or loss on the transaction. The specific accounting treatment may vary depending on the jurisdiction and accounting standards.

Read Also: What is the minimum opening deposit? | A Comprehensive Guide

Treasury stock reissuance can have various implications for a company, including the potential increase in capital, dilution of ownership, and impact on financial ratios. It is important for companies to carefully evaluate the benefits and risks associated with reissuing treasury stock before proceeding with the transaction.

Recording the reissuance of treasury stock requires determining the cost at which the stock was originally repurchased by the company. This cost is essential in accurately reflecting the financial transactions involving treasury stock.

Read Also: Can You Make Money with a Bot? Find Out Now!

To determine the cost of treasury stock, follow these steps:

By following these steps, you can accurately determine the cost at which the treasury stock was repurchased by the company. This cost is crucial for recording the reissuance of treasury stock and ensuring accurate financial reporting.

Once the treasury stock has been purchased and accounted for, it may be reissued by the company. Reissuing treasury stock involves selling the shares back to investors or using them for a variety of corporate purposes.

Here are the steps to reissue treasury stock:

It is important to carefully consider and document the reasons for reissuing treasury stock, as well as comply with any legal and regulatory requirements. Additionally, companies should consult with their accountants or financial advisors to ensure that the reissuance is properly recorded and reported.

Treasury stock reissuance refers to the process of selling previously repurchased shares of a company’s own stock back to the public or to shareholders.

There can be several reasons why a company may choose to reissue its treasury stock. One possible reason is to raise additional capital for the company. Another reason could be to improve the company’s financial ratios by reducing the number of outstanding shares. Additionally, reissuing treasury stock may provide an opportunity for the company to increase shareholder value.

The reissuance of treasury stock is recorded by debiting the cash account for the proceeds received from the sale, crediting the treasury stock account for the cost of the shares being reissued, and recording any difference as a gain or loss on the sale of treasury stock. The entry should also include a credit to the common stock or additional paid-in capital account, depending on the company’s policy.

Yes, a company can choose to sell its treasury stock below its cost. In such cases, the difference between the sale price and the cost of the treasury stock would be recorded as a loss on the sale of treasury stock. This loss would reduce the company’s net income for the period.

Treasury stock reissuance can impact a company’s financial reporting in several ways. First, it can impact the company’s earnings per share (EPS) calculation, as the number of outstanding shares is reduced. Second, it can affect the company’s balance sheet, as the treasury stock account is adjusted to reflect the reissuance. Finally, any gains or losses on the sale of treasury stock need to be properly disclosed in the company’s income statement.

To record the reissuance of treasury stock, you need to debit the Cash or Treasury Stock account and credit the Common Stock or Additional Paid-In Capital account for the amount received from the issuance. This transaction increases the stockholders’ equity and reflects the sale of treasury stock to new shareholders.

Treasury stock reissuance is the process of selling previously repurchased shares of company stock back to the public. These shares were previously considered treasury stock, which means they were taken out of circulation and held by the company. The reissuance of treasury stock allows the company to raise capital by selling these shares to new investors.

Is Using Trailing Stop Losses a Good Idea? Implementing a stop-loss strategy is essential for any trader or investor, as it helps to minimize …

Read ArticleChoosing the Best Stop-Loss Order for Options Trading Options trading can be a lucrative investment strategy, but it also carries a significant amount …

Read ArticleWhat is the Best Affiliate Program in the World? Are you looking to make money online and own your own business? Look no further than the top …

Read ArticleIs options trading available in USA? Options trading has become increasingly popular in recent years, providing investors with the opportunity to …

Read ArticleGuide to Trading Soybean Futures Trading soybean futures can be a lucrative venture for those who know how to navigate the market with skill and …

Read ArticleIs Sensibull free or paid? When it comes to options trading, having the right tools can make all the difference. Sensibull is a popular options …

Read Article